Kincora Copper Ltd. (KCC:TSX.V) continues to make excellent progress exploring Australia's foremost porphyry copper-gold belt in New South Wales (NSW). So much work is getting done behind the scenes, culminating in the three high-profile drill programs we're seeing today.

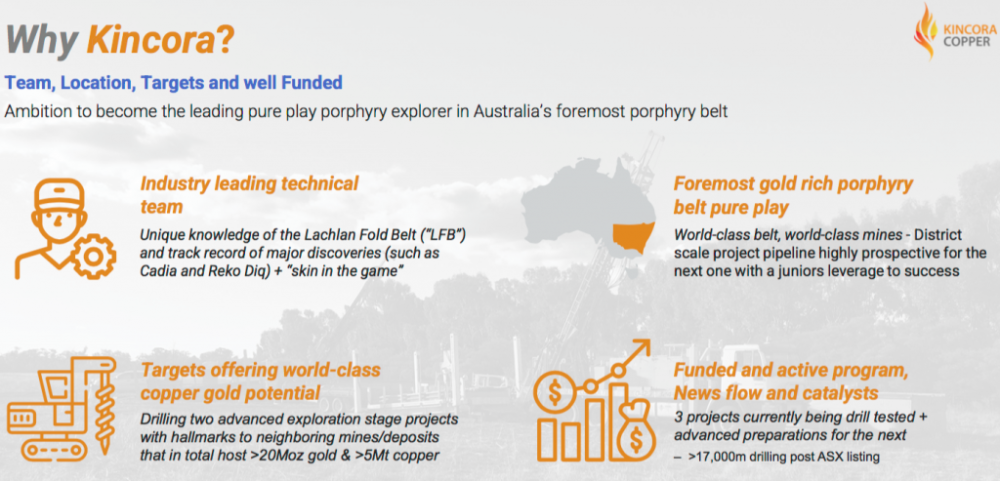

CEO Sam Spring, non-executive chairman Cameron McRae, technical director John Holliday, SVP Exploration Peter Leaman, Operations Manager Sam McRae, Principal Geologist Murray Booker and Exploration Manager Dr. Paul Cromie are very experienced in Australia, and in copper-gold porphyries.

I happen to be very bullish on intermediate-to-long-term copper prices. Even at US$4/lb, companies like Kincora can make hay while the sun shines. If management can deliver a few exciting discoveries, US$4/lb would be fantastic, but I believe we will see US$5–$6+/lb within five years.

Copper is one of the very few metals that directly and substantially benefits from; the EV revolution (including charging stations), new power plants (especially renewable facilities), [essentially, everything related to massive decarbonization efforts], new infrastructure build outs and replacements of old, damaged or destroyed infrastructure, wireless phone/internet growth (towers/base stations—5G, 6G, 7G…), the "internet of things," and new, upgraded and replacement electrical grids (Africa will need a staggering amount of copper).

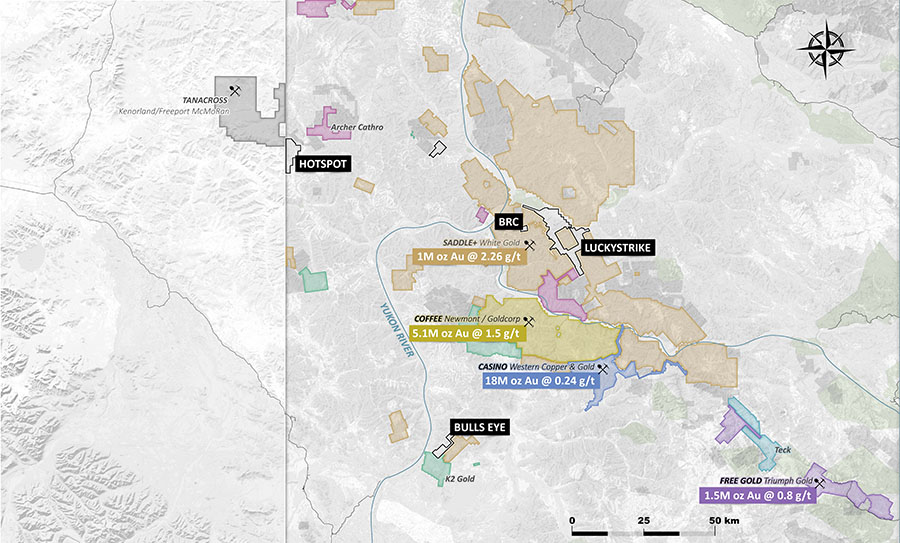

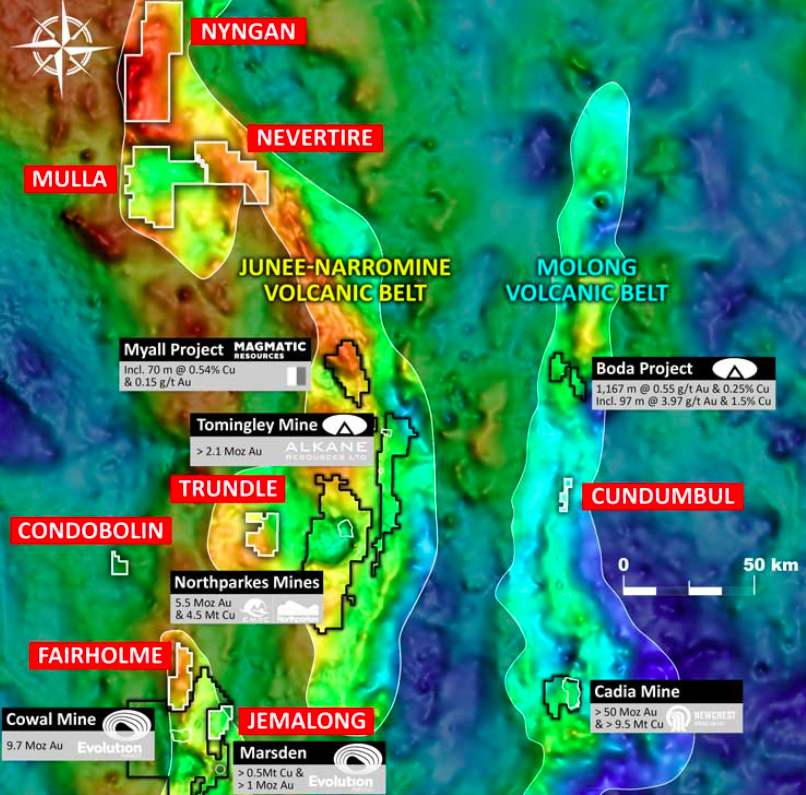

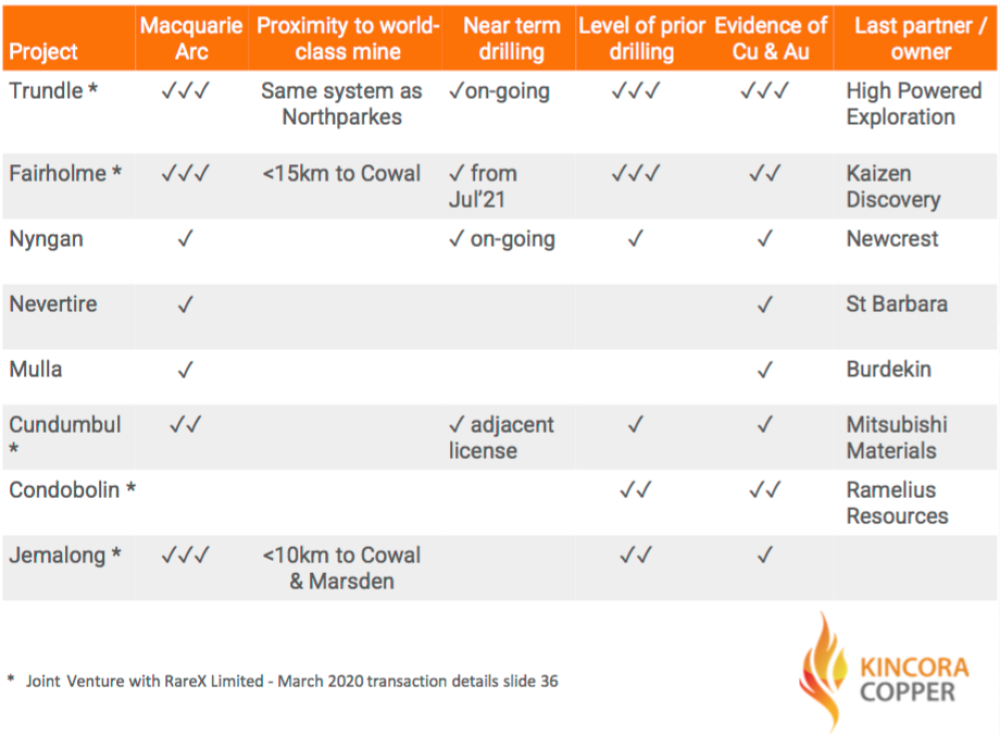

Kincora is fully funded into 2022 and is prudently/actively conducting three drill campaigns (at Trundle, Nyngan and Fairholme—see map below) in the famous, prolific Macquarie Arc in NSW.

To find out more, I turned once again to its hard-working CEO and director, Sam Spring. Please continue reading to consider the merits of Kincora Copper's high risk/high reward opportunities.

Peter Epstein: Until recently, the Trundle project had been the sole focus of your drilling activities in NSW. Please expand upon results at the Trundle Park and Mordialloc targets.

Sam Spring: Since Kincora's activities in NSW commenced in April of last year, we've completed 22 holes for 14,452 meters at Trundle Park and Mordialloc, which are approximately 8.5 km apart.

Drilling at Trundle Park has focused on simultaneously testing near-surface skarn mineralization, with the strike now extended >500 meters, and the underlying causative intrusive porphyry source—the latter being a much larger-scale target.

A recent highlight has been hole #22. It returned the best confirmation to date of our targeted "brownfield" Northparkes-style setting for a series of intrusive porphyry systems.

Northparkes, the second largest porphyry mine in NSW, hosts >5.5 million ounces Moz) gold and >4.5M tonnes copper—in the eastern part of the same mineralized complex—in a cluster of finger porphyry deposits.

We're very keen to follow up on hole #22 to test if we're indeed proximal to the interpreted and targeted core of one of these finger porphyry intrusive systems, which visual logging of core suggests.

In the northern section of the project, we've completed a total of six holes at the central Mordialloc prospect and confirmed a large multiple-phase intrusive complex with significant intervals of low-grade copper and molybdenum.

There's a big system at Mordialloc. Drilling is testing targets on the northeastern and southwestern sections, following up on coincident geochemical and geophysical anomalies on the peripheries of the system—thought to host a more favorable structural setting and higher grade potential.

In summary, more drilling is needed and ongoing at Trundle with the targeted geological setting confirmed at both targets, particularly at Trundle Park, where there's now significant encouragement that we're potentially close to a significant discovery.

Peter Epstein: What should readers know about the Nyngan project? Describe the goals of the current Nyngan drill program?

Sam Spring: The goals for drilling at Nyngan are very different from that of Trundle and Fairholme. The latter have hallmarks of, and are adjacent to, existing world-class mines that host >20 Moz gold, plus >5 million tonnes copper. Success at Trundle and Fairholme would be returning intervals of economic mineralization in existing proven large-scale systems, and confirming new globally significant discoveries.

Nyngan is a lot earlier stage, so success would be identifying a mineral system, and the project hosting a meaningful portion of the interpreted and under-explored northern extent of the Macquarie Arc (the key region in Australia for porphyries).

Kincora was an early mover into this area. Inflection Resources is drilling to the west, south and east of our Nyngan project. Fortescue Metals has pegged adjacent ground. Success by us, or others, would have positive implications for the prospects of this region.

We've drilled one hole at Nyngan, with dollar-for-dollar direct drilling grant support from the NSW government. The hole was a geological success—intersecting basement volcanics in-line with targeted depth. We're currently waiting for age-dating of the fossils, which will have implications for both the target drilled and a second hole we're doing.

Peter Epstein: What should readers know about the Fairholme project? Explain the goals for the current Fairholme drill program.

Sam Spring: We've commenced a maiden drill program at Fairholme, at the Gateway prospect. Gateway is 15 km on trend from the Cowal mine "gold corridor," which hosts a 13.7 Moz gold endowment across a 7-km strike, and is the flagship project of Evolution Mining, Australia's third largest gold miner.

Gateway has analogous mineral tenure, alteration, geochemical zonation, structure and scale potential to the Cowal gold corridor. Our program is seeking to confirm and expand previous significant broad, high-grade intervals.

For example, our first hole follows up on 123 m @ 0.62 g/t Au + 0.12% Cu] from 44 m, incl. [4 m @ 2.39 g/t Au], [8 m @ 1.07 g/t Au], and [5 m @ 8.21 g/t Au + 0.85% Cu.

No drilling has taken place at Fairholme since Evolution Mining's nearby acquisition. Previous explorers underestimated the gold-base metal corridor scale potential at the Cowal and Fairholme projects. Instead they focused on deeper copper porphyry potential.

We have permits for up to 39 holes and 6,000 meters of drilling at Fairholme. The immediate goal is to test a 400-meter strike for "Cowal-style" widths and grades.

Peter Epstein: Has there been any meaningful drilling successes or new discoveries on third-party properties that have implications for Kincora?

Sam Spring: Yes, ASX-listed junior Sultan Resources is drilling on the license boundary to our Cundumbul project with a program that's returning encouraging results, with a second phase expected soon. We're keenly watching their progress as they test their Big Hill target that continues across onto our ground.

As mentioned, exploration successes by Inflection or FMG in the northern under-explored region of the Macquarie Arc would have significant implications for the prospectivity of that part of the belt and our ground including the Nyngan, Nevertire and Mulla projects.

Peter Epstein: I see you have picked up a new project in the region. How important might the Mulla gold-copper porphyry project be?

Sam Spring: Yes, when drafting our cooperative funding drill grant application for our Nevertire project, and looking to potentially drill on the western margin of it in 2022.

We noticed there was open ground with a regionally significant, multiple-phase intrusive complex confirmed by limited drilling, indicated by an extensive gravity low, a setting not dissimilar to Northparkes and Cowal to the south in the same belt, yet minimal past drilling.

Hence the application for the Mulla license, which builds up our project pipeline (extremely cheaply). Drilling within the Nevertire/Mulla portfolio is being planned as a 2022 event.

Peter Epstein: Are there other targets in or around the Lachlan Fold Belt region?

Sam Spring: We continue an active project generation function, both on new opportunities in the region that have walk-up drill targets, and value accretive deals for projects we have in our pipeline. We don't want to be land-bankers.

I should add that we expect Resilience Mining to lodge a prospectus fairly soon to seek an ASX IPO with our Mongolian assets. Kincora will retain a free carried interest at the asset/project level to certain material milestones and we will own 9.9% of the listed company. Drilling in Mongolia is planned soon after the listing, effectively a fifth project being drill-tested that we have exposure to.

Peter Epstein: Four months ago, Kincora Copper started trading on the Australian Securities Exchange. How has that worked out? Have you received any research coverage out of Australia?

Sam Spring: The dual listing on the ASX has proven to be a very good move; liquidity improved significantly. We've seen nine times the dollar value traded on the ASX vs. the TSX-V. We had an oversubscribed A$10 million raising with a number of high-quality domestic institutions & family offices.

We've had excellent support from both joint lead managers to the IPO, Morgans (and their wide retail network) and Bridge Street Capital, who are providing detailed research coverage from Dr Chris Baker, one of the most knowledgeable analysts in the sector. (see July 2021 Bridge Street report).

Peter Epstein: In the coming months would you rather see US$2,000/oz. gold, or US$5/lb copper?

Sam Spring: As our name suggests, it would have to be US$5/lb copper. We're looking to position ourselves as the leading pure-play porphyry explorer in Australia's foremost copper belt. New copper projects are increasingly being advanced in difficult jurisdictions.

$5 copper would further highlight the attractive medium-to-longer-term outlook, driven by slow advancement of existing development-stage copper projects, coupled with structural demand growth from decarbonization and the tens of trillions of dollars of COVID-19 related economic stimulus spending coming this decade.

Unlike in the gold space, there's a shortage of listed junior copper plays with assets in Tier-1 jurisdictions.

Peter Epstein: Thank you, Sam. Exciting stuff going on with drill results from multiple projects expected in coming months.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.