This is a very unique and new story that I have been following for several months. The company did a name change effective September 1 from Red Moon to Atlas Salt to better reflect their business.

Atlas Salt Inc. (TSXV:SALT; OTC:REMRF) Shares Outstanding: 75 million Recent Price: CA$0.98

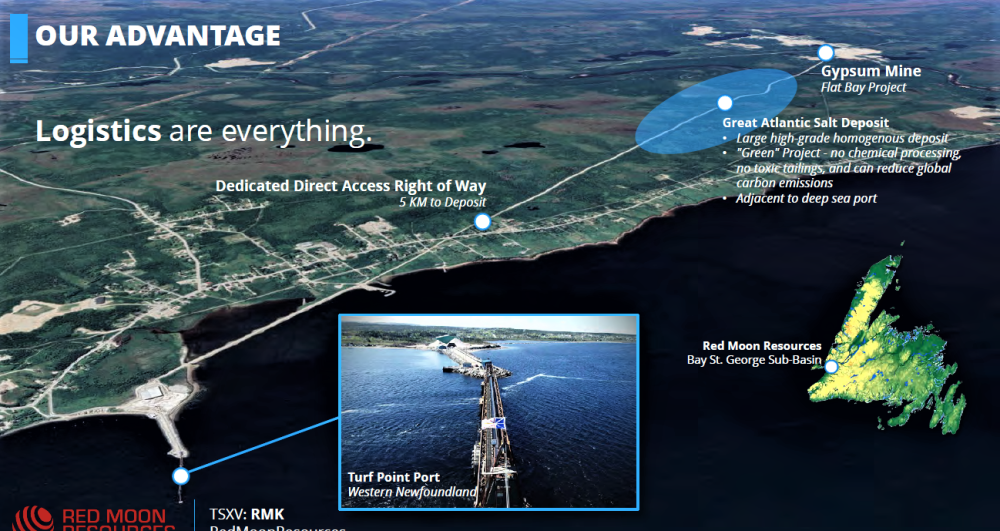

Atlas Salt has a unique project on the west coast of Newfoundland. I would venture to say it is the best risk/reward scenario in the province. Strategically located, the Great Atlantic Salt Project can serve significant North American demand and is uniquely positioned to capture market share from overseas countries with higher shipping costs.

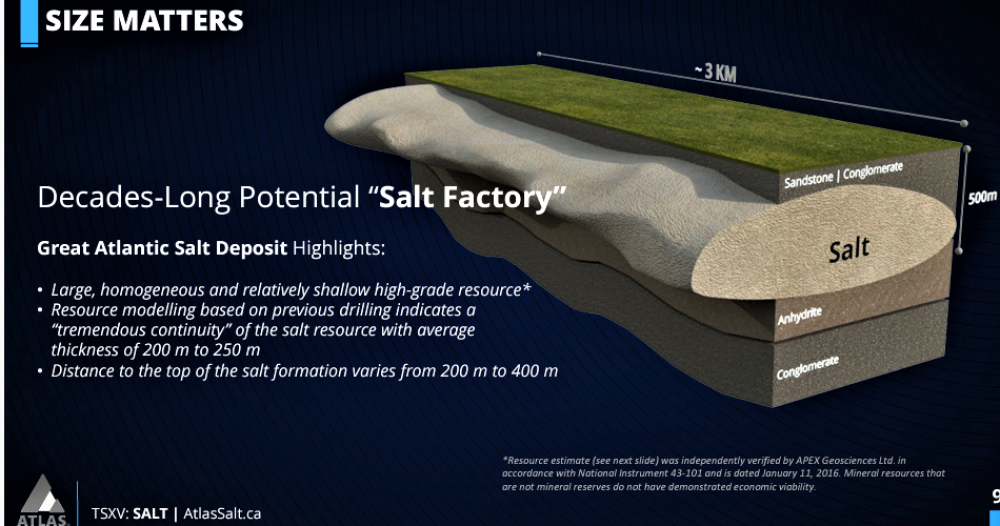

What makes this rare and unique is that it is a massive salt deposit near a major coastal port in Newfoundland with access to Eastern North America. It was already advanced privately and has a 880-million tonne 43-101 resource at 96.9% NaCI, using 95% cut off. The total resources is massive that varies in thickness between 200 and 250 meters. It could have a mine life cut-off of over 100 years.

What is most important to understand is there is no risk with grade, metallurgy, strip ratios, processing and mining methods like mining other metals or materials. A processing plant is not required, you simply scoop material out of the deposit with a salt processor and ship to port. It is more like a salt factory than a mine. These salt projects generate huge cash flow and profits, but very seldom does one ever come to market in a public company.

Management

Atlas Salt's management team has a lot of experience in NFLD and in provincial corporations. They boost one of the top experts in the Salt industry as well.

Patrick Laracy, LL.B., P.Geo, CEO & Director is the founder of the company and has leveraged over $100 million of high risk exploration expenditures through equity and joint venture financings. He is a member of the Professional Engineers and Geoscientists of Newfoundland and Labrador with over 30 years of industry experience in various technical and executive capacities.

Rowland Howe, President & Director is a chartered Engineer with an impressive background in the salt industry. He was with North American Salt since the beginning that later became Compass and went public in 2003. Rowland was Mine General Manager at Goderich in Ontario from 1995-2011 where he led the expansion of the operation to the largest and most productive salt mine in North America. Following this, he was Director of Strategic Projects for Compass Minerals (NYSE: CMP) through 2016. He is currently President of the Goderich Port Management Corporation.

John Anderson, Director, is the founder of multiple start-up companies and a director of Newfoundland-based New Found Gold Corp. (NFG:TSX.V), has 25 years of successful corporate and financial capital market experience. He is currently President of Purplefish Capital Management Ltd., a private investment company focused on the resource sector.

Fraser H. Edison, Director has experience in finance, construction, Oil and Gas, and transportation management. He is currently President and Chairman of the Board of Rutter Inc., Chairman of Newfoundland and Labrador Liquor Corporation, and member of the board and governance committee of Newfoundland and Labrador Hydro.

Highlights:

-

Strong management team with lots of experience in salt and NFLD.

-

Salt deposit is close to sea port, greatly improving economics.

-

High grade deposit, at 96.9% NaCI.

-

Large resource with many decades of supply.

-

Location location, location – can offset oversea imports.

-

Feasibility started to move into production.

-

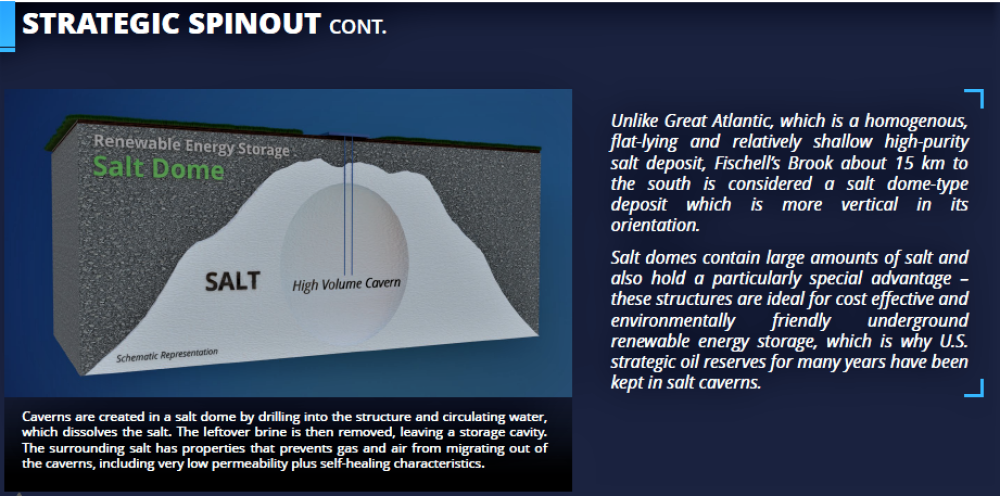

Planned spin out of their Fischell's Brook Salt dome (renewable energy storage).

Salt Industry

Salt is produced by the following three primary production methods: seawater solar evaporation or inland brines, brine extracted through solution mining, and mined rock salt.

The countries with the highest volumes of salt production in 2019 were China (67M tonnes), the U.S. (42M tonnes) and India (29M tonnes), together comprising 46% of global production. These countries were followed by Germany, Australia, Canada, Chile, Mexico, Brazil, Egypt, the Netherlands, France and Turkey, which together accounted for a further 29% (IndexBox estimates).

With COVID-19 lockdowns it is no surprise that In 2020, almost every country experienced a drop in salt production. China was the exception, indicating a 1.7% growth against 2019 figures. In the EU countries, salt extraction decreased by approx. 16%; in the U.S., it fell by 7%, in Canada, by 10%, in Russia, by 12%, and in India, by 3%. Since salt is widely used for the production of chlorine and sodium chloride, the stagnation seen in the chemical industry in 2020 explains this decline in production.

However, when it comes to Atlas Salt, the highway deicing market remains consistent. Demand is mostly affected by weather and with climate change we can expect wild swings in winter weather. Remember the snow storms in Texas last year. De-icing salt is a very specific salt that requires a minimum 95% grade.

Compass Minerals (CMP:NYSE) estimates the consumption of highway deicing salt in North America at about 39 million tonnes per year in an average winter. The consumer and industrial market is approximately 10 million tonnes year.

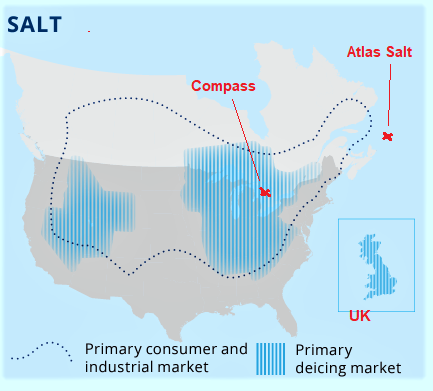

This graphic is from Compass at the same link. I highlight the two companies in relation to the market. Compass is also in the UK so why it is shown. Compass has great access in the middle area via the great lakes. Atlas will have very good sea access to all of Eastern Canada and Eastern US.

What is more important is supply that comes from South America and the Middle East is far more expensive to ship compared to what Atlas could do. Currently around 8 million tonnes per year are shipped from these distant sources into the Eastern US and Canada. The has been no new mines in North America in the last 20 years.

Atlas has that location, location, location and they have a whack load of salt too (see next 2 graphics). I might also add it is high grade at 96.9% NaCI (de-icing market standard).

On July 7, Atlas engaged SLR Consulting (Canada) Ltd., a global leader in the mining and minerals advisory service, to complete a feasibility study (FS) for the Great Atlantic Salt project. By proceeding from a resource estimate directly to a feasibility study, given the geological nature of this relatively homogeneous and shallow high-grade deposit immediately adjacent to key infrastructure, the goal is to expedite potential development of Great Atlantic to serve the North American road salt market.

Drilling is planned to upgrade the resource but also very interesting will be step out drilling towards the port. With the potential they can start the mine or ramp into the deposit much closer to the port. It is only about four kilometers away as it is. A conveyor is not out of the question either, we will just have to see what the feasibility comes up with. This would all be beneficial to the economics resulting in stronger cash flow.

Atlas is not just a one-trick pony. They have an open pit gypsum mine, just several kilometers away and as shown in the next graphic, the stock has further strong potential with a planned spin out of a salt dome for renewable energy storage. Atlas's Fischell's Brook salt dome also has the same advantage, having potential to be very close to the same seaport.

Financial

Last financial s as of June 30th show $7.6 million cash and no long-term debt. Since then Atlas completed a $1 million financing at 78 cents per unit. Each unit consisted of one common share and one common share purchase warrant, with each whole warrant exercisable at a price of $1.05 for a period of two years following the closing of the offering.

Summary

There has been over $5 billion in acquisitions in the industry over the past two years. For example, in April 2020, Stone Canyon Industries bought out The Kissner Group that controls the Detroit Salt Company for $2 billion. Detroit Salt has a salt mine dating back to the early 1900s at 12841 Sanders St. It’s now a so-called “salt city” about 1,200 feet below the city’s surface and spreading over 100 miles of underground roads, according to the company website.

Mark Demetree of Stone Canyon appears to be reshaping the North American Salt industry and is probably not done. Whether Stone Canyon or not, it would not surprise me if Atlas is bought out within the next 2 years at multiples of the current share price.

The best comparison is Compass Minerals with a market cap of US$2.2 billion and very profitable. They are the largest salt company in North America and run the largest salt mine in the world at Goderich Ontario. I am familiar with this when I lived in Owen Sound and worked for IBM. I have been to the site numerous times many years ago. I never went into the mine but a couple of my friends have. It has been operating since 1959.

Rowland Howe was Mine General Manger at Goderich from 1995 to 2011 and led the expansion and modernization of the mine. He joined Atlas Salt as President and Director this year as he knows how big the potential of this is. This gives Atlas very strong expertise in this sector. Patrick Laracy is CEO with over 30 years experience and lives in Newfoundland. John Anderson from New Found Gold is also a director.

SALT has a small market cap of just US$58 million compared to Compass at over US$2 billion, and the Great Atlantic Salt project has the potential to be a Goderich-type asset. Of course more development is required, but SALT has already started their feasibility study. Some drilling is planned as part of the feasibility to potentially expand the deposit closer to port so a decline into the deposit could be a shorter shipping distance to port, perhaps about 3 kilometers.

This YouTube video is a must-view. It will give you an excellent perspective on the industry and company.

On the chart, there is strong support around $0.65 and the stock just bounced off this level. It also just tested first resistance around $1.00. Once that is breached there will probably be a quick test of the $1.35 area.

[NLINSERT]

Disclosures:

1) Ron Struthers: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Atlas Salt Inc.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.