It took some time, but it all seems to come together rather nicely now for hybrid prospect generator Kenorland Minerals Ltd. (KLD:TSX.V) and its young prodigy CEO, Zach Flood. A few days ago the gold price broke through the important barrier of US$1900/oz again, lots of metals are witnessing positive sentiment on the back of a recovering world economy as COVID-19 vaccines are rolled out worldwide, so despite a recent crypto crash the mining industry is enjoying a bull market again after 2016-2017.

Of course, most importantly Kenorland produced a nice batch of drill results at the Regnault target, part of its flagship Frotet project in Quebec on May 26, 2021, with an absolute highlight being hole 21RDD024, returning 5.72m @ 90.56g/t Au. The markets recognized this for being nothing short of a world class result, and the share price raced up to as high as C$1.50 that day, before closing at C$1.27, generating a volume of 482k shares, almost 7 times the average volume:

Share price 6 month period; Source: tmxmoney.com

It is always nice to start coverage of a client at rock bottom prices (in this case at C$0.79), and see them doing well shortly afterwards. But this is just the beginning if I'm correct, so let's have a look at the specifics and potential implications of the recent assays.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Frotet exploration

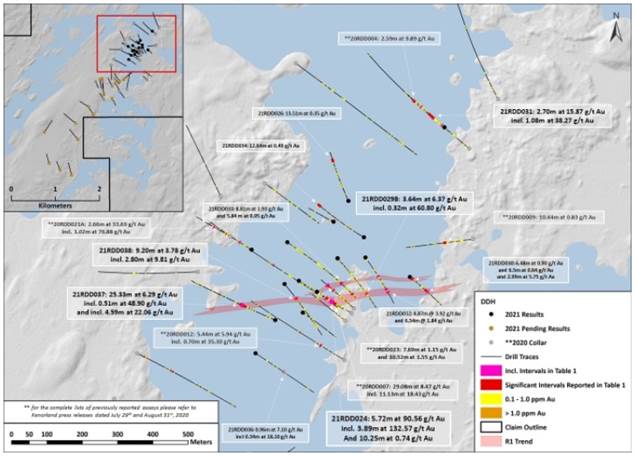

Things seem to go smoothly so far for CEO Zach Flood, as the phase 2 Regnault drilling keeps confirming more and more mineralization, some of it very high grade although relatively near surface. The company completed 8,591m of diamond drilling, and 15 from 30 holes (3,487m) were reported in the latest news release, discussed in this article. As a reminder, the Frotet project is located adjacent to the Troilus deposit (7.06Moz Au Indicated and Inferred, owned by Troilus Gold), and Japanese mining giant Sumitomo recently formed the 80/20 JV with Kenorland (which continues as the operator), meaning pro rata funding begins from this point onwards and any party diluted below a 10% interest will convert their interest to a 2% uncapped net smelter royalty.

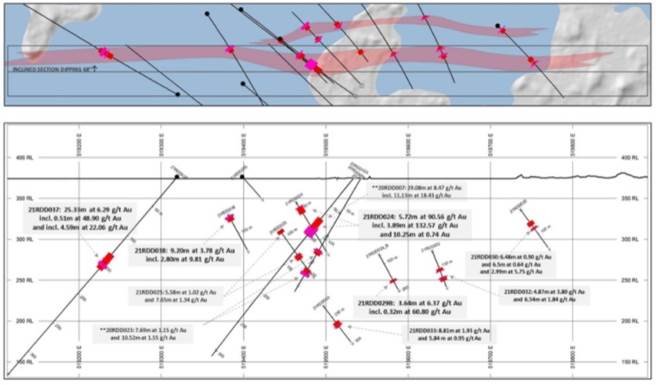

Kenorland has been focusing for this program on the northern part of the Regnault target, as can be seen here:

Since there was a strong north-south orientation for the overall drill results, I assumed any structures would trend in that direction as well. This didn't turn out to be the case, as Flood cs. appears to have defined an east-west mineralized trend across two of the most impressive intercepts to date, 20RDD007 and the aforementioned 21RDD024. More on this later. Highlights of the last batch looked like this:

- 21RDD024: 5.72m at 90.56 g/t Au incl. 3.89m at 132.57 g/t Au

- 21RDD029B: 3.64m at 6.37 g/t Au incl. 0.32m at 60.80 g/t Au

- 21RDD031: 2.70m at 15.87 g/t Au incl. 1.08m at 38.27 g/t Au

- 21RDD037: 25.33m at 6.29 g/t Au incl. 0.51m at 48.90 g/t Au and including 4.59m at 22.06 g/t Au

- 21RDD038: 9.20m at 3.78 g/t Au incl. 2.80m at 9.81 g/t Au

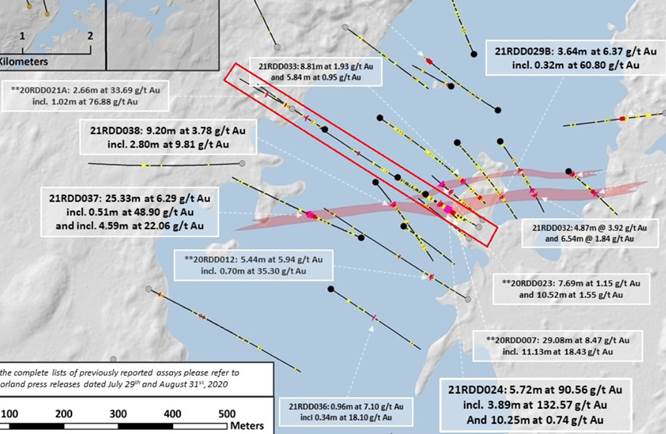

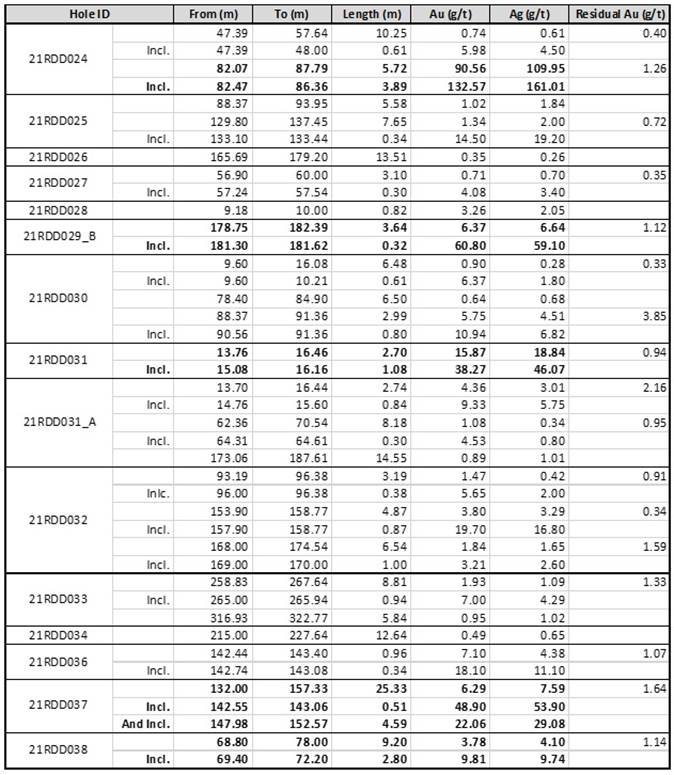

Besides the stellar 21RDD024 result, 21RDD037 was impressive as well. The other highlights are economic without a doubt, as veins can be mined at a width as narrow as 2m. Economic grades in that case would be around 4-6g/t Au, so this can be globally extrapolated towards 10-15g/t Au over 2m. As it will probably be pretty hard to recognize drill holes and results in the last map, I zoomed in somewhat for the next map, hopefully making things a bit more convenient:

It looked like Kenorland geologists were drilling a fence (marked in red) following 20RDD007, as three separate holes (black dots are the latest results) were drilled in the same direction, but at variable spacing (50–150m). As can be seen in the map above, holes 20RDD021A and 20RDD007 indicated the outer limits of the fence. It is not indicated which are the three "infill fence" holes in between. According to Flood, these are holes 21RDD025, which was drilled in the same orientation as 21RDD024 (both scissor holes to 20RDD007), and RDD027 was drilled beneath 20RDD021A, which intercepted 2.66m @ 33.69 g/t Au.

For a proper overview of results, here is the table with all 15 drill intercepts of this year's campaign:

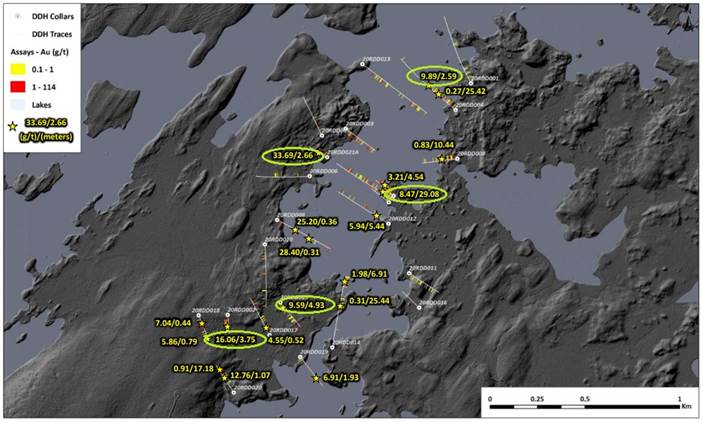

There appear to be several mineralized levels, indicating several stacked veins or stockwork present. What is special about Regnault is that most intercepts are within open pit boundaries (above 200m depth), although I have no immediate illusions about any open pit operation, as the main mineralization of Regnault so far is located under a significant water body, as can be seen here at the map with the 2020 drill results:

This was confirmed by Flood, who had this to say about any water issues regarding a future operation: "The target here is narrow high grade veins which would be mined underground if an economic resource was discovered. The lake would not be a major issue in this mining scenario and many high grade underground mines operate beneath shallow bodies of water." It is clear at a first glance that gold mineralization is spread out north-south over 2km. As mentioned, it puzzled me that management came up with a smaller, east west structure, called the R1 Vein Corridor. Why exactly did they conclude to define this orientation, and rule out others? Would this imply many more east-west trending structures/veins/stockwork? Shouldn't any fences be oriented north-south then, in order to cross these potential east-west mineralized envelopes?

CEO Flood had this to answer when asked: "Our original holes from the discovery program in 2020 were oriented to the northwest, in order to test both a north east trend and an east west trend. This latest program has concluded that the veins, at least in R1, are striking EW. Much of the current drilling is not optimal to be testing that orientation, so there is a lot which we might have missed on that initial discovery program last year. Going forward we will be drilling in a more north-south direction, to test more east-west structures."

As you can probably conclude, geology isn't exact science, but there is a lot of trial and error involved before the puzzle of a mineralized body can be solved. The company geologists constructed a long section as well on this R1 Vein Corridor:

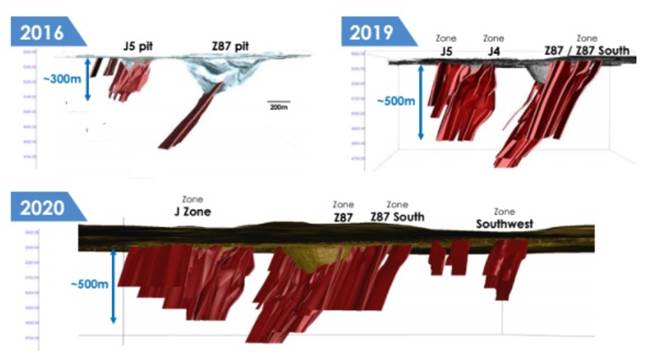

This section, combined with the different depths at which mineralization is found, implies that this R1 Vein might drop off pretty steeply, like a curtain. And of course that there can be many more curtains. Coincidentally, this is exactly the type of mineralization found at the nearby Troilus deposit (owned by Troilus Gold, see its presentation), albeit lower grade:

Mineralization over there is also found over a large strike length, and in addition is open at depth. Troilus is hosted in diorite, and in porphyritic felsic intrusions, and this is also seems to be the case at Regnault. The difference is that 90% of Troilus mineralization appears as disseminated low grade gold, and most of Regnault mineralization seems to be high grade veins, part of an intrusion-related gold system. Of particular interest is that their mineralization widens and increases in grade at depth. I wondered if this could be the case for Regnault/Frotet as well, and if Flood is testing this and/or other potential analogies, or planning for the near future. I did notice a few deep drill holes in the last two programs. He commented that "The disseminated bulk-tonnage lower grade mineralization is certainly a valid target here. We have encountered broad low grade mineralization in the intrusions themselves, which does not seem to be associated with veining. We will continue to test this concept going forward in other target areas, but the majority of our efforts will be focused on the high grade mineralization."

So far it is safe to assume that gold is almost everywhere at Regnault, but to what extent that would be too forward looking as Kenorland is just scratching the surface. Otherwise I am more than happy to do some first back-of-the-envelope estimates on a potential resource. But for this I need better defined, 3D, more continuous, schematic mineralized envelopes, at this stage it is simply too early. For reference to get an idea, when assuming R1 is actually a curtain or lens of 500m long, 200m deep and 3m wide, with a gravity of 2.7t/m3 and the average grade is 8g/t, this envelope alone would contain 208koz Au. Keep in mind this is estimated with an average grade, as real drill results vary much more. Also keep in mind a standard minimum mining width for a vein is 2m (smaller is possible, but costs rise), so an underground vein with a width of 2m and an average grade over about 5g/t Au can be mined economically.

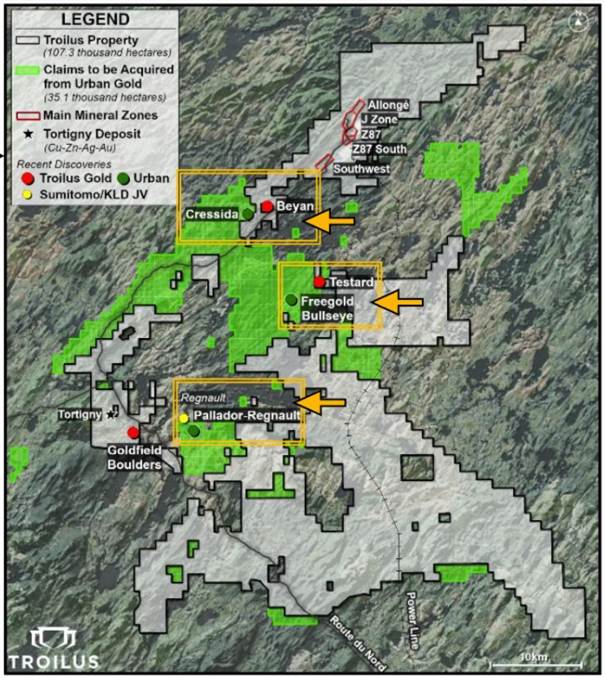

It is probably no coincidence either that Troilus Gold is consolidating lots of claims around their deposits by acquiring Urban Gold, and also prominently indicates Regnault and the Kenorland/Sumitomo JV on this map which can be found in their presentation as well:

I wondered about Flood's insights regarding the UrbanGold acquisition, if ultimately Sumitomo could buy it all, or Troilus, or Troilus buying Frotet as it is within trucking distance of their main deposit, and here is what he had to say, "I cannot comment on Sumitomo's intentions going forward; however, I think Troilus Gold was smart to acquire UrbanGold as there is significant discovery potential remaining in the belt. The Frotet Evans is very underexplored relative to the Abitibi, for instance."

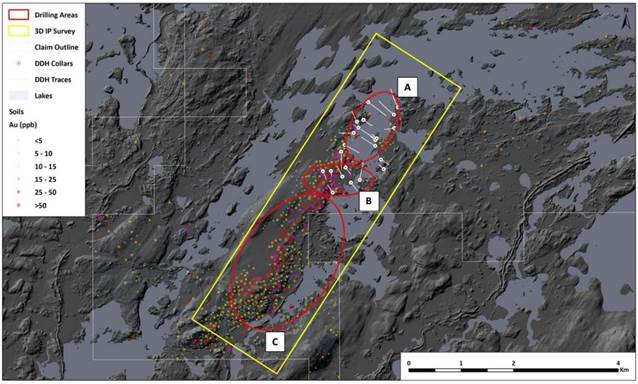

The following map indicates the zoning of this year's drill program. Part A has been completed and the results released, Part B and C have been completed and assays are pending (expected in late June, early July):

As results were expected to roll in from the first week of April onwards, I wondered why it took until the end of May. Flood answered that "we began receiving results in April; however, we wanted to receive and compile all of the drilling on Block A in order to put the results into context, specifically with regards to the definition of the R1 structure. The 3D IP survey at Regnault has been completed in addition, and resulting preliminary sections and targets were expected to be released early May." According to Flood, the 3D IP survey has been completed and more information will be released once all of the drilling results have been received and incorporated into more robust geologic and geophysical interpretations.

Management further indicated in the latest news release that a 20,000m drill program is coming online, somewhere in July:

"The company's understanding of the Regnault gold system, namely the orientation of mineralized structures, has developed significantly throughout this latest round of drilling. The R1 vein corridor is now defined as a shear hosted, laminated quartz-carbonate-pyrite vein system hosted within the intrusive complex, striking in a general east-west direction and dipping steeply to the north.

"Step-outs from this program have delineated an approximate strike of 550 meters along the R1 structure, which remains open to the east, west, and down dip. True widths along this structure are not currently well defined with the amount of drilling to completed to date. The upcoming summer drill program, which will include up to 20,000 meters of drilling, will be designed to systematically infill and step-out further along this vein corridor, both horizontally and vertically, as well as target additional gold-bearing structures throughout the Regnault trend."

Regarding their other, much larger but also much more early stage exploration projects, the Tanacross project is awaiting reconnaissance exploration (mapping, geochemistry, geophysics), followed by 2,000m of drilling starting in June of this year, to test new targets in the area. Management has also planned a 4,000m diamond drill program on their Healy project for 2021, starting in August, 2021, and will target the strongest chargeability anomalies associated with faults and coincident gold in soil anomalies. The planned drill holes will closely follow IP lines, which in turn followed the soil anomalies.

Conclusion

The Regnault target is quickly growing into the flagship project by itself for Kenorland, as new drill results returned world class values at 5.72m @ 90.56g/t Au. I am curious about the assays of the remaining 15 holes that are pending for the South Area, if they hit intercepts more or less resembling the current batch, the Regnault target zone would extend its strike length to no less than 5km. With the current amount of geological information coming in, management's understanding of geology and orientations has received a huge boost, resulting in increased efficiency when defining new drill targets. It will be very interesting to see if CEO Flood might actually have found another Troilus deposit on its very doorstep.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Read what other experts are saying about:

Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Kenorland Minerals and Troilus Gold. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kenorland Minerals and Troilus Gold, companies mentioned in this article.

Charts and graphics provided by the author.