Ice drilling at Regnault target, Frotet project, Quebec

It probably sounds a bit out of context to discuss results of a winter drill program when the summer really is kicking in with tropical temperatures across the globe, with temperatures up to 38C in Toronto a week ago during PDAC, but Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO:FSE) completed their ice drilling in April at Regnault, part of their Frotet project in Quebec, part of the 20/80 JV with Sumitomo where Kenorland is the operator, and assays have been received from the lab and interpreted as per the latest news release.

The absolute highlight was the 3.85m @ 44.95g/t Au at the R1 trend, being a 100m down-dip step-out from known mineralization, potentially adding lots of ounces of gold. It seems that every drill program keeps meaningfully expanding the existing structures, and on top of that also discovers new structures, with most drill holes hitting economic mineralization. Let’s see what kind of beast Kenorland seems to have by the tail here, at a time where inflation, rate hikes, supply shortages and a slowing down world economy spook the stockmarkets.

With PDAC starting at June 13, 2022, Kenorland Minerals decided this day it was a good time to release the results of the first 20 out of 25 drill holes completed, to have their news out in front of the PDAC audience, amounting to over 17,000 investors, fund managers, experts, country officials etc this year as it cautiously ramps up after two years of COVID measures. A normal PDAC would draw 25,000-27,000 people on average, but this was a good start and from a personal standpoint it was good to see live faces again after a long period of calls, Zoom calls, Teamviewer calls, Whatsapp video calls and whatever other calls you might have. And didn’t we all miss the parties! One thing nobody missed were the Niagara Falls freezing cold temperatures, a household horror around the normal PDAC date, early March. If there is any petition out there to sign in order to change this permanently, please let me know so I can sign it asap. Enough about PDAC, lets continue with the Regnault results.

The current batch of results involved 20 of 25 drill holes completed, containing 8,040m of 10,880m completed in total. The highlights looked like this:

- 22RDD111: 2.00m @ 20.43 g/t Au incl. 0.70m @ 46.20 g/t Au at R4

- 22RDD113: 2.25m @ 18.63 g/t Au incl. 0.35m @ 72.90 g/t Au at R4

- 22RDD121: 5.70m @ 8.10 g/t Au incl. 2.30m @ 15.72 g/t Au at newly discovered vein

- 22RDD124: 4.00m @ 10.17 g/t Au incl. 1.35m @ 25.99 g/t Au at R5

- 22RDD130A: 3.85m @ 44.95 g/t Au incl. 1.20m @ 127.83 g/t Au at R1

At the R2 and R4 trends drilling was designed primarily to expand the strike extent of mineralized structures, while drilling at the R1 trend was testing the down dip extents and exploring for additional mineralized structures immediately to the south. As these drill holes can all be considered step-out holes, I found these highlights, but also the majority of results, impressive. Just 2 holes didn’t return economic intercepts, and only one hole didn’t return any mineralization (22RDD118). CEO Zach Flood was pleased with the outcomes:

“Initial results from the 2022 winter drill program at the Frotet Project continue to demonstrate the scale and high-grade nature of the Regnault gold discovery. Most of the drilling this year, including the program currently underway, has been designed to aggressively step-out and expand the mineralized footprint both along strike and at depth of the vein system. In addition to these step-outs, we have been drilling beyond the known veins which has led to the discovery of multiple sub-parallel mineralized structures, which are now also being followed up on with wide-spaced step-outs. So far, we are delighted with the success rate we are seeing at the drill bit and the impressive trajectory of this discovery.”

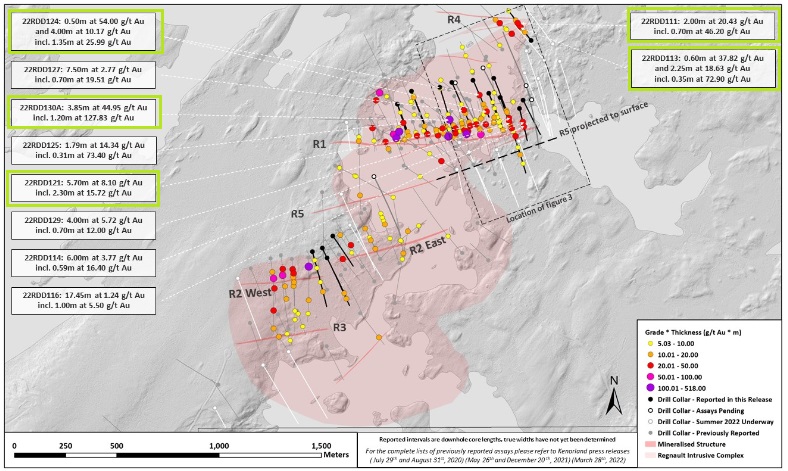

The news release provided the following map with drill collar locations, trajectories and intercepts of the highlights (in green) and a few other strong results:

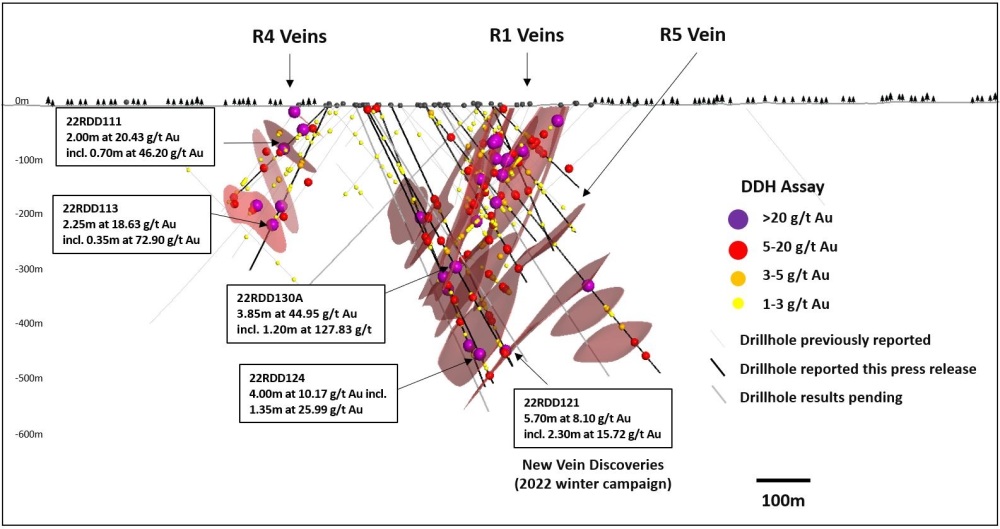

As the scale of this map does show the overall structures, but is a bit too small for additional detail, fortunately a 3D visualization of the mineralized structures was provided as well:

Into some more detail, highlights of the summer/fall program included:

- R4: Hole 22RDD111 stepped 70m east from 21RDD031 (2.70m @ 15.87 g/t Au) and intersected 2.00m @ 20.43 g/t Au including 0.7m @ 46.20 g/t Au.

- R4: Hole 22RDD113 stepped 100m east from 20RDD004 (2.59m @ 9.89 g/t Au) and intersected 2.25m @ 18.63 g/t Au incl. 0.35m @ 72.9 g/t Au.

- R1: Hole 22RDD130A stepped 100m down-dip of 21RDD098 (0.33m @ 30.60 g/t Au) and intersected 3.85m @ 44.95 g/t Au incl. 1.20m @ 127.83 g/t Au.

- R5: Hole 22RDD124 stepped 125m down-dip of 21RDD110 (4.50 @ 2.52 g/t Au) and intersected 4.00m @ 10.17 g/t Au incl. 1.35m @ 25.99 g/t Au.

- R1/R5: Hole 22RDD121 intersected new vein intercepts interpreted to be sub-parallel to, and 100m below the R1/R5 structures, returning 5.70m @ 8.10 g/t Au incl. 2.30m @ 15.72 g/t Au.

The discovery of these additional mineralized structures indicates the potential for further sub-parallel structures at depth in the Regnault system. These results along the R1 and R5 structures extend the known mineralization to depths of 400m and 450m below surface respectively, and remain open at depth.

These results confirm and gradually extend the mineralized R1 zone over 950m of strike length, to average depths of 300m, coming from 250m. The R1 zone is in fact a set of layered veins, but for guesstimating purposes this will be calculated as one zone. This results in an updated, very global back-of-the-envelope estimate on the R1 structure, with an average grade*thickness (or GT as Kenorland calls it) of 5*5 = 25, and arrive for R1 at 950 x 300 x 5 x 2.75 = 3.92Mt, at an average guesstimated grade of 5g/t Au this would mean a hypothetical 630koz Au.

No additional results came in for the R2 structure, so my back-of-the-envelope guesstimate stands unchanged at 700 x 200 x 2 x 2.75 = 770kt, at an average guesstimated grade of 9g/t Au this remains a hypothetical 223koz Au.

For the R3 structure it is too early to do any guesstimates, as there haven’t been enough results reported for this particular structure. The R4 structure to the north seems to be consisting of fairly narrow veins as well, 200m long and 225m deep, however not continuous from surface but separate vein structures, so the combined mineralized envelope is guesstimated at 200 x 100 x 2 x 2.75 = 110kt, at an average guesstimated grade of 15g/t Au this could imply a hypothetical 53koz Au. If we do this for the R5 structure as well, which appears to be a combination of 4 different veins, I arrive at a guesstimate tonnage of 300 x 100 x 5 x 2.75 = 412.5kt, at an average guesstimated grade of 5g/t Au potentially resulting in 66koz Au.

In total this back-of-the-envelope guesstimating would lead to a combined figure of 972koz Au, which is very close to the important first threshold of 1 Moz Au in gold exploration. And the good news is the end isn’t in sight yet it seems, as all structures are wide open, especially to depth as the company keeps hitting new structures at depth. As of now, Kenorland has drilled 55,966m at Regnault, and is currently drilling a summer program of 12,000m, as part of up to 40,000m of drilling, which has an approved JV budget of C$12.5M (Sumitomo).

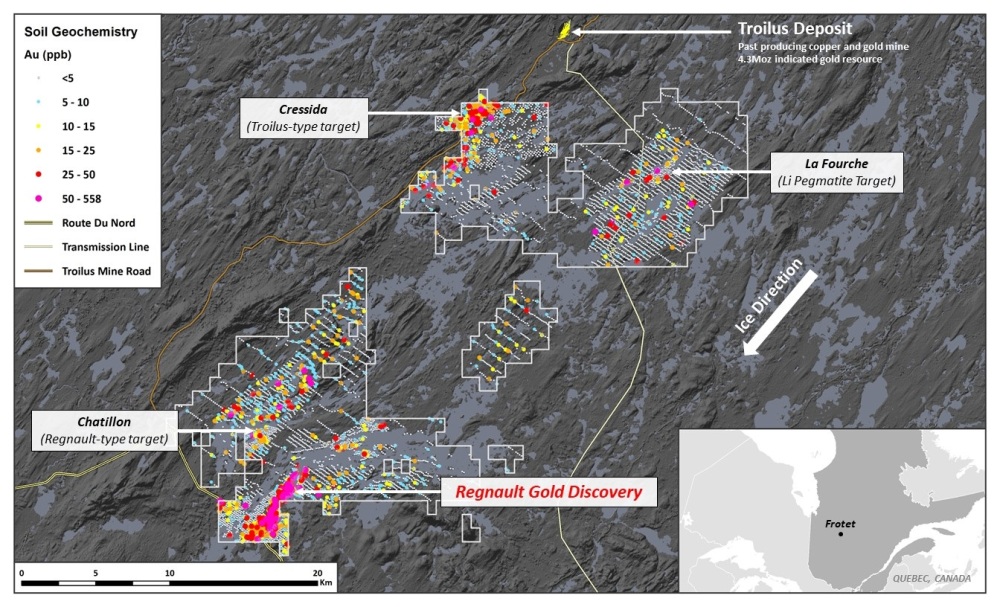

The aforementioned ongoing summer drill program of 12,000m at Regnault has the intention to systematically step-out along known mineralized structures and explore for additional sub-parallel structures to the south. In the meantime, the company is also busy with another target in the Frotet project area called Cressida, and has planned 2,500m of diamond drilling here.

As can be seen, the Cressida target has the second best sampling results besides Regnault. I wondered if the claims in between the Regnault/Chatillon and Cressida/La Fouche claimsets couldn’t be acquired, most likely owned by Troilus. CEO Zach Flood answered, “We dropped much of that ground early on as our regional till sampling had effectively sterilized it.”

The second most important project for Kenorland is Healy (Alaska). After a first drill program returned not very impressive results, management has no immediate plans to explore Healy at the moment, however they are looking at alternative paths forward which could still advance the project.

Another important project for Kenorland is Tanacross (also Alaska), which could have a high likelihood of being drilled during 2022. The current status on drilling is currently on hold, as management is waiting on results from surface exploration including geochemical and geophysical surveys that were completed in June.

Kenorland also completed a VTEM survey at the Hunter project in Quebec (optioned to Centerra Gold), and a LiDAR survey and mapping at South Uchi (optioned to Barrick). The current status on these projects is as follows: at Hunter a property-wide sonic drill-for-till program will be carried out next month. At South Uchi, Barrick will be following up on the 2021 property wide till geochemical survey with further exploration. Multiple discrete gold anomalies were identified and have been prioritized for follow-up exploration in 2022. For 2022, Barrick has approved a C$1.8M budget to complete infill glacial till geochemical sampling, within the regional As-Sb+/-Au anomaly, on a 350m by 150m spaced grid. The follow-up survey is planned to be carried out between mid-June and mid-August.

Since till sampling, boulder prospecting, airborn magnetics and an IP survey have been completed at Deux Orignaux (Chebistuan), further targeting is on its way. According to CEO Flood, they are still waiting on the final IP data. Once they have that in hand and have completed our targeting, they will propose a program and budget to Newmont.”

Another important project for Kenorland is Chicobi. As a reminder, the Chicobi Project is held under an earn-in option to JV agreement with Sumitomo where they have an option to earn up to 51% interest by funding C$4.9M in exploration expenditures. As the 2,000m of drilling was completed during April, and results are expected to come back from the labs within 2-3 months, I wondered what the current status is here. CEO Flood commented that an update will be provided soon.

The treasury currently stands at about C$6M, and the idea of management is to spend around $1.6M of this on exploration advancing their own projects including funding its joint venture commitment at Frotet, further exploration in Alaska, and additional generative exploration, including advancing projects in Manitoba. The revenue generated from its operations, including management fees as well as cash and equity received from partners, will more than cover the G&A of Kenorland. This is of course a good thing as the money markets these days aren’t the most easy ones to raise cash at the moment.

Conclusion

Kenorland Minerals keeps generating strong drill results at Regnault, and as such the mineralized zones could hypothetically grow to very close to 1Moz Au at the moment. As it still is early days, this could grow much larger. Of course, a lot of work still has to be done, but as JV partner Sumitomo decided to pony up another C$12.5M for Regnault, it seems Sumitomo hasn’t lost interest and has high hopes on further success. The other projects are more early stage, and will probably achieve more attention when substantial drill results come in. In general, the markets are tough at the moment, and prospect generation is a slow game, benefitting as a minority partner only from large deposits, but since I consider Kenorland the poster child of prospect generators, with excellent projects, management and backers, I view this as the single best opportunity to have exposure to prospect generators, which also have much less downside compared to the usual exploration juniors, and the chart of Kenorland can testify about this advantage against almost every junior in the field.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Disclaimer

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence and talk to their own licensed investment advisors prior to making any investment decisions.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.