Argentina Lithium and Energy Corp. (LIT:TSX; PNXLF:OTC; OAY3:FSE) seems to be capitalizing nicely on the unstoppable all time high lithium prices, as it is raising significant amounts of cash at the moment, currently standing at C$4.99M and not done yet.

The proceeds will be used for new exploration programs on their various LatAm lithium projects. The company already owns several early stage lithium projects in Argentina, and recently signed an option agreement to acquire two more projects in the same country, the Rincon West and Pocitos properties in the Salta Province.

Argentina Lithium announced the non-brokered private placement for up to C$4.95M @ C$0.45 with a full C$0.70 3 year warrant on November 1, 2021. A first tranche of C$2.75M was closed on November 10, 2021, a second tranche was closed on November 26, 2021 for another C$2.25M, so gross proceeds so far stand at C$4,997M. On top of this, the company was pleased to announce that they had to increase the PP to C$6.75M due to high demand, so the third tranche is expected to bring even more cash into the treasury.

Total finder’s fees for the first and second tranche of C$185.9k and 413k warrants will be paid to arm’s length parties of the company after closing. It was good to see CEO Cacos buy into this round, acquiring 225k shares, bringing his total to 1.325M. According to him, the money raised came primarily from high net worth individuals, industry trade professionals and investors from Argentina.

The C$0.45 price is a decent one, as the current share price stands at C$0.48 and has been side-ranging around this price since the last month, after enjoying a huge spike up on October 18 and 19 on massive volumes, going as high as C$0.96.

Share price one-year timeframe (Source: tmxmoney.com)

As the share price went up almost four times in a few days on no news, I wondered what could have caused this. According to CEO Cacos, the spike was a reaction to the takeover activity of companies operating in the Lithium Triangle in Argentina, as seen by the takeover of Neo Lithium Corp. and Millennial Lithium Corp.

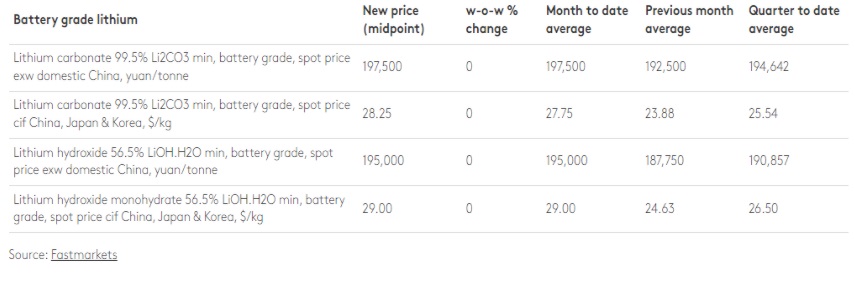

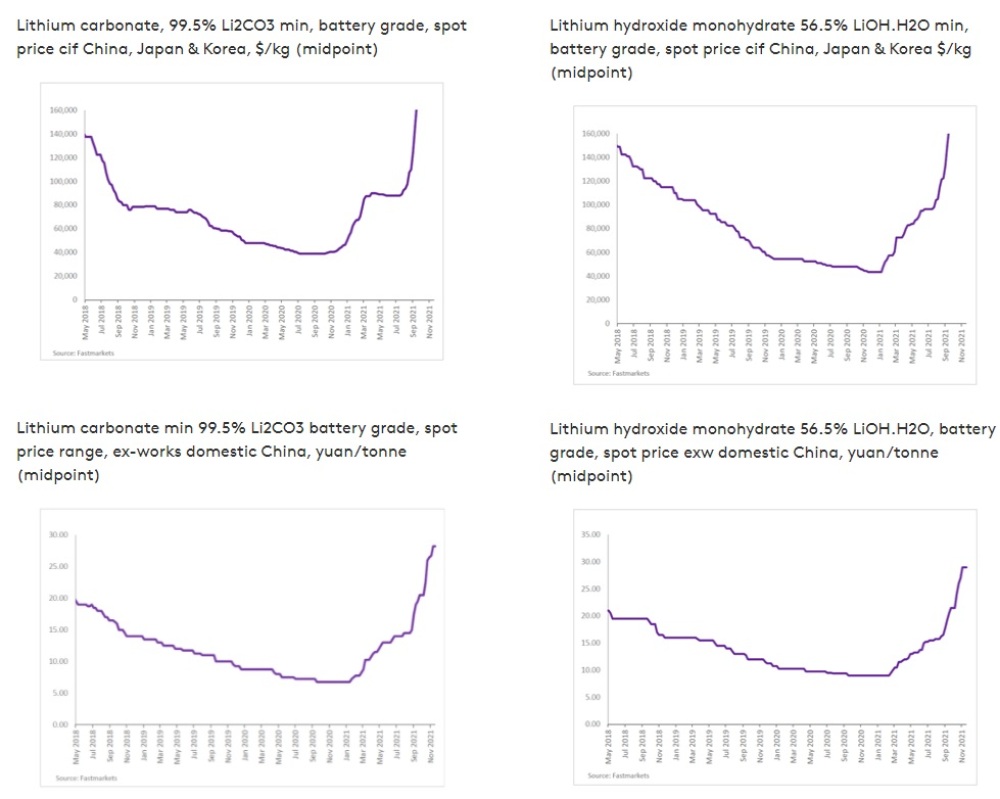

Talking about lithium product pricing, new all time highs keep getting printed almost every week now, as at this moment Fastmarkets shows lithium carbonate prices at US$28,250/t:

Fastmarkets also produces insightful charts, representing the difference between international markets in USD, and Chinese domestic markets in yuan:

The domestic prices in China are still rising faster than international prices. According to Argentina Lithium CEO Niko Cacos, this is most likely caused by higher interest for everything EV related in China. If the current shortages and especially extremely high prices of lithium products are short-lived and caused by COVID-19 is hard to say, but the recent new Omicron variation coming from South Africa seems to be another roadblock for increasing lithium production for now.

Let’s have a look at the projects of Argentina Lithium, all firmly located in the Lithium Triangle.

Rincon West and Pocitos were recently acquired. The terms for the two properties, with a combined footprint of 18,227 hectares, weren’t cheap, as the company already issued 750,000 shares to the local vendor on signing plus C$500,000 worth of shares over a 12-month period; and cash payments totaling US$4,200,000 over 36 months, but limited to only US$1,050,000 in the first 18 months, US$800,000 of which are firm commitments over the first year.

Therefore the ongoing financing is pretty important, not only to initiate exploration, but also considering the cash payments of the two latest additions are substantial.

Argentina Lithium has high hopes for these projects, but especially for Rincon West, as it is planning on completing 40 line kilometers of deep seeing Transient Electromagnetics (TEM) soundings on the Rincon West property, followed by 5 diamond drill holes after targeting.

The neighboring project of Argosy has an average grade of 321mg/L, which is economic at lithium carbonate prices over US$10,000/t, so I expect the potentially encountered grades at Rincon West globally to be the same. The project is already permitted for exploration.

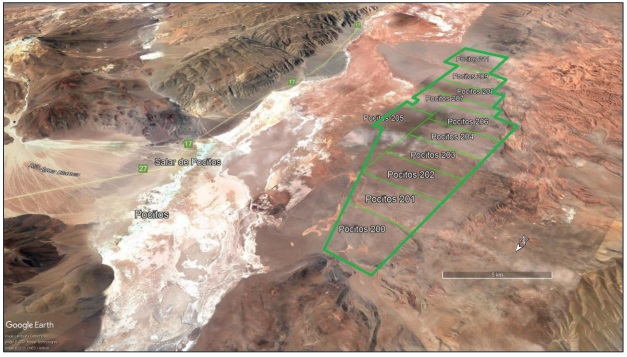

The Pocitos prospect is located on the western side of the Pocitos salar, and has seen modest lithium exploration in the past, including geophysics and surface sampling, with very limited drilling.

Salar de Pocitos

I asked CEO Cacos who owned the majority of the Salar the Pocitos, and if the company has an eye on acquiring more of it, located closer to the salar itself. He answered: “We are always looking to acquire more prospective ground to add to our portfolio, and this includes the Pocitos Salar. This is a large salar with many owners.”

Exploration plans for Pocitos involve 50 line kilometers of TEM soundings in H2, 2022, and as such is a second priority target for Argentina Lithium.

Another first priority target is the Antofalla project. As a reminder, the company optioned additional properties at the Salar the Antofalla in August, where they already owned a significant 9,000 hectare land package.

Argentina Lithium is earning into a 100% interest in a 5,380.5 hectare property set adjacent to the existing claims. Albemarle owns the largest part of this salar, which has a historic estimate of 11.8Mt LCE @ 350mg/l Li, which is the average grade I hope to see as a result of Antofalla exploration by the company.

Terms of the option agreement includes a cash payment C$600,000 in the first 18 months, and annual exploration expenditure commitments of C$500,000 in year one, These amounts mean that the company has to spend sufficient money, and the current plans involve 35 line kilometers of TEM soundings, followed by an estimated 3 diamond drill holes.

The exploration permitting process is almost finalized, as the company expects to receive them around first quarter of 2022.

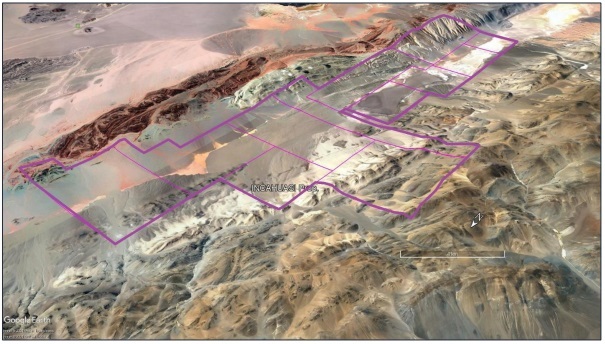

Finally, the company is planning on doing 50 line kilometers of TEM soundings on their Incahuasi Project in the second half of next year, making this a second priority target like Pocitos.

Exploration programs from a few years ago returned interesting sampling values (up to 409mg/L Lithium) and low grade brine drill results (on average 109mg/L Lithium), indicated by CEO Cacos with the black ellipse, so Argentina Lithium will be looking at exploring new zones on the Incahuasi Project claim set.

Conclusion

Argentina Lithium is making the most of the record-breaking lithium price environment these days, as it hopes to raise no less then C$6.75M, and already closed 2 tranches for C$4.99M. This money enables the company to finally start geophysics and diamond drilling, with the focus on Rincon West and Antofalla.

The company is looking to disclose the new exploration plans right after the closing of the third and last tranche of the ongoing financing, and hopes to start drilling in the first quarter of next year. The extreme lithium prices already lit a fire under this tiny explorer, but if they actually achieve solid drill results and lithium sentiment is still as strong, a further re-rating seems likely.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Argentina Lithium & Energy Corp. is a sponsoring company.

All facts are to be checked by the reader. For more information go to https://argentinalithium.com/ and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

All charts and graphics provided by the author.

All pictures are company material, unless stated otherwise.

All currencies are in US dollars, unless stated otherwise.

Streetwise Reports Disclosures:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Argentina Lithium & Energy Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.