The time to buy stocks is often when most potential buyers’ attention

is elsewhere and that is certainly the case with White Gold Corp. (WGO:TSX.V; WHGOF:OTCQX; 29W:FRA) where most investors seem to have “gone walkabout”. It looks forlorn and abandoned after a grueling 15-month downtrend, yet, as we will see, this is a very good point for it to reverse to the upside and there are plenty of reasons for it to do so.

Let’s start by looking at the technicals.

On the 6-year chart we can see that White Gold had a massive rally late in 2016 and early 2017 that took it as high as about CA$2.30 but after that it has tended to drift lower and lower with long downtrends punctuated by relatively brief sharp rallies.

Importantly there appears to be a zone of strong support in the

CA$0.40 to CA$0.50 zone which the price has now arrived at after the latest downtrend, so this would be good point for it to turn up, which is made more likely by the strong On-balance Volume line which is close to making new highs (Accum – Distrib is still weak), and the improving background of gold and silver at last looking ready to begin a major uptrend.

Zooming in via the 2-year chart we see that the latest downtrend from the 2020 peak really has been a long and grueling one and this of course increases the chances of it turning higher. The arrival at what looks like a cyclical low at strong support, the relative strength of the On-balance Volume line and the increasing bunching of price and moving averages together make the chances of its reversing soon high.

The 6-month chart by itself still looks grim with the price trending lower beneath falling moving averages, so as buyers here we should remain aware that it could take a while to get moving.

What about the fundamentals?

They look impressive.

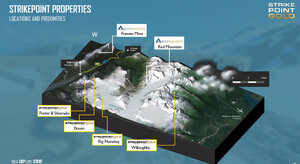

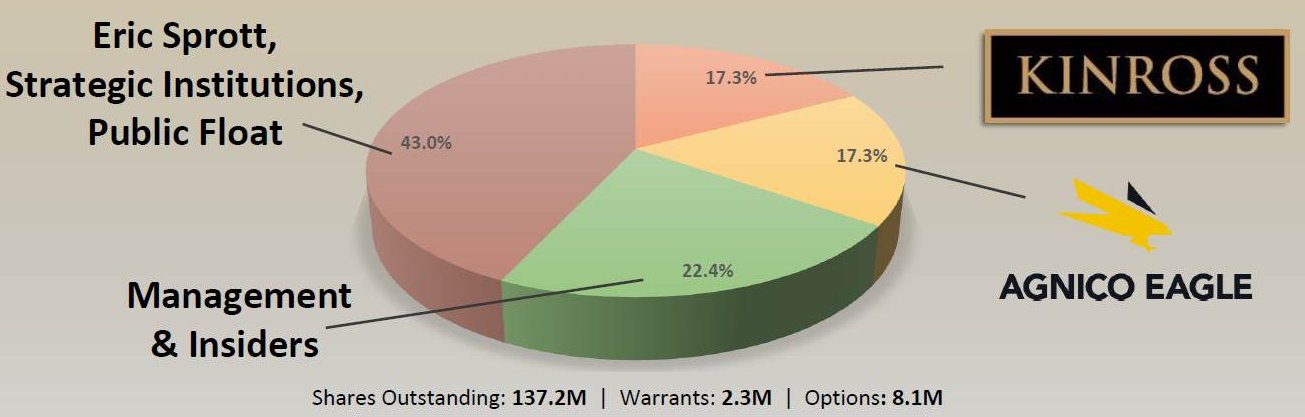

White Gold has a large land position in the Yukon and a range of promising prospects. Drilling is ongoing with a stream of drilling results expected going forward, which could of course spark a sudden rally if favorable. In addition, there are some heavyweight investors in the company including Agnico Eagle with a 17.3% stake, Kinross also with a 17.3% stake, and Eric Sprott and Strategic Institutions also own sizeable stakes, so that the percentage of stock in the float is low, as you can see in the chart below.

It should also be clear from this chart that there are some big fish circling this company – it is a takeover candidate and any takeover would obviously result in a dramatic appreciation in the stock price.

White Gold is therefore regarded as a strong buy here so we stay long – we bought it rather too early back in August at about CA$0.56 - fresh purchases are in order, and it is not regarded as being unduly speculative.

Here is a link to some interesting presentation slides by the company.

Update: Since the original publication, White Gold announced its discovery of significant gold mineralization at the Ryan's Surprise and Ulli Ride targets on its flagship property.

After the announcement, White Gold Corp. closed at CA$0.60 on Nov. 8, 2021, up from its CA$0.49, $0.406 close on Nov. 5, 2021.

Originally posted on Nov. 8 2021.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Additional Clive Maund disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: White Gold Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Streetwise Reports: White Gold Corp. Please click here for more information.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of White Gold Corp, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosures:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.