Tightening energy supplies and geopolitical tensions have led to greatly increased worldwide natural gas and oil prices, making investors the only winners. Soaring European energy prices are hitting households and energy providers. Since the fall of 2021, energy prices have been increasing steadily and have been pushed even higher by the Russian - Ukraine War. The cost-of-living crisis is not going away anytime soon and promises to get even worse next winter. Paying the energy bill has become a challenge to millions of Europeans, all while energy companies are making billions.

[Trillion] is at the forefront of the race to replace Russian energy supplies in Europe and Eurasia, where a once-in-a-lifetime fundamental paradigm shift in the region's energy supply chain is taking place.

According to Keith Anderson, chief executive at one of the UK’s largest providers, this fall the crisis “is going to get truly horrific.” Demand will spike during the heating season in what could be a colder than average winter.

The European Union is close to embargoing Russian oil as part of its sixth sanctions package. Hold-outs Hungary and Slovakia have until 2024 to replace their oil suppliers.

Bulgaria has threatened to veto the embargo unless it also receives an exemption. Whatever the EU may decide, Germany intends to stop importing Russian oil and significantly curtail gas imports. Ukraine recently cut off Russian gas flows to Europe, citing a force majeure provision in its pipeline contract, thus driving May 2022 prices higher. It is no wonder that Rystad Energy, a respected energy consulting group, predicted European gas prices could triple again — citing a perfect storm of events.

Thanks to the geopolitically induced rally, Big Oil is raking in huge profits. BP booked a profit of $6.2 billion for the first quarter of 2022, and Exxon booked a profit of $5.5 billion for Q1 2022. Conoco reported profits of $5.76 billion, and Shell booked $9.13 billion in profits for the same period. The major energy companies are using these profits to buy back their shares, a trend that began during the COVID pandemic.

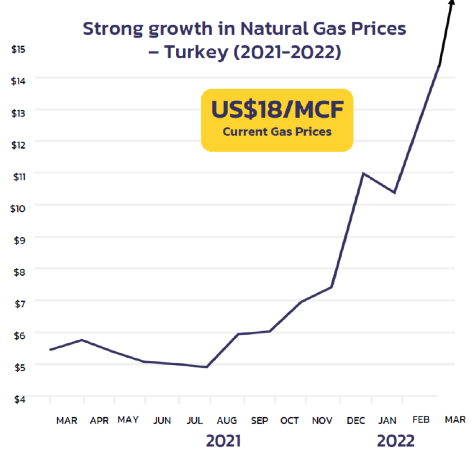

With a few small exceptions, European natural gas producers are woefully ill-equipped the meet the demand. One exception is Trillion Energy International Inc. (TCF:CSE; TRLEF:OTC; 3P2N:FSE), which presents a unique opportunity to investors as it is perfectly positioned to capitalize on the ongoing energy crisis. Trillion produces gas and oil in Turkey, where natural gas prices have rocketed from $6 to $18 per mcf, in less than a year and up 40% in 2022 alone. It is about to put a major gas field back online.

Trillion has a ready-built large natural gas facility and pipeline infrastructure in place, which according to CEO Arthur Halleran has a replacement value that could exceed $500 million. Trillion’s SASB Black Sea shallow water natural gas field holds large quantities of urgently needed natural gas that will help supply a region experiencing acute shortages and high prices.

Trillion has a ready-built large natural gas facility and pipeline infrastructure in place, which according to CEO Arthur Halleran has a replacement value that could exceed $500 million. Trillion’s SASB Black Sea shallow water natural gas field holds large quantities of urgently needed natural gas that will help supply a region experiencing acute shortages and high prices.

Production costs for the SASB field are expected to be sub-US$1 per mcf + 12.5% royalty over a planned 17 well development, giving Trillion massive margins at the current $18/MCF gas price. Netbacks like these are rarely seen and soon Trillion could be raking in cash just like the majors.

In recent oversubscribed financing, Trillion raised much of the cash needed to kick-start the project. Investors participated enthusiastically; no doubt driven by the company’s unique position in the resurgent energy sector.

Trillion’s aggressive multi-well gas drill program starts in Q3, with production revenues expected to follow shortly thereafter. CEO Art Halleran recently visited the regional project office to propel the project forward, targeting July 2022 to have the contracted rig onsite. All supplies required to spud the first wells are on order.

A well-known world-class oilfield services giant has been retained to oversee the engineering of its drilling program.

Thus, the company is at the forefront of the race to replace Russian energy supplies in Europe and Eurasia, where a once-in-a-lifetime fundamental paradigm shift in the region's energy supply chain is taking place.

Trillion aims to drill over 17 wells over the next two years, bringing one new well into production after another. It's a bold plan that will escalate cash flow as each well comes online.

According to CEO Halleran, "We are using best in class engineering and drilling support services at SASB. Using long reach drilling technology, directional drilling tools, and state of the art engineering, we will lower our capital costs for bringing the new wells into production and increases the anticipated returns."

When the SASB gas field is fully developed, at its peak, Trillion’s estimated cash flow could reach $180 million per year; many multiples of the company’s current share price.

The company received third-party engineering reports for its reserves and resources prepared by GLJ Inc and when combined, estimated the following:

|

Item |

Class |

BCF |

NPV10% $US Million(2) |

Class |

Bcf |

NPV10% $US Million |

|

Discovered non-producing |

2P |

20.2 |

$75.7 m |

3P |

31.4 |

$129.2 m |

|

Development prospects, risked |

Medium estimate |

23 |

$93.6 m |

High Estimate |

36.4 |

$156.0 m |

|

TOTAL |

|

40.3 |

US $169.m |

|

62.4 |

US $285 m |

|

|

|

|

CA $216 m |

|

|

CA $367 m |

From the above chart, representing the current work program, the combined net present value discounted at 10% (“NPV10%”) for the current 17 well work program (2P gas reserves plus risked medium case estimate of gas prospects is $169.3 million (CA$216m) up from $138.64). The combined net present value discounted at 10% (“NPV10%”) for the 3P Reserves plus high estimates for prospects, the NPV10% USD is USD $288m (CA$367m) up from $243.3m.

Actual cash flows could be much higher than the assessment shows, if current gas prices hold up. In April 2022 natural gas hit $18 /MCF, far exceeding the modest $8-9/MCF sales prices used in the reports.

Trillion has more than one European natural gas project on the burner. Russia's late April arbitrary cut-off of Bulgaria’s natural gas supplies caused an economic crisis. The company then announced plans to accelerate its Bulgarian project's development.

Sky-high natural gas prices have improved the Bulgarian project economics too much to be ignored. Bulgaria's current natural gas price is $22/mcf, indicating that this project could have enormous upside potential. Trillion is currently in discussions to prepare the necessary environmental reports to commence drilling work on the field; it intends to drill five new wells.

On the Bulgarian gas property, a 2014 preliminary survey by engineering firm Netherland Sewell & Associates estimated that undiscovered gas resources amounted to some 1.15 billion cubic feet (32.6 million cu m), according to best estimates.

Undiscovered Original Gas in Place -Billion Cubic feet (Bcf)

|

Prospective Formations |

Low Estimate |

Best Estimate |

High Estimate |

|

Macedonka |

220.0 |

520.8 |

702.1 |

|

Mogilishte |

214.6 |

624.7 |

1,082.0 |

|

TOTAL |

434.6 |

1,145.5 |

1,784.1 |

Unrisked Gross (100%) Prospective Gas Resources (Bcf)

|

Prospective Formations |

Low Estimate |

Best Estimate |

High Estimate |

|

Macedonka |

66.0 |

260.4 |

491.5 |

|

Mogilishte |

64.4 |

312.4 |

757.4 |

|

TOTAL |

130.4 |

572.8 |

1,248.9 |

Trillion is pursuing its Black Sea and Bulgarian projects with renewed vigor to capitalize on the current favorable environment for oil and gas producers. Fresh from its recent financing, it now has the cash and resources to commence drilling on these projects, along with the infrastructure needed for distribution in Turkey.

Once production starts, Trillion expects to generate substantial cash flows which could likely result in large shareholder returns, all while providing much-needed scarce energy to its partners and customers.

Kerry Lutz is the founder of the Financial Survival Network, whose mission is to help investors prosper and thrive in the new economy.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Kerry Lutz: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Trillion Energy International Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Trillion Energy International Inc.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.