Traditionally, Denver-based Crescat Capital, a macro hedge fund firm, has been a value shop. But value is a mostly empty notion with valuations at unrivaled peaks.

Crescat Chief Investment Officer Kevin Smith’s state of the markets address goes something like this: U.S. markets are at peak growth, equities are at peak valuations, bond yields are setting records, mostly due to low interest rates — and the king daddy topper — inflation is on the rise in a post-COVID world.

What now?

About two years ago Smith and Crescat Portfolio Manager, Tavi Costa, started to develop a data-driven investment thesis based on the historic debt-to-GDP imbalances in the U.S., Japan, and most of Europe. The culprit? Post-global financial crisis money printing.

As a value investor, Smith sought value in a familiar if perhaps unfairly punished segment of the market: precious metals equities, which were emerging from a near-decade-long bear market.

“Personally, I had been investing in precious metals for over 20 years. But having been through this incredible bear market and seeing the setup that we had in [precious metals], we decided that not only do we want to be long gold and silver, we launched our precious metals, separately managed account strategy, and then launched the Precious Metals Hedge Fund a year ago,” Smith explains.

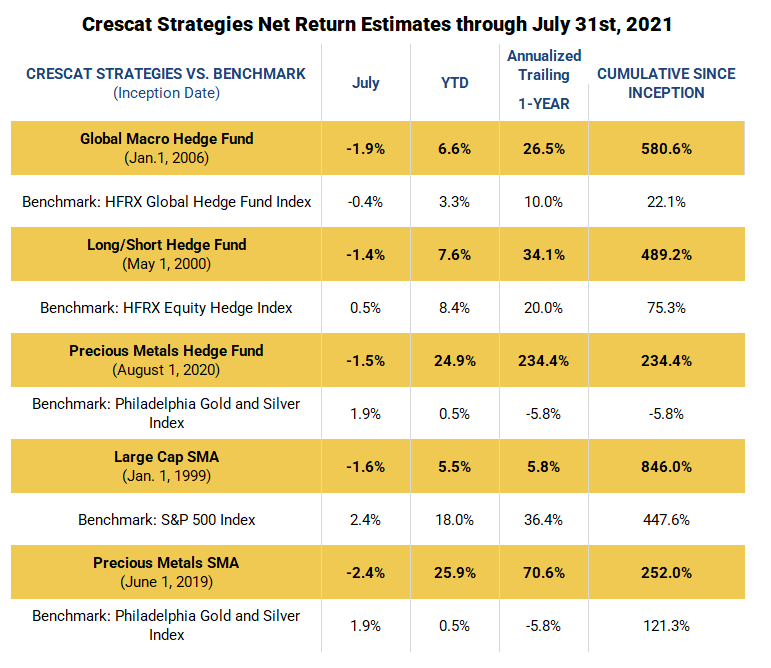

As of July 31, the Precious Metals Hedge Fund was up 234.4% since its launch Aug. 1, 2020, versus the Philadelphia Gold and Silver Index, which was down 5.8% over that same span.

The firm also made substantial gains in Crescat’s Precious Metals Separately Managed Account (SMA), which was up 252% since June 1, 2019, versus the 121.3% gain made by the Philadelphia Gold and Silver Index over the same time frame.

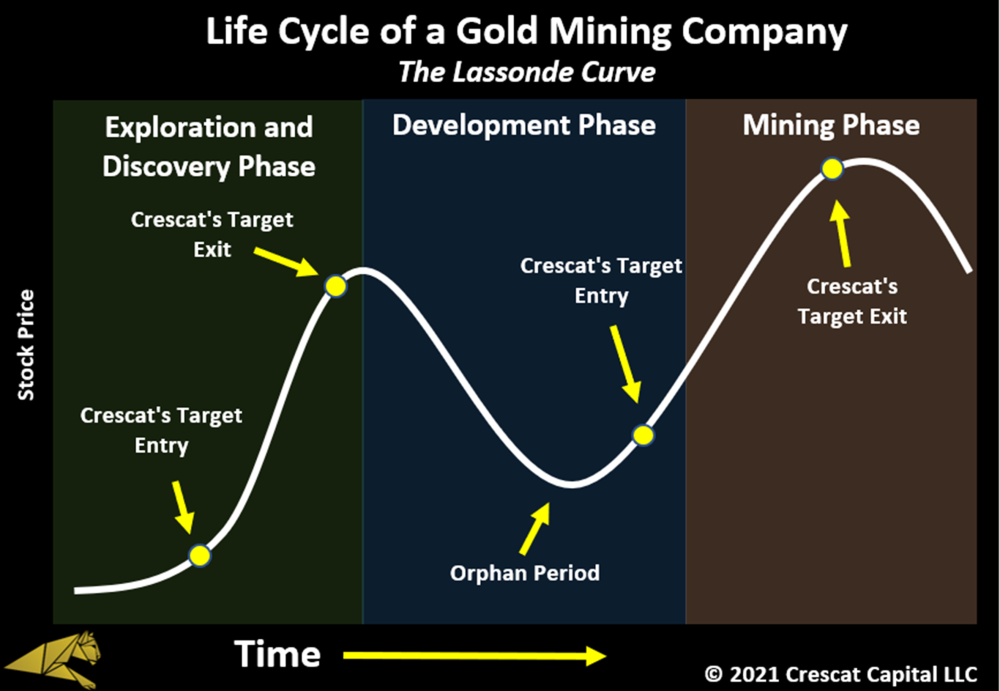

Smith says further gains in the precious metals space will be found among the small-cap equities, the junior gold and silver explorers making discoveries with the drill bit and then building resources.

“The opportunity really seems to be on the discovery and exploration side of the market because that's where you can really see the 10 and the 20 baggers and more from making a big discovery,” Smith tells Streetwise Reports.

The thesis is further fleshed out as follows: The major gold producers — companies like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Newmont Corp. (NEM:NYSE), and Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) — have kept their budgets tight and under-invested in exploration and development over the last 10 years or so. Many of them are gushing free cash flow, but it takes at least five or six years to find, derisk, permit, and ultimately build a new mine.

Nonetheless, these large-cap gold and silver producers are depleting their reserves each day and must replace those ounces or risk losing market dominance. The easiest and often the most cost-effective way to do that is to buy up companies with new gold and silver discoveries or those adding ounces to their advanced stage projects.

But it’s tricky to properly evaluate small-cap gold explorers with zero cash flow but thousands of ounces in the ground that may or may not be minable. Enter Dr. Quinton Hennigh, a geologist who Smith had met in Denver some 25 years back when Hennigh was wrapping up his PhD in geology/geochemistry at the Colorado School of Mines.

“I got to know him in those days,” Smith recalls. “But I didn't realize what a true genius and expert he was until we invited him in two years ago to help advise us on our portfolio and help us pick stocks in the sector.”

Hennigh had plied his trade with some of the biggest brands in the gold space, including Barrick Gold (via Homestake Mining), Newmont, and Newcrest Mining Ltd. (NCM:ASX).

But perhaps his greatest success was when, as a consultant to Kirkland Lake Gold Inc. (KL:TSX; KL:NYSE), he recommended that Kirkland merge with Newmarket Gold and its Fosterville orogenic gold deposit, not far from Bendigo, in Victoria state, Australia.

The high-grade, low-cost Fosterville mine transformed Kirkland Lake into a major gold producer with a market cap eclipsing US$10B. Fosterville produced 640,000 ounces of gold in 2020 and has been in production since 2005.

Hennigh signed as a consultant with Crescat in 2019.

But his success derisking and evaluating precious metals juniors proved invaluable, and, in August, Hennigh was appointed Crescat’s full-time Geologic and Technical Director.

He’s the linchpin in Crescat’s “friendly activist” investment approach to exploration and development stage gold and silver equities.

It works something like this: Crescat takes a significant position (5%-20%) in a junior via a private placement, where it negotiates a discount to the public market share price and gets warrants to boot. Perhaps more importantly, Crescat often gets a say in where the company drills next — and, in some cases, Crescat helps juniors bring aboard the talent necessary to make their projects a success.

“It's a friendly activist strategy focused predominantly on the exploration side of things. We have a few development-stage companies that we're investing in, a few producing companies, but mostly we want to find the big, high-grade deposits that the majors will need,” Smith explains.

He adds: “That's where you can create the most value by literally buying stuff for pennies on the dollar, in terms of the target number of ounces of gold that we believe are in the ground.”

One example of Crescat’s strategy in action was a recent private placement in E2 Gold Inc. (ETU:TSX.V), which is developing the Hawkins Gold Project in north-central Ontario.

Crescat acquired 10 million common shares in E2Gold and another 10 million warrants. Each whole warrant, good for one share, is exercisable at $0.15 for a period of 24 months from the date when the warrant was issued.

The entire private placement, which includes investors other than Crescat, closed in late July.

In total, E2Gold issued 16,249,366 units at $0.10 each; 8,475,345 “flow-through” units (one common share and one half of one warrant) at $0.11 each; and 23,550,000 special “flow-through” units (one flow-through share and one warrant) at $0.13 each. (The securities issued to Crescat are being held in escrow until E2Gold gets all the necessary approvals from the TSX Venture Exchange.)

The gross amount raised for E2Gold was about CA$5.6M. The cash is paying for a 5,000-meter drill program currently underway at Hawkins.

Crescat’s funding didn’t come without some strings attached. In fact, it hinged on getting the junior to drill test the depth extension of the deposit.

“We've been talking with (Crescat), and they're the ones that were hot to trot on the deep level drilling that we're doing,” E2Gold CEO, Eric Owens, tells Streetwise Reports.

“So we're going to do a series of deep level holes all targeting the zone at 500 meters (below surface), three or four times as deep as what's been drilled to date,” Owens elaborated.

“That's going to be exciting,” he confirmed.

Crescat Capital and its investors think so, too.

[NLINSERT]

Disclosures:

1) This is contributed content from Crescat Capital compiled by Brian Sylvester for Streetwise Reports LLC. Brian Sylvester provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None

2) Dr. Quinton Hennigh is Crescat Capital’s full-time Geologic and Technical Director. You should assume that as of the publication date, Dr. Quinton Hennigh has a position in the securities discussed and therefore stands to realize significant gains in the event the price of security moves.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

4) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

5) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Important Crescat Disclosures Provided by Crescat Capital

Please read Crescat’s important disclosures.

Nothing herein should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies are included for informational purposes only and are provided as a general overview of Crescat’s general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of Crescat’s strategies or of the entirety of its investments.

Crescat has compiled its research in good faith and while it uses reasonable efforts to include accurate and up-to-date information, it is provided on an “as is” basis with no warranties of any kind. Crescat does not warrant that the information on this site is accurate, reliable, up to date or correct. In no event will Crescat be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of its data.

You should assume that as of the publication date, Crescat has a position in any securities discussed and therefore stands to realize significant gains in the event the price of security moves. Following the publication date, Crescat intends to continue transacting in the securities, and may be long, short, or neutral at any time.