Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX)

Uranium is the one energy source that could satisfy every Millennial and Genexer on the planet; zero pollutive impact anywhere and a reliable cost-effective means of heating the planet and recharging Elon Musk’s vehicles – BUT – only as long as earthquakes avoid nuclear power stations and tsunamis avoid Japan. Handled properly, nuclear power is truly the alternative for coal and oil and natural gas but what spooks the world is that the collateral damage of a ruptured nuclear power station is infinitesimally larger than a pipeline leak or a coal fire.

Uranium is the one energy source that could satisfy every Millennial and Genexer on the planet; zero pollutive impact anywhere and a reliable cost-effective means of heating the planet and recharging Elon Musk’s vehicles – BUT – only as long as earthquakes avoid nuclear power stations and tsunamis avoid Japan. Handled properly, nuclear power is truly the alternative for coal and oil and natural gas but what spooks the world is that the collateral damage of a ruptured nuclear power station is infinitesimally larger than a pipeline leak or a coal fire.

Now, there are friends of mine from university days that shed their bell bottom blue jeans and later their briefly owned white three-piece disco suits to work in the State Department of the U.S. government that years later told me that Chernobyl and Three Mile Island were sabotage jobs carried out by Big Oil interests in the Middle East. I have little doubt that there was a certain degree of shenanigans involving two nuclear disasters within the two major superpowers of the era within a seven-year span of time.

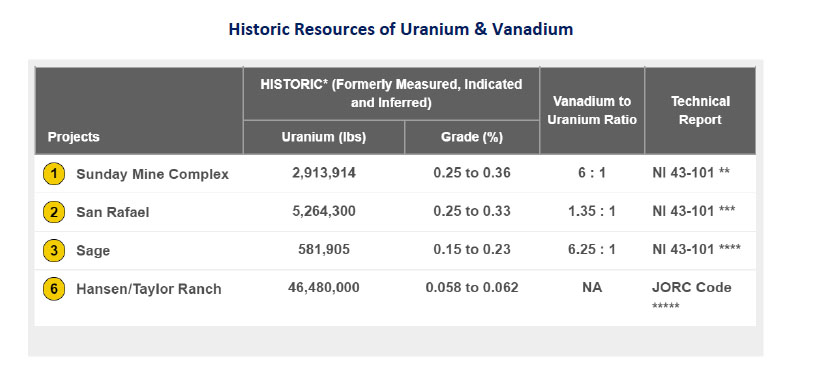

With 55.24 million pounds of uranium and approximately 35 million pounds of vanadium held on the balance sheet (see below), management could be a bunch of trained chimps and still get their share price cranked up when the masses move back to this sector. The in-situ metal value of this historical resource exceeds US$2.8 billion against a 100% ownership and which must be weighed against the company’s US$72 million market cap. At today’s prices, and after a 56% correction in the share price in under eight weeks, the market cap lies at a mere 3.8% of gross metal value and has to be considered “cheap” relative to its peers where, by example, Energy Fuels Inc. (UUUU:US) carries on its balance sheet US$2.35 billion of combined U3O8 and V2O5 and a market cap of US$1.28 billion, valuing them at over 17 times the market cap of Western U & V Corp.

The existence of Western’s high-grade vanadium resource (35m lbs.) cannot be overlooked. The vanadium redox battery, a type of flow battery, is an electrochemical cell consisting of aqueous vanadium ions in different oxidation states. Batteries of the type were first proposed in the 1930s and developed commercially from the 1980s onwards. Cells use +5 and +2 formal oxidization state ions. Vanadium redox batteries are used commercially for grid energy storage and it is this application so critical for the implementation of global electrification and carbon footprint reduction.

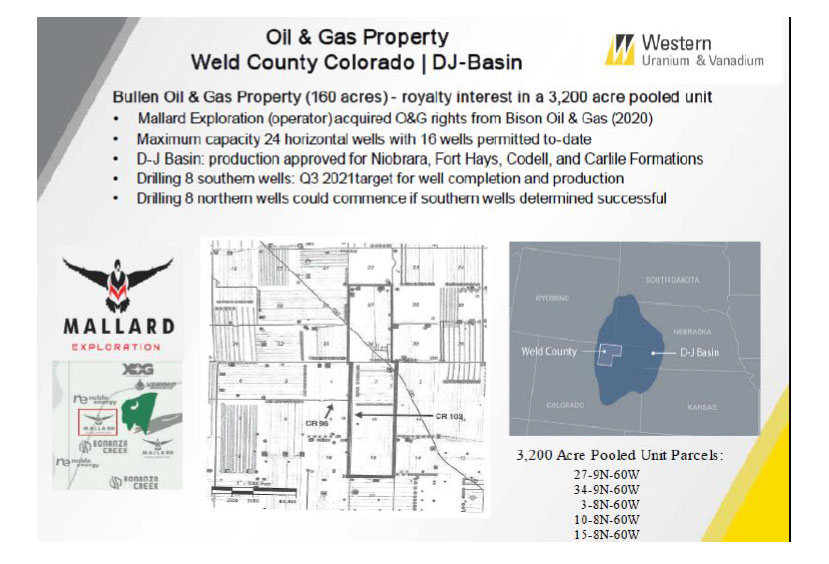

Also contributing to the underlying value is a royalty interest in a 3,200-acre pooled oil and gas unit where cash payments are expected to commence in Q1/2022. Since this is a fracking procedure, it is not possible to estimate the amount of cash to be generated but unlike most development stage companies, the continual need to finance through public offerings and dilution is mitigated by cash flow contributions from royalty revenues.

My US$10.00 target price assumes a $75/lb price for U3O8 in 2022 as the supply of spot uranium evaporates due to the insatiable appetite of the Sprott Physical Uranium Trust purchases (as well as others joining the fray) and utilities around the globe scramble for the surety of supply.

My US$10.00 target price assumes a $75/lb price for U3O8 in 2022 as the supply of spot uranium evaporates due to the insatiable appetite of the Sprott Physical Uranium Trust purchases (as well as others joining the fray) and utilities around the globe scramble for the surety of supply.

Originally published Dec. 10, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at [email protected] for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Western Uranium & Vanadium. My company has a financial relationship with the following companies referred to in this article: Western Uranium & Vanadium. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Uranium & Vanadium, a company mentioned in this article.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

All charts are provided by the author.