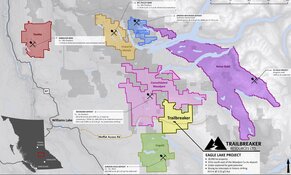

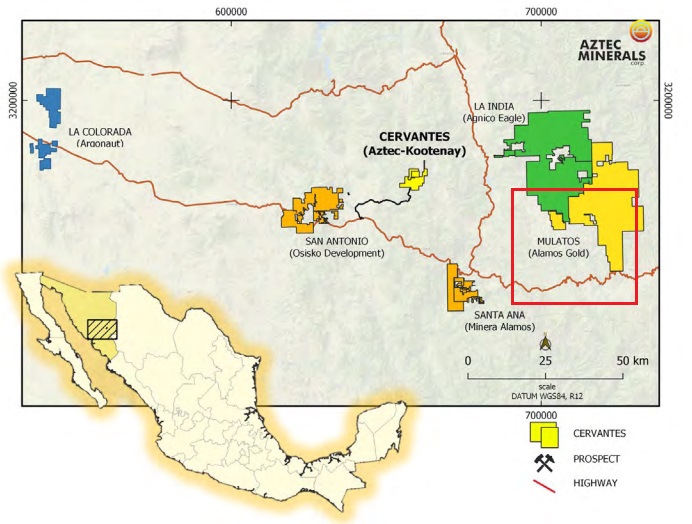

Just after releasing intriguing drill results at Cervantes, Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) announced a CA$3M non-brokered private placement with Alamos Gold, which can be called intriguing for sure as well. Alamas Gold is operating Mulatos, one of the largest heap leach gold mines in Mexico, not that far away from Cervantes. Although Mulatos still has about 10 years of reserves, and there do not yet appear to be any direct synergies between the Cervantes project and Mulatos operation, it still is a stamp of approval and a sign of strong interest in what Aztec Minerals is accomplishing at the moment.

It is not every day that you see a mid-tier producer like Alamos Gold Inc. (AGI:TSX; AGI:NYSE) (“Alamos”) indicating that it intends to purchase securities to obtain a 9.9% interest in a small exploration junior like Aztec Minerals, so the news release on May 16, 2022, definitely surprised the markets. I already contemplated a financing coming soon in my latest update, but I didn’t expect this for sure, and definitely not this soon. Well done by CEO Simon Dyakowski. I asked him to provide some background story to this financing as far as he could disclose, but unfortunately, he couldn’t share too much info as the deal hasn’t closed yet: ”Aztec is in a fortunate position to be able to finance in a tough market because of our strong exploration results in the Winter 2022 RC drilling Campaign at Cervantes. We are excited at the prospect of welcoming Alamos Gold as a large strategic shareholder of Aztec. The investment will allow Aztec to advance exploration at the Cervantes Project over the late Spring and into the Summer. ”

The non-brokered private placement would involve the issuing of up to 10M units at a price of CA$0.30 per unit for gross proceeds of up to CA$3.0M. Each unit consists of one common share and one warrant exercisable to purchase an additional common share at an exercise price of CA$0.40 for a two-year period following the closing of the private placement. As the Aztec shares were trading around CA$0.26 when this was announced, the shares would be issued at a premium, which is rare these days with lots of negative sentiment everywhere due to the Fed rate antics, reacting to multi-decade high inflation, fueled further by commodity shortages, initiated by COVID-19 which halted investments for almost two years, and exacerbated by the ongoing Russia-Ukraine conflict. Besides the premium, Alamos was able to negotiate a full warrant, which is something you don’t see very often anymore, but it seems only fair after paying the premium.

Aztec Minerals intends to use the net proceeds of the PP to conduct exploration work on its Cervantes Porphyry gold-copper project in Sonora, Mexico, and its Tombstone Epithermal gold-silver & CRD silver-lead-zinc-copper-gold project in Arizona, USA, as well for general working capital purposes. As a reminder, management is contemplating a 5,000m follow-up drill program at Cervantes in the second quarter. Not only will the near-surface heap leachable mineralization be explored, but a stronger diamond drill rig will finally be utilized to drill at depth for large porphyry targets, indicated by a large IP chargeability anomaly. Aztec is also carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California Norte, and Jasper, and is expanding surface sampling and mapping on the property in general, in order to continue the 2021 phase 1 surface program.

The last drill program has been completed, containing 26 holes with 4,649m drilled, and Aztec has still four more holes to report, located at the California Zone, and final assays for hole JAS22-001 and the remaining holes are expected over the coming weeks.

As another reminder, the exciting thing here is of course, that the Cervantes oxides already seem to account for an estimated 1Moz heap leachable gold, but aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for their Tombstone gold-silver oxide project (subject to a 75/25 JV with Aztec as the operator) in Arizona for the summer, also enabling them to go after large porphyry/CRD potential at depth at both projects. With the financing cash, Aztec is enabled to continue its exploration activities.

Conclusion

Although I had already contemplated financing sooner or later, this latest announcement surprised investors and me by the speed and the involved party. It is always good to see a mid-tier like Alamos Gold taking a strategic interest of 9.9% in a junior. For me, it is a stamp of approval by a company that knows better than any other type of investor out there what the mineralized potential could be at Cervantes. There probably is a good reason they want to sit in the front row from now on. Besides this: keep in mind Cervantes isn’t the only project, and both Cervantes and Tombstone have near-surface oxides plus deep porphyry/CRD potential.

I hope you will find this article interesting and useful and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material unless stated otherwise.

All pictures are company material unless stated otherwise.

All currencies are in US Dollars unless stated otherwise.

Please note: the views, opinions, estimates, forecasts, or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts, or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts, or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed, and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.