Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO:FSE) keeps expanding and finding new mineralized structures at its Regnault target, part of its Frotet project in Québec, which is part of the 20/80 joint-venture (JV) withSumitomo Metal Mining Co. Ltd. (STMNF:OTCPK) where Kenorland is the operator.

After announcing the second 25-hole batch of its 57-hole, 17,792-meter 2021 summer-fall drill program, it is clear that Regnault contains a considerable gold system, spread out over multiple vein structures.

A recently completed 2022 winter drill program at Regnault, with assays pending, indicated the discovery of additional veins. Management is happy with the results.

“The last remaining results from the 2021 drill program continue to demonstrate the exceptional high-grade nature of the Regnault gold system, including the most significant intercept at R2 to date. We have also completed the 2022 winter drill program, which concludes the fiscal 2021 budget cycle," Kenorland Minerals CEO Zach Flood said.

He added: On this program we pushed drilling southward well beyond the R1 veins and intersected a series of additional parallel shear veins at depth. The significance of this development cannot be understated as it confirms the potential for additional vein discoveries within the intrusive complex. We anticipate the 2022 fiscal budget to be finalized towards the end of the month and we look forward to continuing our advancement of this remarkable gold discovery.”

Let’s have a look at where these latest results and discoveries rank in the overall story of Regnault.

Besides this, Kenorland also received assays back for its Healy project, commenced drilling at its Chicobi project, and very recently optioned out the Separation Lithium project.

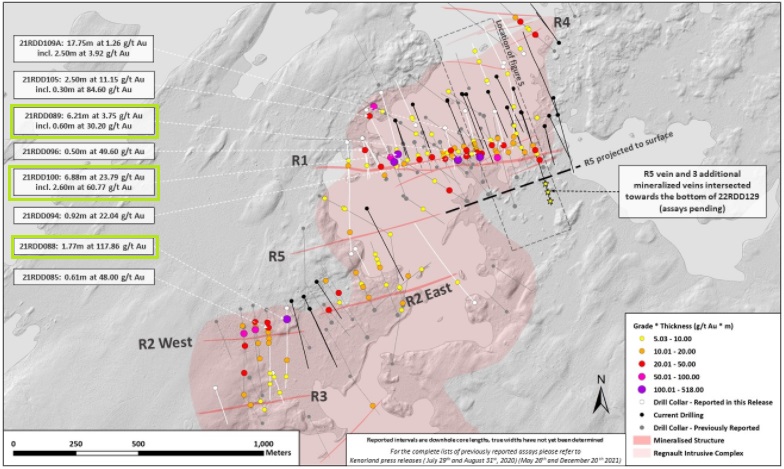

The current batch of 25 drillholes (totalling 7,968 meters) follows the previously reported batch of results of 32 drillholes (9,824 meters) of the 2021 summer-fall drill program completed in October 2021.

This drill program was designed to systematically test along strike and the down-dip extensions of the R1, R2 East and R2 West mineralized structures at Regnault.

The recently completed winter drill program looked for new potential structures/mineralization, and although results are pending, the R3, R4 and R5 structures could be identified based on visual inspection of the core, which showed visual gold in several instances.

Along the R1 trend, highlights of the summer/fall program included:

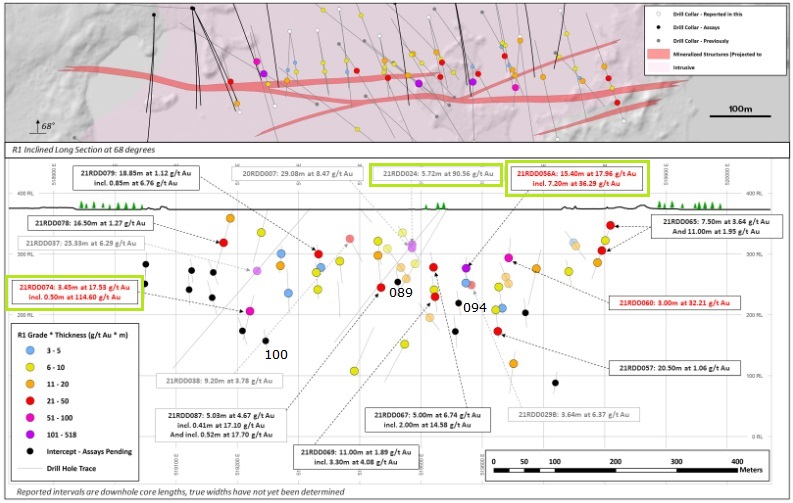

- Hole 21RDD089 stepped out 60 meters down-dip from one of the best holes at R1 to date 21RDD024 (5.72 meters at 90.56 grams per tonne gold [90.56 g/t Au]) and intersected 6.21 meters at 3.75 g/t Au from 140 meters, including 0.6 meter at 30.20 g/t Au.

- Drillhole 21RDD094 stepped out 80 meters down-dip from excellent hole 21RDD056A (15.4 meters at 17.96 g/t Au*) and intersected 0.92 meter at 22.04 g/t Au from 247 meters.

- Hole 21RDD100 stepped out 80 meters down-dip from 21RDD074 (3.45 meters at 17.53 g/t Au*) and intersected the best hole in this batch, containing 6.88 meters at 23.79 g/t Au from 349 meters, including 2.60 meters at 60.77g/t Au.

- Drillhole 21RDD105 returned 2.5 meters at 11.15 g/t Au from 40 meters, including 0.30 meter at 84.6 g/t Au near the top of the hole along a separate structure 200 meters north of R1 and 50 meters along strike from 20RDD021A (2.66 meters at 33.69 g/t Au).

- Hole 21RDD109A stepped out 75 meters down-dip of 21RDD032 (4.87 meters at 3.80 g/t Au) and intersected 17.75 meters at 1.26 g/t Au from 223 meters, including 2.5 meters at 3.92 g/t Au.

These results confirm and gradually extend the mineralized zone over 950 meters of strike length, to depths of 350 meters, coming from 750 meters along strike and depths of 330 meters. The following long section of R1 indicates this structure:

This results in an updated, very back-of-the-envelope estimate on the Regnault structures, with an average grade* thickness (or GT as Kenorland calls it) of 5x5 = 25, and arrives for R1 at 950 x 250 x 5 x 2.75 = 3.27 million tonnes (3.27 Mt). At an average "guesstimated" grade of 5 g/t Au, this would mean a hypothetical 525,000 oz gold.

Mineralized structures transect both the multiphase Regnault intrusive complex and surrounding volcanic rocks and are defined by zones of moderate-strong strain, biotite-calcite ± silica-chlorite alteration and disseminated pyrite (locally ranging from 3-10%). High-grade intercepts are characteristically shear-hosted, laminated quartz-carbonate-pyrite veins, often haloed by variably deformed extensional stockwork quartz veining locally, containing up to 20% pyrite along with trace chalcopyrite, Au/Ag tellurides and visible gold.

Besides R1, results also came in for the R2 structure. At R2 West, hole 088 intersected a narrow but still impressive 1.77 meters at 117.86 g/t Au, and is 80 meters east of step-out hole 082A, which returned 1.6 meters at 28.34 g/t Au.

Hole 085 returned 0.6 meter at 48 g/t Au, 30 meters up-dip of 082A. Mineralization for the R2 structure now has a strike length of 950 meters, and extends to 350 meters depth — this could indicate a back of the envelope guesstimate of 700 x 200 x 2 x 2.75 = 770 Kt, at an average guesstimated grade of 9 g/t Au, is a hypothetical 223 Koz Au. This brings the total guesstimated mineralized envelope to 748 Koz Au.

Not included are the R3, R4 and R5 vein structures, so in my view Kenorland could already be approaching 1Moz Au here.

Mineralization is found in stacked, shallow north-dipping extensional type quartz veins (R2 West) and steeply north-dipping shear hosted quartz-carbonate veins (R2 East).

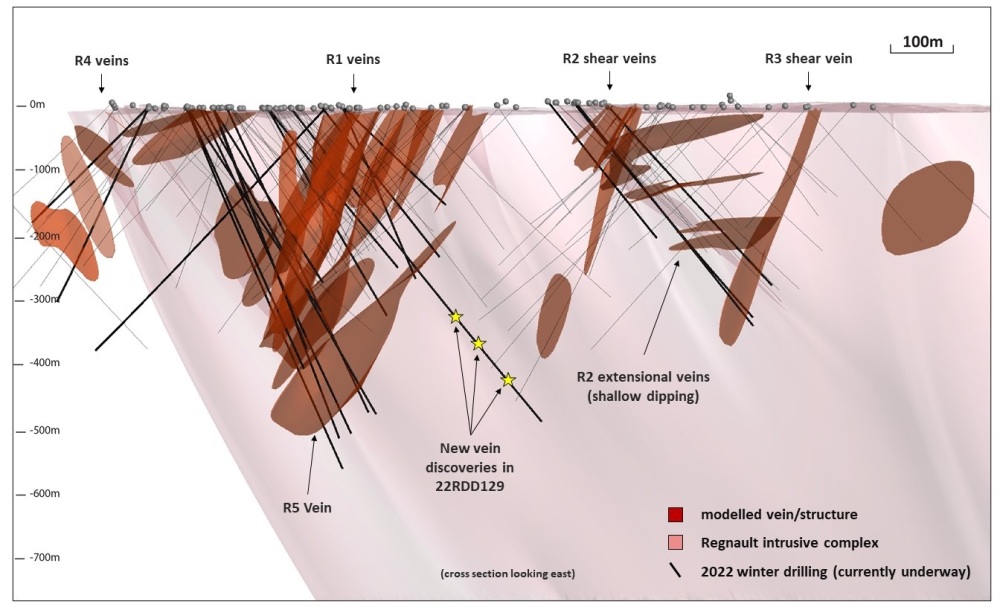

General mineralization for current structures appears to be differently oriented (shallow and steeply dipping, some stacked, some individual) vein stockworks, which appears to be quite complex (although Regnault is not as complex as most, the veins are relatively consistent in terms of strike and dip):

Holes like 22RDD129 (included in the winter drill program, assays expected back in two months) indicate the potential of new veins at depth, so the Regnault vein structures could run much deeper, somewhat comparable to the nearby Troilus deposits, which I discussed in another article about Kenorland.

It seems by the schematic models provided in the news release as if the mineralized veins run outside the intrusive complex as well, so I asked if management is focused completely on the intrusive complex, or looks outside it as well. CEO Zach Flood answered, “We have found, and there is great potential for, gold mineralization in the volcanics surrounding the intrusive complex.”

As Flood indicated in my previous interview with him, Kenorland continues to step-out along strike but its focus is really more on deeper step-outs down plunge of potential high-grade shoots.

The company is looking to drill more aggressive step-outs down dip. I wondered how much deeper would the company target for its next drill program (it drilled to 500 meters depth during the winter program), and what percentage would be aimed at infill holes versus step-outs at depth.

Flood said: “The next phase of exploration will be focused on wide-spaced step-outs along the new vein discoveries to the south of, and parallel to, the R1 trend, including R5 and the three additional veins we discovered with hole RDD129. We will also see step-outs along R4 to the north, the R2 trend, as well as testing entirely new targets to the south of R3.”

This wraps up the results from Regnault, let’s see what other projects Kenorland is working on these days.

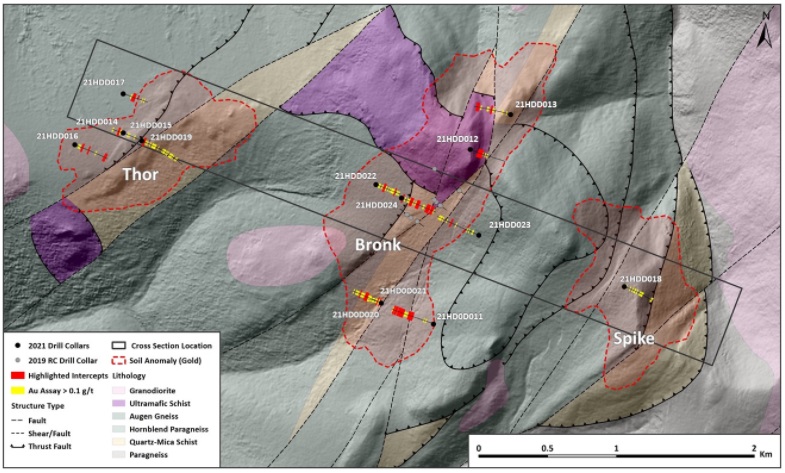

Regarding the Healy Project, Alaska, optioned from Newmont Corp. (NEM:NYSE), a 5,200-meter maiden diamond drill program has been completed, and results were announced on April 1. A map indicating the three main targets can be seen here:

Results weren’t very impressive, but keep in mind it is still early days at Healy.

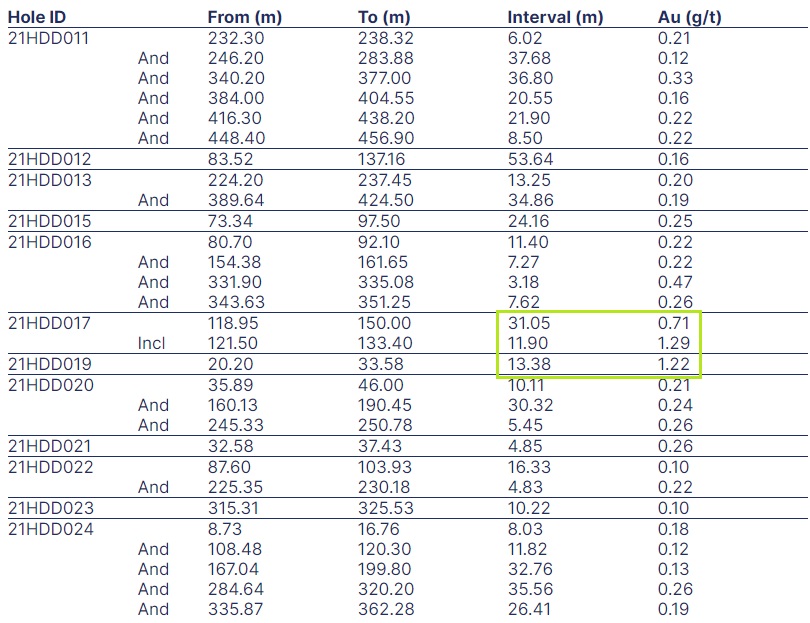

Hole 019, the best intercept drilled at the Thor target, returned 13.38 meters at 1.22 g/t Au from 20.2 meters. This was closely followed by hole 017, a 250-meter step-out, assaying 11.9 meters at 1.29 g/t Au from 118.9 meters.

Although width and grade look similar, the depths vary considerably, and as Healy represents disseminated sulphide, vein-hosted sulphide and breccia-fill sulphide styles of mineralization, chances are that these two results aren’t relating to the same gold structure. Here is a complete table of results:

CEO Zach Flood wasn’t unhappy about this first round of drilling:

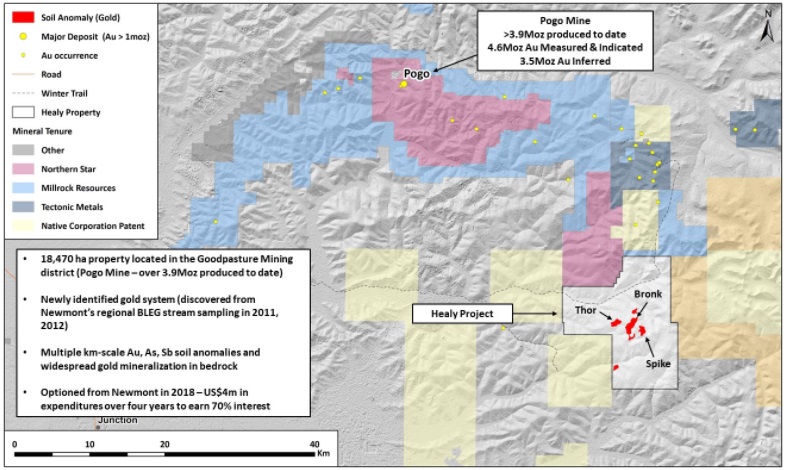

“The maiden diamond-drill program confirmed the presence of a large-scale gold system at Healy evidenced by broad mineralization encountered throughout the wide-spaced drilling across multiple target areas. While there are many indications that Healy represents a significant greenfields gold discovery within ’s prolific Goodpaster Mining District, it will require additional drill testing to fully evaluate the economic potential. We will provide an update on our exploration plans going forward after we have completed a detailed review of the results and targets with Newmont, which currently holds a 30% participating interest in Healy.”

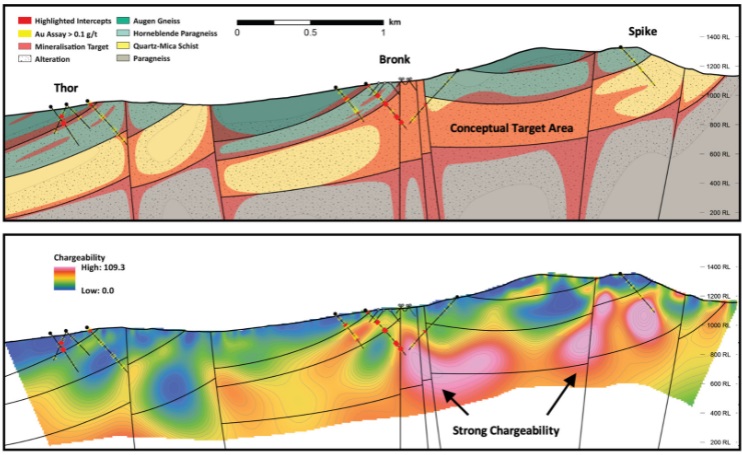

It would be great of course if Kenorland would find another Pogo (8 Moz Au) or Naosi (1.5 Moz Au) deposit, to name a few examples of major deposits in the region. After completing induced-polarization (IP) and magnetotellurics (MT) surveys, management has high hopes of finding mineralization at depth, but this will require deep and costly drilling, as can be seen in these sections:

As there are strong and significant chargeability and conductivity anomalies at depth, and gold mineralization and alteration occurs over a 4 by 2-kilometer footprint, management anticipates the potential presence of an extensive gold system.

Another important project for Kenorland is Tanacross, also in Alaska. Extensive soil sampling program has been done, a 5-kilometer IP and MT survey were completed, and an airborne magnetics survey was flown over several targets.

As surveys and consequent assays were delayed, and drilling put on hold, I was wondering if the assays were received from the labs. CEO Flood answered, “Yes, all assays have been received from the 2021 summer soil program. We have identified a very compelling target, which we will provide more information on in the near future. There is a high likelihood we will be drilling the project this summer.”

Kenorland also completed a VTEM survey at the Hunter project in Québec [optioned to Centerra Gold Inc. (CG:TSX; CADGF:OTCPK)], and a LiDAR survey and mapping at South Uchi, which was optioned to Barrick Gold Corp. (ABX:TSX; GOLD:NYSE).

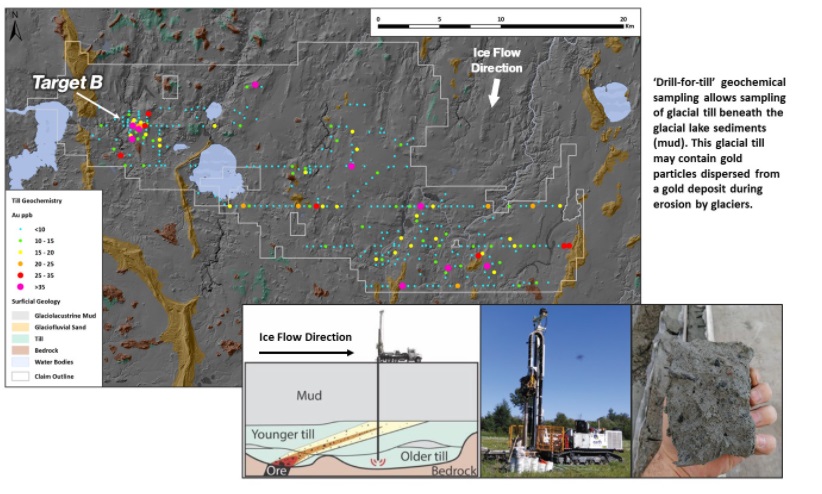

A property-wide sonic drill-for-till program at Hunter will be carried out in 2022.

At South Uchi, Barrick will follow up on the 2021 property-wide till geochemical survey with further exploration. More details on these projects will be presented in the coming weeks.

Since till sampling, boulder prospecting, and airborne magnetics had been completed at Deux Orignaux (part of Kenorland's Chebistuan project) and crews were preparing for an IP survey last time we spoke, I wondered if the IP survey had already been completed and if there would be further targeting. CEO Flood answered, “We are still waiting on the final IP data. Once we have that in hand and have completed our targeting, we will propose a program and budget to Newmont.”

Drone magnetics, IP and EM were completed at Chicobi in January, and targeting and permitting were completed in March, resulting in the commencement of drilling on April 4. Kenorland announced a small 2,000-meter diamond drill program over four holes, testing a 1.5 x 3-kilometer till anomaly.

Chicobi is another example of the deployment of extensive sonic “drill-for-till” sampling of glacial tills below cover. The results of these sampling programs have indicated a major contact between sedimentary rocks including iron formation and sericite-chloritoid altered mafic volcanic rocks. Drone based aeromagnetic and ground-based IP and EM geophysical surveys performed at Target B in November and December of 2021 have identified areas of strong chargeability and conductivity coincident and adjacent to a prominent jog in strongly magnetic sedimentary stratigraphy.

An initial drill test totalling 2,000 meters of drilling along one fence is currently underway to test the strongest of the geochemical anomalies. The fence is designed to cross all favourable stratigraphic horizons and elevated chargeability, magnetic and conductive geophysical responses.

The Chicobi Project is held under an earn-in option to JV agreement with Sumitomo where it has the option to earn up to a 51% interest by funding CA$4.9M in exploration work. Some 2,000 meters of drilling are expected to be completed in mid-April, and the results are expected from the lab within 2-3 months.

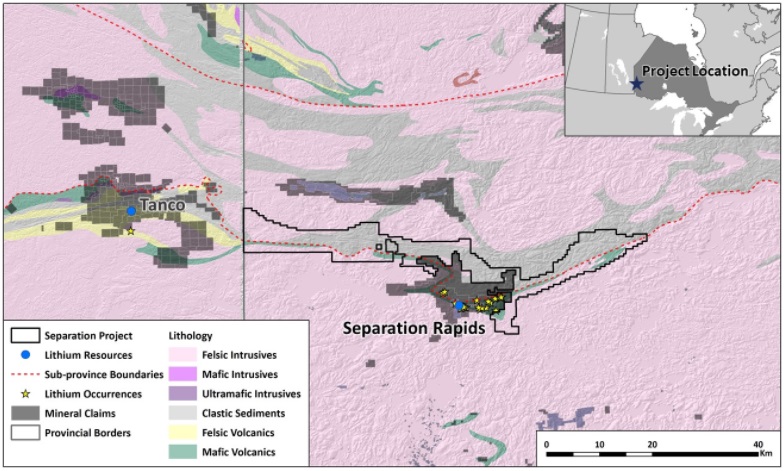

On a final note, Kenorland optioned its Separation Lithium project in Ontario to privately held Double O Seven Resources Ltd., which has the option to acquire a 100% interest. The staking costs for Kenorland were CA$100,000 so the initial payment of CA$100,000 by Double O covers the acquisition cost for Kenorland — all else is risk-free upside.

Such flipping of assets can be quite profitable, as total payments over five years would account for CA$1.5M. Kenorland retains a 2.5% net smelter return royalty, remains the operator and receives a 10% management fee on any exploration expenditures.

The Separation Lithium project is on trend with the large Tanco lithium-caesium-tantalum pegmatite deposit (owned by Sinomine Resource Group Co. Ltd., a Chinese giant), but is also located directly to the north and east of Separation Rapids held by Avalon Advanced Materials Inc. (AVL:TSX; AVL:NYSE; AVARF:OTCQX).

The treasury currently stands at about CA$8M, and the idea of management is to spend around $5M of this on exploration advancing its own projects, including funding its joint-venture commitment at Frotet, further exploration in Alaska, and additional generative exploration, including advancing projects in Manitoba. The revenue generated from its operations, including management fees as well as cash and equity received from partners, will more than cover its G&A.

Conclusion

The Regnault project seems to be shaping up to become quite a substantial gold system after the second batch results came in — as my back-of-the-envelope guesstimate indicates potential up to 1Moz Au. Kenorland Minerals is still waiting for JV partner Sumitomo to approve its budget for another extensive drill program at Regnault, and this is due any day now. Results for the recently completed 10,000-meter program at Regnault are expected to come back in two months. Healy did disappoint me somewhat, although it is still early days; it is a very large system and with lots of deep geophysical anomalies to drill. For now, Kenorland is focusing on drilling at Chicobi, let’s see if the successful reconnaissance exploration can result in economic intercepts.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Platinex’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Platinex or Platinex’s management. Platinex has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Tectonic Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.tectonicmetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.