With the push for more renewable sources of energy and electric vehicles comes the need for the materials needed to produce them. Demand for metals, such as cobalt, lithium, copper, and uranium is predicted to grow much faster than available supply.

Finding new sources of these minerals is going to take innovation and new types of technology, such as artificial intelligence (AI).

One company fueling the shift to electric power is KoBold Metals, a minerals explorer that is using AI to find the cobalt resources manufacturers need. Privately held, Kobold is funded in part by climate tech group Breakthrough Energy, which is backed by Bill Gates, Jeff Bezos, Richard Branson, and Michael Bloomberg, to name a few of Breakthrough’s heavy hitters. Founded in 2015 by Gates, Breakthrough Energy is “concerned about the impacts of accelerating climate change” and “supports the innovations that will lead the world to net-zero emissions." Investors also include well-known names Andreessen Horowitz and Equinor.

KoBold bills itself as "the world's first AI powered mineral exploration company, "innovating at the very upstream of the EV supply chain." It pairs mineral explorers with cutting edge AI technology "to bring the most comprehensive and cutting-edge knowledge available to bear on battery mineral exploration." The company uses AI to decide what land to acquire, and then its geoscientists use AI to drive exploration programs. The company noted that it has formed alliances with mining companies to use historical and "underexploited datasets to generate new exploration opportunities."

In September, KoBold announced a partnership with mining giant BHP Group where KoBold's AI technology will be used initially to explore a wide area of Western Australia. "We need new approaches to find the next generation of essential minerals, and this alliance will combine historical data, artificial intelligence, and geoscience expertise to uncover what has previously been hidden," said Keenan Jennings, BHP's head of metals exploration.

This Publicly Traded Explorer Also Supports Clean Energy

KoBold is privately held, so investors can't participate in its value proposition. But another resource explorer that’s in on the AI-meets-mining trend is Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC), a Vancouver-based, public company specializing in the strategic acquisition, exploration, and development of alternative energy/fuel projects, including uranium, lithium, and other critical clean energy elements.

Azincourt was the only company that matched all of my criteria, with its focus on clean energy, solid ESG principals, and cutting-edge technology. — PennyQueen

Azincourt has entered into a data consulting agreement with Fobi AI Inc. (FOBI:TSX), a data intelligence company also based in Vancouver, British Columbia, that uses AI to mine real-time data for actionable insights.

Why did PennyQueen invest in Azincourt? Read her thoughts and due diligence on Azincourt Energy Corp exclusively avalable for Streetwise Reports' Readers. Click here and we will deliver the FREE due diligence Report link to your inbox.

PennyQueen is an investor who focuses mostly on clean tech and does her own independent analysis. She has created a social media community of over 10,000 like-minded investors with whom she has shared her progress of taking a $329k nest egg and building it to over $6 million within a year.

Chart analyst Clive Maund said, "We bought Azincourt Uranium at what turned out to be a good entry at a low on 10th October... After we bought it popped higher nicely, but has since reacted back. The price / volume pattern suggests a Triangular consolidation is forming that should lead to renewed advance, and it is therefore rated an immediate buy again here." Through a one-year, $250,000 contract, Fobi will help Azincourt develop an operational intelligence platform to help transform legacy exploration practices: This will potentially allow the company to generate more impactful drill holes in less time and with fewer costs. Fewer holes means less impact on the environment, and efficiency here, if achieved, reflects an even deeper commitment from Azincourt to the development of clean energy sources.

The team-up will allow Azincourt to benefit from Fobi’s experience architecting and deploying its established AI and big data operational applications in an effort to support Azincourt’s goal of making discoveries and delineating a resource at its East Preston project.

Rob Anson, CEO of Fobi commented, “This agreement with Azincourt will enable Fobi to demonstrate the power of our real-time operational data applications and real-time analytics and insights to provide Azincourt with leading-edge technology, strategies, and the necessary tools to streamline and automate current manual applications. Fobi will continue to drive innovation and best practices to improve the industry’s existing antiquated operational and data systems.”

Anson concluded, “The powerful combination of Fobi’s artificial intelligence and real-time big data applications will be key to enabling Azincourt to make faster, smarter, data-driven decisions which ultimately will be key to driving further success in regard to the Company’s operational efficiencies and performance.”

Potential of AI to Streamline Exploration

“Exploration is the riskiest endeavor in mineral exploration, and we have to be efficient in how we spend money to do it,” said Alex Klenman, president and CEO of Azincourt Energy. “I’m interested in perhaps speeding up the exploration process by using artificial intelligence to possibly recognize patterns that weren’t as readily apparent in current methods of exploration.”

Klenman said the company will work with Fobi to acquire and accumulate public data about uranium exploration in the Athabasca region through historical reports, releases, and public filings, and then apply artificial intelligence techniques to determine any patterns that may exist.

“I look at this as our company dipping our toe in a new area,” Klenman said. “At some point, it may lead to cutting down the number of exploratory drill holes.”

Klenman said Azincourt is not aware of other uranium companies using AI and said he was intrigued by KoBold Metals, which calls itself the first AI-powered mineral exploration company and is committed to the long-term development of new battery metal resources.

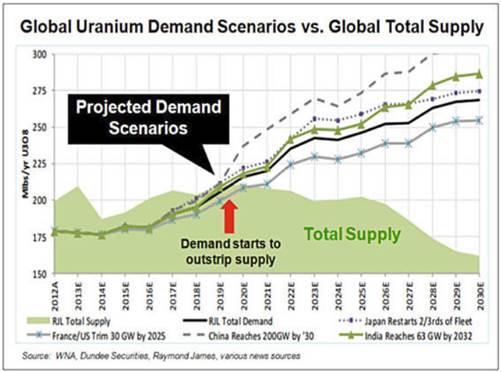

Uranium prices are now in the $40 to $50 per pound range, Klenman said, down from a peak of $160 in 2007.

“We’ve been in a prolonged bear market since then and some mines have been shut,” he said. “Existing supplies have been used for the past 10 years, but we’re reaching a point where demand could turn. Even with existing reactors, the need for raw material is there.”

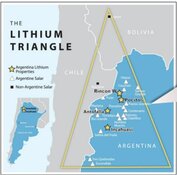

Azincourt Energy is currently active at its majority-controlled joint venture East Preston uranium project in the Athabasca Basin in Saskatchewan and in the Escalera Group uranium-lithium project located on the Picotani Plateau in southeastern Peru.

“In terms of drilling, we expect to explore another 7000 meters this winter at a cost of somewhere around plus or minus $3M. We have approximately CA$14M on-hand, and that will buy us several more years,” concludes Klenman.

If you have not already, be sure to read PennyQueen's thoughts and due diligence on Azincourt Energy Corp exclusively avalable for Streetwise Reports' Readers. Click here and we will deliver the FREE due diligence Report link to your inbox.

Disclosures:

1) Evan Cooper compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Azincourt Energy. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy and Fobi, companies mentioned in this article.

-->