While there seems to be no short-term answer for skyrocketing agricultural commodity futures, higher crop prices have foisted agtech ventures into the spotlight. Efficient vertical farming is becoming an increasingly popular investment as a result of the headwinds facing traditional farming.

As it stands, the volatile nature of climate change and population growth are creating a double whammy for the global crop supply. New data shows that vertical farming can increase crop yield by up to 700% while cutting water usage significantly. Vertical farming could one day prove to be a mainstream agricultural industry as its scalability comes closer to realization.

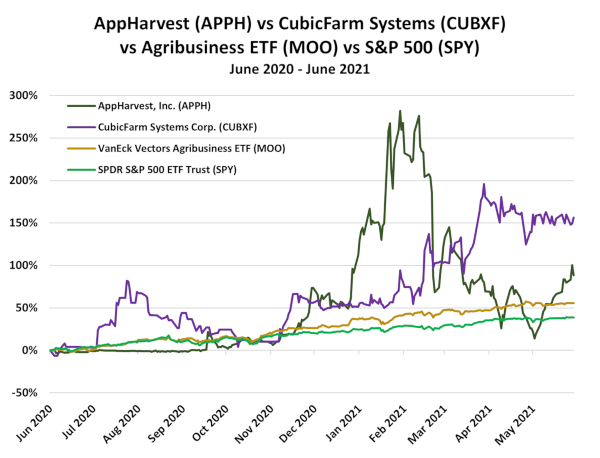

Related ETFs & Stocks: VanEck Vectors Agribusiness ETF (MOO), Invesco DB Agriculture Fund (DBA), AppHarvest, Inc. (APPH), CubicFarm Systems Corp. (CUBXF)

Vertical Farming Provides Solutions to Farming Inefficiencies, Climate Change

Vertical farming, a type of indoor, controlled farming where crops are grown in several stacked layers (similar to a multi-story building), has been a relatively niche market—until recently.

A report from Big Think recently found that vertical farms are incredibly efficient when it comes to water usage, requiring 95% less irrigation than soil-grown plants. Nate Storey, co-founder of vertical farming startup Plenty, Inc., has highlighted the efficiency of vertical farming, noting that 99% of moisture transpired by plants can be recaptured and reused in a vertical farming system.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on June 10.

A recent report from Eden Green Technology found that food production accounts for 70% of global freshwater production.

As MRP has recently highlighted, water has become an increasingly scarce resource and years of drought may continue to become more common. Per Oregon Public Broadcasting, the past year has been the driest or second driest in most Southwestern states since record keeping began in 1895. Higher average temperatures, as we've seen over the last two decades, increase the loss of water to the atmosphere, likely playing a significant role in increasing the frequency and severity of droughts. Studies show that, since 2000, about half the reduction in the Colorado River's flow has been due to warmer temperatures. For every degree Celsius of warming, the river's flow is expected to shrink by 9%.

According to the US drought monitor, most of California is currently experiencing drought level D3 (Extreme Drought) or worse. Reuters writes that Lake Mead, the reservoir created by Nevada's Hoover Dam, has sunk to its lowest level ever. Mead is the largest reservoir in the United States and crucial to the water supply of 25 million people including residents of the cities of Los Angeles, San Diego, Phoenix, Tucson and Las Vegas.

South America's crop king, Brazil, is also facing a drought that marks its worst dry spell in 91 years. Drier-than-normal weather has slammed production of sugar and coffee in Brazil, the world's largest supplier of those products. Last week, coffee futures touched their highest price since 2016.

Axios writes that if the global population continues its upward trend we will need 50-70% more food over the next 30 years, according to UN data. Fortunately, crop yields could rise by roughly 700% per year with vertical farming technology, as indoor systems can operate 365 days year without worrying about weather patterns.

In addition, the amount of land used to grow crops is significantly diminished when farms switch to an indoor vertical approach. Per Free Think, roughly 700 acres of farmland can be condensed into a vertical farming structure the size of a big box store.

Further, these farms can be constructed in urban areas due to their limited footprint, which in turn can reduce the time necessary for produce to make its way into cities. Eden Green Technology writes that most crops would be able to move from indoor farms to retail shelves in less than 48 hours, minimizing the loss of freshness and fuel waste in the agriculture transportation process.

As climate shifts continue to affect the global agriculture industry, indoor farming provides an efficient and sustainable way to produce more crops with fewer resources.

Market Poised to Grow as Investment Surges

The rapid rise of crop prices and resulting food inflation, now at its highest level in a decade, has made the need for innovation in agricultural technologies even more of a necessity.

According to a report from Fortune Business Insights, the global vertical farming market is projected to reach $17.59 billion by 2028. Today, the global market stands at $3.04 billion, which would set the industry's compounded annual growth rate (CAGR) at a strong 25.4%.

The report emphasized that a pandemic-era boost in organic, locally grown food products caused the market to grow 19.1% in 2020. Per Axios, venture capital funding for vertical farming companies reached $1.9 billion globally in 2020, almost tripling the level of investment from the year prior.

Recently, TechCrunch reported that indoor farming startup Bowery Farming, based out of New York City, raised $300 million in a new funding round. The announcement brought total funding for the company above $472 million, which values the company at roughly $2.3 billion.

Bowery experienced 750% retail growth since January 2020, with its produce now available in 850 grocery stores including Walmart, Whole Foods and Giant Food.

Aerofarms, another vertical farming company, recently announced a 136,000-square foot indoor farm in Virginia, which would be the world's largest indoor vertical farm, slated to begin production in mid-2022. The company is rapidly expanding its distribution operations in the Northeast, collaborating with Whole Foods, Amazon Fresh and FreshDirect , according to Supermarket News.

Aerofarms says its indoor model yields annual productivity up to 390 times greater than traditional farming. Headquartered in Newark, NJ, the company is focused on bringing fresher produce to cities at a faster rate than conventional agriculture can provide.

Vertical Farming Still Faces Hurdles

As much as vertical farming technology is advancing, the industry still faces many challenges before it can become a mainstream way to grow and deliver produce.

Currently, there are more than 2,000 vertical farms in the US. That figure is well above Japan, which currently has the second most vertical farms in use at roughly 200. More vertical farms are rolling out across the Asian continent, in nations like China and Taiwan, the latter of which has been battling a historic drought.

However, in the US the vertical farming market is still relatively niche compared to the traditional farming industry. The output of US farms alone was worth $136 billion in 2019.

Further, the high fixed costs of implementing indoor farms still limit the industry's development in the short term. According to Free Think, these farms can cost upwards of a hundred million dollars to construct individually. Meanwhile, the cost of production while selling produce at market prices has hindered the ability of vertical farming companies to turn a profit in the past.

It will likely be several years before vertical farming technologies begin tapping their true potential, but a scaling of the industry is becoming increasingly likely as a counter to climate change and diminishing water availability. Investors can gain exposure to this burgeoning industry via CubicFarm Systems (CUBXF) and AppHarvest (APPH).

Aerofarms (AFRM) is slated to go public soon, via a SPAC merger.

Theme Alert

For now, though, traditional farming techniques continue to struggle with climate-related headwinds, which are forecast to worsen. In light of this, our LONG Agricultural Commodities theme remains highly relevant.

You can read MRP's most recent reports on rising crop and livestock prices here:

Meat Prices, Cybersecurity Concerns Surging as Grilling Season Arrives and Supply Chain Issues Escalate (June 3, 2021)

Water May be a Hot Commodity as Drought Brings Heightened Crop and Wildfire Risks to the US West (April 29, 2021)

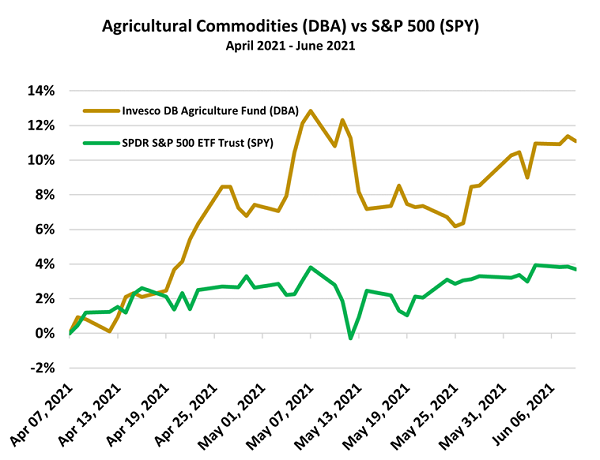

MRP added LONG Agricultural Commodities as a theme on April 7, 2021. Since then, the Invesco DB Agriculture Fund (DBA) has returned 11%, outperforming an S&P 500 gain of 4% over that same period.

Originally published June 10, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of AeroFarms, a company mentioned in this article.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.