Crescat Capital Portfolio Manager, Tavi Costa, began the briefing by pointing out some macroenvironmental factors that support a bearish outlook on the markets today.

One concern, Costa said, is the weakening of the Chinese economy because Crescat Capital likes having hedges in Chinese currency. This downtrend in China is evidenced by the non-manufacturing Purchasing Managers Index, which is at a level below what it was during the global financial crisis.

As well, banking stocks have been steadily declining, with some having already plummeted. Also affected are domestic companies such as Evergrande Real Estate Group, but not large conglomerates. Costa attributed the current scenario to the Chinese Community Party's recent crackdowns on domestic companies.

"We think the People's Bank of China is going to come to rescue the economy, and at some point we'll see a devaluation of the yuan," Costa added.

Also of concern, Costa said, is the five-year cyclically adjusted earnings yield of the Standard and Poor's 500, which is near all-time lows, even lower than it was in 1929 and 1937. Every time it has been so severely down, "the following years have been very painful for equity investors as a whole," he added. During those five or so subsequent years, the return was about –50% on average.

Inflation is another macroeconomic factor impacting how Crescat Capital invests, and Costa said there are signs that it is going to increase. One indicator is that U.S. governmental debt and the net worth of individuals are increasing in tandem. This suggests fiscal policy targets the bottom 50% of earners, (proven in part by the recent 27% increase in food stamps, the biggest in history), and this worsens the inflation situation.

Costa said another indicator is current supply chain problems — of which U.S. car inventories are one example. He pointed out that reduced auto supply began before the COVID-19 pandemic, suggesting the problem is more complex than simply being caused by the effects of the pandemic. Thus, it will likely take longer than people expect for car supply to return to its previous strong levels, and that, too, will negatively affect inflation.

Given the current macroenvironment, Costa elaborated, Crescat Capital's current investing approach is to have some shorts, to have some put options on the Chinese and Hong Kong dollar, and to be long commodities.

One of the best opportunities in commodities now, according to Costa, is precious metals, and thus, Crescat Capital remains focused on them. Today, gold and silver companies are the cheapest, even among commodity producers.

Precious metals firms have excellent free cash flow growth and little debt relative to their assets. Their operating expenses are increasing at a slower pace than those of other commodities.

"So, clearly, this is a better picture than others," Costa added.

As for gold, Costa said, following the monthly candle of reversal last month, the price is expected to increase. With respect to silver, the price appears to be starting to break out.

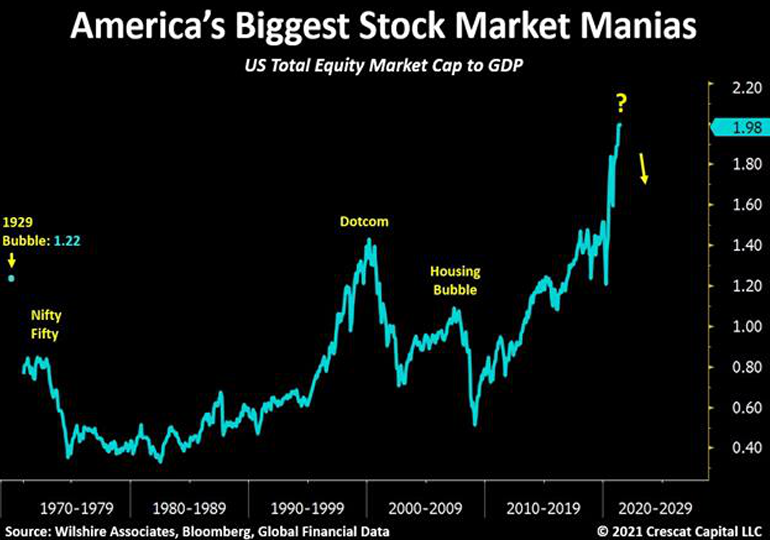

Next in his overview, Crescat Capital Chief Investment Officer, Kevin Smith, provided evidence of the current overvaluation in the market.

"What we have is an insane excessive stock market bubble today," he asserted.

First, Smith compared, in terms of their percentage of gross domestic product (GDP), today's top five market cap stocks — Apple, Microsoft, Amazon, Alphabet, and Facebook — which rose to the top five at the peak of tech bubble. Today's top quartet comprises 37% of GDP, a 54% increase over the percentage in 2000.

"The fundamentals of today's top five and other tech companies, they look fantastic, but when you project these growth trends and momentum trends and stock prices out at a point where this growth inflection is likely to wane, it's a big mistake," Smith said.

At the same time, hedge funds are record long, retail sentiment is record bullish, and investors are long stocks, he added.

The overall U.S. market shows a similar picture, Smith noted. Total U.S. equity market cap to GDP was 1.2 in 1929 during the stock market bubble and then about 1.5 during the dot-com bubble. Today, it is about 2, suggesting another bubble.

Another indicator a bubble exists is the record low Goldman Sachs Financial Conditions Index. This metric mostly measures interest rates on the 10-year yield, which are incredibly low, and corporate credit spreads, which are extremely tight.

The bottom line, Smith said, is that "we think we're in a renaissance age for a new rush of money into the precious metals industry with the macro setup that we have — overvalued stocks, undervalued commodities, undervalued precious metals, bubbles, and cryptocurrency."

Accordingly, in its Global Macro and Long/Short Hedge funds, Crescat Capital is long commodities and precious metals:

"And we are not afraid to be short stocks in the funds," Smith said.

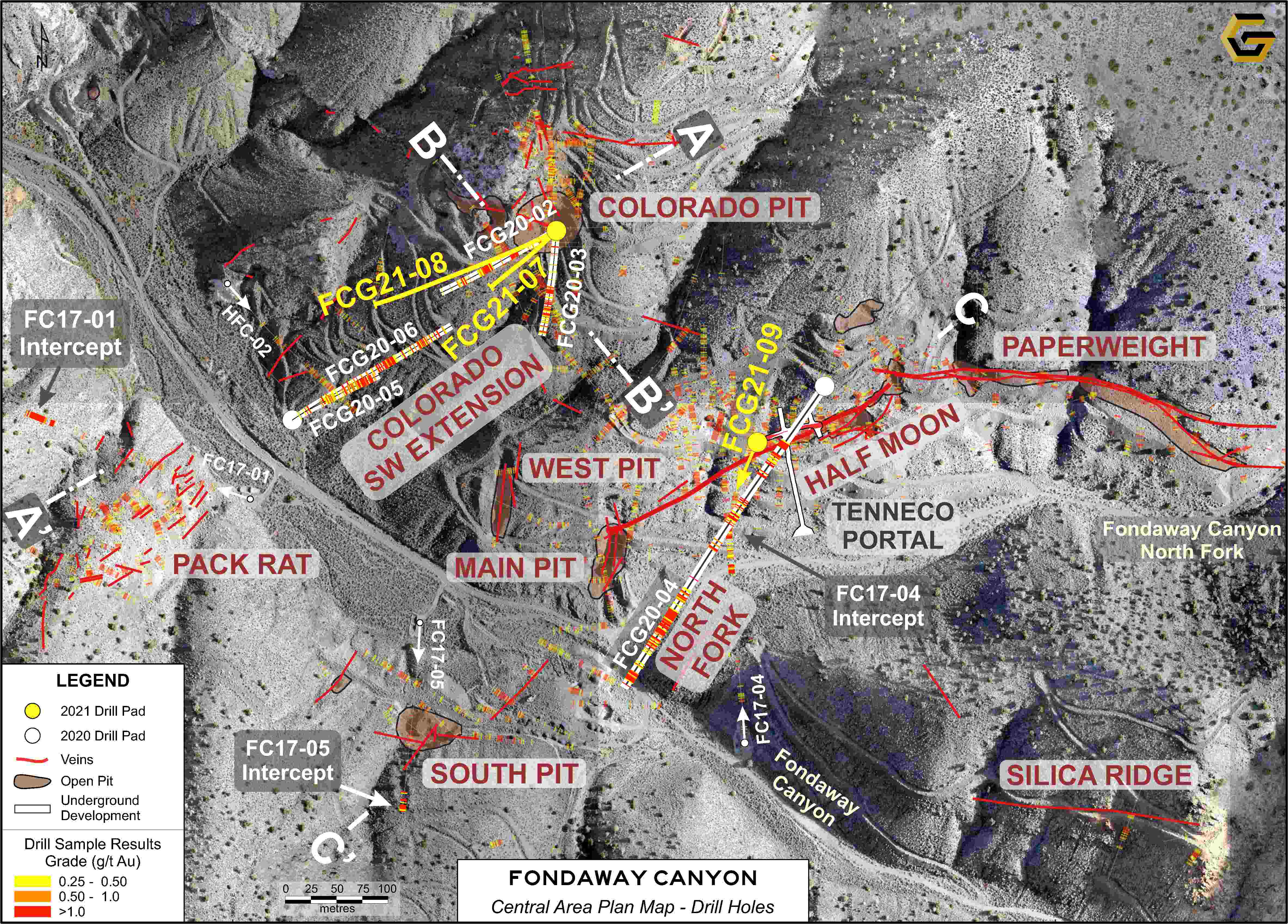

Regarding Crescat's precious metals exploration portfolio, it contains 90 companies focused on making high-grade metals discoveries. Geologist and Crescat Adviser Quinton Hennigh discussed 10 of the stories later in the briefing.

"When you add it all up, among our 90 companies, we have over 300,000,000 target gold equivalent ounces of precious metal in the ground," concluded Smith. "This is truly incredible because of the value opportunity that we have today with the setup in the industry, to be able to come in and acquire big stakes in companies, between 5% and 25% stakes."

Read more about 10 companies Quinton Hennigh discussed in part two of the September 3 briefing.

[NLINSERT]

Streetwise Reports Disclosures:

1) This is contributed content from Crescat Capital compiled by Doresa Banning for Streetwise Reports LLC. Doresa Banning provides services to Streetwise Reports as an independent contractor. He/she or members of his/her household own securities of the following companies mentioned in the article: None. He/she or members of his/her household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) Tavi Costa is Crescat’s Portfolio Manager. You should assume that as of the publication date, Tavi Costa has a position in the securities discussed and therefore stands to realize significant gains in the event the price of security moves.

The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Important Crescat Disclosures Provided by Crescat Capital

Please read Crescat’s important disclosures.

Nothing herein should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies are included for informational purposes only and are provided as a general overview of Crescat’s general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of Crescat’s strategies or of the entirety of its investments.

Crescat has compiled its research in good faith and while it uses reasonable efforts to include accurate and up-to-date information, it is provided on an “as is” basis with no warranties of any kind. Crescat does not warrant that the information on this site is accurate, reliable, up to date or correct. In no event will Crescat be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of its data.

You should assume that as of the publication date, Crescat has a position in the securities discussed and therefore stands to realize significant gains in the event the price of security moves. Following the publication date, Crescat intends to continue transacting in the securities, and may be long, short, or neutral at any time.