Matador Mining Ltd. (MZZ:ASE; MZZMF:OTCQX) is the most undervalued gold stock in Canada's hottest jurisdiction of Newfoundland, says Ian Murray. Ian thought so highly of Matador Mining's potential that he came out of retirement a year ago to become its executive chairman. Prior to Matador, Ian was the executive at the helm of Gold Road Resources, overseeing its gold discovery and advancement.

Ian stated, "So here [at Matador Mining] you've got this gold bearing shear zone in a tier one jurisdiction with a very supportive, Newfoundland government and Canadian government wanting more exploration, more mine development on the island. And it can be sitting on what I think, as the saying goes, is a gold mine. It is 120 strike kilometers, which has never been tested except in one area where we've got 840,000 gold ounces. So for me, it was, 'Wow, this is fantastic. Let's build up another team here.' At DRDGOLD, that was over a tenbagger when I was running that company. Gold Road went from 5 cents to a $1.90 for shareholders. And I see at Matador, we can do exactly the same thing here. Be smart with the exploration, make the big discoveries, build up the critical mass, and then look at converting that into production and into cashflow for shareholders."

Bill: Please share about your success at the helm of Gold Road Resources (ASX:GOR) and your success in the industry.

Ian: Gold Road was a great story and the most important thing is have fun. So in Gold Road, we built up a very good exploration team. We owned an untested greenstone belt in Western Australia. It's 1,200 kilometers from Perth where I'm based; that's probably 800 miles from Perth so it's not close to the city, it's far away. And we knew that we had to discover a big enough deposit to build a new mine. You can't have a small 200,000 ounce deposit. You'd never going to be able to develop it. You needed to have 10 year plus mine life and over 100,000 ounces of gold. And I challenged the geologists; there was already a million ounces in resource, but I challenged the geologists. I said, "How do you know what you've discovered is the best system? I know you found the easiest system to find, but you haven't found the best system."

And then they went off, they did the targeting across this massive greenstone belt, came up with the targets. We then got the money, funded it, they went out and explored and then they discovered Gruyere. And we discovered it in September 2012 and we had the maiden resource by July 2013 of 3.5 million gold ounces. It's now over a 7 million ounce gold resource with a 15-year mine life with very low operating costs and generating significant cashflow. But that was my second foray in the gold mining space. I started in South Africa with a company called DRDGOLD, which is listed on the NYSE. I was chief financial officer there, and then I became managing director. And that company had 90% of its shareholders in the U.S. trading through the ADR program, and we traded 500% of our issued capital per year.

And that's a company that had old mines in South Africa, but we ran them very effectively, made good money for shareholders. And that share price was a tenbagger in South Africa with through the ADR program. I left South Africa, moved to Australia, got involved in Gold Road, built up a very good team of geologists to do the work. We found an amazing project called Gruyere, built that mine. And then I decided to retire at the end of 2018 and focus on non-executive roles.

Bill: So I want to focus on two things here, your experience with American investors, obviously with DRDGOLD, you've had experience with American investors. Matador Mining is a Australian company with its flagship project in Newfoundland in Canada. But now you've just listed on the OTCQX to reach American investors. The ticker symbol, I should note is MZZMF. The website is matadormining.com.au. So I want you to talk to my American audience, of course, but also talk about why did you come out of retirement to take on the helm of Matador Mining? What did you see with your experience? You didn't need to do it, but why did you step back into this role?

Ian: I'll first start with the U.S. shareholder base. So, in South Africa, with DRD, I used to get across to the U.S. once a quarter. Do the road shows, attend those gold trade shows down in New Orleans, New York, San Francisco. And I really enjoyed speaking with the U.S. investors. They were incredibly passionate, and that was the time when gold hit $254 an ounce. So it was the dark days, but the investors were there. They had faith that gold could go a lot higher and it has. I really enjoyed speaking to those investors and hearing their passion. And while they were diversifying away from the U.S. dollar into the gold industry, both physical gold and gold stocks.

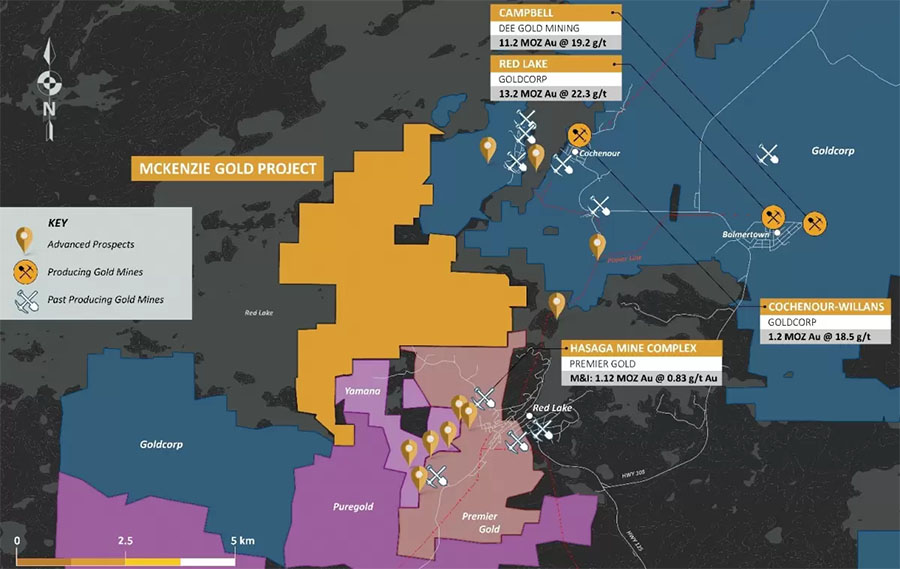

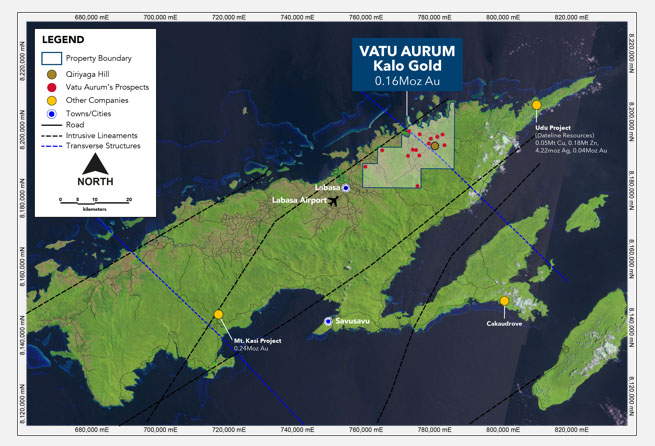

So the reason I came out of retirement, I was asked to look at this company called Matador Mining with a project in Newfoundland, which I'd never looked at before because in Australia as an Australian, there's so many Australian gold companies with projects in Australia. But I had one look at what Matador had, which is 120 strike kilometers of an untested shear zone. At the northern end of that shear zone Marathon Gold has got 4.8 million ounces. At the southern end Matador's already got 840,000 ounces. There's over 100 kilometers between those two discoveries with no exploration. In fact, over a 100 kilometer strike length, there are less than 20 drill holes ever being drilled into this area. So in Australia, or any of the known gold districts in North America, you'd have thousands of drill holes over that strike extent. So to me, this was... Going back to Gold Road Resources, what I saw there and the million ounces, but had to find the best system? And that's the question I had for the geologists in Matador. Yes, we've got 840,000 ounces, but is this the best deposit on that belt? The 840,000 ounces is where the mineralization outcrops at surface. So the original explorers there found gold at surface and kept following it down. Some 90% of the tenement is covered in transported material, shallow, transported till between half a meter to five meters.

So it's not very thick from an exploration perspective, but it is thick enough that no work's ever been done under it. So here, you've got this gold bearing shear zone in a tier one jurisdiction with a very supportive Newfoundland government and Canadian government wanting more exploration, more mine development on the island. And it can be sitting on what I think, as the saying goes, a gold mine. It is 120 strike kilometers, which has never been tested except in one area where we've got 840,000 ounces. So for me, it was, "Wow, this is fantastic. Let's build up another team here." At DRDGOLD, that was over a tenbagger when I was running that company. Gold Road went from 5 cents to a $1.90 for shareholders. And I see at Matador, we can do exactly the same thing here. Be smart with the exploration, make the big discoveries, build up the critical mass, and then look at converting that into production and into cashflow for shareholders.

Bill: I think you have good fundamental value with the deposit that you've already outlined. But as you say, you have this extreme exploration potential that you and your team see. Talk about the deposit, the Cape Ray Gold Project is your flagship. This is at the scoping study level and for my North American listeners, we refer to it as a PEA or Preliminary Economic Assessment. Go over the highlights here before we talk about your exploration program.

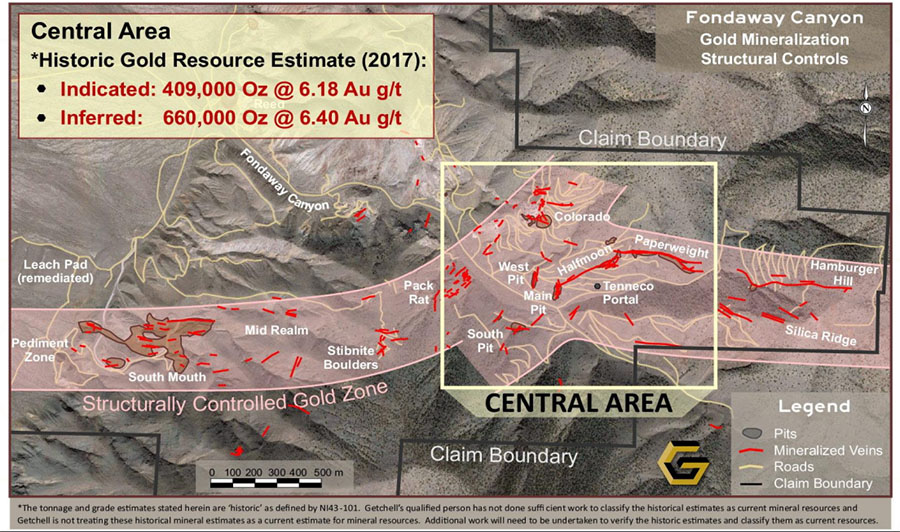

Ian: So the 840,000 ounces is in three main areas. Those three areas are within 10 miles of each other. So 10 miles north to south, you've got these three areas that host that resource. The main one is central zone with over 500,000 ounces of gold, Window Glass Hill with 230,000 ounces of gold and Isle Aux Morts at 60,000 ounces of gold. So the PEA that we published in May of last year, 2020, that looked at simple open-pit mining of these deposits. When you're talking a gold mine mineralization, the average depth is about 120 meters below surface. So these are simple open portable deposits trucked in within that 10 mile area to central processing plant. The process plant is stock standard gold mining technology. So crush, grind, chemical recovery, CIL recovery and gravity recovery giving us 96% recovery of the gold in the rock.

Of the 840,000 ounces, 480,000 ounces is the minable component of it. It's a seven-year mine life. The first four years are particularly good. The average grade mine is 2.6 grams per ton (g/t), but bear in mind, this is open pit. So 2.6 g/t, this would be one of the highest open pit mines in the world that has not yet been developed. So 2.6 g/t for the first four years, 88,000 ounces of gold per year, average AISC (all-in sustaining costs) per ounce produced in the life of mine is under $800 US an ounce. So very low operating costs. The NPV (net present value) of that project is in Australian dollars, $245 million compared to capital spend of $145 million Australian. So in U.S. dollars, you're talking roughly, probably $180 U.S. NPV relative to $100 Capex. And I mentioned those two numbers because in all the projects I've studied and then developed, the key ratio is what is the NPV compared to your capital spend? And you want that to be over 1.2. A factor of 1.2 and here we are talking a factor of 1.8.

And it's only at scoping study stage, and it's only a seven-year mine life. The other key number to bear in mind when you're looking at developing a mine is what is the payback period relative to the life of mine? And the payback period because of that good grade in the first four years is just over one year relative to a seven-year mine life. So you'll pay off the capital quickly and then the rest of the cashflow goes to shareholders. So from a scoping study perspective, what I learned a long time ago in the industry is the only two outcomes of a scoping study that you focus on, technically, are there any roadblocks that will stop you developing this project? And no, there are not. The metallurgical recoveries are very, very good.

There's a lot of space in the area where these deposits are to build the infrastructure. The project is only 25 kilometers or 15 miles away from a major town called Port aux Basques, which is also a port. So to bring in all the materials we need to build the project, we can bring it into that port and we only need to track it 25 kilometers. It's not like when we bought the Gruyere project in Australia and we had to transport the material 1,200 kilometers or 800 miles to build a project. This is 25 kilometers or 15 miles. So it's very close, easy to build, so technically there are no roadblocks to stop us going ahead. And the second key point is economically... And as I mentioned NPV to Capex ratio is very, very strong. Payback to life of mine is very, very strong.

So the next question is, well, why don't we go ahead and develop it? And the reason for that is, as I showed with Gruyere, we may not have found the best deposits there. I want to... As long as we are drilling and growing the resources, let's do that before we press the button for the pre-feasibility study. All the study work is going on in parallel with our exploration activity, but our aim is to grow the resources, so we do have a longer than a 10-year mine life and longer than or more than 100,000 ounces per year of production. And those two numbers are key to me because at a project longer than 10 years, you'll get very good, especially for a Canadian project, very good, low cost debt, which leads to low cost equity, so good returns for shareholders. And the second reason is at 100,000 ounces per year with those operating costs of less than US$800 AISC cost per ounce, you'll generate very strong EBITDA or cash flows, which can go to payback the debt, further exploration on this untested belt and, thirdly, dividends for shareholders. So, yeah, the scoping study or PEA was great, but we all believe we can continue to grow that into something that is really substantial.

Bill: And you're looking to grow it with a unique exploration method. This is what I want to get into. You are successful with this, with Gold Road. You mentioned you have 120 kilometers of strike on the shear zone and 90% is under till so it's untested in a sense, but you're employing this new method. Walk us through this new method and why we should expect better results with it.

Ian: Well, the first thing I'll say is it's not a new method. It's what all the Australian explorers use in Australia.

Bill: New method to Canada perhaps?

Ian: In Australia, we explore under 50 meters of cover, 100 meters of cover, 200 meters of cover. And this is the way we do it because the two options, either you go and you pepper the area with lots and lots of diamond holes, which is pretty much throwing lots of darts at the dart board, or you make the bullseye in the dart board a lot bigger by doing your first pass testing. So what we've proved in 2020 is that magnetic surveys show the right structures underground very, very clearly. So previously we relied on the government provided area of magnetic surveys, which are based on 200 meters spaced lines. And that gives you very vague images, but it was good enough as to discover the Angus discovery in 2020, which is the first discovery in 20 years on the belt, by a company that's only been exploring for the last two years, so great outcome for our team.

So the guys walked on the ground with magnetic backpacks, 30-meter spaced lands and we got very clear images of the structures in the area where Angus was discovered. So that's proof that magnetics give us the care structures. To accelerate how quickly we get the magnetic data, we flying magnetic surveys. So we're using helicopters, those helicopters will fly 30-meter spaced lines and 30 meters above the ground. A hundred foot lines and a hundred feet above the ground. They will do that over 45 strike kilometers, 30 miles of the belt first. So we're doing two phases of aero-mag, the first 30 miles, and then the second 30 miles, close space and that'll give us clear images of the structures at depth.

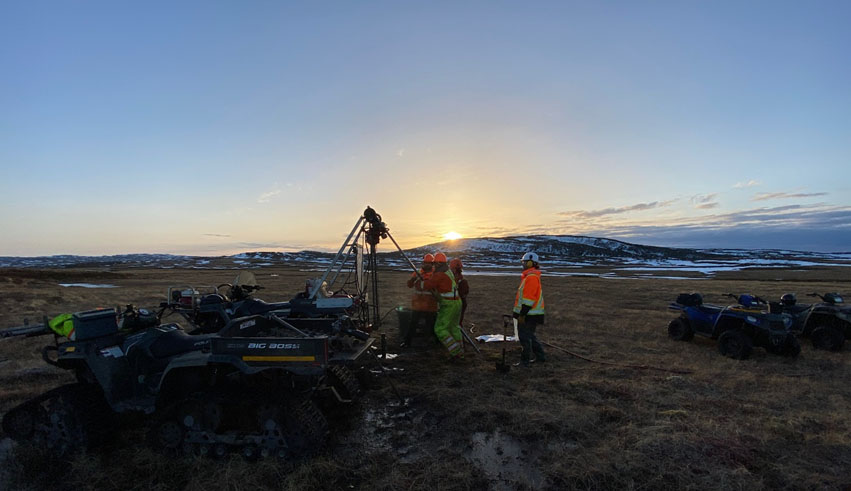

Once you've got the targets identified from that we then go in with what's called a power auger. So it's cheap, it's quick. So it's a drill rig built on the back of an ATV, all-terrain vehicle, a track-mounted ATV that can go through the swampy areas. It can go through the snow. It can get to all the remote areas. So we identify targets through the magnetic images. We then test through the transported material with this power auger. So, we drill down and we take a sample of the transported material. Once you get through the transported material and we are at the top of the fresh material, we changed the drill bit to a diamond drill bit. And we get a 20-centimeter sample of the top of the fresh rock as a diamond sample. Both of those are sent away for multi-element assays.

We test for 47 different elements, including gold, but all the pathfinder elements that we know are normally associated with gold mineralization. So through this testing with the auger rig, we don't have to hit gold. All we have to hit with it are the pathfinder elements that we know from testing on the rest of our belt, where we have the rest of our resources, these minerals are associated. So that's molybdenum, zinc, arsenic, copper, etc. So where we draw with a power auger and we get these pathfinder elements, we know we're close to gold; we refine the targeting and then we only put the expensive diamond drilling in when we've made that bullseye a lot bigger for us. So the dart is going to hit the bullseye. It's not going to hit all the other numbers around the bullseye, but we know we've got a bigger target to hit. So that's the strategy for our exploration in 2021. We're doing what we did in 2020, but we're doing it on a much bigger scale than what we did in 2020.

Bill: And one of the ways it differs from other explorers, if I understand this correctly, is that you're looking to do more shallow holes rather than spend money on deep holes. So, you could potentially outline more gold ounces because what you found thus far has been relatively close to surface.

Ian: Well, if you think of diamond drilling, diamond drills down 100 meters to 200 meters, you might get 50 to 60 meters per shift. With the power auger we'll get 10 drill holes a day. So whereas the diamond drill hole would take you four days to do, we would get 40 of the power auger drill holes, so we are testing a much bigger footprint quicker with a cheaper drilling method as well.

When it comes to the diamond drilling and you raise a good point there about the number of holes. A lot of explorers in Canada are looking for deposits 500 to 700 meters below surface. We're drilling down to 100 meters, down to 150 meters. So when we say, as we announced when we started our program, we are going to do in excess of 20,000 meters of drilling. If our average drill hole is 100 meters, that's 200 separate diamond holes, on top of all the power auger holes we doing. So it's the most cost-effective way for us to explore for shareholders. And the most important thing for us is shareholder money. It's hard to raise money from the market and we don't waste any of it. And that is why we've come up with these cost-effective approaches, which proved their success in 2020, and have proved their success in Australia over the last few decades.

Bill: And let's talk your valuation relative to some of your peers in Newfoundland. There's explorers, as you know, with some very impressive results that over a billion U.S. dollars market cap with no proven resource. There's other explorers that have an $80 million U.S. market cap with no resource. You have a resource, you have a scoping study, you have the exploration upside you just outlined. What is your valuation relative to your peers?

Ian: Our market cap is in U.S. dollars around $50 million. When we look at our peers on the island... Let's start at the top. You've got New Found Gold, which is listing on the NYAC at some stage. Market cap of $1.2 billion with no resources yet. Yes, they are getting very high-grade intercepts, but we control an entire shear zone, 120 strike kilometers untested. We know there's 4.8 million ounces at the north. We know there's 840,000 ounces in the south, and we're going to test what's in between those two now. So you've got New Found Gold at $1.2 billion. You've then got Marathon Gold who've got the 4.8 million ounce project. Their market cap is around $600 million. They've just published feasibility and they are starting their early works program to get ready for construction, so they'll be building the project for the next two years.

Then you've got the other explorers on the island. Maritime Resources, Labrador, and they were around US$80 to US$100 million, but much smaller exploration programs than ours, and much smaller tenement than ours and no current resources. So you're right, we've got 840,000 ounces. We've done the PEA. We've shown that that's very, very economic, but to me, I get really excited about what we haven't tested yet. That's where we're going to come with the big step change discoveries that will move us up in value significantly. If we compare ourselves to the Australian companies that operate in Canada, they are trading at between US$150 and US$200 million and we US$50 million, so there's a huge valuation gap. And that just comes down to education of the Australian investors, but also we've gone for the OTC listing so that we are trading in the same time zone as our project. And we are trading in the same time zone as our Canadian peers are trading, so investors in the U.S. can do the direct comparison to these other companies, see how cheap we are, and then invest in us in your time zones.

Bill: Let's talk treasury and burn rate. What's in the treasury? And how fast are you going through it?

Ian: In treasury, we've got A$8 million at the end of March; Australian dollars so that's US$5 or 6 million. We had the same number in December, which some investors may say, "How do you have the same number?" And that's because we've got a number of in-the-money options, which expire in July 2022. Those options are being exercised all the time, and when the people exercise those options, money comes into our treasury. So there's a further $5 million that will be exercised over the next 14 months. That'll come in and add to our A$8 million. So, we've got A$8 million now, but the way I look at the budget is we've got access to $13 million Australian. Our current burn rate is around a million dollars a month. So this money will help fund this exploration program all the way through to very late in the year. And at some stage, as all exploration companies, we will raise money, but we don't need to rush out and raise money now.

We did it in Gold Road successfully. You get good exploration news, you get new investors wanting to come in, you have the share price moving up, and then you can raise further capital. The other thing I would highlight for the North American investors is when we raised money in July last year, we raised it through the Canadian charity flow-through model. So when we raise money, we raised it at a 45% premium to what the normal market price is. So it's less dilutionary for our existing shareholders. And it's a great model and wish the Australian government would adopt it. Canada's got it. It's a fantastic model for the exploration companies and for the charities. So we've got the cash. We're kicking off the program. We've got more cash coming in from the exercise of the options. And we will have significant news flow through the big program that we are already rolling out.

Bill: And Ian, as we wrap it up, could you just review for us, what news flow should we expect the rest of this year?

Ian: Because we've kicked off exploration already, there'll be news flow coming through from the power auger drilling. There will be news flow coming through from the heli-mag surveys as they progress. But most importantly, there'll be news flow coming from the plus 20,000 meters of diamond drilling that we're doing. On top of that, I mentioned that we are doing all the study work in the background. So further metallurgical test work, further environmental test work that we're doing, all to prepare us so that when you press the button on the pre-feasibility study, when the resource is big enough, all that work's been done. So significant news flow, because we are so active with all the work that we are doing. We'll be highlighting new targets that get identified from the aero-mag and the power auger. And we'll be announcing drill results from the diamond core drilling that could do with the diamond rig. So lots of news; most probably every two weeks there'll be another announcement out for the market.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

[NLINSERT]Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Matador Mining is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.