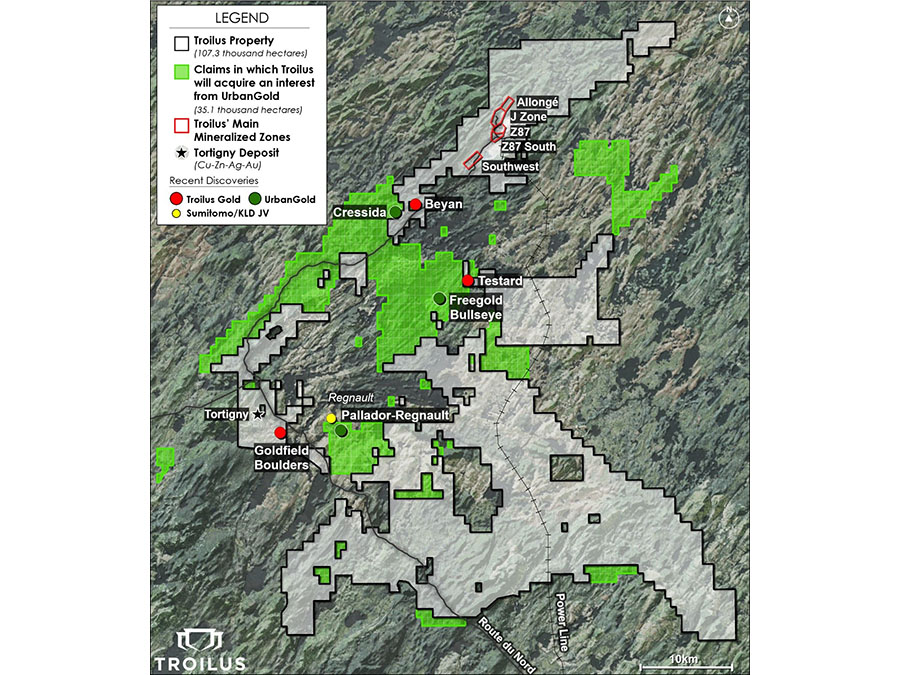

In a May 12 research note, Stifel analyst Ian Parkinson reported that "recent drilling at Troilus Gold Corp. (TLG:TSX; CHXMF:OTCQB) is highlighting additional upside to an already compelling [5,000,000-plus ounce] open pit project."

Parkinson pointed out that new drill results, from the J zone, proved that a prior assumption about the area was erroneous.

"The previous geological interpretation was the package of rock within the J zone pit was the upper gold bearing unit, but this recent drilling points to additional horizons higher in the stratigraphic sequence that were previously missed," Parkinson explained.

Recent J zone results show that mineralization exists in the undrilled area previously labeled in the preliminary economic assessment (PEA) pit volume as waste. "Drilling has transformed" the so-called waste into "resource grade rock" and "likely represent[s] accretive ore," Parkinson wrote.

Highlights from assays from the J zone and inside the PEA pit shell include 68 meters (68m) of 1.10 grams per ton gold equivalent (g/t Au eq) from 93m downhole, seen in hole ZJ21-226. Hole ZJ21-225 showed 34m of 1.01 g/t Au eq from 63m downhole.

The presence of mineralization in the "waste" area positively impacts the Troilus project in many ways, Parkinson noted. One, it widens the area of mineralization in the J zone, thereby increasing the size of the mineralized envelope and adding scale to the land package.

Two, it means there is potential to add ounces near the surface, as "more prospective rock along strike to the southwest of J Zone remains open," Parkinson wrote.

Three, the waste turned mineralization lowers the strip ratio associated with the project.

Four, it "unlocks tonnes deeper, which when drilled have usually carried higher grades," he added.

"Looking big picture beyond today's results, this drilling has the ability to widen the mineralized horizon," he wrote. "This means wider pits, lower strip, and more ounces close to surface and close to the mill. These factors should help improve PEA economics, and provide more prospective rock to showcase the scalability of the project."

Stifel has a Buy rating and a CA$4.00 per share target price on Troilus Gold; its current share price is around CA$1.26.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Troilus Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Troilus Gold, a company mentioned in this article.

Disclosures from Stifel GMP, Troilus Gold, May 12, 2021

Important Disclosures and Certifications

We, Ian Parkinson and Cole McGill, certify that our respective views expressed in this research report accurately reflect our

respective personal views about the subject securities or issuers; and we, Ian Parkinson and Cole McGill, certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this research report.

Company-Specific Disclosures:

Troilus Gold is a client of Stifel Canada or an affiliate or was a client of Stifel Canada or an affiliate within the past 12 months.

Troilus Gold has paid the research analystís travel expenses to view their material operations.

Troilus Gold is provided with investment banking services by Stifel Canada or an affiliate or was provided with investment banking services by Stifel Canada or an affiliate within the past 12 months.

Stifel Canada or an affiliate has received compensation for investment banking services from Troilus Gold in the past 12 months.

Stifel Canada or an affiliate expects to receive or intends to seek compensation for investment banking services from Troilus Gold in the next 3 months.

Stifel Canada or an affiliate managed or co-managed a public offering of securities for Troilus Gold in the past 12 months.

The equity research analyst(s) responsible for the preparation of this report receive(s) compensation based on various factors, including Stifel's overall revenue, which includes investment banking revenue.