America's largest silver producer, Hecla Mining Co. (HL:NYSE), today announced financial and operating results for the first quarter of 2021 ended March 31, 2021.

The company reported that in Q1/21 in achieved sales of $210.9 million, which it advised is the second highest amount in its 130-year operating history. These revenues represented a 54% increase over the $136.9 million of sales registered during Q1/20. Hecla Mining stated that silver production in Q1/21 increased by 7% to 3.459 million ounces (Moz), versus 3.245 Moz in Q1/20.

The firm indicated that for Q1/21 gross profit increased by $53.4 million to $64.8 million, compared to $11.4 million in Q1/20. The company pointed out that the substantial increase in gross profit in the quarter was mostly due to benefits from higher metal prices and increased production of silver, lead and zinc.

Hecla reported that in Q1/21 net income attributed to common shareholders was $18.8 million, or $0.04 per share (basic) and that adjusted net income applicable to common stockholders came in at $30.6 million, or $0.06 per share. The company further highlighted that in Q1/21 it delivered record adjusted EBITDA of $86.1 million, which was 145% higher than the amount earned in Q1/20 and is $12 million greater than any quarter in Hecla's history.

The company reported that its Board of Directors has agreed to increased the silver-linked dividend at the $25 per ounce silver price threshold by 50% to $0.03 annually and in a separate news release today announced that the board also increased each level of the silver-linked dividend by $0.01 per year.

Hecla Mining's President and CEO Phillips S. Baker, Jr. commented, "The strong performance Hecla has had in five of the last six quarters continued in the first quarter of 2021 with the second highest sales in our history, a new record for EBITDA and gross profit on sales that is about a third higher than the next closest quarter...Free cash flow generation was the most Hecla has had in the first quarter in a decade. Since the first quarter is typically our smallest quarter, we anticipate cash flow increasing over the rest of the year. Therefore, the Board has increased the silver-linked dividend at the $25 price threshold by 50% to $0.03 per share annually."

"The backdrop for silver remains very positive with improving industrial demand due to global policies that support green energy where silver is a key component, strong investment demand and tight supply. Hecla is in a key position as the United States' largest silver producer, mining more than a third of all U.S. production, which should increase as our U.S. silver production is anticipated to be 15 million ounces by 2023 with the Lucky Friday's silver production expected to increase to 5 million ounces by then," Baker added.

The company stated that its Greens Creek Mine in Alaska produced a total of 2.6 Moz silver and 13.266 Koz gold in Q1/21, compared to 2.8 Moz silver and 12.273 Koz gold in Q1/21. At the Casa Berardi Mine in Quebec, the firm said that in the current quarter it produced 36.190 Koz gold, which was 35% higher than the 26.752 Koz gold it produced in Q1/20.

The company provided some forward guidance for annual production and cost estimates during the next three years. Hecla Mining stated that for FY/21 it expects total production of 12.9-14.0 Moz silver and 185-193 Koz gold.

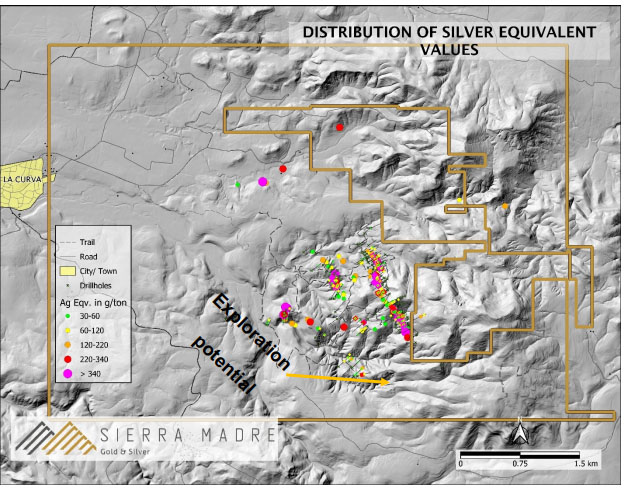

Hecla Mining Co. is headquartered in Coeur d'Alene, Idaho. The company operates the Greens Creek and Lucky Friday silver mines in Alaska and Idaho and is becoming a growing gold producer at its Casa Berardi underground/open pit gold mine located in western Quebec, Canada. The company has a portfolio of six exploration and one pre-development properties in seven different silver and gold mining districts in the U.S, Canada and Mexico. The company operations benefit from production of both precious and base metals zinc and lead, which the firm indicates serves to provide a natural revenue hedge.

Hecla Mining started the day with a market capitalization of around $3.3 billion with approximately 535.3 million shares outstanding and a short interest of about 1.9%. HL shares opened 2.5% higher today at $6.41 (+$0.16, +2.56%) over yesterday's $6.25 closing price. The stock has traded today between $6.41 and $7.315 per share and is currently trading at $7.26 (+$1.01, +16.16%).

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.