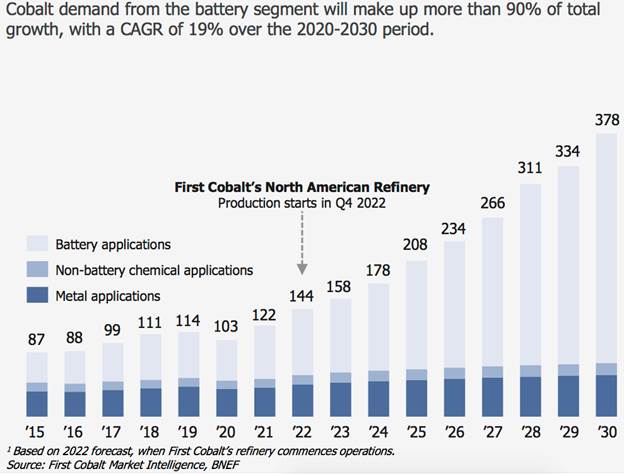

The global electric vehicle (EV) narrative continues to get better as over three dozen automakers with market caps >US$1 billion fight for the world's attention. Add to that a few dozen lithium ion (Li-ion) battery makers in need of long-term, sustainable, clean battery materials. Demand for metals including lithium, nickel, cobalt and copper will range from strong to extremely strong for decades to come.

Nickel (Ni)-heavy Li-ion batteries (Li-B) are standard in luxury models, SUVs and vehicles that get 400–500+ km per charge. Lucid Motors is delivering a mainstream sedan next year with a range of 653 km/406 miles.

Cobalt (Co) provides safety, stability and longevity to nickel manganese cobalt oxide (NMC) and nickel cobalt aluminum oxide (NCA) batteries. At lower concentrations, the price of Co becomes less important. For Li-B makers and the OEMs they serve, it's well worth paying up (modestly) to protect valuable brands from damaging headlines and lawsuits over battery failures.

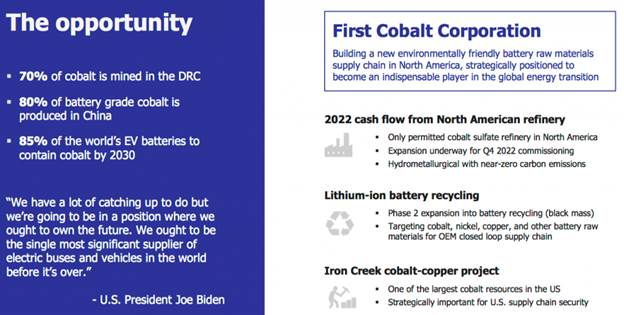

FCC leveraging its 100%-owned refinery into other battery materials refining + recycling

First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) is a North American battery materials company with leading ESG credentials that's ideally positioned to play an important role in Ontario's emergence as a significant regional EV and Li-B materials manufacturing hub.

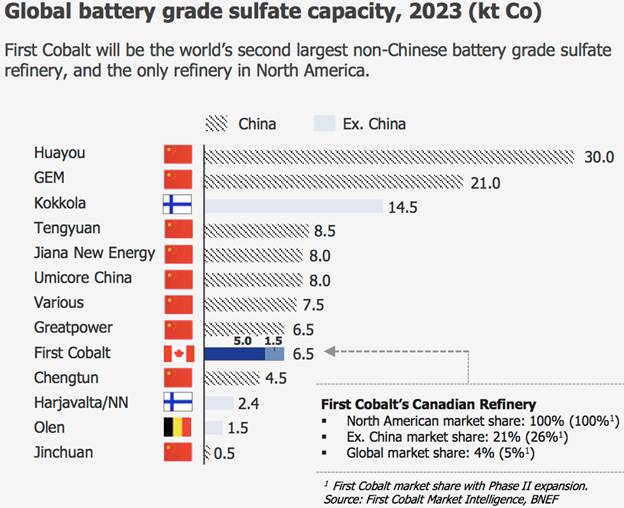

The company is currently expanding, optimizing and recommissioning North America's only permitted refinery—capable of producing clean, conflict-free battery-quality cobalt sulfate (CoSO4). FCC's competitive advantages include its existing hydrometallurgical facility, best-quartile carbon footprint and proximity to U.S. and European markets.

Phase 1 will be completed in October 2022, at which time the facility will ramp up to 25,000 tonnes/year CoSO4, making it the second largest producer outside of China. Please see new corporate presentation.

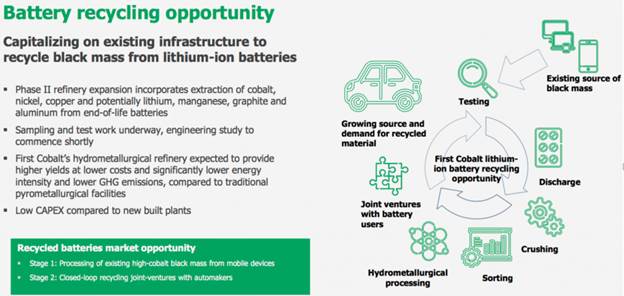

Management is eager to articulate its new strategy to supply not only battery-quality CoSO4, but also recycled battery-quality Co and Ni—plus (potentially) lithium and manganese. In addition to processing Co hydroxide into CoSO4, management is carefully considering the viability of refining Canada-sourced Ni.

The goal is to produce CoSO4 from late 2022 on, recycling end-of-life Li-Bs from 2023/24, and Ni refining in 2024/25. Importantly, (subject to further analysis), all of these activities should be able to run concurrently. Incremental cap-ex for recycling and Ni refining is expected to be relatively modest and partly, or largely, funded from free cash flow.

Li-B and EV makers to benefit by co-locating next to FCC's refinery complex

Management believes that one or more Li-B makers or OEMs will want to co-locate a cathode or precursor plant next to its refinery, creating an integrated battery park. Synergies and cost savings for FCC and co-locating parties would be meaningful.

Partnered companies could share expenses (workforce, energy, infrastructure, materials and equipment handling and procurement) CEO Trent Mell believes his op-ex could be cut by 10% (by skipping the crystallization step), or >10% including other synergies and savings. This arrangement would score high on ESG charts.

Management is actively engaged in discussions with OEMs and Li-B makers with operations in North America and Europe. Ontario has a number of significant advantages over Chinese competitors in terms of shipping times, costs and logistics, security of supply, and tariffs.

Security of supply is of paramount importance—end users see that nearly 80% of battery-quality Co is produced in China—and it concerns them.

FCC and its world-class partners guarantee that fair and safe labor practices will be upheld by the companies they work with. Therefore, end users will enjoy security of supply of clean, conflict-free CoSO4, diversification away from China and a transparent, sustainable chain of custody from beginning to end.

Prospective offtake partners need to reduce environmental footprints by sourcing locally, or at least regionally. FCC's refinery is powered by a green hydro-electric grid. It emits half the greenhouse gases of a similar-sized Chinese plant that's most likely coal-powered.

Moreover, the Co hydroxide feedstock comes from mines that are powered with hydroelectricity. The refinery's location reduces the distance raw materials and finished goods need to travel. This lowers carbon emissions and the risk of supply chain disruptions.

Attractive US$45M debt funding package should be in place by next month

FCC's refinery is expected to produce ~11M pounds/year CoSO4 from 2023 on. However, if market conditions are strong, mgmt. believes it can flex that 11 million pounds by as much as 30% to ~14.3 million pounds, with relatively minimal incremental cap-ex. Please see new corporate presentation.

President and CEO Trent Mell commented, "This is the first major battery-grade CoSO4 refinery to be built outside China in over 20 years, this is not only an exciting project for us, but also for the Western battery supply chain. Cobalt prices are up >20% over the past five weeks and we're witnessing stronger interest in off-take contracts as the battery supply chain shifts its focus from Europe to new investments in North America."

Lenders are finishing due diligence on a US$45M = ~C$57.5M (C$/US$ FX = 1.277) debt facility that, combined with working capital of C$13 million, plus C$10 million in committed government funding, should cover FCC through refinery start-up in 4th quarter 2022.

One of the more compelling developments at FCC is the fairly new Li-B recycling strategy. When I first heard of it, the plan was to focus entirely on CoSO4 through 2023, pay down some debt, and optimize operations—before thinking about recycling.

Now, the goal is to further study black mass recycling this year. After removing plastics, copper (Cu), graphite and aluminum from crushed batteries—a sludgy mixture of Ni, Co and lithium (Li) remains—that's black mass. Prior testing already demonstrated that the hydro-metallurgical refining process employed at FCC's refinery generates high recoveries of Ni and Co from black mass feedstock.

Why the change? The team realized that with refinery enhancements on time/on budget, new hires on hand and full-funding nearly in place, they could pursue multiple initiatives at once. With that in mind, management is also kicking off exploration activities in Idaho (more on that later).

This year management learned that black mass feedstock is readily available to satisfy the company's initially modest needs. Several companies have been collecting spent consumer electronics for years. These devices typically contain Li-Co-oxide batteries, which have higher Co content than the latest NCA and NCM batteries used in EVs.

Strong profits from 2023 + potential to double cash flow by 2026

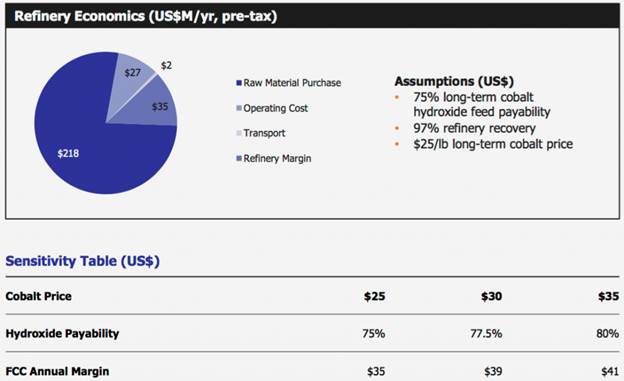

Therefore, the team can start Co operations that could produce C$44.7 million in annual, pre-tax cash flow (before debt service) from 2023 on, while concurrently ramping up recycling operations. Management believes that recycling margins could be higher than that of Co/Ni refining. I don't know how much higher, but soon-to-be-listed Li-Cycle is forecasting EBITDA margins of >50%.

FCC's refinery is a natural processing option for black mass because it already has extraction circuits for Ni and Co installed. Management expects its recoveries to be significantly higher than competing pyrometallurgical facilities. And, greenhouse gas emissions are negligible compared to Chinese alternatives.

Another important consideration in the recycling equation is that primary battery material scrap (from current EV production) is rapidly increasing. In the early years, new mega-factories scrap 30% (or more) of their battery metal inputs. FCC will be able to treat defective material from precursor, cathode and other materials makers/users, and faulty batteries from cell manufacturing lines.

In phase 2 of the refinery expansion, FCC will add a Li-B recycling operation. Spent batteries—in the form of black mass—will be processed to recover Co, Ni and perhaps other critical materials.

Exciting new discovery and Co + Cu resource expansion opportunities in the U.S.

FCC owns a growing Co-Cu mineral deposit in the U.S. state of Idaho, providing a foundation for a secure, strategic supply of critical raw materials. Known as the Iron Creek Project, the deposit sits on patented property within the Idaho Cobalt Belt. So far, there's a combined 25 million lb Co + 69 million lb Cu (Indicated and Inferred).

Last month, a $2.5 million exploration program totaling 4,500 meters over two drill seasons was announced. Field work is underway consisting of bedrock geological mapping and geochemical surveys.

Management is optimistic it can possibly double its existing resource in known mineralized zones, and possibly make significant new discoveries in un-drilled areas. The vision is to build an underground 'mine of the future, leveraging best practices and technology to minimize the environmental footprint.

If Co and Cu prices continue to rise, FCC's small resource could become a lot more valuable, especially if it can be doubled (or more with discoveries) in size.

Conclusion

First Cobalt is well down the road of future-proofing its business. If Co demand grows too slow, management can expand its recycling operations. There's substantial exploration upside in the U.S., but the story does not hinge on new discoveries. New discoveries would be icing on the battery materials cake.

The flagship refinery has a useful life of decades, a lot longer than most mines! If all goes reasonably as planned, cash flow is only ~18 months away. A full-funding package should be in place by next month. FCC's pro forma enterprise value {market cap – cash + debt} will be roughly C$170 million ($0.265/share) after management deploys all the cap-ex dollars.

Compare that C$170 million figure to the dozens of new high-tech battery, drone, EV, energy storage, charging infrastructure companies with market caps 10x–100x times larger. Unlike most of those high-fliers, FCC should be strongly cash flow positive in under two years.

Once FCC gets a full NASDAQ or NYSE American listing, (in next six months), the valuation could move meaningfully higher.

Please see FCC's new corporate presentation.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares of First Cobalt Corp., and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.