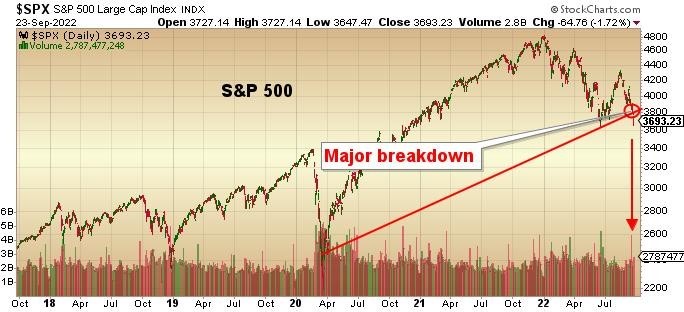

I am throwing up a few charts that all confirm the arrival of the bear market, not just in the breaking of trendlines but also in the new lows registered by the Dow Jones Transports in combination with new 2022 lows in the Dow Jones Industrials.

Under Dow theory guidelines, this is a confirmed new low and does not call for a capitulation washout yet. We might get an oversold bounce, but then the retest should give me the clue as to whether or not we see a non-confirmation as either the Trannies or the DJIA close above this week’s low.

It was different for the S&P 500, which did not take out the June lows and as was also the case for the NASDAQ 100.

These are minor positives, but they do not outweigh the breakdown of major trendlines dating back to the lows of the COVID crash — a large negative.

I purposely omitted RSI and MACD studies which are quickly moving deep into oversold territory because when these declines move from “gradual” to “parabolic,” markets can stay oversold for weeks, and while the lows may be close in terms of time, they may not be close in terms of the all-important price, which is all that matters.

Watch these last two markets (U.S. Dollar Index and the 10-year UST yield) for a signal of an impending reversal in risk assets, which is basically stocks and commodities, including gold and silver.

Two final charts that may provide guidance as to the potential for some buying in early-mid-October (or toward month-end on Friday, September 30, 2022).

The first is the chart of the U.S. 10-year Treasury Yield, which is now well into overbought territory in both RSI (75.62) and MACD (0.166).

The vehicle to look at is the ETF for the U.S. long-bond (20-year) TLT:US, which began the year at USD$150 and went out on Friday at US$105.

If stocks go into freefall next week, yields will fall sharply, and TLT will go up sharply.

The next chart is the U.S. Dollar Index which has been on an absolute tear since December 2020. It was as if the dollar smelled a Fed policy shift on its way with the bond vigilantes that have been beaten in Pavlovian fashion every time they think the Fed might tighten since 2009 finally got Jay Powell’s memo calling for an anti-inflation campaign in place of a stocks-to-da- moon maximum full employment campaign.

This shift meant higher interest rates, and since money flows to where it is treated best, the sh*tshows in Brussels and Tokyo are forcing flows across the pond and into the U.S. bond market, which means dollar purchases are safe haven purchases — until they are not.

The dollar is extremely overbought with the RSI at 75.63, and MACD looks stretched. Watch these last two markets (U.S. Dollar Index and the 10-year UST yield) for a signal of an impending reversal in risk assets, which is basically stocks and commodities, including gold and silver.

| Want to be the first to know about interesting Special Situations and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclaimer

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.