Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS) and Saskatchewan-based joint venture partner Lightning Creek Mining have announced that they are in the final stages of hydraulic grouting at the Wingdam underground placer gold project in British Columbia’s historic Cariboo mining district, 45 km east of Quesnel.

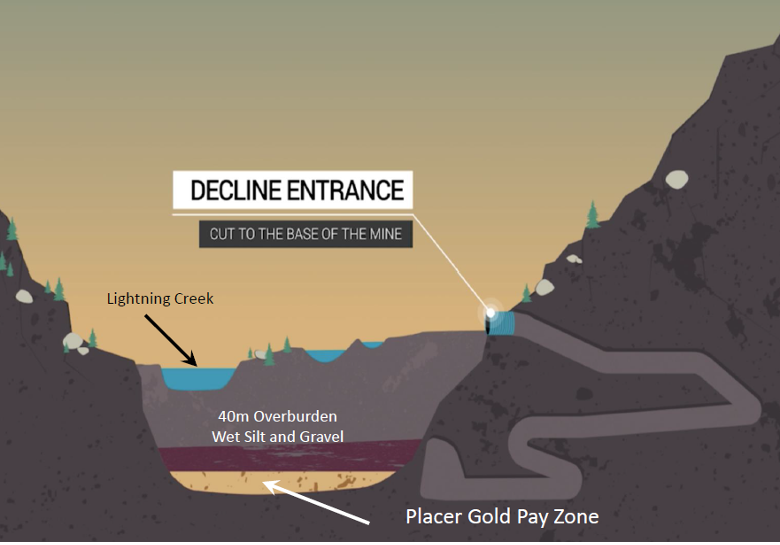

Lightning Creek is currently drilling grout holes above where the gold-bearing crosscuts will be mined in a paleo channel (riverbed sediment as old as some dinosaur bones) about 50 meters under Lightning Creek.

Grout, basically like cement, will be hydraulically pumped into those holes to form a curtain to hold back the notorious Cariboo Slum, a sloppy wet mix of overburden above the rich layer of gold-bearing sediments.

Once the curtain is sufficiently tested, the crosscuts will be mined and the gold recovered by gravity separation in a wash plant that reuses water. The plant will be assembled underground in the fully ventilated, electrified, and dewatered decline.

The wash plant uses no chemicals or reagents, something that recently helped Lightning Creek secure a two-year mining permit extension at Wingdam.

The wash plant uses no chemicals or reagents, something that recently helped Lightning Creek secure a two-year mining permit extension at Wingdam.

“It's a very rich deposit. Our National Instrument 43-101 qualified person, Stephen Kocsis, made the comment in one of our filings that this is one of, if not the richest placer deposits in British Columbia history that remains un-mined. And the reason that it has remained un-mined is because it's slightly technically challenging,” says Omineca President and Chief Executive Officer Tom MacNeill.

Omineca is not a miner, it’s more of an explorer. So while Lightning Creek will handle the mining, the two companies will divide any recovered gold 50/50, with Lighting Creek taking an additional CA$850/oz to cover its mining costs on Omineca’s share. At a gold price of C$2,300/oz, Omineca will clear about CA$1,400/oz. Cha-ching.

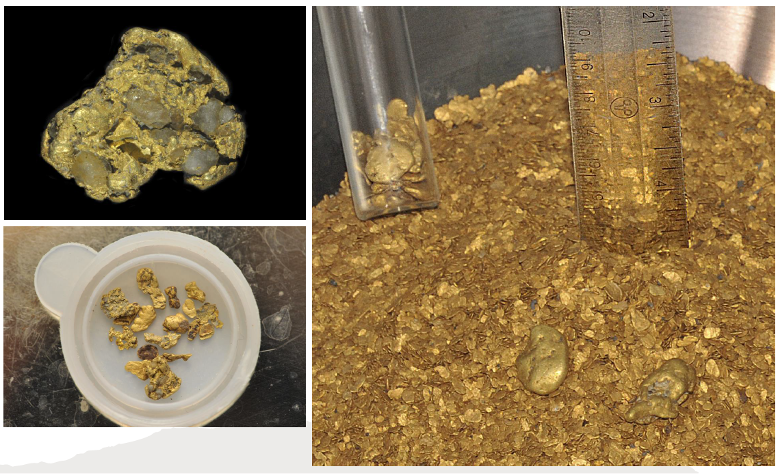

Coarse gold—the kind that prospectors pan for in films—was deposited in the paleo channel at Wingdam millions of years ago by fast-moving water carrying it from nearby sources. Numerous companies have attempted to recover placer gold there since gold was first discovered in the storied Cariboo region in 1860.

“You can determine how far gold has traveled coming off the lode gold sources by what the gold grains look like and how beat up they have been by the stream environment,” explains MacNeill. “All of our gold appears to be from less than 1 kilometer away, and some likely came from less than 100 meters away (from Wingdam).”

“You can determine how far gold has traveled coming off the lode gold sources by what the gold grains look like and how beat up they have been by the stream environment,” explains MacNeill. “All of our gold appears to be from less than 1 kilometer away, and some likely came from less than 100 meters away (from Wingdam).”

MacNeill’s eyes widened in 2012 when a bulk sample, extracted from a 2.4 meters by 2.4 meters by 23 meters crosscut at Wingdam, yielded 173.4 ounces or 5.4 kilograms of coarse gold.

At that time, freeze mining technology was used to stabilize the Cariboo Slum. But since then, advances in grouting have allowed the joint-venture partners to eschew freezing for more cost-effective results—though MacNeill says that the lines necessary for freezing remain in place.

“This is one of, if not the richest placer deposits in British Columbia history that remains un-mined.”

—Omineca President and Chief Executive Officer Tom MacNeill

Lightning Creek will mine another 125 crosscuts over 300 meters in the paleo channel. If the sediments contain gold grades similar to those in the 2012 bulk sample, then this 300-meter section should yield around 21,000 ounces of gold.

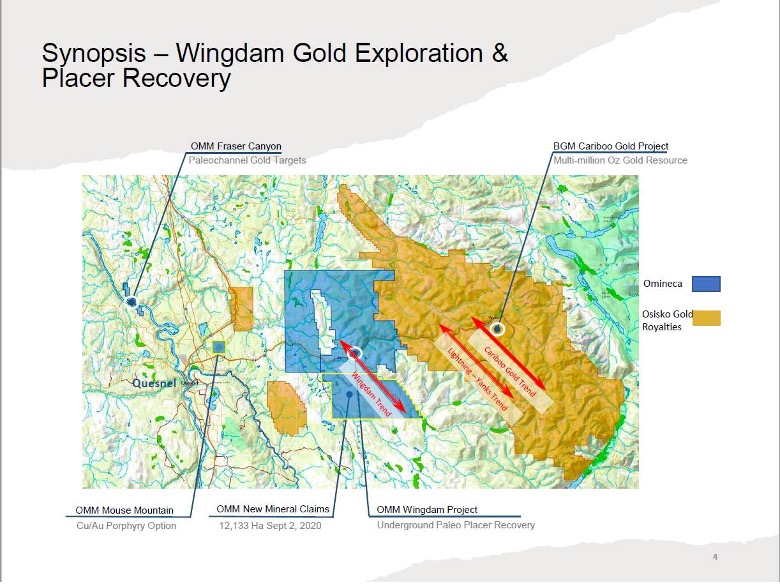

Through sampling, historic drilling, and seismic surveys, Omineca has mapped another 2.4 kilometers of potentially placer gold-bearing paleo channel, upstream and downstream of the successful 2012 crosscut.

Osisko Development Corp. (ODV:TSX.V), through subsidiary Barkerville Gold Mines, has found considerably more gold in hard rock sources at its Cariboo Gold Project, some 25 kilometers east.

Cariboo has a measured and indicated resource estimate of 21.4 million tonnes grading 4.6 g/t gold for 3.2 million ounces (3.2 Moz); and an inferred resource of 21.6 million tonnes grading 3.9 g/t gold for 2.7 Moz. Osisko arrived at those numbers after almost 500,000 meters of core drilling from 2015 to 2019.

Osisko drilled another 152,000 meters in 2021 that have yet to be added to the resource. One noteworthy hole from this year’s program intersected 12.6 g/t gold over 10.15 meters, including samples of 97.8 g/t gold over 0.5 meter and 102 g/t gold over 0.5 meter.

Omineca’s claims are contiguous with some of the Cariboo claims on the Quesnel side of the block.

“The thing that that gets us excited is usually around those placer mines, there are local (gold) sources. And that's evidenced by the fact that our neighbors, Osisko Development, have half a dozen deposits that they're actively developing, a couple of them are historical producers that produced over a million and a half ounces out of that small area, contiguous to us,” MacNeill tells Streetwise.

MacNeill adds: “(Osisko) have 2,200 square kilometers in their land package. That is the largest contiguous gold exploration land package in the world, anywhere, by any company. They got big real fast for a reason. They know what they're onto.”

Technical analyst Clive Maund sees Omineca’s proximity to Osisko’s land package as a potential catalyst for the share price.

“As we can see on the map below, Osisko Gold Royalties has a large property adjacent to Omineca’s property, and it is understood that it has 10 rigs currently turning on this property or soon to do so, which is a lot. If this is so and anything is found, it is likely to have a positive impact on Omineca’s stock, as although there is a mountain between the two companies’ properties, the geology either side of it is not radically different,” Maund writes.

Some of the larger Omineca shareholders include Crescat Capital and 49 North Resources Inc. (FNR:TSX.V). The latter owns 44.3 million shares.

Fully diluted, Omineca has 163.6 million shares outstanding. It trades in a 52-week range of C$0.41 and C$0.14.

Disclosure:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Omineca Mining and Metals Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Inc. and 49 North Resources, companies mentioned in this article.