There’s a bear market in junior mining stocks today.

Investors are afraid and that overshadows everything. It’s making great projects cheaper and it overshadows some great new discoveries.

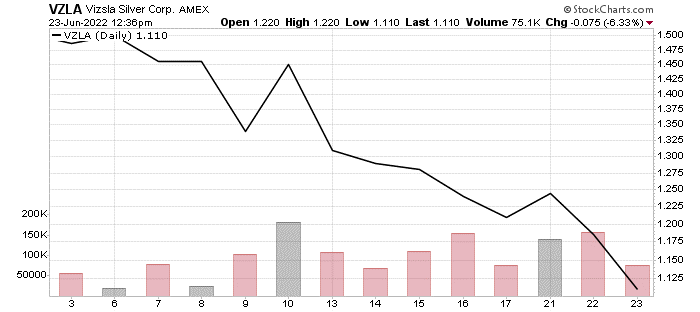

You need look no further than the market’s response to good news lately. Take Vizsla Silver Corp.'s (VZLA:NYSE American) latest press release for example.

On Monday, June 21st, the company announced a drill hole of 1,030 grams per ton silver equivalent over 20.45 meters. That’s fantastic news and should have prompted a jump in the share price. Here’s what the stock did (image on the left).

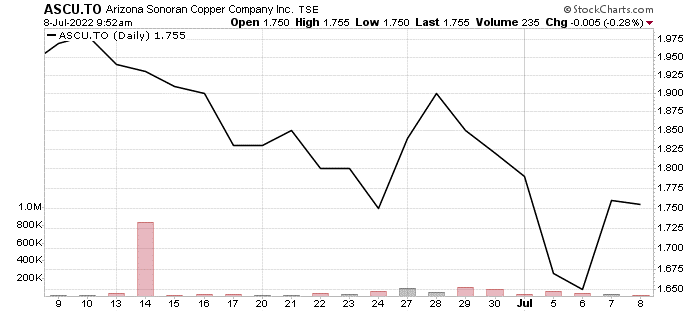

Another example is Arizona Sonoran Copper Co. Inc. (ASCU:TSX), which announced hitting 1.32% copper over 479 feet on June 23rd. The press release was excellent…and investors greeted that news with selling as well.

In both cases, the results created real value for the shareholders. And in a rational market, the announced results for both of those companies would result in higher share prices.

But today, we have a “risk-off” market. And good news receives higher selling volumes. Owners use any news to dump shares and run.

That put huge downward pressure on prices across the junior mining sector. But it creates an opportunity for investors who understand the cyclicality of natural resource markets.

And while current shareholders bemoan this situation, the rest of us should be licking our chops. Because some exciting projects just keep getting cheaper and less risky, from a price perspective.

Take this little exploration company Cross River Ventures Corp. (CRVC:CSE; CSRVF:OTC; C6R:FWB) in Ontario, for example.

Back in March 2022, I wrote about several exciting gold projects in the Red Lake Region of Ontario. Called “The Nevada of the North,” Red Lake is a current darling of major gold companies looking for new projects.

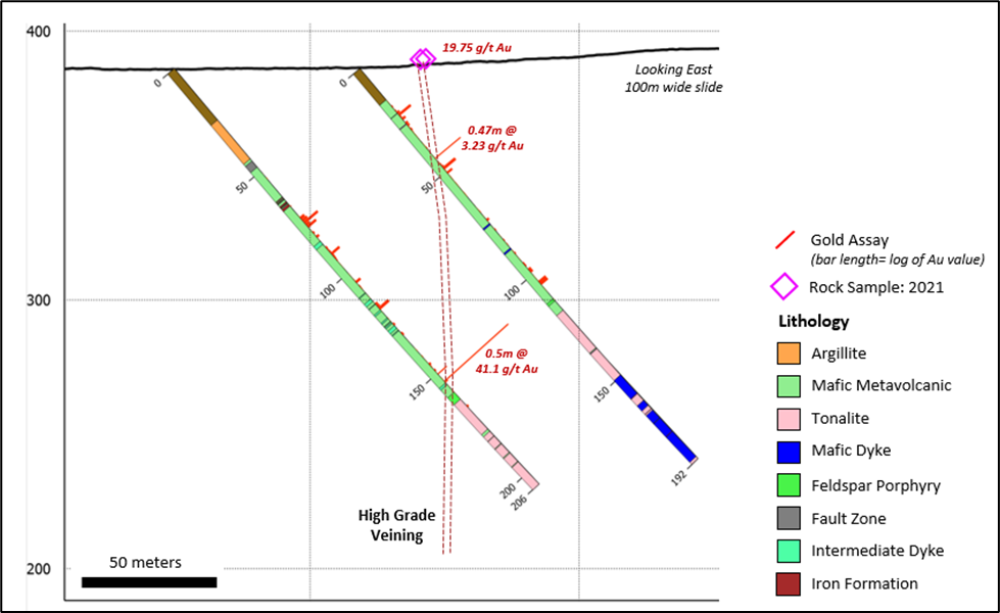

In the essay, I pointed to two tiny companies preparing to drill…and one of them paid off. As I mentioned in that essay, Cross River Ventures Corp ran its first drill campaign on its McVicar project this past winter. The results were better than expected. The program hit high-grade gold in its maiden drill program at the Bear Head zone.

The high-grade gold in BH-02 appears to be part of a vertically plunging structure, as you can see below.

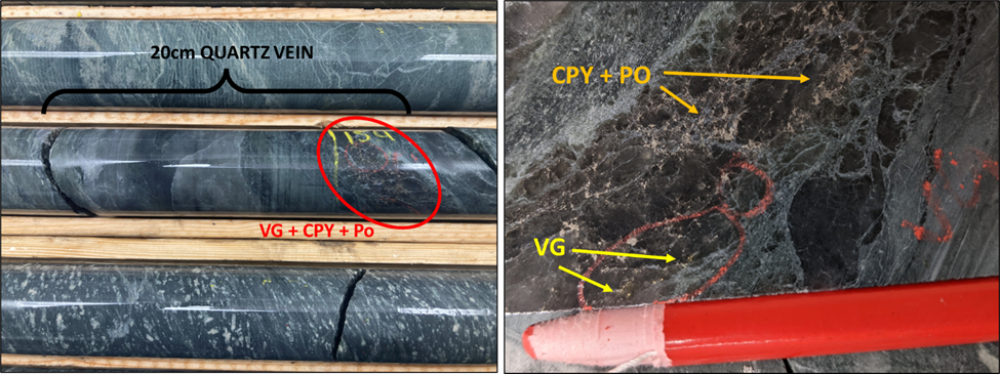

This structure outcrops on surface and carried gold in holes BH-03 and BH-02. In BH-02, the core held visible gold:

This is tremendous results for such a tiny company. And it’s a brand new, grassroots gold discovery in Red Lake.

The company released the news on June 16th that it hit 41.1 g/t gold over 0.5 m with visible gold in the core. That’s an excellent result for the very first drill program.

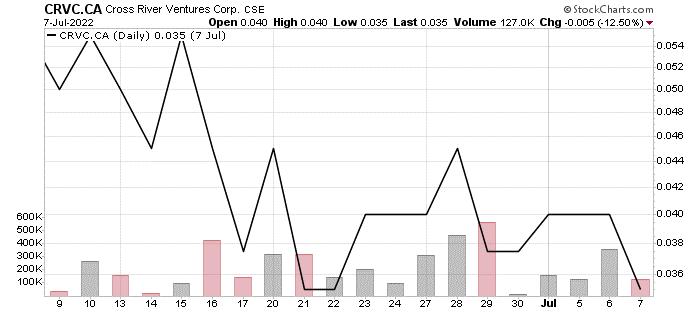

And, as expected, the market sold the company off, as you can see below.

Cross River is a tiny company. And in a normal market, the Bear Head Zone discovery would have sent shares soaring higher.

But this market is brutal. And that gives us a chance to pick up shares at a deep discount.

Cross River Ventures holds a highly prospective 11,500-hectare project on the Lang Lake greenstone belt, just east of Red Lake. The rocks looked like a fantastic area to explore. But now they have a high-grade gold discovery on their first set of holes. And are currently waiting for the rest of their drilling results to come in.

It’s the kind of exploration story often swallowed by the shock of a bear market.

A tiny company finds high-grade gold, and no one noticed. That’s why I’m telling you now. The story is great, the stock is cheap, and the rocks are exciting.

Cross River Ventures is one to keep an eye on.

Reach Matt Badiali at www.mangroveinvestor.com.

Matt Badiali is the founder and CEO of Mangrove Investor Media, an independent investment research publisher. He is a geologist by education, an investment analyst by profession, and a writer by nature. He began researching and writing about natural resource investments in 2004. His research appeared in Bloomberg, Barron’s, The Wall Street Journal, and Forbes. He’s an avid surfer, boater, and fisherman. You can find him at www.mangroveinvestor.com.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Vizsla Silver Corp. and Cross River Ventures Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Cross River Ventures Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Cross River Ventures Corp. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cross River Ventures Corp., a company mentioned in this article.