For someone who is not a chemical engineer or economist, I spend a disproportionate amount of my time thinking about decarbonizing the economy. As a human who has created two additional humans, being part of the answer to our climate crisis is more than a good idea — it is my responsibility. Finding a way to profit from it is the icing on the save-the-world cake.

To decrease greenhouse gases (GHGs), we need to reduce the amount of them being emitted, capture and sequester GHGs, and find new ways to draw down carbon through agriculture.

The market to produce and utilize green hydrogen as a fuel, feedstock, and means of energy storage is slated to reach a total addressable market size of $2.5 trillion per year by 2050. Yet, until this month, I hadn’t found any hydrogen companies that I felt warranted a slot in my portfolio.

Now, I am happily holding shares of Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTCMKTS). They have proven and patented technology that is already being utilized, and they are creating end-to-end solutions for the hydrogen value chain.

On the surface, hydrogen looks like an easy answer. It is the most abundant material in the universe, making up almost three-quarters of all matter. It can be burned completely clean, and it has about 3.4 times the energy of gasoline. So why aren’t we using hydrogen in our everyday lives?

Be sure to sign up to receive PennyQueen's next stock picks exclusively available for Streetwise Reports' Readers. Sign Up Now!

PennyQueen is an investor who focuses mostly on clean tech and does her own independent analysis. She has created a social media community of over 10,000 like-minded investors with whom she has shared her progress of taking a $329k nest egg and building it to over $6 million within a year.

Most of the attention surrounding hydrogen has been focused on transportation, but — due to the difficulties in storing hydrogen, because of its very low volumetric density — widespread use in the transportation industry is a way off. (Don’t worry; Jericho is working on and investing in end-to-end hydrogen solutions.)

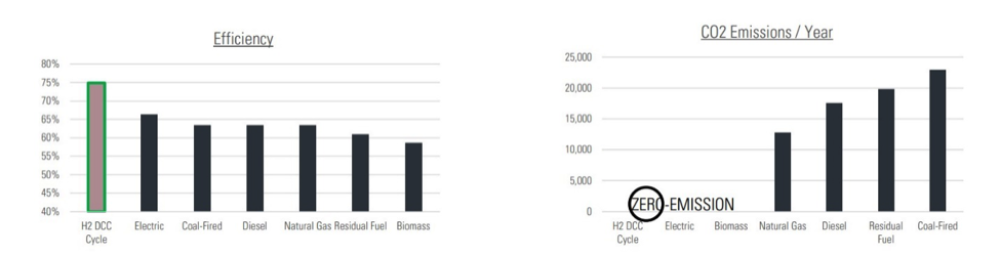

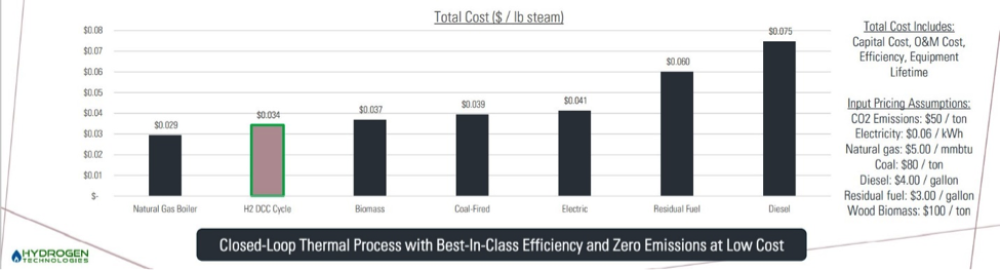

In the meantime, they have found a practical way to harness hydrogen that works seamlessly with today’s infrastructure. Jericho’s wholly owned subsidiary, Hydrogen Technologies, has created the dynamic combustion chamber (DCC) boiler. Their patented, zero-emission DCC boiler uses the reaction of hydrogen and oxygen to create heat and steam and to combine heat and power (CHP).

No air pollution is created, since air is not introduced into the system, and it is 30% more efficient than a conventional boiler (97% thermal efficiency). Water is the only byproduct, and no air permits are needed. The DCC eliminates all NOx and co2 emissions with its closed loop combustion process.

I know the commercial heating and steam industry doesn’t sound as sexy as a Tesla, but if you look just a little deeper, you’ll find that it is a 28-billion-dollar market ready for disruption — and if that isn’t hot to you, maybe mutual funds are more your style.

Industrial boilers are traditionally coal-, oil-, or gas-fired. All these fuels create GHGs when burned, and regulatory changes are putting pressure on the industry to find cleaner methods. This is essentially an untapped market. Between rising natural gas prices, carbon taxes, and changing sentiment, I expect to see the DCC take off in earnest in 2022.

Industrial boilers are a genius application, and Jericho, through Hydrogen Technologies, has a broad patent covering the combustion of pure hydrogen and pure oxygen in a vacuum for heating or power.

So now that Jericho has given us a clean way to generate power and heat for every school, office, distillery, refinery, and commercial building, let’s talk about hydrogen’s drawbacks, which Jericho is working on.

Not all hydrogen is clean. Sure, it burns clean, but the majority of hydrogen is produced from dirty processes.

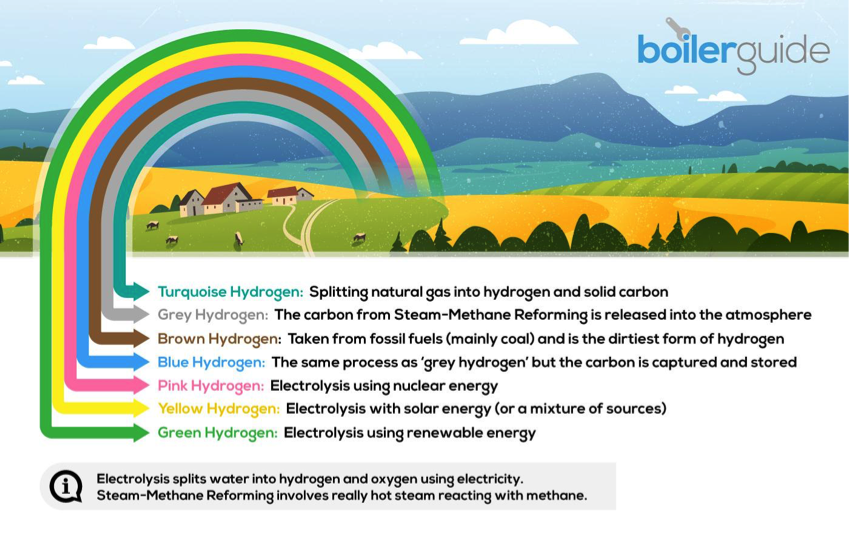

I’m sure many of you have heard mention of the various colors of hydrogen; if not, I’ll give you a quick recap.

It has nothing to do with the actual color; rather, it is classified by how it is produced. Green hydrogen is truly clean hydrogen. It is created through electrolysis using renewable energy. Brown hydrogen, sometimes also called black hydrogen, is the dirtiest type of hydrogen, sourced from burning coal and other fossil fuels.

All in all, about 96% of hydrogen is derived from fossils fuels — and this is a problem.

Somewhere Over the Hydrogen Rainbow | Boiler Guide

While Jericho isn’t the ARK of hydrogen technology yet, they are investing heavily, through Seed and A series investments, in energy transition technology companies that are trying to solve every pain-point facing the hydrogen sector.

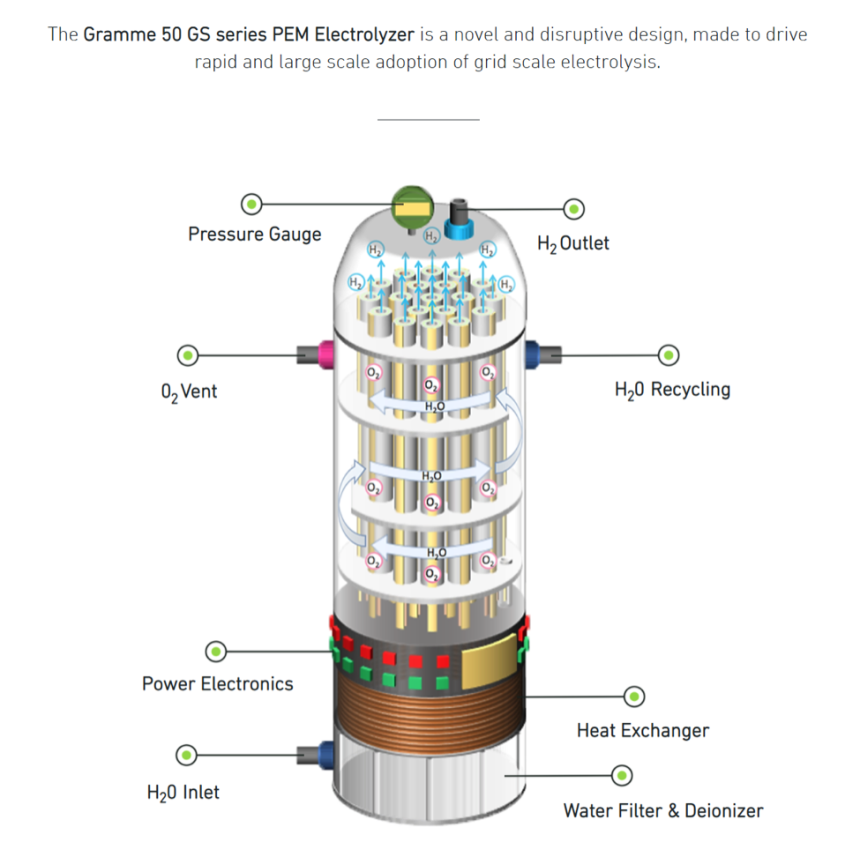

My favorite investment they have made so far is in H2U Technologies. They hold a minority stake in this company that has created technology to create inexpensive grid-scale electrolysis.

Source Products | H2U Technologies

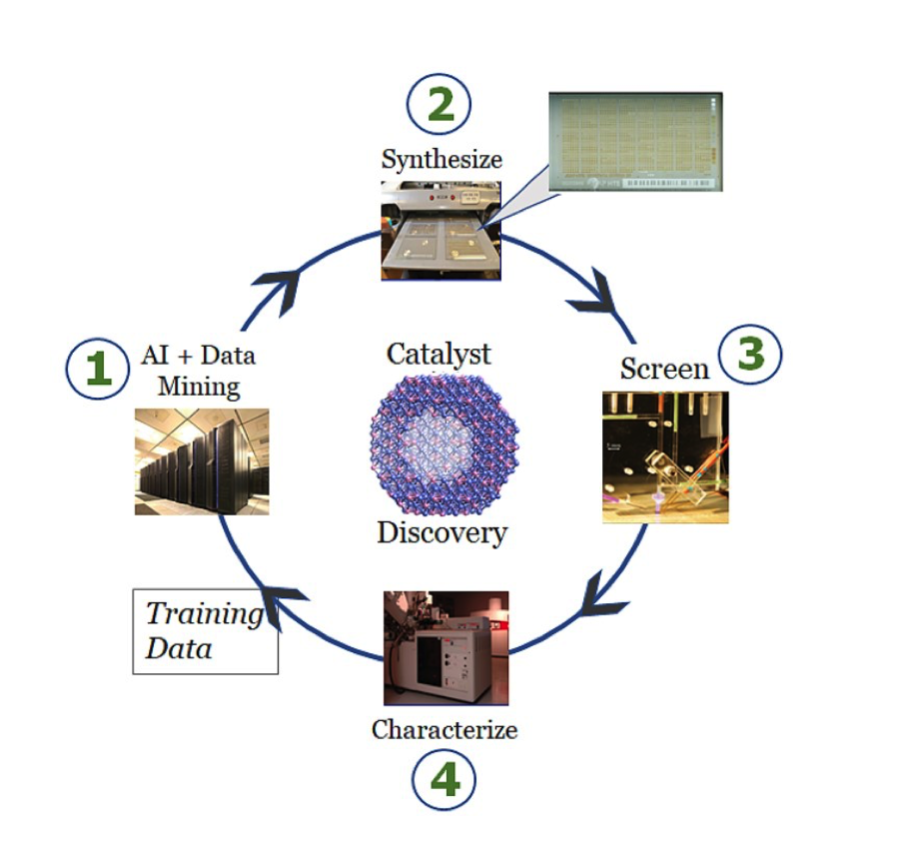

Electrolyzers are the biggest bottle neck in green hydrogen. They are expensive, and much of that is due to their catalysts, which are typically iridium, platinum, or other really rare, really expensive metals. H2U has created and patented artificial-intelligence and data-driven processes of discovering less expensive, new-earth-abundant electrocatalysts for both electrolyzers and fuel cells. The system can test millions of compositions a month.

Source Products | H2U Technologies

H2U has exclusive rights to over 30 patents. If we want to transition to a world where the majority of our hydrogen is green, this is the technology we need!

Now that you understand what exactly Jericho is doing, I want to cover a few other things that made me invest.

The Jericho Management Team

I don’t invest in any company without talking to the CEO. This is something I do not recommend for most people, but I typically take pretty large positions in terms of my portfolio. And since I have a habit of telling other people about what I find, I like to have a good sense of the people I’m talking about.

I was able to meet with Brian Williamson, the CEO and President. While he has an extensive history of working in accounting, private equity, and energy investment — and happens to hold a law degree — I would swear he’s a chemist. His passion for hydrogen technology is impressive, and his vision will move the company forward.

The bottom line is I like the people at Jericho.

They Have a Strong Backing

In my searching of SEDAR documents, I was able to learn that there are some influential major shareholders, including Ed Breen, the CEO of DuPont; the Belzberg family office, including Chairman Strauss Zelnick the Belzberg founder, who is also the chief executive officer (CEO) and managing partner of private equity firm ZMC, the chairman and CEO of video game company Take-Two Interactive, and the former chairman of media conglomerate CBS Corporation; Andrew McKenna; and Michael Graves, among others.

I always see it as a good sign when powerful investors are picking the same companies I am.

Jericho’s Transition to Hydrogen

Jericho started out as an oil and gas company. They still have some O&G assets, and that strong balance sheet is one reason they can afford to be investing in clean tech. It was clear from my conversations with the company that they are committed to a decarbonized future in which they believe that hydrogen will play an important role.

I will let you determine the appropriate valuation for Jericho, but I would like to point out that I believe sales of the DCC will be starting in the very near future, especially on the heels of COP26.

They are, as of this writing, sitting at a market cap of about $120 million. They have patented technology ready to go in a virtually untapped area with an annual total addressable market of $28 billion, according to Grand View Market Research.

Meanwhile, Fuelcell Energy sits at a market cap of $3.6 billion dollars with revenues for 2020 of $70.8 million and a net loss of $100 million.

Plug Power has $316 million in net revenue for 2020 with a net loss of $476 million. They currently sit at a market cap of $25.7 billion.

In Conclusion

There is certainly room to grow in the hydrogen economy, and I believe Jericho has the technology, the backing, and the right people to innovate. If the $1 trillion U.S. infrastructure plan was any sign, the transition to clean energy will be faster and better funded than we had imagined.

I am placing my wager on Jericho for explosive growth in the hydrogen sector.

This is not investment advice, and I am not an investment advisor. I am a mom and a professional firefighter, and I am passionate about clean and disruptive technology. I own shares in Jericho Energy Ventures and am not compensated by anyone for my due diligence reports.

If you have not already, be sure to sign up to receive PennyQueen's next stock picks exclusively available for Streetwise Reports' Readers. Sign Up Now!

Disclosure:

1) Statements and opinions expressed are the opinions of the Penny Queen and not of Streetwise Reports or its officers. The Penny Queen is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. The Penny Queen was not paid by Streetwise Reports LLC for this report. Streetwise Reports was not paid by the author to publish or syndicate this report. Additional Penny Queen disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Jericho Energy Ventures Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This report is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles, reports, and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures Inc., a company mentioned in this article.

Images provided by the author.

Sign up to receive PennyQueen's next stock pick

Sign up to receive PennyQueen's next stock pick