With gene-editing technology on the rise and human trials accelerating, the WHO recently announced new guidelines for genomic editing firms that could pave the way for treatments to move from a mostly experimental healthcare tool with only a few marketable products to mainstream adoption.

Related ETF & Stocks: ARK Genomic Revolution ETF (ARKG), Intellia Therapeutics Inc (NTLA), Crispr Therapeutics AG (CRSP)

Excitement Builds in Gene-Editing Industry as Technology Advances

Advancements in gene-editing technology have begun to accelerate, creating a great deal of excitement and promise in this rising corner of the biotech sector.

One of those developments, highlighted by Interesting Engineering, is the ability to stop COVID-19 from replicating in humans using CRISPR gene-editing technology. Scientists have successfully used CRISPR to block the virus from spreading between infected human cells, a development widely considered a major medical breakthrough.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on July 22.

The technology could transform the way we are currently treating patients with COVID-19, as well as help minimize the spread of future pandemics. Researchers involved in the trial believe that patients who test positive could use CRISPR gene editing with an antiviral approach, mitigating the risk of severe complications from the virus. The treatment is not unique to just COVID-19, as CRISPR can potentially be used to remedy any future virus, but the process needs to develop further.

Similarly, a clinical trial from University College London and Intellia Therapeutics has delivered promising results for a simpler way to deliver CRISPR treatment. The treatment is aimed at people with a heart condition called hereditary transthyretin amyloidosis, which causes a build-up of malformed protein in the heart and nerves that eventually turns fatal.

Per Singularity Hub, patients who used the treatment received a single infusion of a CRISPR-based therapy into their bloodstream that turned off the mutated gene and minimized production of the errant protein. Infusing a gene-editing treatment into the bloodstream is a novel treatment and represents a significant step for the development of gene therapy.

The Phase 1 trial only tested six individuals, but the results are strong enough compared to other treatment options to generate enthusiasm in the gene-editing industry. Bloomberg writes that within weeks, levels of proteins that cause disease dropped by nearly 96%, with no adverse effects noted after four weeks. Additionally, most gene therapies can be intense and expensive, which is why researchers believe that promising results from the single-infusion therapy are a major milestone for patients.

Since the trial has a relatively small sample size, the technology requires additional testing ahead. However, the early-stage results of single-dose CRISPR gene therapy could be a potential game changer to effectively eliminate genetic diseases as the industry continues to grow.

WHO Raises Regulations, Market Poised to Grow as Earnings Season Approaches

Potential applications of gene-editing technology are virtually endless, boosting interest in what was once considered a relatively niche market.

Recent developments are even more impressive when you consider just how new gene-editing technology is. Advanced Science News writes that CRISPR tools were developed no more than a decade ago, and the growth of the market over that period has been tremendous.

According to a report from Markets and Markets, the global gene-editing market is poised to rise from $5.1 billion in 2020 to 11.2 billion by 2025, a CAGR of 17%. Similarly, Market Screener writes that the potential of gene editing is still largely unrealized, noting that the technology could spur a flurry of activity leading to the next biotech investment boom.

One of the key factors that will contribute to growth is an increase in government funding, but in order for that to occur, gene-editing technology needs improved regulation and stricter guidelines to allow the public to effectively access the treatments.

The Wall Street Journal recently reported that the World Health Organization (WHO) has announced new standards for gene-editing technologies, aimed at avoiding potentially dangerous usage of the tools. The announcement noted the exceptional growth of gene editing since 2018, a sign that WHO officials realize the potential of the technology, and that the continued growth of gene editing requires additional regulation. Gene-editing companies would be held by the same standards for trial development and testing, which could accelerate the timetable of when these technologies become widely available to the public.

Having successfully tested the aforementioned CRISPR infusion strategy, Intellia Therapeutics told CNBC they expect their gene-editing treatment to reach patients "very, very soon."

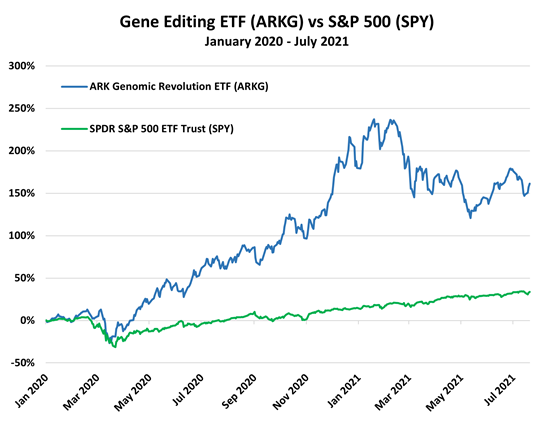

Further, a handful of gene-editing companies are getting ready to report earnings in August, some of which could receive a boost from the slew of positive results seen in the second quarter. Forbes notes that the CRISPR therapy results from Intellia should give the overall gene-editing sector a lift. Intellia's results caused the stock to jump nearly 80%, and it's now up roughly 170% year to date. However, other gene therapy stocks have largely underperformed the market recently, but recent advancements are overall bullish news for the sector.

Gene-editing tech still has a long road ahead before it becomes widely available to the public, but initial results of recent human trials have been nothing short of remarkable. The success of Intellia's single-dose CRISPR therapy has paved the way for additional gene-editing companies to follow suit, proving the new infusion breakthrough has the potential to more effectively treat a wide variety of genetic diseases. The market is poised to grow further as the WHO creates new standards for companies to follow, making it easier for patients to access CRISPR therapies in the future while biotech companies continue to develop gene-editing technology.

Investors can gain exposure to gene editing via the ARK Genomic Revolution ETF (ARKG).

Originally published July 22, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.