Kainantu Resources Ltd. (KRL:TSX.V; 6J0:FSE) just announced that is entering into a definitive agreement to acquire the Kili Teke gold-copper project in Papua New Guinea from Harmony Gold Mining Co. (HMY:NYSE; HAR:JSE), a US$2.8 billion market-cap company that is covered by major firms, including Morgan Stanley, HSBC, and UBS.

Papua New Guinea sits along the Pacific Ring of Fire and is home to numerous mines. The Kili Teke project is located approximately 40 km from the massive Porgera Gold Mine, considered one of the world's top-ten producing gold mines. Kili Teke will join Kainantu Resources' portfolio of three other projects in Papua New Guinea.

Papua New Guinea sits along the Pacific Ring of Fire and is home to numerous mines. The Kili Teke project is located approximately 40 km from the massive Porgera Gold Mine, considered one of the world's top-ten producing gold mines. Kili Teke will join Kainantu Resources' portfolio of three other projects in Papua New Guinea.

Matthew Salthouse, Kainantu Resources' CEO, stated, “Having conducted extensive due diligence, we believe Kili Teke is an incredibly accretive acquisition for the company and elevates our portfolio, adding an established copper gold resource that has potential for further growth.” The company notes that Kili Teke, an advanced exploration porphyry project, features an existing mineral resource, and offers the "potential for further re-optimization and discoveries to increase overall value." According to the company, an open-pit option may be possible to increase the economics of the project.

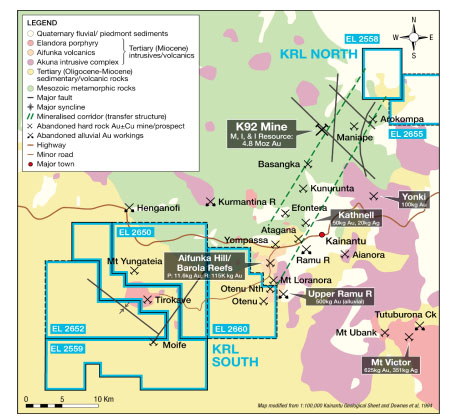

Kainantu's projects surround K92 Mining Inc.'s (KNT:TSX.V) property. K92 recently updated its resource estimate at its producing Kainantu Gold Mine, increasing the Kora Resource Measured and Indicated resource to 2.1 million ounces at 9.20 grams per tonne gold equivalent, a 91% increase from its April 2020 estimate. Its Inferred resource remains at 2.5 million ounces gold equivalent. Its Judd deposit has a maiden resource of 0.13 Moz at 11.0 g/t AuEq Measured and Indicated and 0.18 Moz at 5.7 g/t AuEq Inferred.

Kili Teke has seen 36,325 meters of drilling in 54 holes and features an Inferred resource of 237 million tonnes (Mt) of copper at a grade of 0.34% (0.8 Mt), 1.8 million ounces (Moz) of gold and 168 parts per million (ppm) molybdenum (Mo) equaling 0.04 Mt. Inferred resources are estimates based on limited sampling and have a lower level of confidence than Measured and Indicated resources. Harmony Gold has invested an estimated US$20 million in exploration on the project.

“The project lies on the highly prospective Papuan Fold Belt, which hosts world-class projects, such as Ok Tedi, Frieda River, and Porgera. We look forward to exploring and developing another potentially world-class project for the region,” Salthouse said, adding, “Harmony Gold has already made excellent progress to date in developing the project, delineating an impressive copper gold resource of 800 Kt copper and 1.8 Moz gold, with the deposit remaining open to the southeast and down depth.”

Technical analyst Clive Maund, writing before the Kili Teke project was announced, noted that Kainantu's "stock could take off like a rocket from its current low level."

Company management notes that there is upside potential to the existing mineral resource because it excludes "all high-grade skarn intercepts because the drill density was considered insufficient to prove the continuity of these mineralized zones. . . These remain a viable exploration target, with an opportunity to increase the metal inventory significantly, with the inclusion of skarn mineralization in a previously reported mineral resource potentially adding 11% and 10% more Cu and Au metal, respectively, to that of the current estimate."

Technical analyst Clive Maund came early to this stock, covering it since January when it was trading at CA$0.17. Writing on CliveMaund.com on March 7, before the Kili Teke project was announced, he stated that Kainantu Resources "is a stock with the potential to 'do a K92' which is hardly surprising as its properties are adjacent to K92’s big discovery and it has a robust treasury, having recently completed an oversubscribed financing and is working on a drilling program."

Maund noted that K92's stock "rocketed from about CA$0.50 to CA$9.00 for an 18-fold gain, which is certainly impressive," when the company announced a sizeable discovery.

"So it is clear that if Kainantu found something significant here – and the chances are good that it will – its stock could take off like a rocket from its current low level," Maund wrote.

Transformational Asset

Kainantu Resources views this acquisition as transformational by providing the firm with "immediate ownership of a quality advanced exploration project in a region well known to KRL management and stakeholders," and enumerated that the acquisition:

- "allows KRL to incorporate a sizeable gold-copper resource into the company’s asset base, potentially enabling a re-rating of KRL in due course;

- increases exposure to copper and well as gold (in addition to KRL’s other exciting projects in Kainantu and May River);

- moves KRL’s overall portfolio further along the development curve, given Kili Teke’s advanced stage;

- provides upside to KRL by advancing further identified exploration targets and pursing options to re-optimize the mining plan; and

- establishes a framework for Harmony to take a strategic position in KRL by way of an equity investment into the company, providing credibility to KRL as it continues to develop."

Acquisition Terms

The terms of the Kili Teke project agreement set out an initial payment of US$1 million to Harmony with US$500,000 paid upon closing—expected to be May 31, 2022—and the second US$500,000 paid upon tenement renewal, most likely in late 2022 or early 2023.

Kainantu Resources will work toward a preliminary economic assessment (PEA). If it determines that the project is economically viable at that stage, it will pay Harmony US$3 million and begin working on a feasibility study. And if it determines that project is economically viable when completing the feasibility study, it will pay Harmony US$4 million.

Harmony will retain a net smelter royalty of 1.5% from commercial production.

Strategic Investment Potential

The deal also opens the option of Harmony Gold being a strategic investor in Kainantu Resources, a point brought home by Salthouse, “Harmony will continue to be engaged with Kainantu Resources and have an option to subscribe for warrants in the company equal to up to 9.9% of equity.” The warrants will be exercisable at CA$0.28, a 25% premium to Kainantu Resources' 30-day volume weighted average price (VWAP) to February 28, 2022. It also is receiving anti-dilution rights so that it could maintain its ownership percentage during any future capital raises.

According to the announcement, Harmony Gold is selling the property so that it can focus on other priorities in Papua New Guinea, "including the blue-chip Hidden Valley Au-Ag Mine and the Wafi-Golpu Cu-Au joint venture project with Newcrest."

Key Catalyst

Salthouse noted that “KRL will continue to deliver on our strategic objectives and focus on building shareholder wealth, with Kili Teke a key catalyst in driving shareholder value as we develop as an established Asia Pacific copper-gold mining company.”

Kainantu Resources has approximately 45 million common shares outstanding, and just under 67 million shares fully diluted. Its shares have traded in the range of CA$0.15 – CA$0.40 over the past 52 weeks.

Read what other experts are saying about:

Disclosures

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Kainantu Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Kainantu Resources Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kainantu Resources, a company mentioned in this article.

CliveMaund.com

Clive Maund does not own shares of Kainantu Resources, and neither he nor his company has a financial relationship with the company.