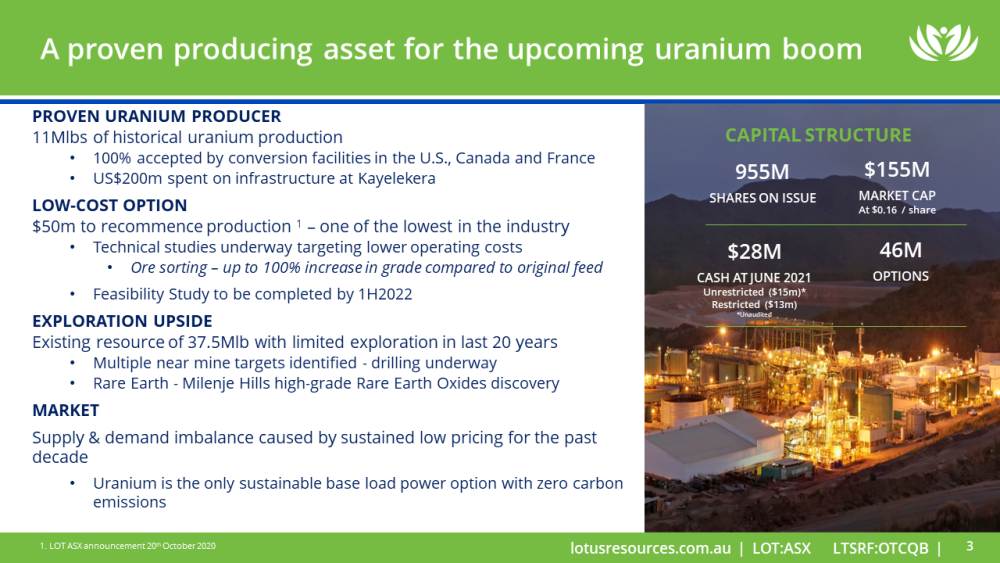

Lotus Resources Ltd.'s (LOT:ASX; LTSRF:OTCQB ) flagship Kayelekera uranium mine in Malawi is a proven past producer. Lotus owns 85% of the Kayelekera mine, which was acquired from Paladin Energy in the beginning of 2020. Kayelekera produced about 11 million pounds (Mlb) from 2009 to 2014 before being put on care and maintenance due to low uranium prices. The mine has an existing resource of 37.5 Mlbs at 630 parts per million (ppm) U3O8 as well as multiple near-mine exploration targets. A scoping study was completed that estimates only about US$50 million capex is needed to recommence production. It is anticipated that the feasibility study will be completed in Q2 2022, followed by a production decision in early 2023. Then after an estimated 12-to-15-month refurbishment period, uranium ore could be feeding the plant again by early 2024. Lotus management believes this timeline fits well with the expected uranium price boom and offers investors an attractive risk-reward investment value proposition with substantial upside.

Keith Bowes is the managing director of Lotus Resources. He is a highly regarded mining executive with over 20 years of experience working on project development and operations in Africa, South America and Australia across a range of commodities and processes. Keith managed the Boss Resources' redevelopment program for the Honeymoon Uranium Mine, including all study phases and commercial trials of the new processing technology. As part of the study he led the development in the application of two new technologies that have redefined the Honeymoon opportunity (leach chemistry and IX resins).

Bill: Thanks for tuning in to Mining Stock Education. I'm your host, Bill Powers. You will be getting an introduction to a uranium company that I think presents a very good risk-reward investment thesis. This is Lotus Resources, and here to tell us about it is Keith Bowes.

Keith, welcome to the show. Your flagship Kayelekera Project in Malawi in Africa is your flagship project. It is a proven past uranium producer. Give us an introduction to this project and why you're excited about it.

Keith: Well, thanks very much, Bill. It's great to be on your show. Lotus Resources is the ASX-listed company that acquired the Kayelekera uranium mine from Paladin Energy. Paladin Energy was the previous owner, and I think anyone who's been in the uranium space before will recognize the name. Paladin previously owned two assets: the Kayelekera asset, as well as the Langer Heinrich asset, which is located in Namibia. Now both of those assets were put on care and maintenance by Paladin. And we made an offer to Paladin back at the beginning of last year to acquire the Kayelekera asset, which is the smaller of the two. It's located in Malawi.

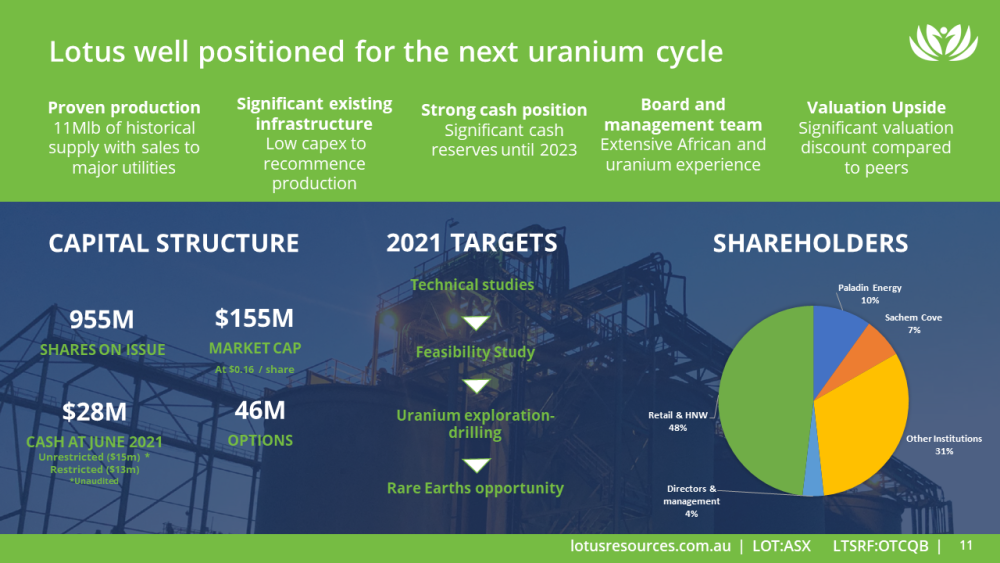

The reason why we're so excited about the Kayelekera project, I think, it is really twofold. First of all, it's a proven producer. And we know from our experience within the uranium space that it's important to be able to de-risk the project as far as possible. And I think it's a very, very valuable thing that the project has previously produced and has produced almost 11 million pounds between 2009 and 2014.

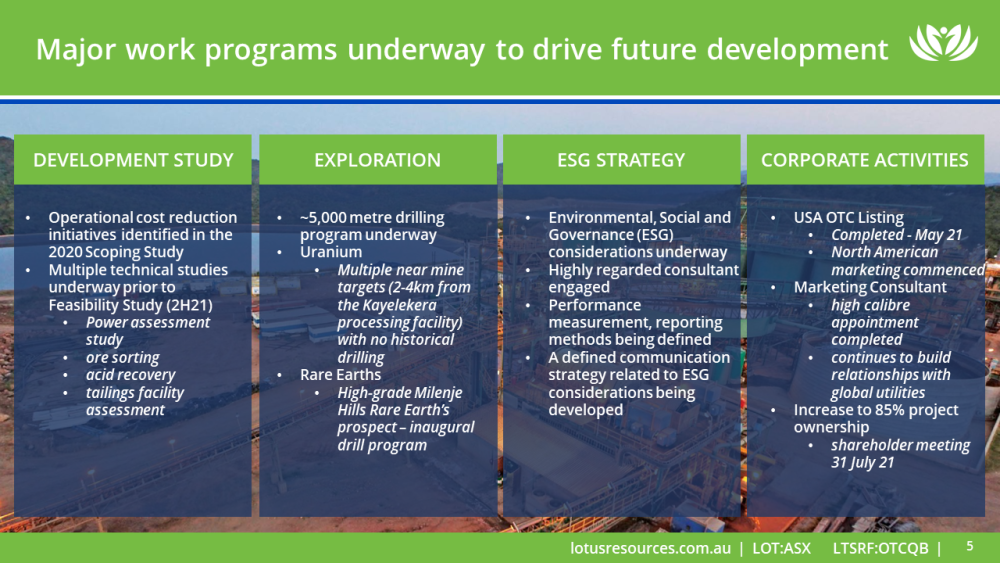

Now the other thing that really interests us with it is when we were having a look at the project, we recognize a past producer. We recognize its capabilities and all that stuff. But we still believe there's some significant upside to the project that we can bring to it by applying some new technologies; by applying some new strategies to be able to operate the plant. So we will see some further upside moving forward with when we start the plant back up again.

Bill: So you have the assurance that this was a past producer, but anytime one company takes over an asset from another company that was on care and maintenance, investors have to ask the question: Are there any fatal flaws? Could you address any potential warts that this project might have that could cause investors to be concerned?

Keith: I think the first comment to make on that is: why did Paladin shut down the plant in 2014? I think that really is the key thing. And when we asked the question, of course, and we did our own due diligence on it, it was very obvious to us that the reason it shut down was because of the uranium price at that point in time. When you look at the way that Kayelekera contracted their product—the uranium contracting strategy can be quite complex for certain companies. You can look at things like spot markets, medium-term contracts, long-term contracts, and those types of things. Now Paladin's or Kayelekera's asset was heavily weighted towards the spot market. So they sold a significant portion of their production into the spot market, and we know that when we have a look at the spot price over that period in time in 2014, the spot price had dropped down to around $35 per pound.

And again, you have a look through the historical operating data. At that point in time Kayelekera was producing uranium at about $35 per pound as well. So it was for an economic reason that they shut down the asset at that point in time. It made more sense for them to shut down, retain the uranium in the ground, and allow a restart when the uranium price came back up again.

So those are the key...that to me was really the key issue for it. I'm quite comfortable with that. There's obviously...there's a few things when you have a look at the way that they started the asset up again--or started it up, sorry. The ramp up was probably a little bit slower than what they expected, and they had to do quite a lot of optimization work around the circuit to get it up to the 3 or 3.3 million pounds production rate, but they achieved that in 2012, 2013 and the beginning of 2014. They had really good production rates and the costs were exactly within target of their budget as well. So very, very confident from that side.

Maybe from just some of the other risks that we have to be aware of, we have to recognize that the mine itself is within the Rift Valley in Eastern Africa. Rift Valley is well known in terms of its earthquake potential and all that kind of stuff. So we need to take that into consideration when we're doing things like the design of our tailings dam, when we have a look at our mine pit designs, and also ground movement associated with the plants and all that stuff. So we've had a look at those, we're very, very comfortable with the way things are at the moment, and we're quite confident we'll be able to restart the assets up effectively.

Bill: Is Paladin supporting you technically, or are they just a shareholder now in Lotus?

Keith: At the moment they're just a shareholder. I still communicate quite close with Paladin. I'm quite...I'm in communication with Ian Purdy, the CEO of Paladin. And we are talking about doing various things together, but effectively at the moment they're just a shareholder.

Bill: And Lotus owns 85% of this project, right?

Keith: That's correct. When we acquired the asset in March of last year, we originally owned 65% of the asset. And recently we had an offer approved by the shareholders for acquiring the 20% held by a minority shareholder. So we're an 85% holder of the Kayelekera asset, with the remaining 15% held by the government of Malawi.

Bill: Keith, I know from talking to you, you believe this asset, and the company therefore, is undervalued. Make to us your argument for undervaluation for this asset and Lotus, please.

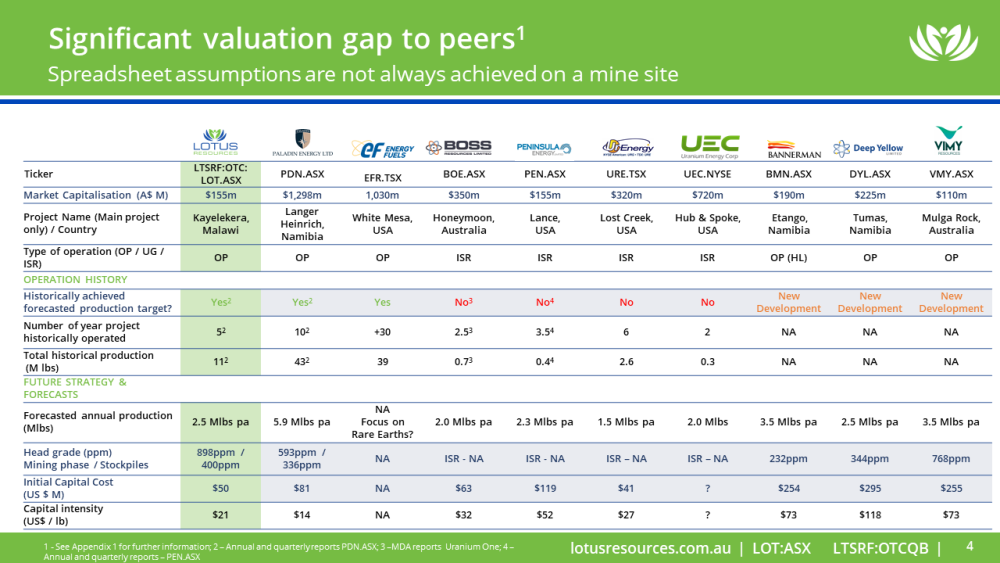

Keith: The way to look at, I think, is obviously you look at our share price today—we've had a nice little jump in our share price today, but our market cap sits around A$160–170 million. Now there's a couple of ways we can have a look at this. First of all, we could do a direct peer comparison with our other peers. And if we were to select peers such as other guys in Australia, maybe some of the other African producers, or look at some of the U.S. junior companies as well, we are well undervalued compared to them. We're probably a factor of probably about a 0.5 to a 0.6 lower market cap than them at the moment.

And I think that's partly because we're a relatively new player in the space. I mean, we've only owned the asset now for just over a year. We need to get up, we need to publicize the story. We need to tell the people what we're doing, and get some confidence that we actually know what we're doing with the asset and we're very, very confident we can get it up and running.

So, I think that's one way of looking at it. But the other thing that I quite like looking at as well is if you go back to the previous boom, so back in 2007, and you look at the market capitalization of Paladin Energy at that point in time, it was valued at about $5.3 billion. And our really basic calculation showed that probably Kayelekera contributed between one and one and a half billion dollars to that market cap. So again, on that metric we're very, very undervalued at this point in time.

Bill: And what you're trying to do is bring this asset into production, coinciding with the expected uranium boom. That's the upside for shareholders?

Keith: That's correct. I mean, I think we're in the same stable as everybody else who's either an explorer or a developer. All of us need the uranium price to increase to a more reasonable level prior to us making a decision to turn the asset back on again. The advantages that we have is we can get into production relatively quickly compared to some of our peers.

Bill: Let's talk about the timeframe. You have a scoping study, and for American listeners the equivalent is a preliminary economic assessment, or PEA. What are some of the numbers there that you're working off of?

Keith: So when we put the scoping study together, there were two things we wanted to do with the scoping study. The very first one is we wanted to set ourselves a reasonable baseline to be working from. And the reason why I say that is that by making the assumption that we were going to operate the asset in exactly the same manner that Paladin did, we were able to use all of the historical operating data that Paladin had between 2009 and 2014, and put that into our models and put that into our cost estimates. So when our scoping study comes out and says—an example in scenario one—that we've got a 2.4 million pound per annum average production at a C1 cost of $33 per pound, we're very, very confident in those numbers because they're based on real data.

This is not a spreadsheet exercise or anything like that; it's real data that's been used to generate those numbers. So we're confident that that's all base case for the project, but even more important is what the scoping study allowed us to do was to identify the cost drivers for the project. What are the key cost drivers or inputs to the project that drive value? And from that study, we identified four areas that we think are really important.

One of them is power. So at the moment the asset is operated off diesel gensets. So we know diesel gensets...the cost of power from a diesel genset runs between about 28 and 32 US cents per kilowatt hour, more or less depending on what the diesel price is you're paying for it. Now that's relatively expensive when we believe there's opportunities to reduce that either by connecting to the national grid, which is a real possibility for us.

Getting power off things like our acid plants, we can retrofit certain pieces of equipment like steam turbines onto our acid plant and recover power from that. We're also in discussions with solar energy providers to see whether we can use solar and then we'd use diesel gensets as a backup. Our target is to reduce our power costs by about 60%—from that 28–32 cents—and we think that's a realistic target for us.

There's other areas that also came up as well: things like acid recovery. So within the processing facility, one of the constraints of the process is the amount of acid that's available to be used. As I mentioned, we have our own acid plant on site that produces about 235 tons per day of acid. We can only feed as much ore into the plant as consumes that amount of acid. If we can find ways to either recover acid within the circuit, or reduce the acid consumption of our ore, we can potentially increase our feed rates and increase our production rates.

So we have some ideas around that, and which ore sorting is one of them. And we can talk a little bit about that later; it's a really important step change for us, I think. And then the last year we picked up on is really to do with tailings. We think there's a way to try and improve our tailings disposal by using such ideas as input disposal once we've left the...once we have vacated the pit. So those are the things that have been used to define the technical studies that we're currently working on, and the outputs of those technical studies, along with our production planning and everything will be used in our feasibility study, which we plan to kick off later this month or early in September.

Bill: And thus far, you're looking at about US$50 million of capex to bring this back into production?

Keith: That's correct. From the scoping study, and using our own assessment of the plant, and using the work that Paladin had done previously, US$50 million is what's required to refurbish the existing plant. If we were to implement some new technology, such as the ore sorting, that's obviously a cost over and above that, but the basic refurbishment of the plant is around US$50 million, yes.

Bill: Obviously you haven't put out the feasibility study yet, so we don't know the exact numbers. But with this ore sorting technology, are you going to be able to get the price per pound down towards $25 a pound? Is that what you're thinking at the conceptual level right now?

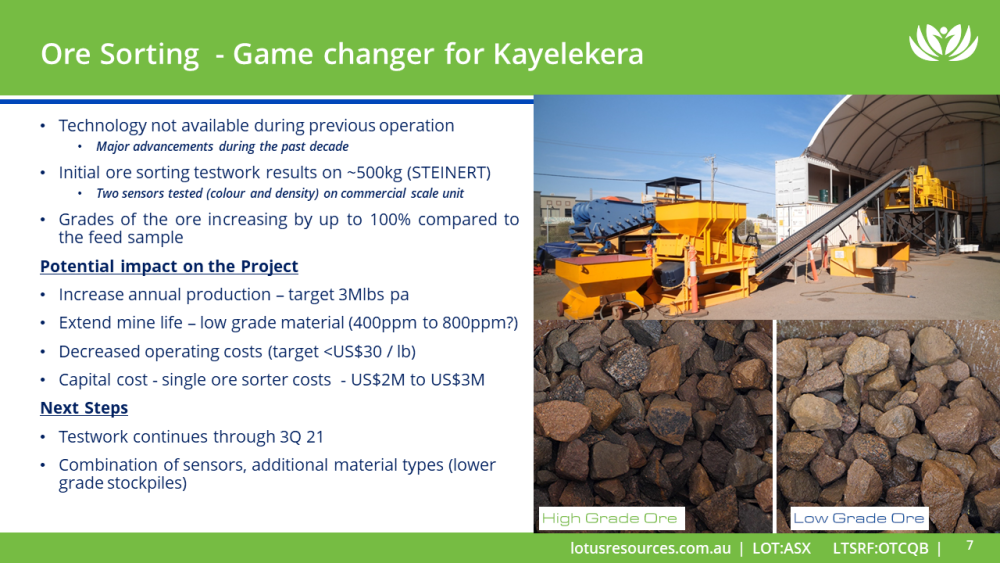

Keith: I'm not too sure we'll get it quite as low as that. I think...the way that ore sorting could work for us, there's really two or three things it can do for us. We can either use it to increase our feed grade across the whole life of mine and increase our production rates. So as I mentioned in the scoping study, we had an average production rate of around 2.4 million pounds. We could use ore sorting to take that up to closer to 3 million pounds. And in that case, I think, yes, we will get a significant drop-off in the C1 cost, because there's a large component of it as fixed. And obviously with a higher production rate, you're able to dilute that fixed component down.

But probably, in my mind, a little more important is we can use the ore sorting to extend the life of mine. So there's a number of marginal stockpiles currently sitting on surface that had been mined back in the Paladin days. And we also know from our scoping study mining schedule that as we talk at the high-grade material, we'll be generating additional stockpiles that run it maybe 350 to 450 ppm. And that's in comparison to our ore feed, which is around 900 to 1,000 ppm.

The test work we've done on our ore sorting has shown that we could feed that material—that 400 ppm material—into an ore sorter and produce a product that's probably got double that grade. So 700 to 800 ppm, and then feed that into the plant. And that's a very, very economic feed for us. And by doing that, we can extend the life of mine. And I think that's the sweet spot for ore sorting at this stage, but of course we need the feasibility study; we need the rest of the results from the ore sorting to define which actually is a better option for us to go for.

Bill: Are you going to include exploration activities into the feasibility study, or just work with the known resource?

Keith: We have 37.5 million pounds at the moment, so around 650 ppm. And then our scoping study we had to look at two different scenarios. In scenario one, we targeted the high-grade material and ended up with an eight year life of mine. We also had to look at taking some of these lower-grade materials and feeding them into the plant, and we were able to extend the life of mine to 14 years.

I think the feasibility study is going to come up with a 10 or 11 year life of mine, but at a higher average feed grade. Now that's a really good project for us to move forward with, and we would actually make a decision to mine on the back of that. We have started an exploration program now, a small exploration program of about 5,000 meters drilling. And this is the first drilling that's been done on site in probably 15 years or so. If we get good success with that, we will upgrade our resource model prior to the feasibility study. However, if it's just a marginal increase, we're more than likely just to stick with our original model and then look at extending our exploration further—either next year or the year after—and then doing the resource upgrade offer after we've completed that.

Bill: So we'd be looking at Q1 next year for the feasibility study being published? Would that be right?

Keith: Q2 next year. We think it's 9 months to 10 months' timeframe required for the feasibility study. So we're in the process now of contracting the various consultants who will be supporting our feasibility study. Expectation is they would be able to start work in September for us. So we're looking at a Q2 next year for announcing the results from our feasibility study.

Bill: Share with listeners your philosophy on price contracting, which is very important in the uranium market. What price per pound are you looking at in order to secure the capex needed from a bank? And in terms of duration of contracting, how far out would you go in order to preserve some of that potential upside for investors?

Keith: So what I'll do is I'll talk a little about the strategy first, before I start to talk about prices. So I'm relatively conservative in nature, and the way that I would like to try and look at the pricing or the marketing strategy is that once we're in a position where we can go out and contract, I would like to make sure that all of the operating costs of the plant are covered by our fixed contracts. Now whether that means putting into contract 60, 70, 75% of our production into fixed contracts to guarantee we've got all of our costs covered, and then use the remainder to go into the spot market, which will be effectively our margins through the system...I think that's a relatively safe way to play the game. I still think we need to have a further discussion on this, but this will be my proposal to the board in terms of the way that we should target the marketing strategy.

Now when you have a look at prices...so as I mentioned, we had a C1 cost of $33 per pound. In our scoping study, we had an all-in sustaining cost of around $39.50 per pound. The targets in my head for our feasibility study are to be able to reduce those costs by probably 10 to 15% on the C1 cost, and maybe a little bit more than that on the all-in sustaining costs. So maybe $35–36 around the ore and sustaining costs. I still think that we would be wanting to sign contracts with the five starting in it, so sort of the mid-$50s, I think is where we'd want to sign our contracts. And then be able to play with the spot market with the remainder of our production.

Bill: So if we have the feasibility study issued in the first half of 2022 next year, should we expect by the end of 2022, that in the second half of next year, you would be able to get some contracts in place and have your capex financing secured so that you could begin development in 2023? Is that the expectation?

Keith: That's sort of the timeframe that we have in our mind. Obviously, it does depend on the pricing and what sort of contracts we would get. We would expect that once we have completed our feasibility study, we'll definitely be able to go out to the potential off-takers, negotiate with them with regard to pricing, and also do the debt financing or equity financing if we decide to do that. And we would see that as a sort of a six-month operation to be able to do that. Once we've got those signed up, we can then make the decision to mine in early 2023. And we believe somewhere between a 12 and 15 month period is required to refurbish the plant, to restockpile all the reagents and that stuff. So by early 2024, we could see first ore going in to the plant.

Bill: And that's coinciding with hopefully a rising uranium price, if our expectations are correct?

Keith: That's the exact timing we're looking at as well. When we see 2024, it seems to be a sweet spot in terms of coming back into production.

Bill: Keith, I was totally unfamiliar with Malawi before speaking with you. I have familiarity with other African countries and jurisdictions. But for my listeners that—like me—don't know anything about Malawi, give us an overview. Specifically, the mining industry in Malawi.

Keith: Malawi itself is located in Southeastern Africa. It's close to Mozambique-Zambia borders, Tanzania as well. So it's in the hub of a well-known mining jurisdiction, but mining itself in Malawi is not that well developed, okay? There are at the moment four international companies that are looking at developing assets in Malawi. There's ourselves, there's a retail company, and two rare earth companies as well. Now the original economics for the company, or for the country, was really an agricultural based economy--and specifically around tobacco. It means you can imagine that the time of the moment, tobacco is not exactly the best crop to be trying to sell out into the market. So the government of Malawi has recognized this, and they've stated publicly that they would like to see their mining industry grow and become their primary income base for the company or for the country moving forward.

So we see that as really, really positive. And as I mentioned previously, the government actually owns 15% of the Kayelekera asset as well. So it is in their interest to see the asset come back up and start operating again. So we believe we have a lot of support from the government moving forward. Malawi as a jurisdiction is a very, very safe jurisdiction. It's known as the warm heart of Africa. People there are very, very friendly; crime is very, very low. And if anything, it's petty crime. There's very little violence or violent crime around at the moment. And we know it as a democratic republic as well. We witnessed an election last year where the opposition party came into power, and that was a very smooth transition of power into the new government. And just a comment on the new government as well: they are slightly more business orientated than the previous government. And we see that as a positive as well for Lotus moving forward.

Bill: Are there any permits that you'll need the government to issue since it was a past producer, or are those permits still active, or what do you have to get in that regard?

Keith: So we have our environmental license in place, and we have a valid mining license as well. That mine license expires next year, and we're in the process of getting that renewed, and it will be renewed for another 15 years. We don't see any issues with that at all. We're also going through the process now. Not only do we have a mining license, but we've also got five exploration licenses, and we're just getting time extensions on those exploration licenses as well, such that we can explore some of the areas that we have other tenements with.

With regard to the other permits that are required, we have kept valid permits like taking water, discharging water, using diesel gensets, and those types of things, because that's what we're active doing. But some of the permits that were required when the plant was operating, but are not required now, such as the transport of yellowcake, those have been allowed to lapse. But we see it as a very, very easy thing to be able to get those permits reactivated once we start the asset back up again.

Bill: Keith, share a little bit of your background and why you're the man qualified to lead the project forward at this point.

Keith: So my background is engineering; I'm a chemical engineer by profession. I spent 20 years in the majors, so I worked for Anglo American, I worked for BHP Billiton, and I worked for Vale as well. And about 10 years ago or so I moved into the junior space, have been involved in a number of projects in Africa—both in my Anglo-American days and also in the junior space—specifically in Namibia, Tanzania and Malawi, previously as well. So lots and lots of African background. And if people might be able to pick up from my accent, I'm originally from Zimbabwe as well. So I have a deep love for Africa and I'm very, very happy to be working back there again.

Specifically with uranium, I was part of the original team that did the due diligence when Boss Resources acquired the Honeymoon project over in South Australia, and I led the technical team there for about three years—redeveloping the Honeymoon asset with some new resin technologies and some new ideas around the ISR, which is the in-situ recovery processes over there, and looked after care and maintenance there as well.

And I actively transitioned from Boss Resources across to Lotus last year to take on a similar role in terms of heading up the technical direction of the company and looking after care and maintenance. And then earlier this year, I was asked to step up to the MD role when there was a realization that perhaps the uranium price was moving a little bit faster than we originally thought, and we wanted to make sure that we were in the correct position when the price does pop, then we can then make the decision to mine.

Bill: Talk us through your treasury. Do you have any debt, and what's your current burn rate?

Keith: So we have no debt at the moment. At the moment we have about $28 million, so that's Australian dollars again, in the bank. Now some of that is restricted and I'll just quickly explain that. Within Malawian law, there's a requirement for us to have a surety bond associated with our environmental liabilities. So there's US$10 million sitting in a bank in Malawi that has restricted cash. Now the remaining cash that we have, the circa 17 million Australian...sorry, 15 million Australian dollars, is sufficient for us to get through our technical studies, to get through our feasibility study, to get through our exploration program, to cover our care and maintenance costs, and to cover our corporate overhead up until the end of next year. So we're in a really strong cash position at the moment. We also know that there are a number of options or warrants out there that are well in the money.

So we're trading today around 19 cents. The options or warrants have got a price of around 4 cents. So there's probably another $3 million worth of cash that can come into the company through those options or warrants. And then we made an announcement about two months ago about the sale of an asset that Lotus had prior to the acquisition of Kayelekera, which was the Hylea cobalt project over in New South Wales.

We sold that to Sunrise Metals for a consideration of $1 million cash and $1.5 million in script [shares] as well. So we're expecting the $1 million to come into our treasury in the next month or two, and then we'll have a look and to see what we want to do with the equity that we also received as part of that deal. So we're well cashed up at the moment. Yeah, we're very, very comfortable with our current cash position.

Bill: And if I understand it correctly, when you did a raise earlier this year, that was oversubscribed and you could have taken a lot more money if you chose to do so?

Keith: Correct. We went out to raise $12.5 million, and we were oversubscribed by a factor of about three. I think it was almost $40 million worth of offers we had come in within literally a few hour hours of us opening the books.

Bill: So you're pretty confident—if you need more cash, it's there. And also capex of only $50 million, that's not going to be too difficult?

Keith: We don't think is going to be very difficult at all for us, no. We're very, very confident we'll be able to raise the capital when required, yes.

Bill: So who are your founding shareholders, and what does your share registry look like?

Keith: At the moment, our share registry is equally distributed between institutions and retail. So 50/50 at the moment. If you have a look at our share register, Paladin is obviously a big shareholder; as part of the original acquisition, they received some equity in Lotus. They own about 9 or 10%. Sachem Cove is another large shareholder for us. L2 Capital is another one, and then there's a few smaller entities as well that make up the register.

Bill: So as investors, as they take a deeper dive into the company over the next few months, what are the key catalysts that they should be looking for?

Keith: I think you're going to see some further results from our technical studies coming out. So we've got some more work being done around the ore sorting. We'll start to see some results coming out from our power studies, which I think will be important as inputs to the feasibility study. You'll see an announcement about the kickoff with the feasibility study in which we will outline what our goals are from the feasibility study to give the investor confidence in terms of where we're going with our feasibility study.

There will be results from our exploration work that we're doing as well. So a little bit on the exploration work: it is obviously focused around the uranium resource growth, but we've also got a rare earth's anomaly that sits about two kilometers to the north of our existing pit, and we're doing some exploration work around that as well to try and define what value that could add to the company in the future.

We'll probably spend a couple of months working on that. Not only exploration work, but potentially some metallurgical test work as well to define a potential process flow sheet or something like that. And once we understand what the requirements are, we can then have a look to how the company can generate value from it. Either developing it ourselves, spinning it out, JV...we're not sure at the moment. But something like that, I would think.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

[NLINSERT]

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Lotus Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Lotus Resources is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.