Zinc is the fourth most widely consumed metal on earth, with only iron, aluminum and copper ahead of it, but it is not on most investors' radar. The price of the metal has been on the rise; zinc has increased from under $1 per pound a year ago to around $1.36 currently.

One company with a zinc focus is Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJ:FSE), which is exploring two—potentially three—deposits at its Iberian Belt West (IBW) project in Spain. The project, acquired through a public tender process, entails no cash payments or royalties.

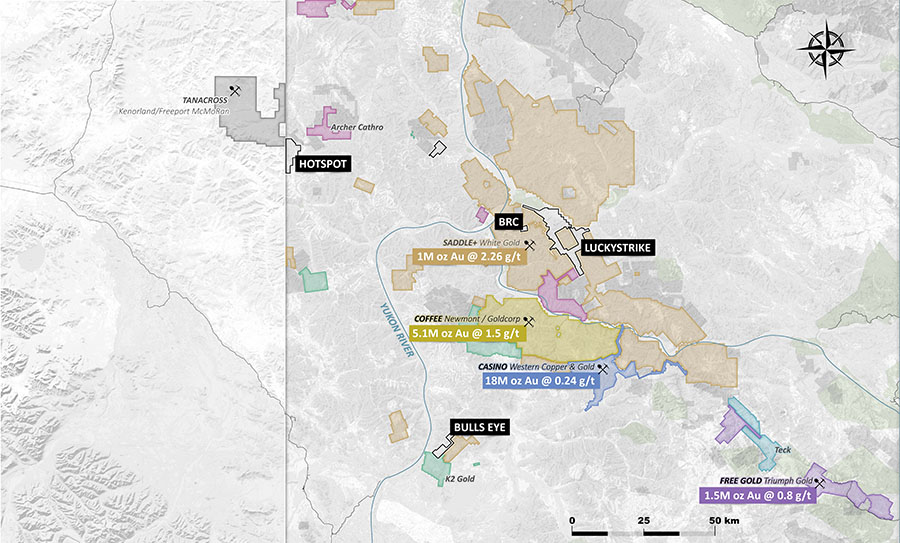

The area is noted for its mining. Lundin Mining Corp.'s copper-zinc Neves-Corvo mine is located approximately 50 km to the west and Trafigura has the Aguas Teñidas mine around 40 km to the east, and a number of smaller producers are in the area as well. First Quantum recently announced approval for its 500 million euro project at its Las Cruces operation in the belt.

The area has become even more receptive to mining recently with the issuing of a directive by the government of Andalusia stating that "underground mining will be given priority and will be permitted on all land classifications," Gower explained. "That was followed by an announcement by the European Union that it was going to invest €3.5 billion in mining and metallurgical project development in the two provinces."

"It's a very exciting time to be working in this area," Emerita CEO David Gower told Streetwise Reports.

Emerita has attracted the attention of Research Capital Corp., which initiated coverage on the explorer in mid-June with a Speculative Buy rating and a target price of CA$2.30 per share. The stock is currently trading at around CA$1.90. Analyst Adam Schatzker wrote on June 15, "We think EMO is an excellent exploration vehicle for investors seeking exposure to high-quality zinc exploration assets with excellent infrastructure, a solid mining culture and low political risk."

Subsequently, Varun Arora of Clarus Securities Inc. launched coverage on July 23 with a CA$4.50 target. "Emerita has consolidated an enviable portfolio of advanced high-grade polymetallic projects with significant copper and precious metals credits on the Spanish side of the Iberian Pyrite Belt—several similar deposits on the belt have been mined for generations with a number of majors active in the region," the analyst stated.

"We believe IBW offers a significant resource growth potential and a high-grade development opportunity that could drive a significant rerating of the stock from its current level," Arora noted.

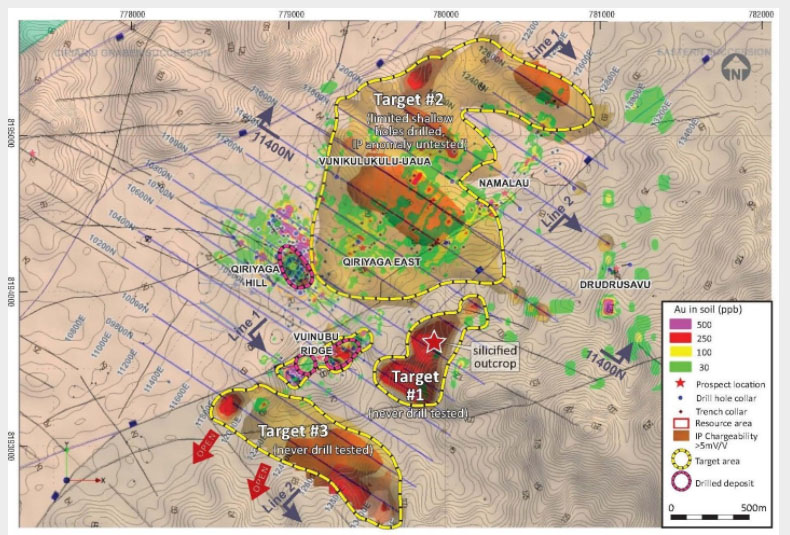

Emerita has historical exploration data on two deposits in the IBW system, La Infanta and Romanera, and is also actively exploring a third potential deposit, El Cura.

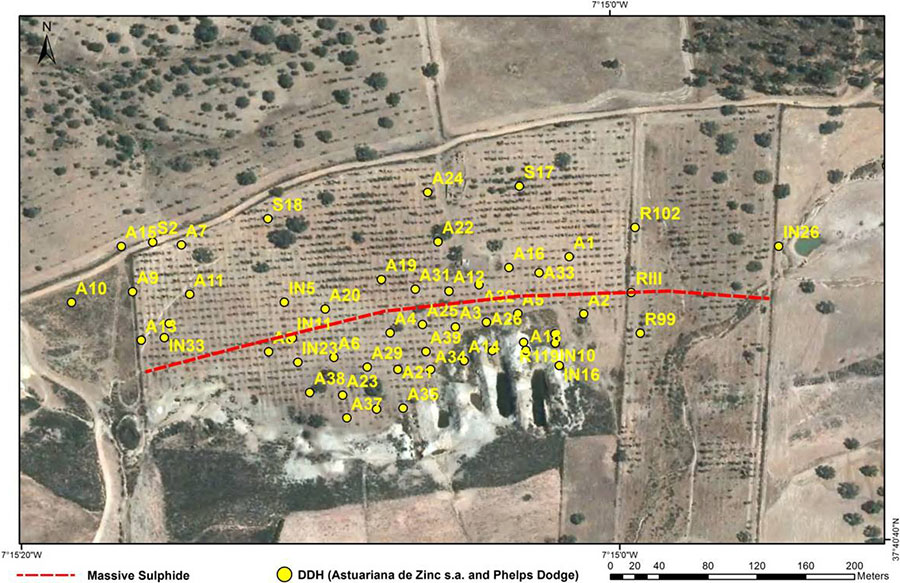

"The extremely high-grade La Infanta deposit system was drilled by Phelps Dodge in the 1980s," Gower explained. "It had a very tiny land position at that time. The public tender that we have been awarded means for the first time all these properties are consolidated into one larger land package."

Gower notes that Phelps Dodge only drilled to about 120 meters deep. "There was a lot of strike, but it dipped off the property. It was a rich deposit: 2–4% copper, 10–20% zinc, 15% lead and 150–350 grams per tonne (g/t) of silver."

The other deposit that has seen some historical exploration is Romanera, done by Rio Tinto. "The assays are not as high grade as La Infanta, but it's much larger and has only been drilled for 350 meters and it's still 20 meters thick at that depth. It's wide open along strike and down pit," Gower said.

"When the historical work was done, precious metals were really not factored into the equation," Gower stated. "So we're seeing values, in some of the historical drilling and in some of our own sampling at surface, of 5 to 10 g/t gold."

He noted that Asturiana de Zinc, which held the property in the 60s and did some of the earliest drilling, before Rio Tinto, "didn't even assay for gold, so that part of the deposit would have to be redrilled for sure, but it's shallow and would go really fast and it's an easy area to access by car."

Emerita has begun to drill an initial 5,000-meter program at La Infanta, which is expected to expand. "We already have data on 49 holes at La Infanta and 51 holes at Romanera, so with relatively modest amounts of drilling, we can convert to pretty significant NI 43-101 resources," Gower explained.

The company just added a second drill at La Infanta to accelerate the program.

Emerita expects to begin to release drill assays fairly soon, "but the initial holes won't be much of a mystery. We have to redrill certain parts of the deposits to get them to current standards. We have to demonstrate that the historical work is valid so we can use all that data," Gower said.

With the consolidated land position, measuring 18 km east-west, and totaling over 6,000 hectares, "there is plenty of room not only to develop the assets, but also to explore for new ones," Gower explained.

In addition to the IBW project, Emerita may be awarded the public tender for the Aznalcóllar project, a past-producing mine. Currently, criminal proceedings are continuing against the company originally awarded the project, and if they are successful, as the only qualified bidder, Emerita would be awarded the tender.

Joaquin Merino, P.Geo., president of Emerita, stated, "We are entering the final stage of this legal odyssey. The years of investigations have been concluded, the crimes are serious, the judge is expected to set a trial date in the near future and based on the evidence and numerous decisions by the Spanish courts to date we are confident that the accused will be found guilty of one or more crimes."

Research Capital analyst Adam Schatzker wrote on June 15, "We believe that the company is worthy of investment based on the IBW project alone. However, the real upside for shareholders would be realized should EMO successfully acquire the Aznalcóllar project through the tender process. The tender process has been fraught with court battles and accusations of misdeeds, but we believe there should be a resolution before the end of 2021."

"We believe the big prize for Emerita will be the awarding of the tender for the world-class, past-producing Aznalcóllar mine that is the subject of an ongoing criminal legal dispute," Varun Arora of Clarus Securities wrote on July 23, echoing the sentiment. "In our opinion, a final decision on the legal dispute is in sight and we are encouraged by the court rulings to date, pointing to the potential for a favorable outcome for EMO—a major near-term rerating catalyst."

Emerita recently closed a bought-deal private placement of 18,182,500 units priced at CA$1.10 per unit, for gross proceeds of approximately CA$20 million. A unit includes one common share and one half warrant; the full warrant is exercisable for one common share for CA$1.50 and is valid for 24 months.

The company has approximately 168 million shares outstanding and 224 million fully diluted. Management owns 12%.

Read what other experts are saying about:

[NLINSERT]

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Emerita Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Emerita Resources, a company mentioned in this article.

Additional Disclosures

Disclosures from Research Capital Corp., Emerita Resources Corp., Update, June 24, 2021

RELEVANT DISCLOSURES APPLICABLE TO COMPANIES UNDER COVERAGE

1. Relevant disclosures required under Rule 3400 applicable to companies under coverage discussed in this research report are available on our web site at www.researchcapital.ca.

2. This Issuer has generated investment banking revenue for Research Capital Corp.

ANALYST CERTIFICATION

I, Adam Schatzker, certify the views expressed in this report were formed by my review of relevant company data and industry investigation, and accurately reflect my opinion about the investment merits of the securities mentioned in the report. I also certify that my compensation is not related to specific recommendations or views expressed in this report.

Each analyst of Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst's compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.

Research Capital Corporation, its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein.

Disclosures from Clarus Securities, Emerita Resources Corp., July 23, 2021

Clarus Securities Equity Research Disclosures

Within the last 24 months, Clarus Securities Inc. has managed or co-managed a public offering of securities of this company.

Within the last 24 months, Clarus Securities Inc. has received compensation for investment banking services with respect to the securities of this company.

Conflicts of Interest

The research analyst and/or associates who prepared this report are compensated based upon (among other factors) the overall profitability of Clarus Securities and its affiliate, which includes the overall profitability of investment banking and related services. In the normal course of its business, Clarus Securities or its affiliate may provide financial advisory and/or investment banking services for the issuers mentioned in this report in return for remuneration and might seek to become engaged for such services from any of such issuers in this report within the next three months. Clarus Securities or its affiliate may buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. Clarus Securities, its affiliate, and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities discussed herein, or in related securities or in options, futures or other derivative instruments based thereon.

Analyst's Certification

Each Clarus Securities research analyst whose name appears on the front page of this research report hereby certifies that (i) the recommendations and opinions expressed in the research report accurately reflect the research analyst’s personal views about the Company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.