Backed by the financial clout and expertise of mining heavyweights Robert Quartermain and Jonathan Awde, Dakota Gold Corp. (DC:NYSE) raised $50 million ($50M) in a private placement to consolidate and explore the 145-year-old Homestake gold camp, near Lead, S.D.

The new company will begin trading today on the New York Stock Exchange (NYSE) under the ticker DC.

Quartermain founded Silver Standard Resources Inc. with a handful of people in 1985 and built it into one of the world’s biggest silver producers — with a market cap of more than $2 billion ($2B) — before walking away in 2010. He’s referred to his work at Silver Standard as a “long-term call option” on the silver price.

After that, Quartermain hand-picked the team that built Pretium Resources and its high-grade Brucejack mine in British Columbia’s “Golden Triangle” into what ultimately became a $2.8B acquisition for Australia’s Newcrest Mining Ltd. (NCM:ASX) late in 2021.

Awde co-founded Gold Standard Ventures in Nevada in late 2009. It started trading at CA$0.60.

Things started to chug in the right direction at its Railroad property in Nevada’s Carlin Trend when the company hit 56 meters grading 4.3 grams gold, including a sweet spot of 18 meters running roughly 7 grams gold, in 2012.

The stock had finished 2011 at CA$0.75 but by the end of April 2012 it had reached CA$2.74 on the news. Gold Standard peaked at $3.75 in 2016 and the South Railroad project is now at the feasibility stage.

Quartermain owns 10.3% of Dakota Gold, while Awde owns slightly more when you add his individual holdings to those of his family trust.

“The opportunity for me to partner with a mining legend, member of the Mining Hall of Fame, and renowned company-builder Bob Quartermain, was just too hard to pass up,” Awde told Streetwise. “We came across this opportunity in South Dakota and Bob and I went down to take a look at it. It was then that we realized this is something that we wanted to get behind and put together.”

The core of the deal sees Dakota Gold, formerly JR Resources (named after the given names of co-founders Jonathan and Robert), take over Dakota Territory Resource Corp. (DTRC) and move its listing to the big board.

DRTC controlled a large portion of the 40,000 acres surrounding the past-producing Homestake gold mine. DRTC shares last closed at $5 when it stopped trading on the over-the-counter board on March 30.

The deal breaks down as follows: DTRC shareholders will receive one share of Dakota Gold for each share of DRTC they own, while DRTC convertible security holders will also receive convertible securities in Dakota Gold at the same one-to-one ratio.

Before the merger went down, JR Resources did a reverse-share split to reduce the number of shares outstanding in JR Resources (now Dakota Gold) to roughly 35.6 million.

So a JR Resources shareholder holding 100 JR Resources shares will now receive 72 shares of Dakota Gold; and a JR Resources warrant holder holding 100 JR Resources share purchase warrants will receive 72 share purchase warrants in the new company.

Dakota Gold plans to list its warrants to trade on the NYSE American exchange once the company is officially registered.

The $50M raised in July 2021 at $4.50 to the oversubscribed private placement helped Dakota secure the land package from Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and establish an environmental, social and governance fund that Awde says will support “local and state initiatives.”

Homestake Mining produced roughly 40Moz gold from its famous namesake mine in Lead, S.D., over 124 years (HBO’s Deadwood is based largely on the events surrounding the Homestake discovery).

In December 2001, with gold below $280/ounce and much of Barrick’s gold production hedged versus the spot price, the decision was made to turn off the lights at the Homestake mine for the last time.

Mothballing the mine coincided with Barrick wrapping up its $2.2B takeover of Homestake and the new owner effectively put the Homestake mine into its “closure group,” which placed it on the shelf in perpetuity.

“What changed was Barrick Gold and Randgold merging and new management saying, ‘if it's not tier one or tier two, or we don't think it has a chance to get to tier one, tier two, get rid of it.’ Barrick was extremely supportive and great to work with,” Awde told Streetwise.

Barrick owns about 3% of Dakota Gold through three different land-package deals.

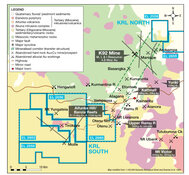

The first was on the 2,112-acre Maitland property, which is contiguous with the Homestake mine. The surface rights at Homestake were next, followed by a third deal that involved the Richmond Hill property, west of Maitland.

Dakota is now following up on the North Drift discovery Homestake made in the 1990s by drilling the up-dip portion of the structure.

Dakota has $15M earmarked for drilling this year. Two rigs are currently operating north and south of the former Maitland mine, with a third slated to show up soon. The plan is to drill Richmond Hill once the Maitland program ends.

The initial drill results should start coming out in late May or early June.

“It was a globally significant gold camp. I don't want to say it has been overlooked, but there has been little modern exploration applied to this camp over the last 20 years. So you combine this tier-one jurisdiction with people who have created a lot of shareholder value, who have found and built mines, who have access to capital markets, and then add in our asset package, and you've got the foundational pieces to do something quite meaningful,” Awde told Streetwise.

Dakota Gold has 70.8 million shares outstanding. Other significant shareholders include Medalist Capital, Delbrook Capital and CI Funds.

Disclosures:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dakota Gold Inc, a company mentioned in this article.