The stock market was at a critical juncture by late last week, and without Fed intervention, or at least the talk of Fed intervention, it would have plunged, so right on cue, it was put about that the Fed would “pivot” soon, meaning abandon its policy of jacking up interest rates to battle inflation (a battle it cannot win, by the way).

This was, of course, what the oversold market wanted to hear, and the effect was immediate, with early losses being reversed and the Dow closing up almost 750 points on the day as yields started to drop and the dollar took a hit.

It hardly looks like the time has arrived to start cracking open the champagne, for overall, the setup remains incredibly dangerous, so if the Fed doesn’t deliver with a “pivot,” or even if it does and it has little effect, the market could yet turn tail and plunge.

If the Fed (and other central banks) keep creating money at an exponentially faster rate than they are now to stop the debt markets from imploding, the result will be hyperinflation, and we are heading in that direction already.

In the writer’s view (that is to say me), this way of carrying on suits the Globalists or New World Order just fine.

After all, they have already had the effrontery to put up loads of adverts saying, “You will own nothing and be happy,” and a policy of continually expanding the money supply will enable them to buy up everything and, at the same time exterminate the population at large by creating hyperinflation that renders them destitute so that they end up going “cap in hand” for their universal-basic-income subsistence handouts which they will have to qualify for by being fully vaxxed and not visiting websites that their Masters don’t approve of, etc.

Clearly, if this is the approach they adopt, it could have a stabilizing effect on the markets regardless of the economy being in terminal decline.

Thus it was that the mere hint yesterday of the Fed going easy caused a dramatic reversal in markets back to risk-on, and the S&P500 index (and other índices) finished the day with a nice big white candle on their charts, as we can see on the latest 6-month chart for the S&P500 index below.

If the Fed takes the easy way out, which is to keep creating money until it leads to hyperinflation, then the precious metals (and many other commodities) should soar.

Incidentally, this positive candle builds on the impressive “bullish engulfing pattern” reversal that appeared the week before last, which involved an impressive large white candle, so it is looking increasingly like the market has put in an intermediate low for now.

However, that said, it hardly looks like the time has arrived to start cracking open the champagne, for overall, the setup remains incredibly dangerous, so if the Fed doesn’t deliver with a “pivot,” or even if it does and it has little effect, the market could yet turn tail and plunge.

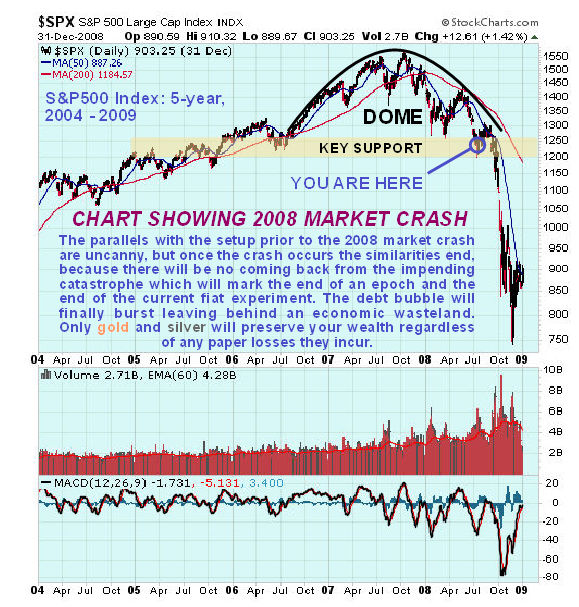

We can see the horribly bearish setup on the latest 5-year chart for the S&P500 index, which would not be changed by a rally in the coming weeks back up to the Dome boundary.

What could be going on now is that the Fed is complicit in massaging sentiment to keep the market propped up until the mid-terms, after which they may permit it to drop like a rock. Therefore a good tactic may be to see if the market can make it up to or near to the Dome boundary, at which point it will be time to thin positions or lay on more hedges, buy tranches of Puts at good prices, etc.

We will be on the lookout for this.

The chart for the 2008 crash is shown below to enable you to see the uncanny similarity between then and now.

The difference is that if the markets do crash soon, they won’t bounce back afterward as in 2008 and 2009.

This is because the bond market will be crashing, too, as there will be no QE card to play, unlike last time, as the entire system flies apart.

On the 6-month chart for the S&P500 index, we can see the large bullish engulfing pattern that appeared the week before last, which marked the turn, and the impressive white candle that occurred yesterday as the Fed leaked out hints that it will “pivot.”

We will be turning our attention to the precious metals sector tomorrow since clearly, if the Fed takes the easy way out, which is to keep creating money until it leads to hyperinflation, then the precious metals (and many other commodities) should soar, so it’s no wonder we saw impressive action in many PM stocks yesterday. Keep in mind the political motivations for keeping the markets propped up until the mid-terms.

Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.