The second set of drill results from Blue Sky Uranium Corp.'s (BSK:TSX; BKUCF:OTC; MAL2:FSE) Ivana deposit in Argentina, part of the company’s 100%-owned Amarillo Grande uranium-vanadium project in Rio Negro province, included a 5 meter intercept grading 0.15% U3O8, including 1 meter of 0.7% U3O8 from a 1.5-kilometer step-out drill hole.

“It looks like this deposit will get bigger,” Blue Sky President and CEO Nikolaos Cacos told Streetwise after the latest results went public.

He added: “When we announced the drill program we had two objectives. One was to do more infill drilling on the Ivana deposit so that we could upgrade the quality of the deposit to indicated from inferred. And the second was to step out and see if we could find additional uranium and vanadium.”

The assay results from Bureau Veritas Minerals Argentina include 970 samples from 115 reverse-circulation holes averaging 8.5 meters below surface.

These holes mostly tested areas of lower drill-hole density at the edges and inside the western portion of the Ivana deposit. The area was discovered during pit-sample testing in 2018.

In a few weeks, Blue Sky will get the third and final set of drill results from the uranium-vanadium mineralized zone, west of the current Ivana resource.

Those results from Ivana will help determine the next steps for the company at Amarillo Grande (which translates to Big Yellow).

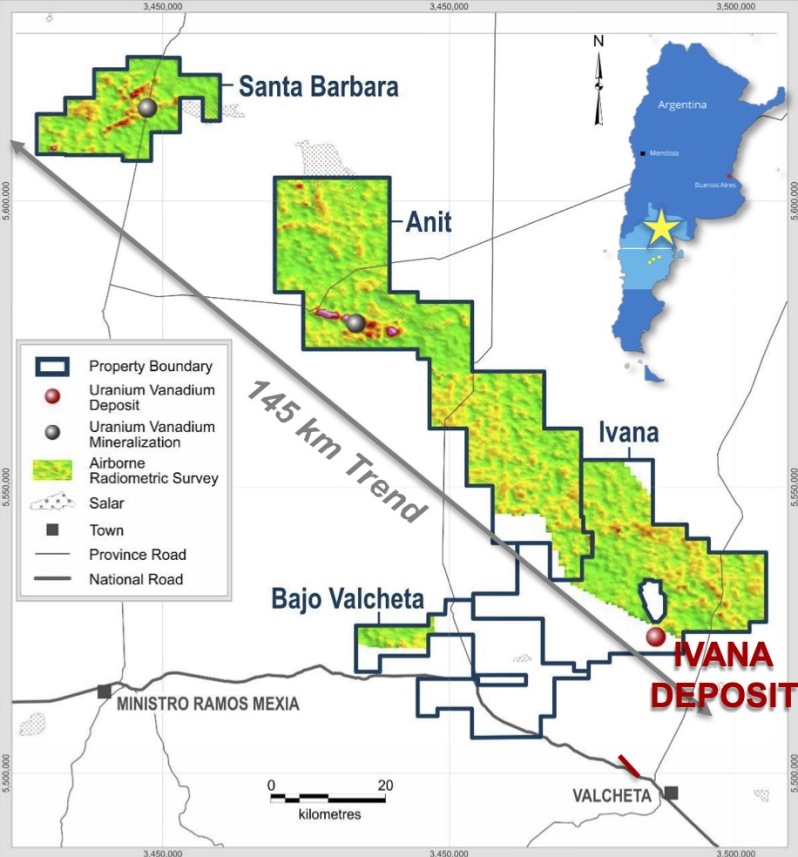

Amarillo Grande consists of three different projects: Ivana, Anit, and Santa Barbara.

The current inferred resource between the three assets stands at 22.7 million lb U3O8 (22.7 Mlb U3O8) and 11.5 Mlb vanadium.

Vancouver-based Fundamental Research started to cover Blue Sky Uranium late last year.

In a report dated Oct. 15, Fundamental says the “major advantage” of the Blue Sky’s flagship asset is that most of the uranium-vanadium mineralization is no deeper than 25 meters.

Fundamental’s model projects that uranium could be mined at the medium-sized Amarillo Grande at cash costs of around $16/lb, which would be among the lowest in the industry and akin to low-grade uranium mines in Kazakhstan and Namibia.

Cacos says the ore simply needs scooped up, washed, and placed on a leach pad — a standard, low-cost method of extraction — often cheaper than in-situ leaching.

Some other drill results from the west side of Ivana included hole AGI-601, which hit 3 meters averaging 702 parts per million (ppm) U3O8 and 1,119 ppm V2O5, including 1,774ppm U3O8 and 1,981 ppm V2O5 over 1 meter (1,000 ppm is about 0.1%).

And hole AGI-616 returned 6 meters averaging 344 ppm U3O8 and 242 ppm V2O5, including 933ppm U3O8 and 109ppm V2O5 over 1 meter.

In the next phase of exploration, the drills will be moved about 10 kilometers north to Ivana Central where the company was drilling before the COVID-19 outbreak forced the program to shut down.

“We got shut down because of COVID. But we were starting to get some really good uranium intersections there. The surface and geophysical work that we've done there makes us believe that this is an excellent target for finding an additional event, so to speak,” Cacos said.

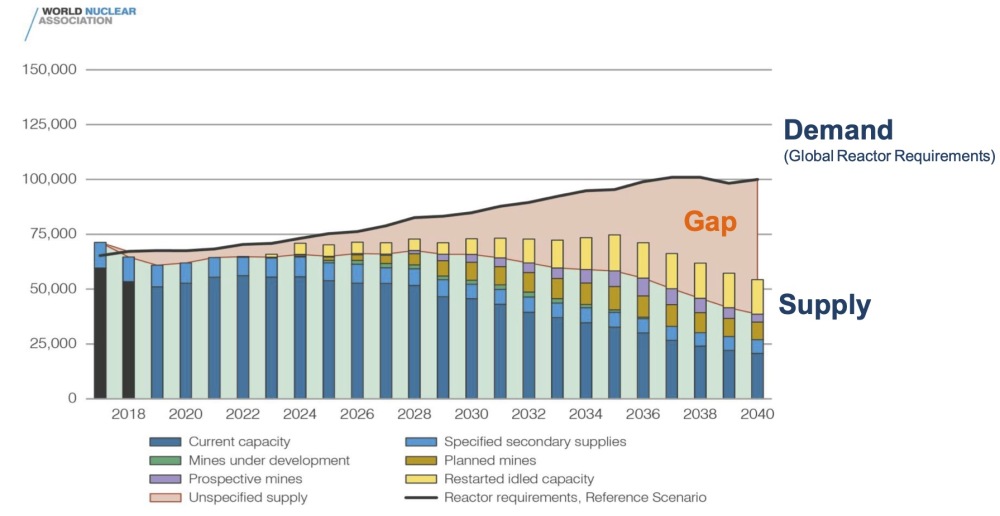

Strong Long-Term Demand for Uranium

Uranium demand is trending steadily higher. In late March, Goldman Sachs published a report that says uranium demand will continue to go up for decades as developed countries seek low-carbon avenues to generate electricity.

A year ago, the spot price for U3O8 was hovering just above $30/lb but topped 60/lb in early April.

“Modeling supply and demand for uranium is not like when you're modeling the demand for gold or copper, which is almost like trying to predict the weather. The nuclear industry is so well regulated that every new mine every that's conceived or about to come into production is taken into account. The projections are usually very reliable,” Cacos said.

A report by the Organisation for Economic Co-operation and Development’s Nuclear Energy Agency says revised nuclear programs in several countries are expected to push global nuclear capacity to as much as 626 gigawatts by 2040 — an increase of 58%.

As of early 2019, there were 450 commercial nuclear reactors on the global grid. These reactors generate as much as 396 gigawatts, powered by about 59,000 tonnes of uranium annually.

Argentina’s Nuclear Past and Present

Argentina doesn’t have any uranium mines, despite having three operating nuclear reactors, one under construction, and two in the planning stage.

Uranium was mined in Argentina by a crown corporation until the mid-1990s. These operations mostly lost money and the mines were in Mendoza province, a largely agricultural region perhaps best known for growing the robust Malbec grape. That ultimately meant that uranium production gave way to wine production (Californians probably wouldn’t look kindly on a uranium mine in Napa Valley, either).

There is another crown corporation in Argentina that builds small modular reactors, while another operates a uranium upgrading facility. Six research reactors there are used exclusively for making things like isotopes.

Argentina has some curious laws. One such law says that if there is a domestic supply of uranium, it must be used by the country’s nuclear industry — it’s actually in Argentina’s constitution.

Without an existing supply, Cacos says the companies operating Argentina’s nuclear reactors have contracts with uranium suppliers abroad for between $65 and $75/lb U3O8 — even when uranium was trading at less $20/lb. That’s because it is more costly to shut down a reactor due to a lack of uranium than it is to maintain a steady supply.

Santa Barbara’s Quirky Discovery

The Santa Barbara discovery, part of Amarillo Grande, was made in 2006 by an exploration geologist who had been laid off by Argentina’s atomic energy agency.

Given his experience, the Grosso Group hired him to help them find economic uranium deposits.

As legend has it, the geologist strapped an antenna to a scintillometer (which measures radioactivity) and drove all over the country. Whenever he would get a reading, he would jot down the coordinates. One day he was on the road that runs through a largely barren landscape in Rio Negro. Everything was normal until the needle on his scintillometer started to bounce wildly.

Cacos and Joe Grosso took the findings to the local government in Rio Negro to seek permission to fly an airborne survey. They did, and eventually the company staked a land package along a 145-kilometer trend.

Blue Sky really started to gain momentum once local geologist Guillermo Pensado entered the picture in 2016. Ivana was found about a year later.

In 2018, Blue Sky published a Preliminary Economic Assessment that valued Amarillo Grande at $135 million (using an 8% discount rate, a $50/lb uranium price, and $15/lb for vanadium). The study said it would take 2.4 years to pay back capital costs at Amarillo Grande and that the project would generate an internal rate of return of about 29%.

“We will probably upgrade the quality upgrade the PEA by summertime, but we're looking at moving this entire project through to the prefeasibility study stage. That will last about 10 months,” Cacos said. “And the results of that will assist us in being able to make a production decision.”

The Grosso Group, led by the venerable Joe Grosso, has made four major discoveries in Argentina since entering the country in the mid-1990s: the Gualcamayo gold mine, now operated by Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE); the Navidad silver project, the world’s largest undeveloped silver asset, owned by Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ); the Chinchillas silver-lead-zinc mine operated by SSR Mining Inc. (SSRM:NASDAQ); and Amarillo Grande.

Fundamental Research has a “buy” rating on Blue Sky with a fair value price of CA$0.47.

Blue Sky has roughly 185 million shares outstanding and trades in a 52-week range of CA$36.5 and CA$0.15.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Blue Sky Uranium Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Sky Uranium Inc., a company mentioned in this article.