Golden Sky Minerals Corp. (AUEN:TSX.V; LCKYF:OTC) is moving full speed ahead with exploration at its three core properties in the Yukon: the Bulls Eye, Hot Spot and Lucky Strike properties.

"Canada's Yukon Territory is a mining-friendly jurisdiction with a long proud history in mining and exploration, starting with the 1897 Klondike Gold Rush. Mining is an important part of its economy today, as the Yukon experiences a new modern-day gold rush," John Newell, CEO of Golden Sky, explains.

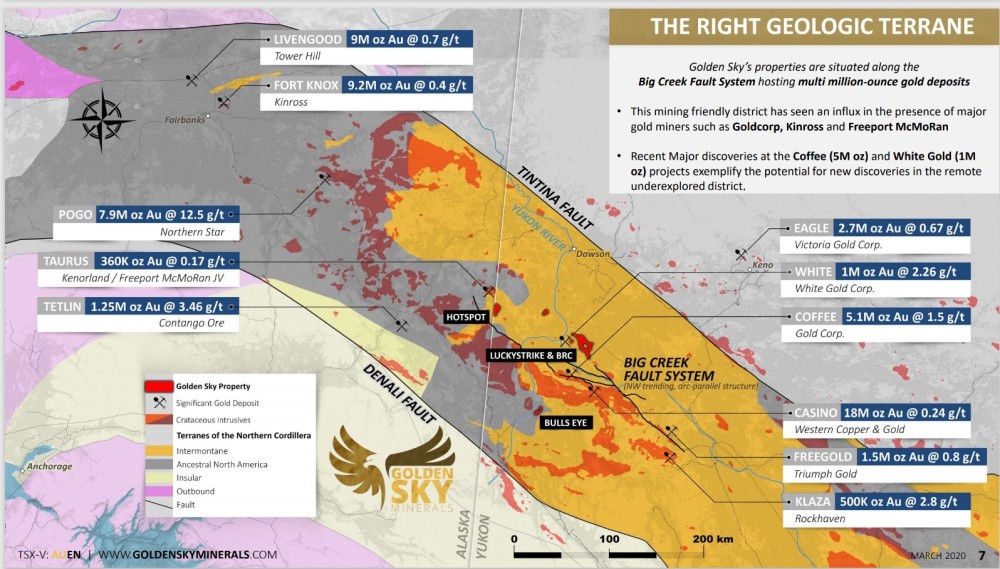

Newell points out that although through most of its history, smaller companies and placer miners have worked and staked the ground in the Yukon, now larger companies are showing interest in the region. "The majors are discovering what the juniors have long known," he says, "This region is largely underexplored, has exceptional geology and exceptionally strong potential for district-sized mining operations."

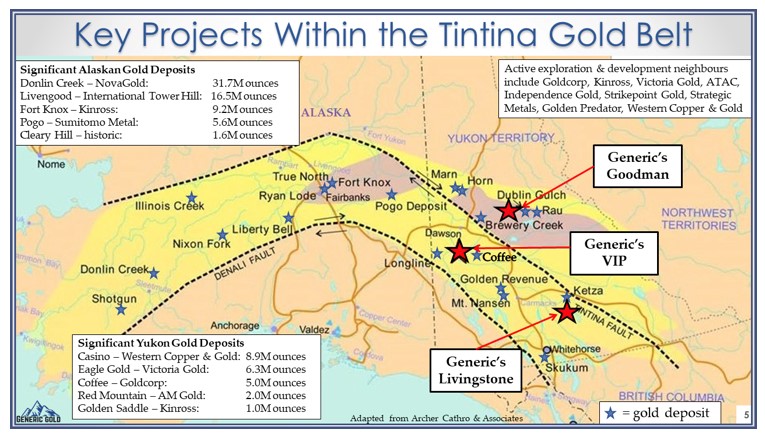

The area is home to the 1,200 kilometers long and 200 kilometers wide Tintina Gold Belt, which extends from British Columbia to Alaska. "Over 50 million ounces of gold have been discovered in this belt over the last 20 years," Newell points out.

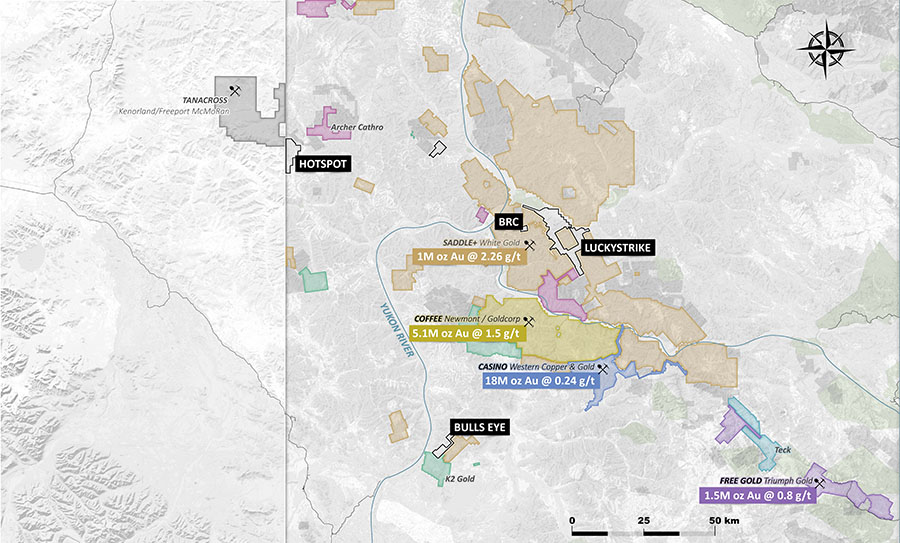

Golden Sky is advancing three main assets of the five properties it holds: the Lucky Strike property, located in the heart of the White Gold district; the Bulls Eye property, which is about 50kilometers south of Newmont's Coffee deposit and next to K2 Gold's Wels property; and the Hot Spot property, which is located 25 kilometers south of the Tanacross copper, gold and molybdenum porphyry deposit with a current resource of 360,000 ounces of gold, held by Kenorland Minerals (KLD.V).

"The properties are all 100% owned with no underlying royalties or property payments," Newell says. "We are currently planning for, and undergoing permitting of, drill campaigns for all our properties in the Yukon, and also for the recently acquired Rayfield property, with permitting and drilling scheduled for later in 2021."

Golden Sky Property Map

The Bulls Eye property was the first in Golden Sky's portfolio to see work this year. "The drilling has been significantly derisked by the trenching program done in 2020 where almost 80 meters of gold mineralization was discovered at surface," Newell explains. "The trench started in gold so it is open-ended and ran over 1 gram per tonne (g/t) for 44 meters. This discovery supersedes the discovery trench at Golden Saddle and that project was taken over by Kinross."

The Hot Spot property sits on the Yukon-Alaska border. "It is 100% owned with no underlying royalties, and no property payments, with strong geological targets, in a world-class geological setting," Newell says. "Situated along the Big Creek Fault, Hot Spot hosts a 1.7-kilometer-long mineralized structure with gold-in-soil values up to 4.1 g/t gold and a pathfinder signature indicative of a low-sulphidation epithermal system."

The company is conducting a 2,000–3,000-meter diamond drill program. "The geologists believe this project could quickly advance into resource-style drilling," Newell explains. "This system could be an extension or part of the porphyry target at Kenorland's Tanacross property next door, a question we hope to answer in this year's drilling campaign."

Third on the list is the Lucky Strike property, which covers more than 150 square kilometers in total and has five main gold zones. The discovery hole drilled in 2017 in the Monte Carlo zone returned 5.36 g/t gold over 22 meters, and follow-up drilling the next year included an intercept of 4.55 g/t over 7.6 meters.

"Future drilling on the property will focus on the Monte Carlo zone, which is the only drill-tested zone to date. Strong potential for new discoveries remains on the other zones," Newell says.

The company recently acquired the Rayfield copper-gold property in British Columbia. "Historical drilling and sampling have produced encouraging copper grades (~0.1–0.15% Cu) and have outlined a broad footprint (~450m x 2,100m) of low-grade copper mineralization and hydrothermal alteration suggesting a very robust copper-gold porphyry system. Several targets from past exploration campaigns remain untested and a significant exploration program is planned for 2021," Newell noted. This acquisition allows for year-round work and continuous news flow, he added.

In addition, in July Golden Sky acquired the Eagle Mountain gold property in the Cassiar district of British Columbia. Cassiar Gold's neighboring Taurus deposit, part of the Cassiar project, has an Inferred resource of approximately 1 million ounces at 1.43 g/t gold.

"We believe there is considerable exploration upside at the Eagle Mountain property. Historical work has demonstrated that gold was deposited in a similar geological setting as the neighboring Cassiar gold project," Newell stated. "With much of the property underexplored, there is excellent opportunity for rapid advancement of the project through the application of modern exploration techniques. We look forward to unlocking the potential of this project."

"Golden Sky Minerals is an exciting, ground-floor opportunity in the high-risk, high-reward, early discovery phase of the mining cycle," Newell proclaims. "Located in a highly prospective region that is inhabited by majors and boasts of several multimillion-ounce gold deposits, its exploration program, as well as the recent acquisition of the Rayfield copper-gold property, present the company with potentially exciting near-term catalysts."

The company has approximately 19.2 million shares outstanding, 33 million fully diluted. In July Golden Sky closed a private placement financing for gross proceeds of CA$3.3 million. Crescat Capital LLC was among the investors. If all the warrants outstanding are exercised, another estimated CA$10 million will come into the company's treasury for a fully diluted cash position of about CA$14 million or about 45 cents in cash per share.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Sky Resources, a company mentioned in this article.