After announcing a CA$5.3 million (CA$5.3M) investment in Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) on Feb. 23, 2022 at a share price of CA$0.59 — and maintaining its equity interest at 10.25% — Hecla Mining Co. (HL:NYSE) decided to invest further in the company, as part of a larger round led by Eventus Capital Corp. and Research Capital Corp., which also saw existing shareholder Eric Sprott participating again.

Total proceeds amounted to CA$13M, bringing the treasury to an impressive CA$26M, providing Dolly Varden with sufficient funds to do lots of exploration over the next two years.

Dolly Varden Silver doesn’t seem to be distracted or the least bit cautious at a time when inflation is approaching double digits; Russia running into unexpected resistance from both spirited military and civilian Ukraïne fighters; and the Western Hemisphere is imposing unprecedented sanctions, effectively crippling Vladimir Putin’s nation.

It seems stock markets are already pricing in some kind of solution and are cautiously finding a way up again, as Russia abandons Kiev as a main target and instead seems to concentrate on harbor cities and the eastern regions. Peace talks in Turkey are on the way, although without any tangible results so far.

The economic sanctions are much more impactful for Russia, when compared to the countries imposing them, but Russia has one important point of leverage: commodities.

Russia is an important supplier of oil, gas, coal, wheat, sunflower oil, iron, nickel, cobalt, vanadium, platinum and fertilizers, and affected supply chains are already resulting in high prices across the board, exacerbating already high inflation.

Ukraïne is a large exporter of wheat, but its exports are not hampered by sanctions, of course, but by the war itself. Russian soldiers consciously target huge wheat depots and shipping methods, but also machinery needed for large-scale wheat production.

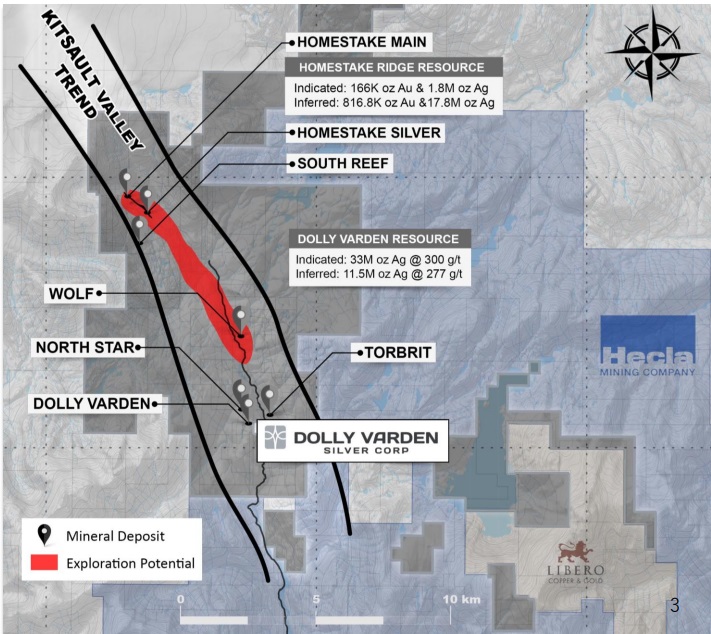

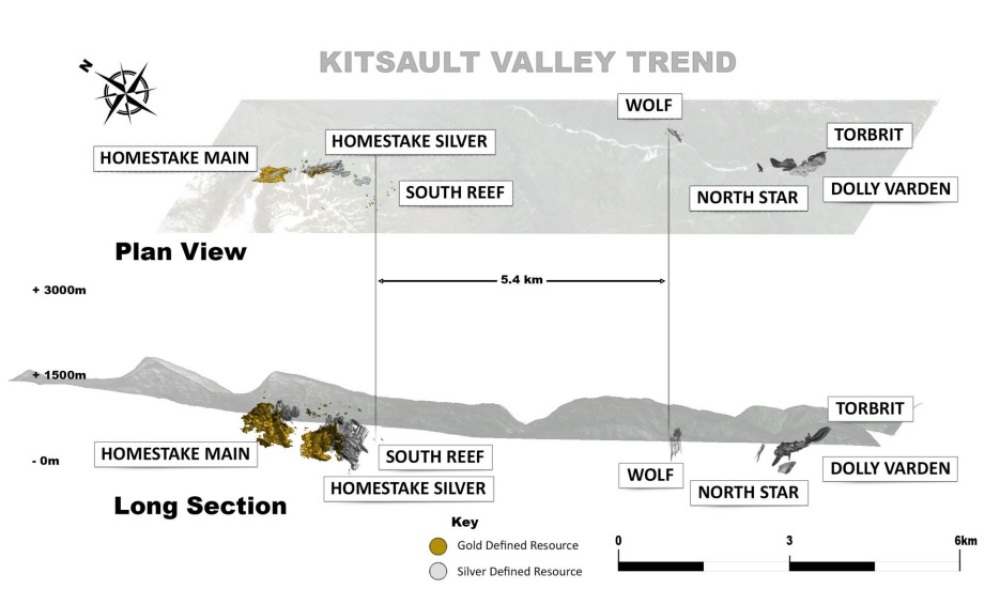

Against this backdrop, Dolly Varden Silver is looking to develop the full potential of the combined Dolly Varden-Homestake Ridge projects, which is now called the Kitsault Valley Project after the recent transaction closed.

Dolly Varden management was in no direct need of raising funds, but was approached by the likes of Hecla, and fellow shareholders Eric Sprott and Jeff Zicherman (Eventus Capital) to do another round.

Private Placement Details

On March 7, 2022, Dolly Varden Silver announced its best efforts brokered private placement for CA$10M @ CA$1.02 Flow Through (FT) shares, lead by Research Capital and Eventus Capital, on behalf of a syndicate of agents including Haywood Securities Inc. and Gravitas Securities Inc.

Since the 15% over-allotment option for the agents was fully exercised, the company eventually issued 11,274,400 FT shares without warrants, for gross proceeds of approximately CA$11.5M.

A big participant was Eric Sprott, and according to management there was a higher level of institutional participation on this round. Hecla acquired CA$1.5M in common shares separately from the private placement.

Eric Sprott, through his well-known vehicle 2176423 Ontario Ltd., acquired 3,448,200 FT shares for total of CA$2.5M.

After the closing of the offering, Mr. Sprott now beneficially owns or controls 25.6 million (25.6M) common shares and 1.25M warrants, representing approximately 11.1% (up from 10.2%) of Dolly Varden on a non-diluted basis and 11.6% (up from 10.7%) on a fully diluted basis.

These shares were acquired by Mr. Sprott for investment purposes, as he has a long-term view of the investment.

Hecla exercised its anti-dilution right to acquire 1.74M common shares of Dolly Varden at a price per common share of CA$0.86 for gross proceeds of CA$1.5M.

Hecla has also exercised its anti-dilution right with respect to the previously announced issuance of shares to Haywood completed on March 11, 2022, to acquire 46,027 additional common shares at a price of CA$0.5896, for additional proceeds of CA$27,137.

The shares issued to Hecla are in addition to those issued as part of the private placement.

The FT shares in the private placement, and shares issued to Hecla, are subject to a four-month holding period in Canada that expires on Aug. 1, 2022. In connection with the FT private placement, the agents received an aggregate cash fee of up to 6% of the gross proceeds, including the over-allotment option.

The proceeds from the private placement will be used for further exploration, mineral resource expansion and drilling involving Kitsault Valley, located in northwestern British Columbia, Canada, and the Hecla proceeds will be used for general working capital.

The Kitsault Valley project is already of considerable size, containing 64 million ounces silver (64Moz Ag) and almost 1million ounces gold (1Moz Au) in the Indicated and Inferred categories, but management is looking to meaningfully expand the resource.

As a reminder, I estimated an after-tax NPV of $300M (CA$380M) in an earlier article for these combined resources using $1,620/oz Au and $14.40/oz Ag. At current precious metals prices this could increase to an estimated CA$700M.

With regards to the current market cap of about CA$178M at a share price of CA$0.82, advancing and expanding the project will only add value and should increase the chances of share price appreciation.

It's hard to say what upside potential should be, as an economic precious metals PEA NPV is valued at anywhere from 10% to 40% of a company's market cap.

An important rule of thumb is a project going into production, which globally speaking usually trades on average at 100% of NPV, meaning it has a price to net asset value of 1. Of course you need to take into account capex funding here, usually with a 65-35% debt/equity package that causes additional dilution. Most leverage will probably come from a rising silver price, as this metal still sits at relative lows.

Share price: 1 year timeframe (Source: tmxmoney.com)

The markets have recovered nicely from the mid-March Russia-Ukraïne conflict correction, and seem to be waiting a bit before further rate hikes are contemplated by the Fed and to see the ramifications of supply chain disruptions all over the globe.

Kitsault Valley Project Resource Expansion

Now that the financing has closed, Dolly Varden is looking to finalize its new exploration programs. According to management, current exploration plans include 10,000 meters of drilling at the high-grade Torbrit deposit, along with closer-spaced drilling in the current block model, as well as step-out holes along areas where the deposit is still open.

The Homestake Ridge target will also see approximately 20,000 meters of drilling to upgrade the Inferred resources in areas where the current model shows the thickest and highest grades.

Once higher grade ore shoots are defined, the down-plunge extension can be tested for continuity at depth.

Homestake Silver has seen relatively little drilling but the plan will be to expand Homestake in order to keep the silver-to-gold ratio high.

The exploration portion of the upcoming drill program will test several geophysical anomalies modelled along the 5.4-kilometer trend between South Reef and Wolf. Recent drilling in the area found strong potassic alteration associated with silver mineralization, which continues beneath the sediment overburden.

Current budgets for this work are estimated in the range of CA$15-20M and drilling may extend late into 2022. The upcoming programs for Torbrit and Homestake will start around mid-May.

An updated mineral resource estimate for the combined project is planned for Q2 2023, and will be used in a consolidated PEA for the Kitsault Valley project, which is scheduled for Q4 2023.

Conclusion

It is always good to see a company raising capital at a relatively high share price, as Dolly Varden just received C$13M from esteemed backers like Eric Sprott, Jeff Zicherman and Hecla Mining, most of it at a healthy FT premium per share.

Dolly Varden is planning exploration programs for the combined Kitsault Valley project, which are likely to commence in May. It will be very interesting to see if the 2022 programs could potentially connect mineralized trends between the Homestake and Dolly Varden/Torbrit deposits, by growing the individual deposits and finding new ones.

Furthermore I view the consolidated Kitsault Valley PEA, although this will take a while, as an important benchmark for indicating the consolidated project economics. The value of the project seems to have a good chance on improving beforehand, through exploration potential, and leverage to precious metal prices.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All currencies are in US Dollars, unless stated otherwise.

All pictures are company material, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Dolly Varden Silver's NPV and resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Dolly Varden Silver or Dolly Varden Silver's management. Dolly Varden Silver has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.