In this article, we look at developments at four companies on our list, including one advancing a property in Pakistan, and another, whose minor earnings miss provides another good opportunity to buy.

Barrick Has Half-A-Century of Gold in Pakistan

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE; 24.54) has had a busy week, capped by an announcement that it had agreed in principle with the government of Pakistan to move the large Reko Diq copper-gold project forward, more than a decade after the local government refused to issue a mining lease.

Under the new agreement, Barrick will own 50% of the project and be the operator, while national and local governments in Pakistan will own the other 50%, including a 10% free-carried interest by the local government. Antofagasta, which had owned 37.5% of the project, has agreed to sell its interest for $900 million. A $5.8 billion damages award to Barrick and Antofagasta by a unit of the World Bank is resolved by this new agreement.

Enormous, Long-Life Project

This is a huge project, but with obvious political risk. The last resource estimate, from 2011, was for 50 billion pounds of copper and over 40 million ounces of gold. Barrick CEO Mark Bristow has said it could produce 400,000 ounces of gold a year and be in production for more than 50 years.

Once the agreement is finalized, Barrick expects to update the feasibility and says the project could be in production within six years. The project is clearly high risk from a political viewpoint. It sits between Afghanistan to its north and Iran to its south and west.

The former owner, the global mining giant BHP, walked away due to geopolitical concerns.

Raised Some Cash, but Faces Lawsuit

Separately, Barrick updated its five and 10-year guidance in publishing its annual report last week, making minor changes and providing more detail. The guidance does not include Reko Diq. And it sold shares in Skeena Resources for $132 million, saying it was selling for “portfolio management purposes”.

Offsetting the positive news, in London, a lawsuit by an NGO alleging Barrick complicity in police assaults on villagers, including deaths, around its Mara mine in Tanzania from 2014 to 2019, has gone before a court. Barrick, which took operational control of the mine in 2019, denies that it is responsible for the actions of Tanzanian police.

Barrick remains one of our top miners. Given the recent move, partly following gold on Ukraine concerns, we would wait for a pullback to add; hold.

Headline Miss Masks Good Quarter for Fortuna

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE; 3.83) fell sharply after its fourth-quarter earnings, due partly to the headline earnings miss, the result partially of special charges. Revenue in the quarter, at $199 million, was up 92%, due to the incorporation of the Yaramoko Mine, which it acquired in buying Roxgold last year (see Bulletin #773), and due also to increased production at its Lindero gold mine in Argentina.

Although operating income was up, 39% over the prior year, it was offset by losses on derivatives, higher interest expenses, and increased taxes. (The company hedges some of the base metals, as well as fuel.) Operating costs were also somewhat higher than expected.

Overall, precious metals accounted for over 90% of sales, with gold at 69%. The balance sheet is rock-solid, with liquidity of $187 million, of which $107 million is cash, and is well funded for all capital projects including the Séguéla mine construction, now over 40% complete and on schedule for its first gold pour in mid next year. Net debt stands at $59 million.

The 8% sell-off in the stock, on what were positive results, is exaggerated and misplaced, and provides us with another opportunity to buy.

Midland Advances Yet Another Property

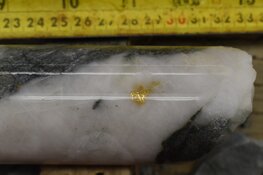

Midland Exploration Inc. (MD:TSX.V; 0.52) announced the resumption of drilling on a new gold discovery on its Casault property, along the Detour Trend, in partnership with Wallbridge.

The program consists of just three holes to test the continuity of the gold zone, though additional drilling is being evaluated. Though the program is unlikely to produce any exciting new discoveries, it is yet one more program advancing another project in an active year for Midland, and following commencement of initial exploration of the Tete nickel property in partnership with Rio Tinto.

We expect announcements on additional exploration programs in coming months. Midland remains a buy.

Reservoir Is Back

Reservoir Capital Corp. (REO:TSX.V, 1.80 x 2.80) resumed trading Friday after it filed missing financials and a cease-trading order, in existence since July of last year, was lifted. The company is in discussions with a dissident Nigerian shareholder, who has caused revenues owed Reservoir to be withheld (see Bulletin #813); the resumption of trading is a step toward a settlement. Hold.

TOP BUYS in addition to the above include Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE, 13.23), Lara Exploration Ltd. (LRA:TSX.V, 0.61), Orogen Royalties Inc. (OGN:TSX.V; 0.46), and Ares Capital Corp. (ARCC:NASDAQ, 20.83).

WHO MAKES YOUR INVESTMENT DECISIONS? There is a disturbing and growing trend for brokerage firms to determine what stocks you can buy.

We mentioned years ago that Schwab had a secret list of ETFs that it would not allow clients to buy.

You found out only after you placed an order to buy some prohibited fund.

Among funds on the list was the large oil fund, USO.

A few years ago, TD decided that they no longer wanted me or my management clients on their platform because we owned too many resources stocks.

Not coincidentally, this decision came after the firm had agreed to be bought by Schwab.

Raymond James similarly has kicked us off their platform because, inter alia, their clients are too old to be permitted to own gold stocks.

You Can’t Buy This

Now, Interactive Brokers has decided that their customers are not allowed to buy Polymetal International PLC (POLY:LON).

The company is a Jersey, Channel Islands company, trading on the London Stock Exchange, which owns some mines in Russia. (A majority of its revenue comes from outside that country.)

The Channel Islands are a Dependency of the British Crown, not, last time I looked, of Vladimir Putin.

Not for the first time, IB provided incorrect information when I asked why I could not buy a particular stock. Initially, they said Polymetal was sanctioned.

Not true.

Then they said that I could not buy the stock because I was “ineligible…no trading permission.” On pushing, it turned out that IB would not allow any customer to buy POLY.

They said it was for “risk management purposes”, but refused to answer if the risk they were trying to obviate was mine or the firm’s.

When I asked, the only reply I could get was that it was “related to the conflict in Ukraine.”

Gee, that’s helpful.

Perversely, after conceding their own inadequacies, they suggested that I go to a different brokerage firm to buy the stock. Not sanctioned, then.

Other firms have similar prohibitions. One firm will not allow me to buy a Singapore real estate company, while another prohibits buying the VXX volatility ETF.

Has anyone else had similar experiences?

More worrying than this one situation is the very idea that a brokerage firm can determine what you can buy, whether for moral or false risk reasons. That surely is up to the individual to decide. (Poly was GBp 94.84 when I first tried to buy and is now GBp 176, less than three weeks later.)

QUESTIONS? I welcome your investment or economic questions, which I shall attempt to answer here. Please write to [email protected].

Originally published on Mar. 26, 2022.

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Disclosures

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Osisko, Lara, Orogen, and Polymetal, companies mentioned in this article.

Adrian Day's Disclosures

Adrian Day's Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor's opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2021. Adrian Day's Global Analyst. Information and advice herein are intended purely for the subscriber's own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

______________________________________________________________________