It was only ten months ago that I constructed the GGMA 2022 Model Portfolio with the intention to insulate the junior miner content from the ravages of what I correctly identified as an oncoming bear market.

I added a 15% position in volatility by way of the UVXY:US, which had been a stellar hedge during the 2008 and 2020 market crashes, thinking that if it performed merely half as well in 2022 as it did in prior selloffs that the weakness in the typically volatile junior miners would be neutralized.

Unfortunately, everyone else in the trading community saw the same thing, and instead of massive short positions in UVXY:US, trader positioning was net long such that the 25% drop in the S&P could only muster enough steam to get the VIX itself to just under 40 in late January versus the highs of 85 and 89 in 2020 and 2008.

With the VIX unable to repeat as an effective hedge, I am left with a basket of junior mining issues with developmental or exploration exposure to gold, silver, copper, and uranium.

Needless to say, they have been a disaster in terms of performance but then again, with the TSX Venture Exchange down 37.56% YTD and the NASDAQ 100 off 32.39% YTD, many of the more speculative issues on both exchanges are down in excess of 90%.

Aftermath and Getchell

Before I proceed, it is critical that we revisit the period of Q1/2020 when I had two issues on the front burner — Aftermath Silver Ltd. (AAG:TSX.V) and Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB),with AAG being a proxy for silver ownership and GTCH my top gold choice.

Despite being fully financed and well-run, the panic of the pandemic took both down under a dime, and I am proud to say I added to both issues.

Less than a year later, after the most novice of shareholders all sold out because of the severity of the declines, AAG was turned into a 17-bagger and GTCH a 10-bagger off the lows of the COVID crash.

Now, not all juniors recovered as nicely as AAG and GTCH, but many did, and the reason for this is best described in a little anecdote from the 1980s.

Back in late 1987, I was working as a stock salesman for a small Toronto-based boutique brokerage firm whose V.P. Development was a former trainer for the mighty EF Hutton in New York.

Having just experienced the crash of ’87, the firm was putting us all through career therapy sessions to come to grips with the fact that many of our clients had been completely wiped out (as in NO money left after margin debits were cleared).

There was a great debate raging as to whether the path to recovering our obliterated assets lay in junior resource companies or in the slower-moving but safer blue-chip securities. In his trademark Connecticut accent, he told us that basically, all junior securities were “S**T,” and that blue chips were like lacrosse balls, and that if you took a brown paper bag and filled it with across balls and then took another brown paper bag and filled it with “S**T,” and then threw them both off the top of the CN Tower when they hit the pavement, the ball would bounce mightily while the “S**T” would simply go “splat!” with nary a bounce to be had.

“S**T don’t bounce.” He would repeat that over and over, and to this day, it makes sense.

There is, however, a compromise to be had in this story. While it is true that blue chip stocks stand a better chance of rebounding after severe market declines, over the many years and numerous corrections that I have endured, there have been more than a few quality juniors that not only bounced but actually went on to all-time highs in the ensuing years.

The junior developers selected in this publication, for the most part, have a great deal of lacrosse ball content, and that was evident after the 2020 crash, and it will be again once the primary bullish case for resources reasserts itself. Shortages in uranium and copper coupled with accelerating demand from electrification and clean energy are going to drive prices higher over the balance of the decade, making those companies with proven resources or new discoveries perfectly positioned for shifts in demand and sentiment.

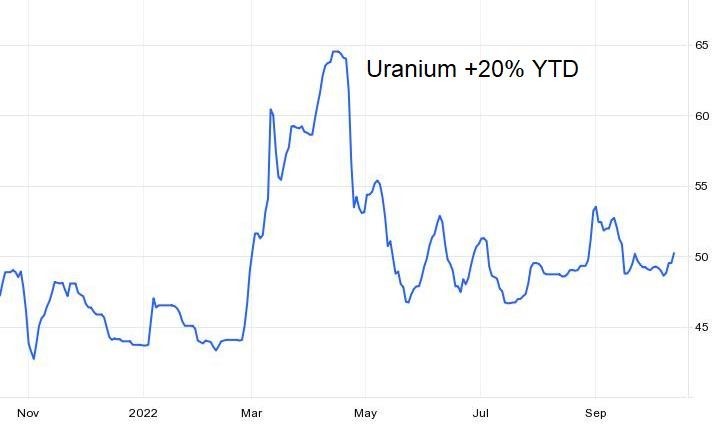

Uranium remains the most compelling of all the stories being told in the resource space for a number of reasons, not the least of which is the 20% YTD advance it has enjoyed here in 2022.

Construction of new reactors is blossoming, which can only be a positive for companies with proven U3O8 reserves.

With the average AISC (“all-in sustaining cost”) of around US$60/lb., there are not very many companies exploring for or developing uranium, leaving a pretty strong economic barrier to entry for would-be uranium players.

With the arrival of fleet after fleet of these new modular reactor units, the global electricity grid is going to find itself in receipt of massive increases in gigawatts in need of equally massive transmission systems (as in wire), which means that copper wire is going to move into structural shortages that not even ten years of capex mainlining will correct.

Accordingly, the three portfolios offered for review have ample exposure to uranium and copper, so if my thesis is proven out, then the weakness experienced in 2022 will be transformed into long-term secular strength as these developments unfold.

That leaves us with the precious metals, and all I can say on that is this: Over the past five thousand years, gold had always been priced off “high human emotion.” Emperors and czars and kings and queens worshipped and hoarded gold, and that emotional pre-condition was what first caught my attention while riding a bus in college between games against Notre Dame and Northern Michigan reading (for the first time) Ayn Rand’s Atlas Shrugged in 1974.

In a financialized world dominated by algorithms and AI software, the historical impact of “high human emotion” has little effect on 2022 prices for gold or silver. The “royalty” of past eras that brought such importance to the possession of gold and silver have today been replaced by emotionally-devoid computers that have the sanction and blessing of the U.S. Government.

However, they are only impactive if they can deal exclusively in paper because if they were forced to set prices only through the purchase and sale of actual metal, true price discovery would not allow the shenanigans that we see on a daily basis to occur.

As a card-carrying Babyboomer with a ton of stories now rendered largely irrelevant by an increasingly-agnostic “new generation,” I have not yet earned the right to tell the youngsters anything regarding the benefits of a “return to the old ways” because that was precisely what was fed to me by my parents (“Marijuana will make you gay!”) and by my grandparents (“Every hippy that walks should be shot!”).

The only way one can benefit from owning anything indelibly etched into your long-term psyche is through experience. The kiddies that control all the money these days need to start having positive experiences with gold and silver ownership.

That would be a great start to the much-needed “re-branding” of the precious metals story.

Once the new generation starts to feel the “love” that embraces a “big pass” on a “gold deal,” watch how rapidly they bring on their own “influencers to take valuation to wherever they wish. (When that day arrives, you will all get an Email Alert within seconds. . .)

The List (in order of priority):

Tombstone Exploration

Tombstone Exploration Corp. (TMBXF:US;TMBXF:OTCMKTS): The primary project is their Arizona-based Bonanza Property, where historical evidence shows high-grade gold mining commenced in the Harquehala region circa 1892 with head grades in the 1-ounce-per-ton range.

Records show production of approximately 180,000 ounces from high-angle shear zones until the miners hit the water table at -200 feet, and because it was sulfide mineralization, mining was discontinued.

However, what the miners left behind in “dumps” (heaps of gold-bearing waste materials) averaged 0.04 to 0.1 opt, with total recoverable falling in the 25,000-40,000-ounce range, with the lower end of that worth more than US$40 million.

The plan is to process those “dumps” and recover those ounces in the Phase 1 portion, after which they will embark on a Phase Two exploration project on the remaining ground (2,600 acres).

The deal intrigued me because, unlike most development opportunities where you put up a ton of money and rarely see any cash returned for more than a few years, this deal is different because of the total funds raised by Tombstone. They are guaranteed at least 80% of all revenues of the Phase One recovery process until their total US$4 million investment is recovered, after which they participate at a 40%-60% split.

However, as to all of the other portions of the 2,600 acres, it remains a 50/50 split on all future exploration success, which is a fully-acceptable deal, given the jurisdictional edge held by the state of mining-friendly Arizona.

To sum it up, the arch-enemy of all junior explorers is the dreaded “dilution effect.” In the heady days of the 1990s, if you were a junior with 10 million shares issued, all trading at CA$0.50, you carried a market cap of CA$5 million.

If you then turned around and issued 5m additional shares at CA$0.50, you arrived at 15 million shares issued and a CA$7.5 million market cap. The Rule of Thumb was then and remains today that 50% dilution demands a fourfold increase in market cap in order to justify the dilution. If, after you stuck a bunch of holes in the ground, the share price advanced so as to create a CA$30 million market cap, investors received a 400% return from the CA$7.5 million market cap that resulted from dilution.

In the case of Tombstone, the share count is 12,210,746 today, and The fully-diluted market cap will be a mere US$4.3 million versus a possible US$45 million recovery of cash from the processing of the dump material. In other words, they could be generating cash flow first with exploration as the follow-up, the reverse of 99% of the deals I normally see.

Tombstone is a joint-venture partner that earns 40% of all Phase One revenues after they get their US$4 million returned to them by way of 80% of all cash generated from the sale of gold from the dumps. Ergo, financial risk, while not eliminated, is mitigated by leaving a 50% interest in all other Phase 2 ounces contained on the property. They may be doing additional funding in the US$0.50 range; I will advise details when received.

Upside Driver: higher gold and silver prices.

Aftermath Silver

Aftermath Silver Ltd. (AAG:TSX.V): The primary flagship property is the Berenguela Project in Peru, where they hold a historic resource of silver in excess of 100m ounces. (A new RRE is in the works as this is being written and expected in Q4/2022.)

I have enjoyed great success with Chairman Michael Williams, having first participated in a funding round in 2019 at CA$0.08 (which included a half-warrant at CA$0.12). In January 2020, I placed AAG into the GGMA 2020 Portfolio in several tranches, with most subscribers averaging around CA$0.20.

After surviving the COVID meltdown in March 2020, the share price responded to participation by Eric Sprott in subsequent funding rounds (CA$0.20 and CA$0.65), and in response to strength in the precious metals in 2020, AAG hit CA$1.70 in January/2021, providing subscribers with a superb gain.

I did recommend a “Sell” on the shares earlier than the CA$1.70 peak price but did nevertheless come out of the COVID crash with a handsome gain in my first year of operation of the advisory service.

With all of the precious metals juniors once again back on their heels, subscribers looking for maximum impact in a recovery story should look no further than Michael Williams and Aftermath Silver. I want to see a turnaround in the precious metals complex with special emphasis on silver which has been an absolute dog since February of 2021.

Aftermath has just announced a CA$0.17/unit private placement (full warrant at $0.27 for 24 months). Interested subscribers should email me with their interest.

The next four companies fall into the category of “copper-centric” deals and represent the bulk of my portfolio weighting in the electrification movement constituting a primary investment theme for 2022 and beyond.

The current global central bank tightening cycle will end within the next six months either from subsiding inflation numbers or a financial “accident” brought about by rising bond yields, and when that happens, the cycle will once again shift to owning companies that produce, develop, or explore for metals in (or approaching) shortage conditions which certainly includes copper.

This group of companies includes explorers and developers, so the inevitable rise in copper prices is going to have a meaningful impact on valuation. With the current slowdown in economic growth weighing in base metal sentiment, the overreaction in the junior copper space is providing us with an extraordinary opportunity.

Upside Driver: pending revised resource estimate and higher silver prices.

Northisle Copper and Gold

Northisle Copper and Gold Inc. (NCX:TSX; NTCPF:OTCPK): This company owns and operates the North Island Project on Vancouver Island, which boasts 2.35 billion pounds of copper and 4 million ounces of gold in a large porphyry copper-gold deposit in a mining-friendly part of the island. The discounted net present value of the resource exceeds $1.1 billion with an indicated IRR of 19%.

There exists substantial exploration upside at multiple locations, so I own this company as a pure proxy for the price of copper, looking out beyond the current difficult market environment toward the implementation of the electrification initiative and accelerated demand for copper concentrate.

Coming from a favorable mining jurisdiction such as British Columbia is a huge plus. Negatives include the rather large and institutionally-dominated share count at over 225 million, but that aside, US$5/lb. copper places a big number on the replacement value of the resource and therefore sets NCX up as a logical M&A candidate.

The company has the backing of corporate influencer Michael Gentile whose fund owns 9.9% of the issued capital and who acts as a strategic advisor to the company. I have a target price of CA$1.35 per share for 2023, which assumes a CA$4.00/lb copper price and a more favorable market environment.

Upside Driver: Improved copper prices; continued drill results from Northwest Expo and Hushamu exploration programs.

Allied Copper

Allied Copper Corp. (CPR:TSX.V; CPRRF:OTCQB): Primarily an exploration company, the original reason that I invested in CPR was Chairman Warner Uhl, an ex-Fluor Corp. “fixer” that knows every facet of what it takes to build and operate a copper mine anywhere in the world.

However, the deal flow that was originally expected to provide Warner and his team of engineers with projects that could be vaulted into production was delayed by the sudden spike in demand for “all things copper” in 2020-2021, sending acquisition costs spiraling into the stratosphere and then the shift in central bank monetary policies from “maximum full employment” which is metals-friendly to “price stability” which is not metals-friendly.

What was supposed to be a flagship deal with a big resource to develop became an exploration story with little to differentiate it from the hundreds of other copper wannabes out there.

The good news is that they raised a big chunk of money in 2020 and are able to ride out the current storm without the need for further dilutive financings (at least for the moment), and while they remain focused on copper, they have indicated that there is a possibility to expand into other areas related to the “battery metals” space with the financial and reputational assistance of a highly- prominent mining billionaire whose accomplishments over the past forty years are legendary.

There is, as of yet, no deal to talk about but if consummated, changes the landscape for CPR in a huge way.

Upside Driver: Improved copper prices and the potential for a new project in the battery metals space in partnership with a proven mine builder.

Norseman Silver

Norseman Silver Ltd. (NOC:TSX.V; NOCSF:OTCQB): NOC has been my second-largest holding and second-top pick since 2020, when I launched the GGMA Advisory Service, and remains one of my most valued holdings. That said, it has been a terrible performer since February of 2021, when it joined the “SilverSqueeze” pump-athon and hit CA$0.76 per share after completing financings at CA$0.30 and CA$0.33 per unit.

While the company originally set out to become a nascent silver developer back in 2019, the acquisition of the Taquetren Project in Argentina, the directive changed when sampling results uncovered a large outcrop of extremely high-grade copper at Veta Nueva and Veta Juan along with a gold occurrence at the Irma zone which resembles geology similar to the Calcatreu gold deposit located adjacent and proximitous to the Taquetren land package.

In charge of this Patagonian project is Daniel Bussandri, an Argentinian local prospector and geologist known as the finder of the legendary Navidad silver deposit, one of the world’s largest undeveloped silver-lead-zinc deposits and 100%-owned by Pan American Silver Corp. who bought it outright in 2009 for USD $630 million. Bussandri is now the sole exploration figurehead for NOC in the region, with both Navidad and Taquetren lying in the Gastre Fault formation noted for multiple world-class, district-scale mineral deposits and well-known to Bussandri and Team.

The region is largely underexplored, which allowed NOC to pick up a truly district-scale land package totaling over 59,000 hectares, and while they most certainly do not have the muscle to adequately explore the ground, in the event of a significant discovery, the land position will certainly be a selling point if contacted by one of the majors.

Upside Driver: continued success at Taquetren, where outcrops have uncovered copper-silver values exceeding 8% Cu and 200 g/t Ag. over big widths and where diamond drilling is expected to commence in 2023.

Max Resource

MAX Resource Corp. (MAX:TSX.V; MXROF:OTCBB): In early January of 2022, I received a call from fund manager/geologist Brad Aelicks who hails from Vancouver and who was first introduced to me by my late colleague and dear friend, Sean Shanahan, who first introduced me to the Getchell Gold story which currently resides as my largest holding and top pick.

Before proceeding, it should be known that Brad Aelicks was one of the original investors in Buena Vista Gold Corp. in 2011, which eventually morphed into Getchell Gold and remains one of his most prized holdings. So, when Brad called and wanted to inform me of a project in which he was an early investor, he said that he was hesitant because it might be seen as a “bait-and-switch” move, which I fully understood and appreciated.

After he finished his detailed explanation of the geology of the Cesar Project in Columbia, I felt as though I might need to go back to my old geology textbooks, but with the advent of the internet, I was able to get a “global perspective” on the gargantuan potential of the 20-km.-long series of high-grade copper outcrops that have been revealed not through “advance technological breakthroughs” but rather through good-old-fashioned piton hammer and shovel prospecting.

Three full years of fieldwork have resulted in three separate discoveries of significance, but when you stand back and realize what CESAR might be, you cannot avoid owning a position.

Now, I was going to put together a 10-paragraph synopsis of the drill program and its objectives, but after reading Rick Mills’ excellent interview with MAX CEO Brett Mattich and Columbian Geology expert Chris Grainger, I will save myself the carpal tunnel agony and simply ask that you click on this link.

The discussion with Grainger is about as good as I have heard in my years as a deal analyst, and it covers Columbian politics and geology from the DRC to Poland to Argentina and back before refocusing on Cesar.

I bought more stock in the mid-$0.30’s this week and will continue to add. Some clangers that I hold from other deals (not covered in the GGMA) have been pitched overboard to harvest tax-loss ammo and re-allocated to MAX.

These markets are TODAY very unfriendly to exploration deals; that is precisely why MAX should be bought. In any other market environment, MAX would be a $1.00 stock looking at $5-10 on results. I urge you all to look out beyond the current central bank / political gong show and buy MAX. It is one of the best exploration stories I have heard in years. . .

Upside Driver: Exploration results from the maiden drill program at URU. Based upon scale potential, one drill hole and this is a multi-month, 10-20 bagger.

Western Uranium

Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX): Not much needs to be said here — 56 million pounds of uranium priced at US$2.8 billion as measured against a market cap of US$43 million. The market cap per pound of uranium is ridiculous, and when I add the 33 million pounds of battery-metal-friendly vanadium to the mix, it in 2017 at CA$1.70 per share.

Upside driver: Total shares issued 43.3 million will absolutely fly once the uranium story resurfaces, which it will, with a vengeance.

Getchell Gold

At last but by no means least. . .

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB): I could go off on a 20-paragraph rant about the company’s Fondaway Canyon Asset and why the current US$26.7 million market cap is all “wrong, wrong, wrong!” but the reality remains that markets are never wrong because they, in the end, reflect the final and sole judgment of all market participants.

Getchell Gold is my largest holding, and by default, means I am thoroughly biased in my analysis. You have all read my case for owning Getchell, and that has not changed.

The company is priced at a US$26.7 million market cap. In-ground ounces in the state of Nevada have carried a historical M&A benchmark of US$100/ounce for low-grade (sub 1 g/t Au) and $200/ounce for high-grade (> 3 g/t Ag). The old historical resource (that the company cannot promote) is 1,069,000 ounces using a cut-off grade of 3.43 g/t at a gold price of $1,150/ounce (circa 2017). If one takes the lower end of the benchmark value-per-ounce guideline at $100, Getchell should be a fire sale at US$106,900,000 or around US$0.89 per share on a fully-diluted basis.

The reason that Getchell and all of its precious metals brethren are trading so cheaply is that the past ten years of egregious money printing have resulted in huge inflation but zero protection from that inflation through gold ownership. I remember writing enormously-long, booze-fueled tombs filled with layer upon layer of reasons why inflation would return to bite us in the backside and then hurling empty wine bottles at TV screens when some CNBC bobblehead would say, “inflation is contained,” but at the end of the day, when you get the inputs right and the outcomes wrong, you have to finally acknowledge that you are wrong.

I played hockey with a fellow that was little, a poor skater, not very strong, and horrible defensively. He scored, on average, 1.8 goals per game and, when on my line, boasted a plus-minus average of over 1.00.

That meant that he was going to force me and my other linemate to pick up his check and our checks going back up the ice to our end because he was gasping to crawl back to the red line. However, when the game was over and the reporters came in to talk to us, they always went to the guy who scored two goals and never to the other guys who assisted on them.

At the end of the day, it is not about “how” I generate a positive plus-minus on the hockey rink, nor is it about how the people scored. More importantly, investing, it is not about the methods used in generating a positive rate of return. It all revolves around getting the job done.

Getchell is due to release more drill results (into a non-attentive audience) and then the much-awaited Revised Resource Estimate (“RRE”). As I have repeatedly told Getchell management from day one, you are lucky if you are still speaking to a shareholder one year out from today. To have long-term shareholders that you can rely upon means you have to make them advocates, and to make them advocates, they must be making huge profits by HOLDING their stock. Berkshire Hathaway shareholders attend the Warren Buffett AGM every year not because Warren is a particularly gifted speaker; it is because they are making money.

Getchell shareholders are precariously close to losing money, and while some of us are up, it is time that the valuation gap described earlier gets eliminated. I no longer want to hold a stock that is perennially “undervalued.” It is up to management to “enhance shareholder value” in whatever way it takes.

The good news is that Mssrs. Wagener and Sieb think the same way because more drilling money will need to be raised by next May and, hopefully, at higher prices. Getchell remains my best idea for 2022 and beyond, with a target price of US$5.00 per share. That number assumes 3 million ounces valued at US$600 million divided by 120 million shares issued. In my mind, the only question is when.

Upside Driver: Revised resource estimate, more assays from Fondaway drilling, and improved gold prices.

Conclusion

- Junior mining issues (which include small-scale producers, developers, and explorers) will undoubtedly come under the pressure of tax-loss harvesting between now and year-end. However, since there are few gains anywhere against which to apply losses, I think it will be negligible.

- If history repeats, the last two weeks of October will present an optimum opportunity for adding/averaging down.

- Finally, it is critical that investors remember the lows of 2001, 2009, and 2020 when novice investors were using phrases like “The end of junior mining,” and “It is over for the TSXV” and “I’ll never touch a junior ever again.” That was until companies like Great Bear Resources landed the Dixie discovery and went from CAD $.25 to $30 in three years. In the GGMA portfolio, there are a number of exploration projects (Getchell’s Fondaway, Norseman’s Taquetren, and Goldcliff’s Kettle Valley) that carry the potential similar to the Dixie.

Want to be the first to know about interesting Gold, Critical Metals, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: All. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with Norseman Silver.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium & Vanadium Corp. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver Ltd., Allied Copper Corp., Getchell Gold Corp.,Norseman Silver Ltd., and Western Uranium & Vanadium Corp., companies mentioned in this article.