Tavi Costa, Crescat Capital portfolio manager, began the broadcast by listing and briefly commenting on numerous factors expected to impact inflation. They are:

- Natural gas prices: They are the strongest they have been in 15 years, Costa said, and they are expected to remain high in the long term.

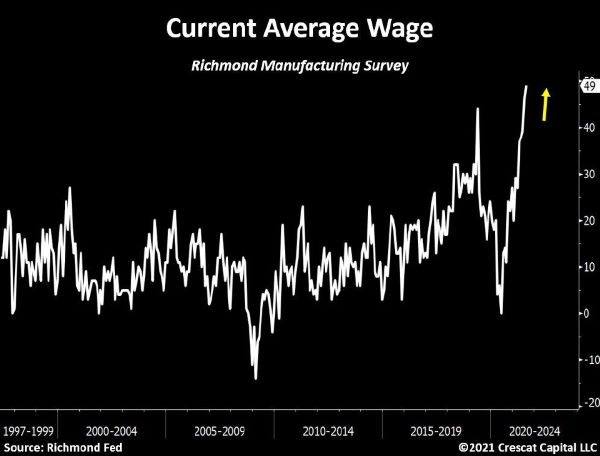

- Wages growth: Growth in wages and salaries per employed person is up 14% year over year, according to the Atlanta Fed Wage Growth Tracker.

- Current average wage: The Richmond Manufacturing Survey of about 60,000 households showed that the current average wage is now moving higher than record levels.

"I'm expecting this to really build on itself again, like inflation," Costa said. "It's a huge part of the inflation thesis."

Fiscal deficit relative to gross domestic product (GDP): It has been improving and is now around 12.5%, compared to 18.5% at its recent worst, Costa said.

Trade balance to GDP: It has a lot of room to go lower, and is expected to do so, if commodity prices and inflation both increase.

"That will add to this issue of the twin deficits in a larger way, where the trade balance becoming more and more negative will be one of the draggers of this twin deficit," Costa said. "That goes back to the gold-silver-tangible assets thesis where [there is] the need for the monetary stimulus to fund those levels of twin deficits."

Next in the broadcast, Crescat Capital's Chief Investment Officer Kevin Smith addressed the current market and two catalysts that could crash it. He explained how, given the setup, his firm is investing.

Smith purported that the broad market is overvalued, thus we are in an "enormous" equity bubble, and two possible catalysts for bursting it loom.

To illustrate today's high market valuations and how they are not sustainable, Smith compared, on an enterprise value (EV) to gross domestic product (GDP) basis, the Top 5 tech stocks today, in terms of market cap, to those at the top of the tech bubble in 2000. During that bubble, the five stocks' cumulative EV to GDP was 24%, and today, it is 37%.

"We think index investors are going to be in for a real shock here, you know, much like they were in 2000 because the big have gotten too big too to grow, to sustain these valuations," Smith said.

He noted that on the flip side, there is a group of undervalued stocks, which are in the commodity sector and in the precious metals asset class.

One of the two potential catalysts for bursting the bubble is volatility spiking then consolidating, which just happened between 2000 and 2021. Smith showed how this recent trend looks compared to two previous incidences, during the oil meltdown in 2015 and during the emerging markets meltdown a few years later. The most recent peak was much steeper, and the consolidation happened faster.

The second possible bubble-bursting catalyst is rising inflation, as discussed in the broadcast by Tavi Costa.

What this current macro situation means for investing, Smith said, is that opportunity lies in the short side of the overvalued market, in the short side of the undervalued market in commodities, such as energy and forest products, and in the long side in precious metals. Crescat Capital is investing accordingly, with its Global Macro Fund and its Long/Short Hedge Fund.

Lastly, in a segue to Quinton Hennigh's updates on numerous companies in Crescat's exploration portfolio, Smith addressed the current gold price. Technically, he said, it appears to be ready to break out and ascend higher than $2,000 an ounce.

"It's just a hop, skip and a jump to get back to $2,000," Smith added.

[NLINSERT]

Streetwise Reports Disclosures:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee. He/she or members of his/her household own securities of the following companies mentioned in the article: None. He/she or members of his/her household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Important Crescat Disclosures Provided by Crescat Capital

Please read Crescat’s important disclosures.

Nothing herein should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies are included for informational purposes only and are provided as a general overview of Crescat’s general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of Crescat’s strategies or of the entirety of its investments.

Crescat has compiled its research in good faith and while it uses reasonable efforts to include accurate and up-to-date information, it is provided on an “as is” basis with no warranties of any kind. Crescat does not warrant that the information on this site is accurate, reliable, up to date or correct. In no event will Crescat be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of its data.

You should assume that as of the publication date, Crescat has a position in any securities discussed and therefore stands to realize significant gains in the event the price of security moves. Following the publication date, Crescat intends to continue transacting in the securities, and may be long, short, or neutral at any time.