I recommended Ecolomondo Corp. (ECM:TSX; ECLMF:OTC) just over a month ago, and although it has made no net progress since then, it is worth highlighting it again here because it is at another very good buy spot and its fundamental situation continues to improve. In this update, we will also consider briefly the positive fundamentals, not least of which is a multi-million dollar offtake agreement for recovered carbon black the company just announced.

Ecolomondo has developed technologies for the efficient processing of hydrocarbon waste, especially old tires, into useful products. While others have attempted this in the past, none have developed processes that are as comprehensively efficient as those of Ecolomondo. After perfecting the processes at a pilot plant, the company has now moved on to building TDP (Thermal Decomposition Process) turnkey facilities that are producing rapid results.

As the company sets out in a Feb. 1 press release, the facility processes an amazing quantity of tire waste per year, producing an equally amazing quantity of useful products — “Comprising four different processing departments (shredding, thermal processing, recovered carbon black processing, and oil fractionation), the facility is expected to process a minimum of 14,000 tonnes of tire waste per year when fully operational, producing 5,300 tonnes of recovered carbon black, 42,700 barrels of oil, 1,800 tonnes of steel, 1,600 tonnes of process gas, and 850 tonnes of fibre when operating at full capacity.” While it can be argued that long-term the globalists will greatly reduce the world population and force those who survive into heavily surveilled urban ghettoes where they won’t go anywhere so there will be far fewer motorists and much less tire waste, that’s still a long way off and there are an awful lot of old tires and other waste for the company’s facilities to work their way through in the meantime.

While the products resulting from the processing of hydrocarbon waste should be a bountiful source of revenue for the company, it is worth taking into consideration that the company will also earn revenue from taking in this material. With respect to old tires there is a fee called a “tipping charge” in the U.S. and the company looks set to earn enough solely from taking in these waste materials to finance the building of new plants.

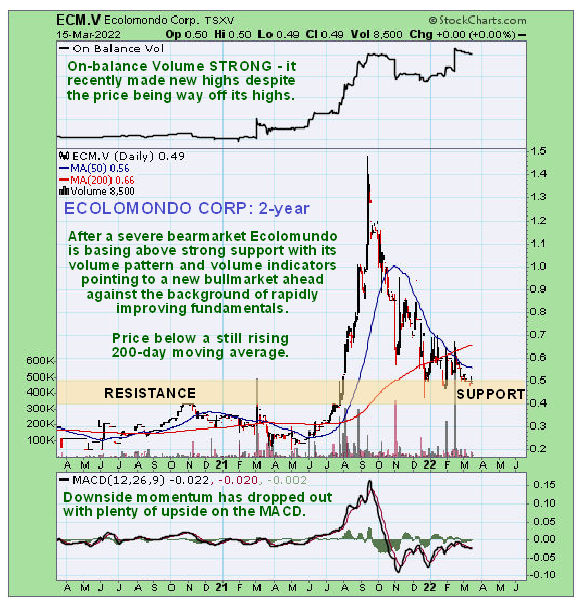

Turning now to the stock charts you may recall that in the original article posted in February we looked at the long-term six-year chart, but in this update we’ll start by looking at a two-year chart, so that we can see last year’s dramatic bull market and the subsequent heavy reaction back to strong support in somewhat more detail.

On the two-year chart we see that the bear market from the peak last September shaved two-thirds off the value of the stock but since December it has stabilized above the strong support shown and appears to be basing ahead of renewed advance. Downside momentum has dropped out and the volume pattern and both volume indicators (Accum – Distrib shown on eight-month chart) are positive, supporting the contention that the current basing pattern will lead to a new bull market, which certainly looks probable given the fundamentals.

On the eight-month chart, the bear market and the base pattern of recent months is visible in still more detail. We can see that momentum (MACD) has been steadily improving from the November low and that the Accumulation line has been trending higher this year (on-balance volume shown on the two-year chart even more so) and that the price is now some way below a rising 200-day moving average which is exerting an upward pull. We can also see where we bought at a low point in mid-February after which it rallied briefly and then drifted back down again so that it is once more at a favorable entry point now being back at the support.

To say that the company’s business model is “green” is an understatement. Used tires and tire dumps are an eyesore and an ecological problem worldwide and the company should therefore gain the favor of the “New World Order.” So it seems likely that Ecolomondo will be building its processing plants all over the world, and even if motoring is drastically reduced in the years to come, there are enough old tires and tire dumps around to keep the company’s plants fed with material for many years to come.

The conclusion is that with Ecolomondo looking more and more likely to begin a new bull market, it is more of a buy here than it was when we first looked at it, so we stay long and it is rated a strong speculative buy here. A point worth noting is that although the number of shares in issue may seem rather high at 183 million, about 76% of them are owned by management/insiders. Although listed on the OTC, trading on this market appears to be nonexistent at present.

There is more fundamental information on the company and its activities in Clean Tech Co. Gives New Life to Old Tires by Colby Mintram.

Ecolomondo website

Ecolomondo Corp, ECM.V, ECLMF on OTC, closed at C$0.49, $0.46 on March 15, 2022.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Additional Clive Maund disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Ecolomondo Corp., a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosures:

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.