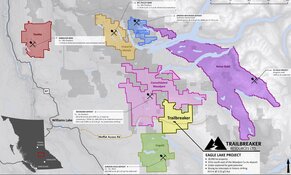

As Alianza Minerals Ltd. (ANZ:TSX.V; TARSF:OTCQB) is looking to do at least 2,000m of diamond drilling at their fully owned Haldane Silver project this year, they needed to fill up the treasury before the winter break was over, and it appeared they did that just in time. On May 19, 2022, they announced the closing of a financing of CA$750K, consisting of 10M shares with a half three-year warrant, with an exercise price of CA$0.125 until May 19, 2025. It was good to see Chairman Mark Brown buying 1.7M shares again, topping up to an impressive 13.2M shares, almost 9% of outstanding shares. This financing was the first step, with another one sufficient to fund the Haldane program to follow. Being a hybrid prospect generator, they have other projects in the works as well, paid for by JV partners.

The company is eying potentially up to five different drill programs this year at their various projects, as the optioned out (Allied Copper) Klondike and Stateline copper projects in Colorado, operated by Alianza, are both in the targeting phase now, with drilling likely to start in July. Coeur Mining, which has optioned the Tim Silver project in the Yukon, has notified Alianza Minerals that the results of the 2021 program have been compiled, and once Alianza has reviewed the data, a news release will detail the results of that work. Alianza expects to hear more about 2022 activities in early summer. The Twin Canyon gold project in Colorado also has seen its fair share of prioritizing drill targets, and a drill permit for a 10-hole RC drill program is also expected in June. Alianza has the intention to seek a partner for this drill program.

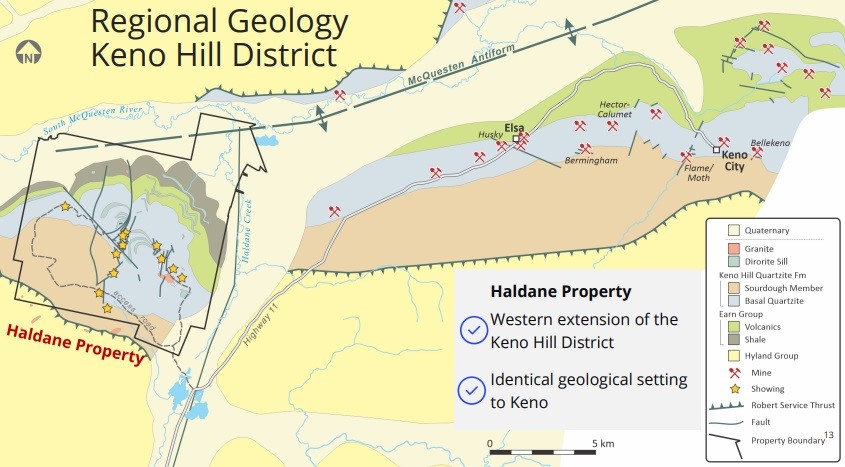

As a reminder, this is why Alianza thinks there is great potential, as the Haldane area very much resembles the geological make-up of the eastern part of Keno Hill, containing several significant high-grade silver deposits and mines:

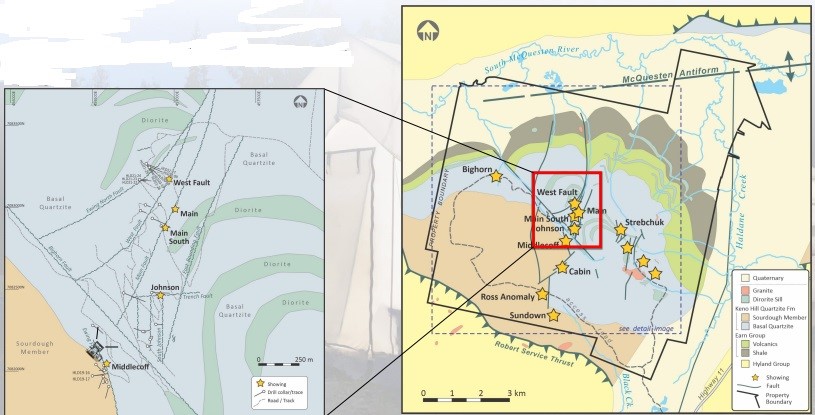

Recent exploration of the past few years by Alianza has focused on the Mount Haldane Vein System (MHVS), and considering high-grade results (HLD20-19: 1.78m @ 818g/t Ag and HLD21-24: 1.26m @ 3,267g/t Ag) at the West Fault target, management is narrowing its focus at this specific target even more:

According to CEO Weber, their insights on Haldane mineralization are improving, and they are looking to delineate a deposit here. He regularly talks to nearby exploring Alexco geologists, and they have confirmed to him that they are on the right track, as Alianza has hit the right type of geology, veins, and structures. Weber expects to drill further step-outs at the West Fault and Middlecoff targets around June, depending on the availability of drill rigs, and targeting for the Bighorn and Ross targets will be finalized in the spring, and drilling will probably commence later this year as it is a combination of crew and drill availability.

Alianza Minerals is working on a drill permit for Twin Canyon, which is expected within weeks, and are looking for a JV partner, with discussions still ongoing.

Conclusion

The latest financing is lower than expected, but nevertheless sufficient to provide adequate funding for Haldane drilling for this year. Besides Alianza’s flagship project, Klondike and Stateline copper projects in Colorado have drilling coming up for both projects this year. The Tim Silver project will very likely also see drilling this year by JV partner Coeur Mining. After the first CA$750k was raised, drilling at Haldane can begin soon, and I am curious if Alianza can expand the known mineralization into something significant, which leads to an economic deposit. But they have more irons in the fire for this year. Stay tuned!

I hope you will find this article interesting and useful and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All pictures are company material unless stated otherwise.

All currencies are in U.S. Dollars unless stated otherwise.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed, and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclaimer

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.