"Why don't you let us help you pay for it?"

That was the question Gary Cope, president, CEO and director of Vancouver-based Barsele Minerals Corp. (BME:TSX.V; BRSLF:OTCQB), casually posed to Sean Boyd, CEO and vice chairman of Agnico Eagle Mines (AEM:TSX; AEM:NYSE) after the major gold producer announced in early January that it would acquire TMAC Resources (TMR:TSX) for about C$287 million.

Both Agnico Eagle and Barsele Minerals are partners in the 2.4 million ounce (2.4 Moz) Barsele gold project in Västerbottens Län, northern Sweden, with the major holding a commanding 55% stake that the junior is now seeking to acquire.

With a market cap north of C$21 billion, it's not like Agnico Eagle needs the extra cash to further develop its healthy cluster of North American gold assets, but Boyd is an accountant by trade and Cope's overture for Agnico's 55% interest in Barsele was greeted not only as an opportunity to save some coin but perhaps make some, too.

After several meetings and dozens of emails, Barsele and Agnico Eagle jointly signed a non-binding letter of intent that outlines a plan that would see Barsele Minerals own 100% of the Barsele gold project.

Under the terms of the deal, Barsele will pay US$45 million, plus a 14.9% equity stake (to be issued when the deal closes), to acquire Agnico Eagle's indirect interest in Gunnarn Mining AB, the Swedish company holding the gold concessions.

Agnico gains further upside by securing warrants equal to 6 million Barsele shares. Each warrant will have a 5-year term and be $1.25/share or a 20% premium to the 20-day volume weighted average price prior to the date the warrant was issued, whichever is higher.

Agnico also gets a 2% net smelter return royalty (NSR) that Barsele can buy back at any time for US$15 million. Another 2% NSR on the Barsele project is jointly held between Orex Minerals (REX:TSX.V; ORMNF:OTC), Gunnarn Mining AB, Agnico Eagle Sweden AB and Agnico Eagle. The buy-back price on the second NSR is US$5 million.

Barsele will pay Agnico a "contingent value right" or CVR equal to US$2.5 million for each 1 million ounces in gold reserves and resources that Barsele outlines at its eponymous project beyond what was outlined before the deal. That amount is capped at US$20 million.

Barsele Minerals has the option to apply the first US$5 million of any CVR payments to buy back the NSR held by Orex and co. Agnico secured the right to participate in any future Barsele financings so that it can maintain its 14.9% stake. The complex negotiation went back and forth for months.

"We went from an all-cash deal, which we were quite happy doing, to where (Agnico) demanded a sizable piece of Barsele stock, an NSR and the bonus structure. All these things showed us that they really believe that with a proper budget we're going to really expand this deposit, and we've always known that, too," Cope explains.

For Agnico, the deal allows the major to focus on its exploration and development pipeline in North America, especially TMAC's Hope Bay gold mine, while retaining an interest in the Barsele Project as an equity investor and royalty holder.

"We wish Barsele success," Boyd says.

Now the junior needs to raise U$45 million, plus at least another C$5 million to fund a season of exploration and development.

Cope expects most of the money to come from a gold streaming partner, with the rest in convertible debentures that will convert at around $1.25/share. Cope says his company has already signed a non-disclosure agreement with a "very well known" streaming company regarding financing.

The Barsele project is located on the western end of the Skellefteå Trend (pronounced (shell-eff-tee-ah), a gold belt known primarily for its volcanogenic massive sulphide (VMS) deposits but also intrusive orogenic gold deposits.

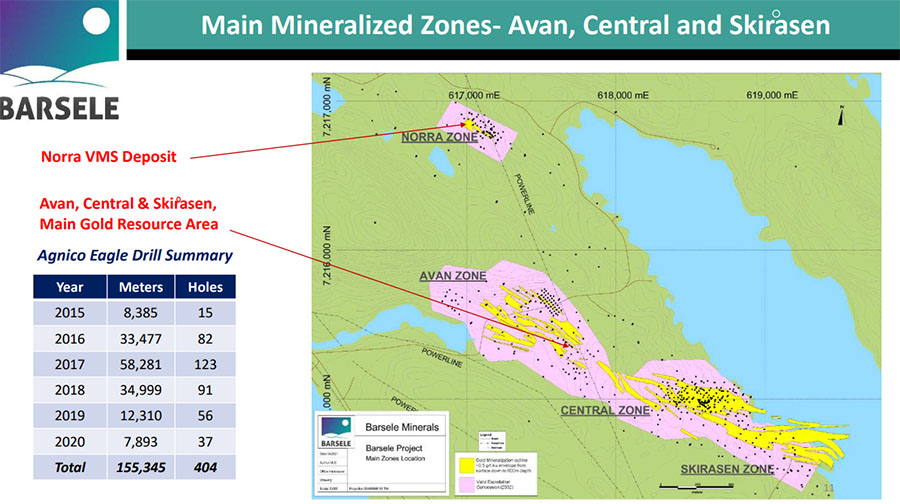

The initial drill program conducted by the Agnico-Barsele duo in 2016 yielded a 112-meter intercept on the Skiråsen zone grading 2.01 g/t gold. The mineralization was 650 meters southeast of the Central Zone.

Two years later, a resource estimate was compiled by Quebec-based InnovExplo at Barsele using drill results along the Avan–Central–Skiråsen gold zones.

The Inferred resource measured 25,495,000 tonnes grading 2.54 grams per tonne (g/t) gold, for 2.086 Moz contained gold, whereas the Indicated resource tallied to 5,578,000 tonnes grading 1.81 g/t gold for 324,000 oz gold. The study used three different cut-off grades.

Further drilling in 2020 at Avan, after some structural reinterpretations, revealed new high-grade intercepts next to and beneath the known mineralized zones.

The Barsele technical team now believes there are cross structures running north-south that carry high gold grades along a trend outside the wireframes outlining the current resource.

For instance, drill hole AVA18003-extension cut 5 meters grading 84 g/t gold (true thickness to be determined) in a deeper, high-grade gold zone. The intercept occurred about 400 meters below surface.

Cope says all three mineralized zones in the Barsele resource—Avan, Central and Skiråsen—are really parts of one system along a mineralized belt. So far drilling has determined that the mineralization stretches 8 km, yet only drill results from the first three kilometers are in the resource.

"There's another five kilometers in the same belt that haven't been explored. And if you go right to the very end of that eight-kilometer trend there is a target called Risberget, which has about 20 drill holes [in it]," Cope says. "It's not in the resource. But it's the same grade, same rock…One of the upsides of the project is that there's a lot of great drill holes that aren't in the resource because of drill spacing and other criteria."

Indeed. Hole RIS-17007 drilled at Risberget hit 32 meters running 2.92 g/t gold, including 1 meter running an eye-popping 248 g/t gold.

Four kilometers north, drills to continue to turn at Bastuträsk, the most recent discovery at Barsele. The best intercept to date returned 0.7 meters grading 32 g/t gold, 0.12% nickel, 0.08% copper and 0.05% cobalt.

And then there's Norra, a promising VMS deposit. The main mineralized body measures 300 meters in strike length at widths that start at five meters and reach more than 50.

Drill hole NOR19008 at Norra hit 12 meters running 11.04 g/t gold, 74.22 g/t silver, 0.29% copper, 0.26% lead and 1.44% zinc. Not to be outdone, drill hole NOR19009 hit 10 meters along strike averaging 8.86 g/t gold, 78.63 g/t silver, 1.51% copper, 0.1% lead and 5.17% zinc. None of the drill holes at Norra were included in the resource.

Some past producing mines in the region such as Boliden and Storliden started out as VMS discoveries. The nearby Bjorkdal mine, a VMS gold deposit owned Mandalay Resources (MND:TSX), produces about 50,000 oz gold annually.

Cope is not shy about his plans for the Barsele gold project—he's going to expand the resource and sell it to the highest bidder. Barsele has hired BMO Capital Markets as its advisor.

"There will be a huge exploration program designed to get the resource to that 3.5 to 5 Moz range. BMO thinks that at that point, there'll be 8 to 10 mining companies that will be all over ([Barsele] because of the jurisdiction," Cope says. "We've got three power lines going right through the middle of the project—the cheapest power in the world, under two cents per kilowatt; a flat tax of 22%; and a highly productive labor force…Now that we have 100%, we can sell it to anybody."

In 2013, Cope was president and CEO of Orko Silver when the junior orchestrated a bidding war for Orko's massive La Preciosa silver-gold deposit in Durango, Mexico. Despite bids from a few different suitors, La Preciosa was sold to Coeur Mining (CDE:NYSE) in a cash and shares deal valued at C$380 million.

Barsele Minerals trades in a 52-week range of $0.32 to $0.82 with 129.5 million shares outstanding. Management owns roughly 25% of the company.

[NLINSERT]

Disclosure:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Barsele Minerals. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barsele Minerals, a company mentioned in this article.