ASP Isotopes (ASPI:NASDAQ) began trading just two weeks ago on the Nasdaq as a pre-revenue company and this morning just announced a contract for up to US$675 million dollars.

The contract is a 25-year supply contract for their Molybdeunm-100 medical isotopes worth up to 27 million a year for 25 years. This is a major change for the US$77 million-dollar market cap company that previously did not have any contracts in place.

The news of the contract comes with another boon; they are now anticipating deliveries of commercial quantities of Mo-100 to begin before Q3 of 2023!

Their plant is being constructed in Pretoria, South Africa, and is designed to produce more than 20 Kg a year of enriched molybdenum.

Demand Anticipated

The company will not release pricing data, but online searching shows isotope prices per gram in tens of thousands of dollars for common isotopes, and ASP has the ability to create very specialized isotopes.

I was a buyer pre-ipo and have been a buyer in the market; this is one I will look to add to, especially if the price declines.

The company is currently in talks with multiple potential customers and anticipates demand being about four times the plant's capacity within the first five years.

ASP stands for Aerodynamic Separating Process and has been developed over the past 40 years. The process involves no moving parts, uses a lot of off-the-shelf components, and is easily scalable.

The plants themselves cost a fraction of the traditional nuclear plants to build and, unlike their competitors, create no nuclear waste because they are harvesting and enriching natural isotopes.

The company has exclusive rights to the unique separation technology.

Because of this, I expect them to have no problem securing cheap debt financing for rapid expansion with customer orders in hand.

As a result, I expect the float to remain tight.

Opportunity With ASP

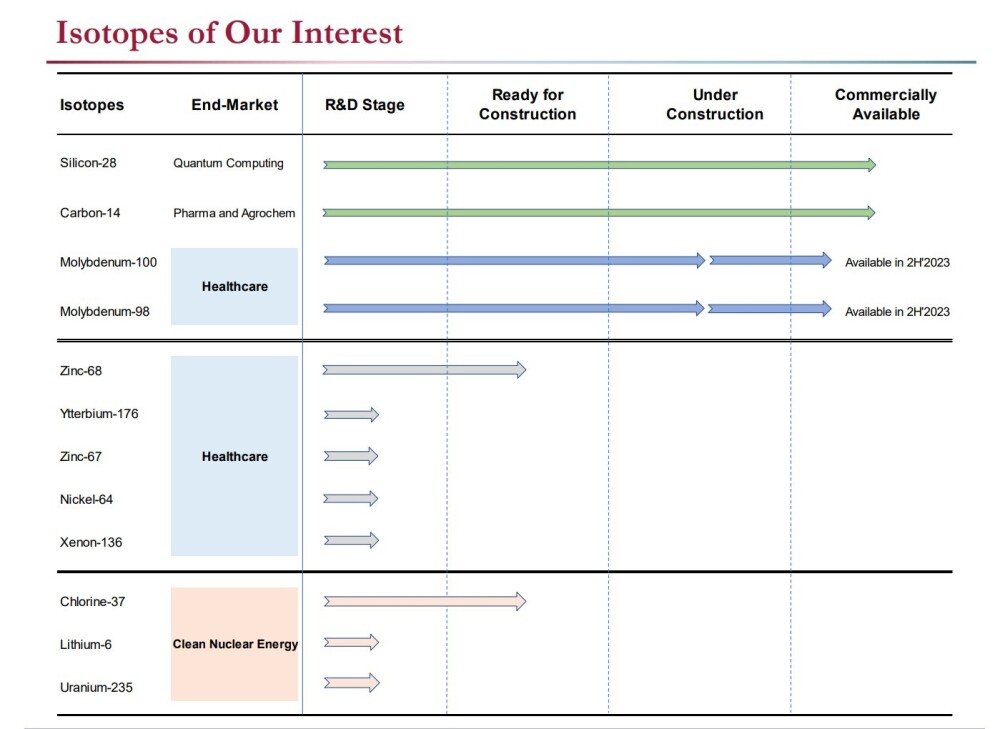

The opportunity with ASP Isotopes is much more than just the US$8.1 billion-dollar global nuclear medicine market. Other isotopes can be separated using this technology.

As you can see below, they can already handle Carbon-14 for radiocarbon dating, pharma and agrochem uses, and Silicon-28, which improves thermal conductivity and may play a critical role in quantum computing.

Zinc-68 and Chlorine-37 are also past the R&D stage and ready for construction. Of the two, I am most excited about Chlorine-37’s potential for modular and safe nuclear energy.

Less Material and Higher Margin Materials

A couple of things that I want to point out, ASP Isotopes will be creating less material than a traditional reactor would, but it is a much higher margin material, and this is before considering the low cost of their actual plants.

They also only have about 32 million shares, and only the shares from the IPO should be trading at this point. With such a tiny float, you can expect more dramatic trading action. I was a buyer pre-ipo and have been a buyer in the market; this is one I will look to add to, especially if the price declines.

If you want to read my original article that goes more in-depth on the potentials of ASP Isotopes, click here.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

PennyQueen Disclosures

I have not and will not be compensated for this report in any way. I write reports on my favorite picks; this is meant to be educational and not investment advice, as I am not an investment advisor, just a mom on a mission to make the world better and make money along the way.

Disclosures

1) PennyQueen: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: ASP Isotopes. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of ASP Isotopes, a company mentioned in this article.