With just days to go before Christmas, Fabled Silver Gold Corp. (FCO:TSX.V; FBSGF:OTCQB; 7NQ:FSE) is about to put a few extras under the tree for its shareholders.

In a news release yesterday morning, Fabled announced an encounter of 7.95 meters grading 85.56 g/t Ag Eq with 1.10 g/t Au on its Santa Maria property in Parral, Mexico.

In yet more breaking news today, Fabled Silver Gold announced that for every five shares that shareholders own as of market close on Dec. 20, 2021, they will receive one non-taxable share in spinout company Fabled Copper Corp. (FABL:TSX)

The Canadian Securities Commission has granted a conditional acceptance for Fabled Copper to begin trading on Dec. 21 on Vancouver’s TSX Venture Exchange under the ticker FABL. The opening price will be set at $0.05.

Fabled Silver Gold closed at $0.06 on Dec. 15. At a 5 to 1 spinout ratio, one Fabled Copper share effectively works out to a 25% bonus — a gift that could continue to give.

"With the price having dropped back a little more late [Tuesday] morning, mainly due to the broad market dropping again, this looks like a good time to buy or add to positions."

—Technical Analyst, Clive Maund

Fabled Copper is exploring the Muskwa Project in northwestern British Columbia, near the Yukon border, about a two-hour drive west of Fort Nelson.

Fabled Copper President, CEO and Director Peter Hawley (the same titles he holds with Fabled Silver Gold) says British Columbia offers perhaps the best copper potential in North America, certainly Canada.

“There's an area about 6 miles by 4 miles, and there is just a crazy amount of copper there in various forms. We own this whole area. We've spent the summer on the property and there has been a lot of field work done. That news will start to come out Jan. 1,” Hawley says, adding that there is sufficient news to put out a release each week until August.

Muskwa consists of the Toro, Bronson, and Neil claim blocks, which were explored in the early 1970s before rockslides and burgeoning snowfields limited further development. Twenty-two copper occurrences were documented on those claims.

“You stand on a valley floor and see this vein system going up a mountain 1,700 feet. And then you get to the top and you walk about 1.1 kilometers along the vein at the top and then you watch it go down the other side of the mountain about another 1,700 feet,” Hawley tells Streetwise. “But the strangest thing, believe it or not, is there's one vein that is completely developed. It was inaccessible for over 25 years to get inside of that either due to ice or snow rockslides, et cetera. And this summer we got in there.”

Hawley says the 2021 exploration program consisted of systematic exploration of the vein and breccia, both horizontally and vertically.

The Neil breccia ranges from 19 meters wide at the junction of the Neil Vein to over 60 meters at the northeast side of the mountain where it is visible vertically for more than 1,000 meters.

Previous work consisted of a deep trench cross-cutting the breccia, which assayed 10.2% copper over 3 meters, while further up the breccia, a true cross section assayed 6.1% copper over 20.8 meters.

The Eagle vein (or Davis Keays vein) on the Neil property witnessed almost 7 kilometers of underground work from 1969 through 1971. Drifting was done on four levels, extending through a mountain. About 40,000 short tons of material were removed.

At the Magnum vein, also part of the Neil claim block, now-defunct Churchill Copper produced about 14,600 short tons of copper concentrate over five years before copper prices plummeted below US$0.40/lb. The operation was mothballed in 1975 until the early 1990s when further exploration work was undertaken by Westaurum Industries.

Fabled Copper aims to ride increasing demand for the red metal in everything from electric vehicles to expanding electricity and communications grids. Copper has steadily climbed from about US$2/lb. in early 2016 to around US$4.30/lb. in early December.

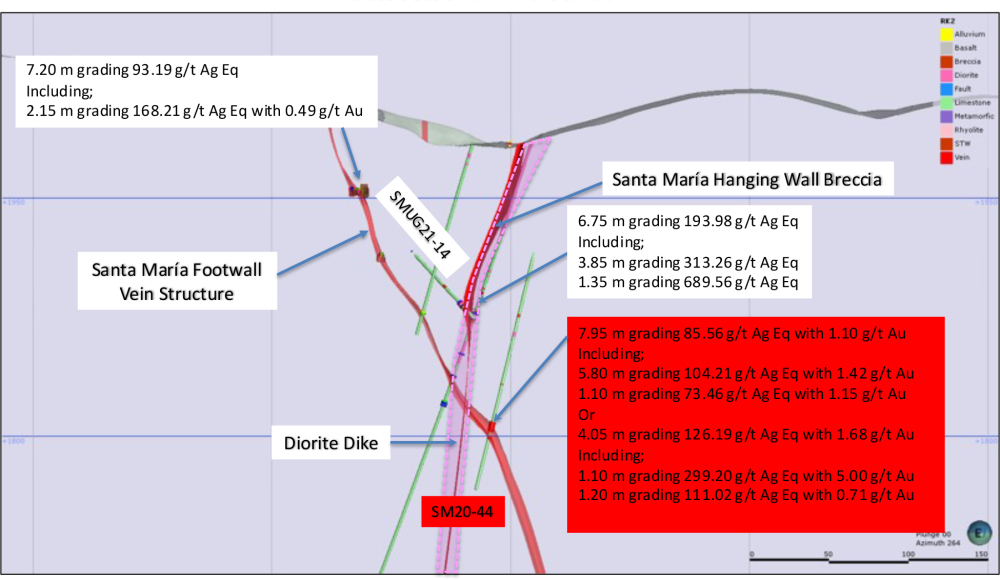

Fabled Silver Gold, meanwhile, drilled deep into its Santa Maria project in Parral, Mexico. Hole SMUG21-14, collared into the footwall of Santa Maria, intercepted 7.2 meters grading 93.19 grams per tonne silver-equivalent (93.19 g/t silver-equivalent), including 2.15 meters grading 168.21 g/t Ag-Eq with 0.49 g/t gold.

Farther along in SMUG21-14 the targeted hanging wall structure returned 6.75 meters grading 193.98 g/t silver-equivalent, including 0.33 g/t gold. The hole includes higher grade intercepts of 3.85 meters grading 313.26 g/t silver-equivalent with 0.53 g/t gold and 689.56 g/t silver-equivalent with 1.35 g/t gold over 1.35 meters.

The hole was part of a planned 9,000-meter drill program that was boosted to more than 14,000 meters in order to better understand the structural controls of the mineralized systems.

Definition Diamond Drill Hole SM20-44 was successful in hitting the targeted Footwall zone over 7.95m with grading 85.56 g/t Ag Eq with 1.10 g/t Au.

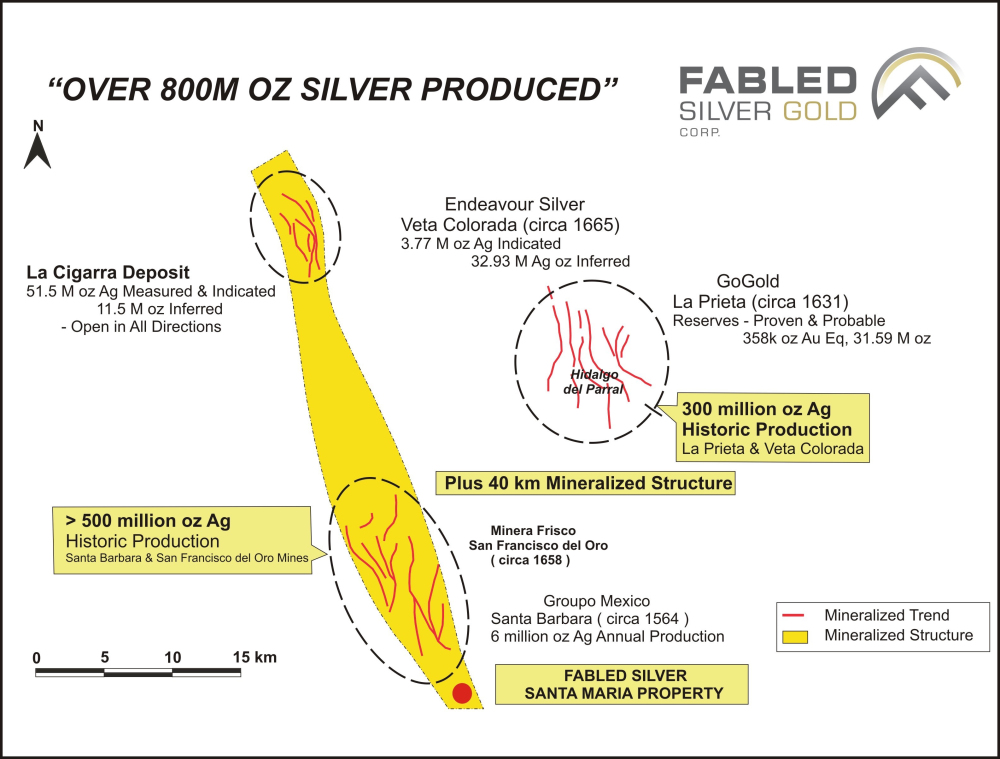

The Parral silver camp has produced more than 800 million ounces (800 Moz) silver since the mid-16th century. Industrial Minera Mexico, a subsidiary of Grupo Mexico (GMEXICOB:MXN), has produced 600 Moz of that total and still mills 4,800 tonnes per day at a head grade above 85 g/t silver.

The camp is also home to Kootenay Silver Inc. (KTN:TSX.V) La Cigarra deposit, which hosts a National Instrument 43-101 compliant mineral Measured & Indicated estimate of 51.5 Moz silver at an average grade of 86.3 g/t.

Hawley says Fabled would have to outline a deposit that could run at 500 tonnes per day for 10 years to get one of the larger players interested. That’s about 2 million tonnes at around 80 g/t.

“Ideally, you'd want to grow a resource that would sustain an operation like that,” Hawley says.

Novadan Capital, Palisades Investments, and mining financier Scott Gibson are among Fabled Silver Gold’s largest shareholders.

The company has about 208 million shares outstanding and trades in a 52-week range of $0.65 and $0.40.

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Fabled Silver Gold Corp. and Fabled Copper Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Fabled Copper Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fabled Silver Gold Corp. and Fabled Copper Corp., which are companies mentioned in this article.