Red Metal Resources Ltd. (RMES:CSE; RMESF:OTCBB) finally got the chance to sink some diamond drill holes into its flagship Carrizal copper-gold-cobalt property in Chile and the initial assay results delivered on expectations.

Hole FAR-022-020 returned 5.7 meters of 1.10% copper (Cu), 0.12% cobalt (Co) and 0.25 gram per tonne gold (25 g/t Au). It marks the first mineralized intercept on a new vein and with cobalt fetching almost $74,000 per tonne on the London Metals Exchange, the cobalt in the ore is worth more than the copper.

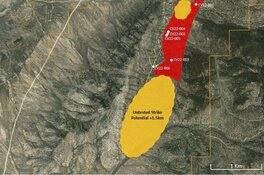

The 9-hole 2,010-meter winter diamond drill program focused on extending known mineralization on the Farellon vein down dip on both the north and south ends.

In fact, most of Red Metal’s exploration work had focused on the Farellon vein. Surface sampling had revealed others but those were never drilled—until now.

Meet Gordal

The newly discovered vein — dubbed Gordal — is about 250 meters away and parallel with Farellon. Another 1.5 km of untested strike length on Gordal remains open for further exploration.

A second hole, FAR-22-017, hit 3.6 meters of 1.36% Cu, 0.01% Co and 0.42 g/t Au. Red Metals President and CEO Caitlin Jeffs says this intercept confirms continuity of the mineralized structure and extends mineralization approximately 25 meters down dip to a vertical depth of roughly 200 meters on the south Farellon zone.

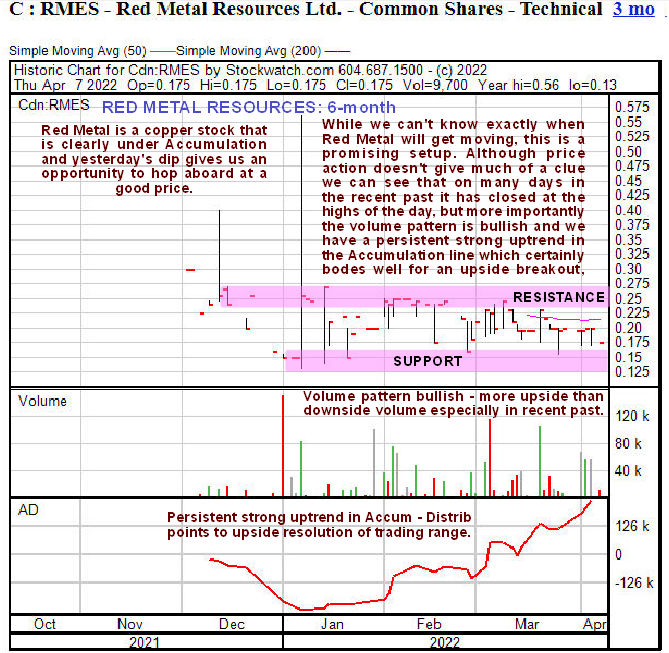

Technical analyst Clive Maund called copper grades in today’s release “good” and added that they “may lead to further gains.”

These comments build on an April 8 post when he wrote “with the stock at an attractive price and under accumulation, Red Metal is a speculative buy here and a worthwhile addition to a junior portfolio.”

Jeffs sees Carrizal’s copper and cobalt grades as proof of the necessary next steps.

“My goal is to properly justify underground mining. I think we need about 1.5 percent copper equivalent. Both of those (intercepts) confirm that and one has extremely intriguing cobalt number,” Jeffs told Streetwise Reports.

She adds: “We know there's cobalt on the property and that's going to be a focus for the next round of exploration.”

Red Metal is waiting for the assays from five more drill holes before the company contuse mapping work and is planning an induced polarization geophysical survey to help determine more drill targets.

Meanwhile, hole FAR-22-12 hit 3.7 meters of 0.62% copper, 0.08% Co, and 0.13 g/t Au or 1.14 copper-equivalent (Cu eq).

And hole FAR-22-013 returned 4.05 meters grading 0.98% copper, 0.07% Co, 0.1 g/t Au for 1.42% Cu eq (copper-equivalent grades were calculated using $1,750 oz gold and $3.75 lb Cu, well below the current spot price).

Copper Prices On Long-Term Trend Upward

Swiss bank UBS says copper exports in Chile fell by 7% from January 2021 through the same month this year. It’s the third straight year of declines.

The reasons include lower headgrades at large Chilean mines like Escondida and Los Pelambres, water shortages and fresh development speed bumps introduced to the space by 35-year-old leftist Chilean President Gabriel Boric, who needs to look like he’s taking greater control of the country’s mining sector.

Copper prices tracked by the World Bank rose by a factor of 13.7 from 1960 to 2021 and seem to now be climbing at an even faster rate given the recent all-time highs in price per tonne.

Much of that upward price momentum stems from economic growth and development in China. The country accounted for 17.4% of the global economy in 2020, versus just 1.6% in 1990.

Continued healthy copper prices could go a long way toward moving Carrizal from an exploration play to development. Yet it’s substantially more difficult to get noticed when another copper exploration play in Chile dominates like market darling Filo Mining Corp. (FLMMF:OTCMKTS).

Filo topped the list of experts’ best drill holes in 2021 with one hole hitting 858 meters grading 1.8% Cu eq at its Filo del Sol project high in the Andes in San Juan province, straddling the border with Argentina. The junior explorer trades at close to CA$26 but the timeline to development remains distant.

“In the mining industry you have a handful of show ponies and then a whole bunch of workhorses, and we're looking for the workhorse-type deposit that's got enough benefits, like being close to infrastructure, close to power and close to people, so that there aren't any huge hurdles to overcome to develop it,” Jeffs explained.

She added that Carrizal could be in production inside three years.

The junior recently raised CA$500,000, but the next round of drilling will require an even larger raise, perhaps as much as CA$3 million.

“I think we can raise the money. We have a lot of blue-sky potential,” Jeffs told Streetwise Reports.

Carrizal is about 23 kilometers from the Pacific Ocean, which is handy if a desalinization plant is ever required. There are about a dozen desalinization plants in Chile and most of them are operated by miners. Many of the other copper explorers are farther up in the mountains where labor and water are more difficult to source.

Copper Plays Having Success

Closer to the coast, some other relatively small copper plays are also having success.

Altiplano Metals Inc. (APN) is producing from the nearby Farellon mine, an iron-oxide-copper-gold (IOCG) deposit. In Q1/22 the mine generated about $857,000 from 282,000 lb copper. In 2018, the head grade at Farellon was 1.54%. Shares in Altiplano closed at CA$0.25 on June 1.

Torq Resources Inc. (TORQ) recently made a discovery at its Margarita IOCG deposit in the Coastal Cordillera Belt, the same belt that hosts Carrizal. It has two other projects on the go and closed at CA$0.68 on June 1.

Red Metal has yet to find an IOCG deposit but as the drills go deeper the core is revealing relevant alteration that typically points toward an IOCG deposit — Red Metal’s ultimate goal.

“People love to say you can't mine alteration. And that's true. But the reason we look for it is because it shows you a wider halo that points you toward what you need to find,” Jeffs said.

Jeffs and her family, own more than 21% of Red Metal. Toronto-based AlphaNorth Asset Management owns 2 million shares. Fully diluted, there are 69 million shares outstanding, including warrants priced at CA$0.20, CA$0.25, and CA$0.30.

Red Metal trades in a 52-week range of CA$0.56 and CA$0.11.

Sign up for our FREE newsletter

Disclosures:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Red Metal Resources Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Red Metal Resources Ltd., a company mentioned in this article.