Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) reported a somewhat disappointing quarter, though with optimism on the period ahead, as it missed earnings expectations mainly on lower-than expected production (which included some net inventory build), and costs higher than expected. This was the fifth quarter in a row with disappointing results on the back of operational difficulties.

Pan American is a top buy at this price.

Costs were higher as foreign currencies (of countries in which it operates) appreciated. In addition, ongoing COVID restrictions added to costs. Gold all-in sustaining costs (AISC) were $1,176, up 16% on the quarter, while silver cash costs were $16.30, flat on the quarter but higher than expected.

Though the company lowered its full year guidance, the guidance still indicates very strong production in the current quarter, which the company confirmed. The ventilation shaft issues at La Colorada have been fixed, resulting in lower on-going capital and higher throughout. At Dolores, another mine that has experienced difficulties, a new pad should see higher production though not till Q1.

At La Colorada skarn deposit, the company reported results of recent drilling, 39 holes in all, both in-fill and step-out holes. These are some of the highest-grade intercepts drilled here. Because of the potential for expansion, the company decided to postpone the preliminary economic assessment planned for completion by the end of the year. CEO Michael Steinmann called them “really astonishing drill holes,” exclaiming “the width, it’s amazing.” The company now considers it has potential to increase the resource significantly. Another 60,000 meters of drilling is planned for 2022.

Game-changers await the go-ahead

The company has available liquidity of $815 million, including $315 million in cash and minimal debt. The operational difficulties that have plagued Pan American at several mines are all in the process of being resolved. It has significant growth potential at three properties; in addition to the La Colorada skarn, it has two projects currently awaiting permission to mine, Escobal in Guatemala, and Navidad in Chubut, Argentina. At the former, the government-led consultation process is now advancing again, after several COVID-related delays. There is no timetable.

We like Pan American for its top management, reasonably conservative approach, and game-changing upside from these two projects, not valued in the stock price. Pan American is a top buy at this price.

Barrick transformation continues, with prospective exploration

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) reported slightly better than expected, with production up on better-than expected recovery from Nevada Gold Mines (following the Goldstrike mill failure), while AISC declined, at $1,034, due mainly to lower sustaining capital expenditures. It is expecting a strong fourth quarter, with ongoing ramp-up at Valadero and Bulyanhulu; continued recovery from the Goldstrike mill failure; and good contributions from copper operations. Costs remain contained, and Barrick is seeing robust free cash flow. This is good news after a somewhat disappointing first half.

Barrick is a strong buy.

In addition to increased production from some existing mines, it has several prospective exploration projects; in particular, the area between Turquoise Ridge and Twin Creeks, in Carlin, has identified some very promising targets. It has also recently made an exchange of assets with i-80 Gold in order to consolidate the South Arturo property in the Carlin Trend.

The third and final $250 million capital distribution promised in 2021, from several asset sales, will be little over 14 cent per share, and payable mid-month. The company is essentially net-debt neutral.

Barrick lagging in Canada

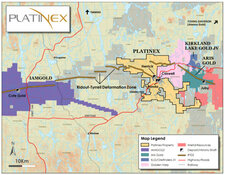

While other companies are making major acquisitions in Canada — recently, for example, Newcrest’s purchase of Pretium and Agnico’s acquisition of Kirkland — Barrick, despite its avowed intention of increasing exposure to Canada, has so far been taking very incremental steps. It recently, for example, acquired an option on a property in Ontario (from Kenorland). CEO Mark Bristow talks of “adding or consolidating” ground in one of more of Canadian gold belts.

As part of what Barrick sees as its more realistic emissions targets than some, it has a trial of electric trucks in Nevada. Bristow somewhat caustically comments, “they are great when they work; (it’s) essentially an R&D laboratory.”

The second largest gold producer in the world, Barrick has made great strides since it acquired Randgold, bringing Bristow as CEO with it, on operations and the balance sheet, as well as completing a merge of Nevada operations with Newmont. It has world-class assets, a solid balance sheet, and energetic management, all while trading at some of its lowest multiples ever. Barrick is a strong buy.

Shareholders approve Agnico merger, not unexpectedly

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) announced that shareholders of both itself and Kirkland have approved the “merger of equals” (see Bulletin 792).

Agnico said 99.862% of votes cast were in favor (better even than Stalin used to receive in Soviet “elections”), while just over 80% of votes cast by Kirkland shareholders were in favor. Some 71% of Kirkland shareholders voted, just under 70% of Agnico shareholders. The merger must now receive a final order from the Ontario Court and is expected to be finalized during the first quarter of 2022.

Retail shareholders do not receive proxies in a timely manner

Some Canadian transfer agents are notorious for not getting proxies out in a timely manner (and custodians for not processing expeditiously; the U.S. postal “service” does not help either). As often as not––as in the case of Agnico––I receive proxies after the relevant meeting. Equally, many custodians vote your shares with management by default, so neither the relatively low turnout (almost a third of shares of each company not being voted on a fundamental issue), nor the high vote in favor, are surprising. When one considers that mutual funds are required to vote proxies, then the proportion of retail shareholders not voting must be all the higher. This is not a unique case for Agnico and Kirkland, and no criticism of these companies. The system is antiquated.

Notwithstanding a bounce on Friday, Agnico is trading at the low since the March 2020 sell off and before that mid-2019. There may be additional selling from disgruntled Kirkland shareholders now the vote has taken place, or from shareholders who owned both companies and may now feel that the position in one company is too large. This always happens in a merger, and it is likely to continue until after Kirkland holders actually see Agnico shares in their accounts.

However, Agnico is a very strong buy at current levels; the combination (as we discussed previously) will make this a stronger company of more appeal to generalist investors.

Any price under $50 is a great long-term price at which to be buying this top company.

Another top partner for Midland

Midland Exploration Inc. (MD:TSX.V) has signed a new option agreement, with Rio Tino on its Tete Nord nickel-copper property. To earn 50%, Rio must spend $4 million over four years, with cash payments to Midland totaling $500,000. It has the right to earn up to 70% with additional exploration expenditures and payments. It is a good agreement for Midland, particularly on a project that has received little work so far.

What Midland describes as an “aggressive” exploration program will be prepared within the next few weeks. It is also positive for Midland to have another global major as a partner; it already has an alliance with BHP. We look forward to the initial exploration.

On other projects, the company is awaiting assays, including from two joint-venture properties, Casault and Gaudet-Fenelon; over 7,000 samples were sent to the lab for assaying. Assays are also awaited on samples from the BHP and Soquem alliances in Nunavik and the Labrador Trough respectively. Other work has taken place recently on several of Midland’s 100% properties, with some drill targets identified.

Midland is a very active company, with several joint ventures, options and alliances, with multiple companies, as well as 100%-owned land across Quebec. It is well-funded, with strong management and technical personnel. The stock, however, has been seriously affected by tax-loss selling, taking it from an already weak level over 60 cents just two weeks ago to 48 cents on Friday, before it closed up. If you do not own, or have room to top up positions, you should buy at this depressed level. Any additional weakness over the next couple of weeks from further tax-loss selling should be embraced eagerly.

It used to be that gold stocks never looked cheap ... and now they do.

—Analyst Bill Fleckenstein

TOP BUYS NOW, in addition to those above, include:

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE)

Altius Minerals Corp. (ALS:TSX.V)

Ares Capital Corp. (ARCC:NASDAQ)

and Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE)

GET READY to hunt for bargains amongst tax-loss selling.

In addition to those mentioned above, Lara Exploration Ltd. (LRA:TSX.V) and Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX) may see further year-end weakness.

GOLD STOCKS BETTER VALUE THAN S&P

Analyst Bill Fleckenstein commented that “it used to be that gold stocks never looked cheap” saying that now they do. In fact, the XAU index of leading gold and silver mines is better value than the S&P 500 on virtually every metric, p/e (19.7 x vs 24.9 x); price to book (1.7 vs 4.7); and yield (1.9% vs 1.3%).

The XAU companies are net-debt positive against $33 billion net debt for the S&P. This situation is a dramatic change from historical norms.

YOU DON’T LIKE FRANCO ANY MORE?

It’s astonishing how a superficial reading can distort meaning, and then, like the game of Chinese whispers (AKA “Telephone”), the meaning gets reversed by the time it is passed on several times.

So, in answer to those who asked why I don’t like Franco any longer, I ask you to (re)read my article from Bulletin 794 in which you will find not a single criticism of the company, concluding the article with “Franco remains a core holding.” Hope that puts it to rest.

NEW ORLEANS RECORDINGS AVAILABLE

I commented recently how many excellent speeches and panels were at the recent New Orleans Investment Conference. They are too numerous to mention.

Many talks were quite topical, with practical advice to act on now, while others were more timeless. Recordings of most of the sessions — over 40 hours — are now available for purchase and I recommend highly; for information, click here.

Originally published on Dec. 5, 2021.

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Midland Exploration, Altius Minerals, Ares Capital, and Fortuna Silver Mines Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold, Midland Exploration, Osisko Gold, Altius Minerals, Fortuna Silver, Lara Exploration, Vista Gold, Pan American Silver and Agnico Eagle, companies mentioned in this article.

Adrian Day's Disclosures: Adrian Day's Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor's opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2021. Adrian Day's Global Analyst. Information and advice herein are intended purely for the subscriber's own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.