Following several weeks of lots of volatility in the gold price caused by

increasing inflation, a reshuffle at the Federal Reserve and most recently a brand new COVID-19 variant, Gold Terra Resource Corp. (YGT:TSX.V; YGTFF:OTC; TXO:FRANKFURT) made a very important acquisition by signing an option agreement with Newmont to buy the Con Mine.

This property contains a significant part of the prospective Campbell Shear, source of millions of ounces of gold production (6.1 Moz) in the past, but also historic reserves and resources left behind when the mine was closed down in 2003 while gold was $370/oz and mining became no longer economically viable.

On top of this, Newmont showed confidence in the company as it signed a CA$1.5M strategic investment for 3.7% of the outstanding shares.

It will be interesting to hear from Executive Chairman Gerald Panneton about backgrounds, exploration potential and further plans.

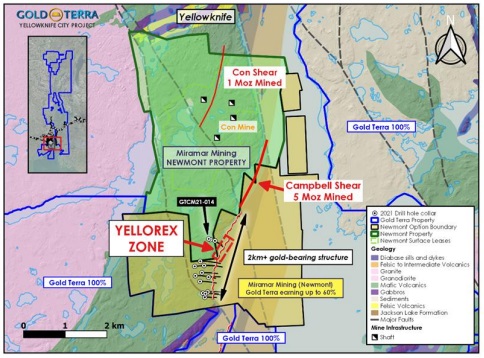

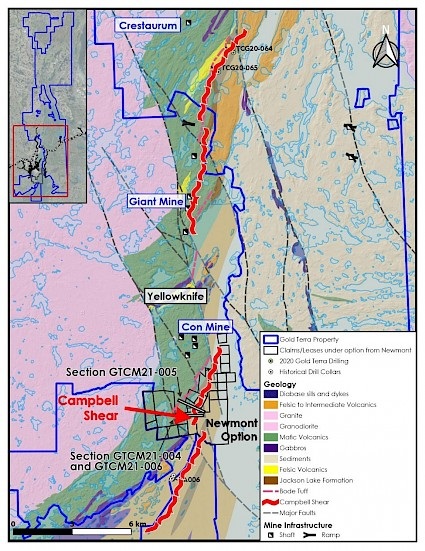

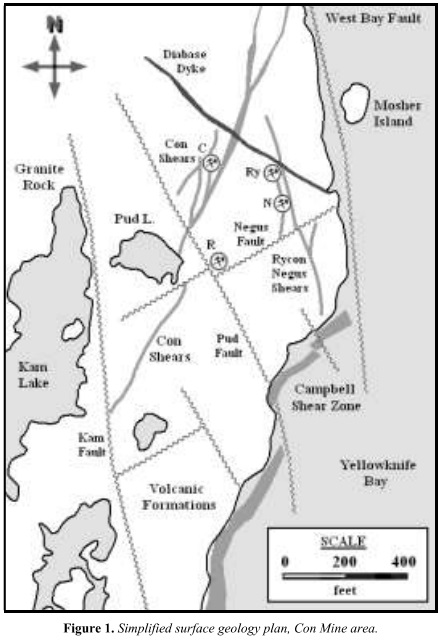

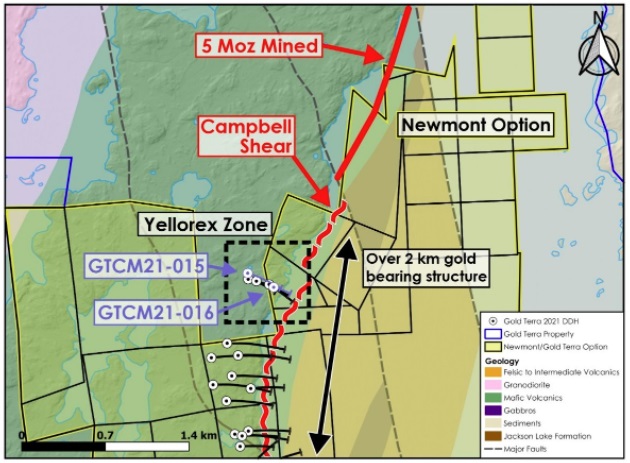

It seems Gold Terra has finally completed their quest to obtain the complete land package involving the Campbell Shear and the Con Mine, as it entered into an option agreement with owner Newmont to acquire the last remaining piece of the puzzle, the Con Mine and its direct surroundings, showed in the map below in green:

As can be seen in the larger scale map below, Gold Terra can explore the entire southern part of the Campbell Shear now, uninterrupted by property boundaries:

The part of the Campbell Shear near the Giant Mine is off limits anyway, as this former mine currently is a reclamation nightmare, and Gold Terra isn’t planning on going anywhere near it. So with this latest acquisition the stage is fully set for the search for the next multi-million ounce gold deposit, according to Panneton. The transaction highlights are, according to the news release from Nov. 22, 2021:

- The initial Exploration Agreement has been replaced and superseded by the Option Agreement to include all (100%) of MNML (owner, subsidiary of Newmont) and the Con Mine Property.

- Gold Terra has agreed to incur a minimum of CA$8M in exploration expenditures over a period of four years, which will include all exploration expenditures incurred to date under the initial Exploration Agreement.

- Gold Terra has spent approximately CA$3M in exploration expenditures to date.

- Gold Terra has also agreed to:

- Complete a Pre-Feasibility Study (PFS) of a mineral resource and a minimum of 1.5 Moz in all categories.

- Obtain all necessary regulatory approvals for the purchase and transfer of MNML's assets and liabilities to Gold Terra.

- Post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing.

The closing of the Transaction will then be completed with Gold Terra making a final cash payment of CA$8M. Such a transaction can’t be complete without a royalty, and Newmont has negotiated a 2% NSR for the Con Mine property, half of which can be bought back by Gold Terra for the rather hefty sum of CA$10M.

To spend a minimum of CA$5M in exploration expenditures over four years seems very reasonable, and the goal is clear: proving up at least a 1.5 Moz Au resource. The CA$8M cash payment seems very acceptable as well, as Gold Terra also acquires a substantial historic resource, which will be mentioned in a second. I wondered what the liabilities and cash bond were. Panneton explained: “As Newmont is to complete its reclamation in the very near future, the remaining liability could be much less than it is today, or approximately CA$8M, or much less at the time of closing. Besides this, the benefits of the transaction can be seen in many ways [by the way], from the remaining infrastructure, to the brown field status of the past producing Con Mine, and to many other benefits.”

To highlight this a bit further, the direct benefits for Gold Terra are according to the news release:

- Mineral leases and overlying surface rights.

- Access to infrastructure, including underground openings and shafts, buildings, storage facilities and roads.

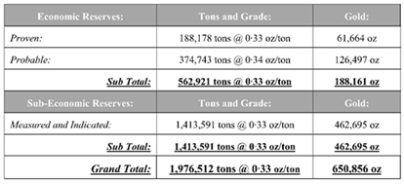

- Access to explore and potentially redevelop the remaining historic mineral reserves within the Con Mine Property (See Table 1 - Historic Mineral Reserves at Con Mine).

This last item is an interesting one, as Table 1 shows:

As can be seen, the historic resources are including the remaining reserves, and measured and indicated, so already with a higher degree of certainty. A historic resource of 651 koz at 10.2 g/t Au is an interesting addition, and according to Panneton the majority of this resource is located below 1000 meters in depth, and isn’t spread out all over the place. He believes there to be even more present, to the tune of about 1 Moz Au. It will take time before this resource can be converted into a NI43-101 compliant resource, as it will probably take at least 10% to 20% verification drilling, and this has to be done from surface before deciding to dewatering of certain shafts first.

Newmont also negotiated a back-in right for 51%, in case Gold Terra really strikes it big, and proves up at least 5 Moz Au at the Con Mine property. This is even beyond Panneton’s high end goal of 3 Moz Au, but in case it happens, Newmont has to pay the following amounts (and the 2% NSR would be terminated as well):

- Reimburse Gold Terra three times (3X) the amount of all of the expenditures incurred on the Con Mine Property from Sept. 4, 2020,

- Refund to Gold Terra the CA$8M cash payment,

- Payment of $30 per ounce of gold for 51% of the total ounces reported in the technical report.

- Assume 51% of the environmental liability and its share of the posted bond.

Assuming Gold Terra spent the required minimum of CA$8M in exploration expenditures, or more, Newmont will have to pay a large sum of CA$107M, plus unknown costs for the liability and bond for the development of a future mine to be estimated in the accompanying Feasibility Study. This sounds interesting for sure, but keep in mind that such a high grade 5 Moz Au deposit is Tier I material, and easily fetches an estimated back of the envelope after-tax NPV8 of $800 million to $1 billion at a $1600/oz gold price. As Panneton is used to big numbers and managed financing and construction of the multi-billion dollar Detour Mine himself, he most likely wouldn’t mind if Newmont wouldn’t exercise their back-in right. I wondered if he would take on such a high profile high grade project again, and he stated: “For sure developing a mine again is something that we are capable of, as our Board of Directors already has the experience.”

I also asked him for some background on this deal, for example how long they were into negotiations, if this was already on the table when doing the first option agreement with Newmont (South of Con Mine), and if they have access to all historic data now from Newmont, and what they expect to gain from this. Panneton answered the following:

“We started negotiating with Newmont in early 2020 and executed the initial exploration agreement nine months later. When we went back to the table in August of this year, another four months was spent negotiating the business part of the deal, and finally, the legal aspects of the agreement. Now it is our turn to find the ounces in 2022, and we look forward to update the market as we drill off the Campbell shear target."

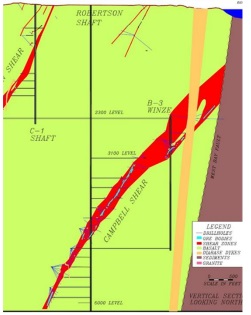

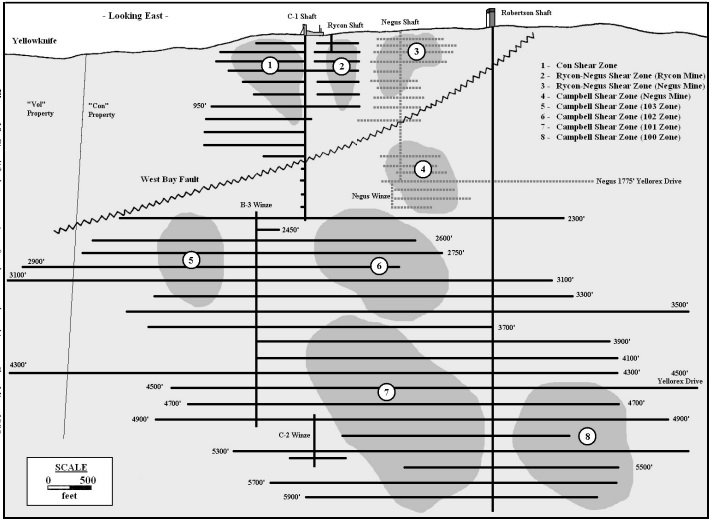

By acquiring the Con Mine, Gold Terra could become the happy owner of multiple existing underground access openings including the original C-1 shaft, and the deep Robertson shaft (1,950-meter) with a 2,000 tpd (ton per day) capacity for future underground exploration and mining, valued for time saving and investment saving, which are shown here on this old section:

The aforementioned dewatering would cost only a fraction of constructing such shafts and underground structures, according to Panneton probably to the tune of maybe 20% of the real cost and time to sink a new shaft which would take at least two years to complete. Still quite an amount, but not the approximate CA$100M of building the complete underground workings from scratch. Besides the underground developments, there is also remaining surface infrastructure including a large 10,000 square foot warehouse and dry surface vehicles, and very conveniently a CA$10M water treatment plant recently built in 2015, which can be used for cleaning any water coming from future dewatering.

On an extensive side note, Panneton and yours truly discussed the potential of this old Con Mine well before this deal was announced, and he sent me an interesting chapter of a 2009 book written by Ron van Silke called “The Operational History of Mines in the Northwest Territories, Canada," describing among others the fascinating history of this mine. Besides being a good story, I had a number of questions for him as a result, which could hopefully improve your insights as well (the illustrations shown in this little Q&A are from the book):

The Critical Investor (TCI): Although Yellorex and Kam were already established claims early on in the 50s-60s, they never went into production. Why was this?

Gerald Panneton (GP): They never had enough ore to sustain new additional development from surface so they stopped.

TCI: Nerco Minerals acquired the mine in 1986, and reopened older workings in 1990 in order to re-mine refractory ore zones, which needed an autoclave and lots of investments. The report also describes ore becoming less refractory at greater depths (below 3,000 feet). Is refractory ore a risk for the Campbell Shear?

GP: Even in refractory ore they were getting 90% recovery, so this is likely not an issue.

TCI: Although reserves were mostly depleted, it seems on the map the CS zone continues at depth, and a new C2 exploratory shaft/winze has been sunk. What kind of potential would there be, and would it be able to approach this from the Gold Terra claims?

GP: The CS deposit is cut off by the Pud fault, and continued south on the Yellorex ground, and it has been poorly explored, and this is where most of our drilling will be occurring.

TCI: Yellorex exploration started in 1967, from a depth of 2,300 feet (about 750 meters). Apparently, diamond drilling at 200 foot to 400 foot intervals in search of gold-bearing ore shoots related to the shear zone was unsuccessful (mine records). It is hard to reconstruct this in 3-D for me related to the current exploration at Yellorex [by the way]. So where is this area, and does this mean this particular zone/area/depth is potentially a low priority target for Gold Terra?

GP: Yellorex was badly approached and drilled with too steep holes, our own target there and 2021 drilling is proving it to be a very nice zone.

TCI: The West Bay Fault (WBF) dips only very gradually to the north. Are the gold structures above and under this fault connected as in that it is a later stage precipitation event, or was the fault from a later date? Where is Yellorex located/projected in this section, above or under the WBF?

GP: The Giant Mine had 8 Moz produced at 22 g/t Au, which is the up-dip of the CS of the Con Mine north of the Westbay fault. Yellowrex is south of the Pud fault, and it is part of the CS extension to the south. Gold circulated using the Campbell shear zone, porosity, and was deposited well before the CS fault displacements, such as the WBF or, the Pud fault.

TCI: Irregular nature of the Con Mine orebodies, combined with slayed veins and nugget effects, did not allow for a standard bulk mining procedure, so selective mining was required, mining only regular shaped orebodies with long hole stoping using remote-controlled mechanized machinery, also effective in locations with dangerous ground conditions. The result was five different mining methods. Is this something Gold Terra would have to deal with as well most likely?

GP: Every deposit has a specific shape, that will eventually dictate the way to mine. But in today’s world, long hole stopping is one of the best mining methods, and mechanized equipment is the way to go.

This method is safer, mines more tons, maybe also more dilution, as we are aiming for 10 g/t versus the original 15 g/t, to include such dilution.

This concludes our little Q & A about the Con Mine, and since Gold Terra acquired it, the additional provided information could be even more useful.

In the mean time, drilling at Yellorex is ongoing, and I’m curious for further step outs along strike, but first we have to await the assays of the eight already completed holes. According to Panneton, we can expect the first batch of results to be announced on a regular basis, from our current drilling. Management estimates the timeline for drilling the deepest holes to happen around late fall and early winter, with the results hopefully coming back from the lab at early winter. As the Phase Two drill program will see 10,000 meters of drilling and just 4,430 meters is completed, there is still 5,570 meters to go.

The plan is to follow the mineralization down plunge, of which the trajectory and depths aren’t clear yet. Over the next 24 months, the strategy is to increase this drilling program mainly south of the original Con Mine to depth of 1,000 meters and more at a step out drill spacing of 100 meters and with 50 meters infill, with the objective of delineating at least a 1.5 Moz high-grade gold mineral resource south of the Con Mine, which was the prime target and the very reason to do the deal with Newmont in the first place. If successful, this will add to the existing 1.2 Moz resource at Sam Otto and Crestaurum of course, and the recently added historic resource, creating opportunities to build a 3 Moz operation.

According to Panneton, one strategy they are contemplating is a 5000 tpd operation near Crestaurum, trucking 1000 tpd from the Con Mine property to the mill located near Crestaurum, and 4000 tpd from it at 5 g/t will be processed together. This would give a nice 200 koz per year production profile. In order to prove up such resources, Panneton told me he wants to be aggressive with his drilling next year and he hopes the markets will be in good shape so they can raise sufficient funds to set up a large program.

The fundamentals for Gold Terra keep improving, but when looking at the share price investors are still not entirely convinced, although a recent road show of Panneton and CEO Suda in Europe in the beginning of November brought some fresh buying into the story:

Share price 1 year timeframe (Source: tmxmoney.com)

It seems most of the tax loss selling is behind us, and rightly so, as I estimated the economic potential of just Sam Otto and Crestaurum already at an after-tax NPV8 of $235M in an earlier article, which would be eight times the current market capitalization. The treasury contains CA$5.2M after the closing of the CA$1.5M investment by Newmont, so Gold Terra is cashed up for at least the next 10,000 meters of drilling, which will take them most likely into H2, 2022 before they need to go back to the markets.

Conclusion

Gold Terra and Newmont seem to have developed an excellent relationship, as Gold Terra acquired the last bit of precious ground: the Con Mine property. Management expects to have a significant advantage when drilling for Campbell Shear hosted mineralization and can drill much closer to the mined out deposit, which still contains 651 Koz at 10.2 g/t Au historic resources. A big bonus in my view is the almost brand new CA$10M water treatment plant, which comes in very handy when dewatering the old workings becomes necessary.

Management has put forward their minimum 1.5 Moz resource target south of the Con Mine even more prominent, and wants to put the pedal to the metal with their drill program for 2022. As drilling is ongoing and results are expected soon, expect continuous news flow for quite some time from this ambitious explorer, with one of the most experienced mine builders around leading the way.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource Corp. is a sponsoring company.

All facts are to be checked by the reader. For more information go to https://goldterracorp.com/ and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

All charts and graphics provided by the author.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. dollars, unless stated otherwise.

Streetwise Reports Disclosures:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are not sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra Resource Corp., a company mentioned in this article.