Energy demand continues to steadily rebound from the COVID crash, but several measures of supply show a continued downturn in oil inventories. Though members of the OPEC+ coalition plan on increasing their crude output over the next several months, OPEC has also upped demand and economic growth forecasts. In the U.S., production is expected to hold steady for some time while the shale industry continues to re-invent itself as a profitable business, less focused on pumping out barrels at a loss.

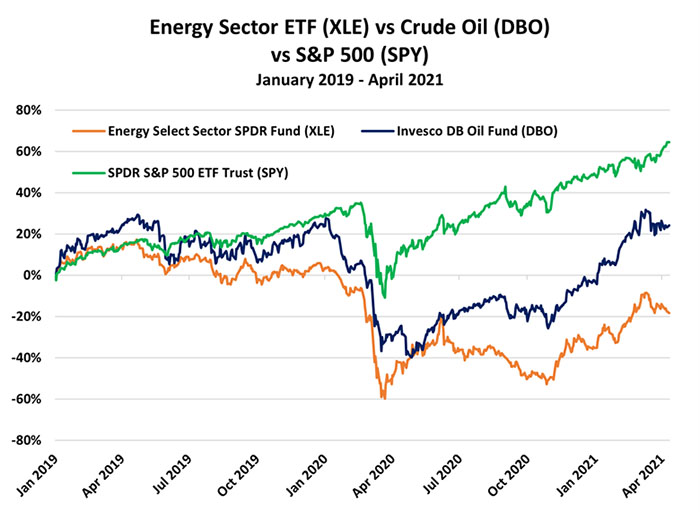

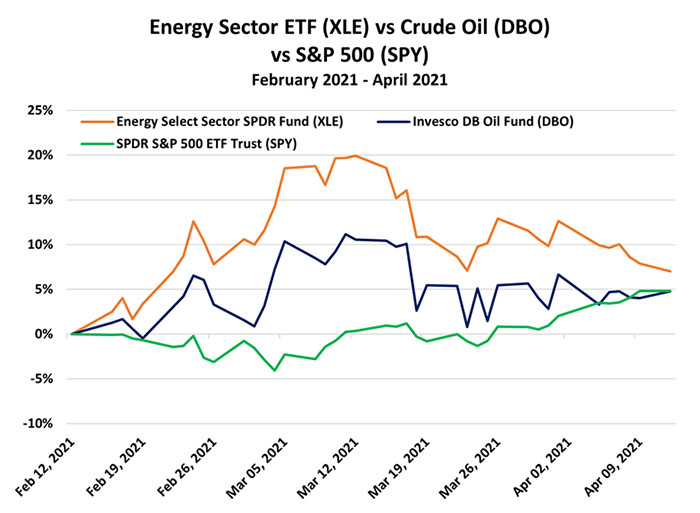

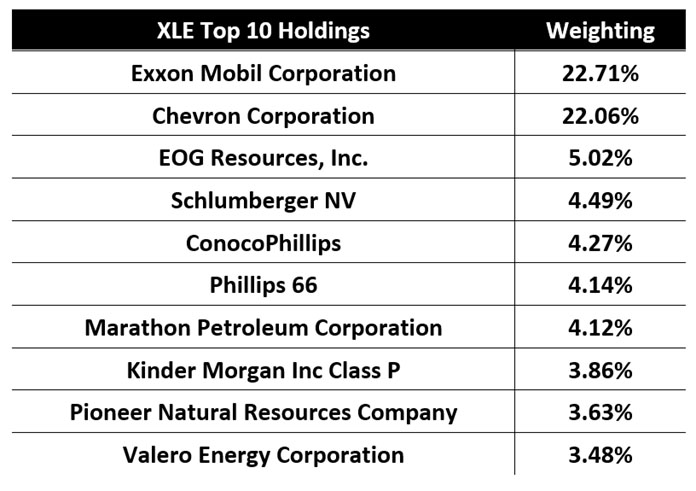

Related ETFs: Energy Select Sector SPDR Fund (XLE), Invesco DB Oil Fund (DBO)

OPEC+ Projects Demand Amid Shrinking Supply

Crude futures rose last week after the 23-country OPEC/non-OPEC coalition known as OPEC+ (each group headed by Saudi Arabia and Russia, respectively) decided to increase production by more than 2 million barrels per day (bpd) over the next few months. Such a decision would usually send prices tumbling. Instead, investors read it as a bullish development as they awaited new energy demand and economic growth estimates from OPEC.

Indeed, OPEC announced that the bloc increased its 2021 global oil demand forecast by 100,000 bpd and raised its forecast for global economic growth by 0.3 percentage points to 5.4%.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on April 13.

Additionally, OPEC recently revealed it expects oil inventories to drop by about 445 million barrels in 2021 in the latest supply and demand outlook. Per Reuters, figure is larger than the implied 2021 stock draw of 406 million barrels seen a month ago by OPEC.

On the back of those developments, analysts at Jefferies increased their oil price view, lifting their long-term Brent oil forecast to $58 from $55, citing recovering demand as the vaccination rollout continues and a lower supply risk from the high levels of OPEC+ spare capacity. Additionally, MarketWatch notes that Exxon was upgraded by the analysts to hold from underperform, though it said Chevron's investment case combined a higher cash flow yield and higher upstream growth potential.

That relative decline in reserves coincides with an even longer-term downturn in exploration and project development, culminating in a 25% decline in the average reserves of major international oil companies (IOCs) since 2015. Per Forbes, those IOC reserves, which include ExxonMobil, Chevron and Royal Dutch Shell's, now stand at less than 10 years of annual production.

US Production Steady, Ushering in More Conservative Shale Industry

In another bullish development for crude prices,

Currently, West Texas Intermediate (WTI) crude oil futures are bumping up against $60 after starting the year around $48.50, a YTD increase of about 24%.

Prior to the pandemic, US crude production was topping out at a much higher 13 million bpd. Even before the COVID-induced oil crash that sent WTI futures into negative territory, constant overproduction pushed prices below the breakeven levels of many drillers and created a sea of red ink in the shale patches. MRP repeatedly warned of an eventual spike in bankruptcies and loss of production in the shale industry, going all the way back in 2018.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on April 13.

Between 2010 and 2020 the industry had negative net free cash flows of $300 billion, more than the annual revenue of Exxon Mobil, according to a study last year by accounting firm Deloitte.

Through mid-2019, well before the COVID-19 pandemic began, EQT's former CEO Steve Schlotterbeck noted that there had already been 172 bankruptcies among exploration and production companies engaged in the shale oil and gas business just since 2015. COVID was the final catalyst that broke an industry already in desperate need of reform.

Through 2020, a huge portion of investor capital in shale was wiped out, forcing an overhaul of how investors approach the industry. Not only are investors demanding a more steady and conservative approach to drilling—one that will actually make money and not require constant capital injections—but a more environmentally friendly approach as well.

As Forbes recently noted, Occidental Petroleum became the first major U.S. oil company to announce a net-zero emissions target last year while Pioneer Natural Resources recently set a 2030 target to reduce its greenhouse gas intensity. The American Petroleum Institute (API) has even endorsed putting a price on carbon.

In January, MRP highlighted this ESG-induced shift in the energy industry toward more sustainable goals, including an acceleration of big oil's plans to diversify their energy offerings with renewable capacity.

Saudi Arabia Takes on Stronger Budget Demands, Continued Terror Threats

Along with the U.S., it is unlikely that we see Saudi Arabia rushing to significantly boost its output anytime soon. As we wrote last month, the Kingdom is probably happier to trade some of its own production for the potential of much higher prices in the here and now. The world's largest crude exporter is working to recover from a 2020 where oil revenues plummeted 30.7% YoY to $109.81 billion.

Additionally, higher crude prices are necessary to help fund Crown Prince Mohammed bin Salman's KSA Vision 2030 project, a national investment initiative that includes major projects in 5G technology, renewable energy, entertainment venues and several other sectors of the economy. Obviously, the buildout of such a blueprint will require a significant amount of fiscal stimulus, but as MRP has noted since 2019, Saudi Arabia's budget and external positions are not sustainable in the long term at oil prices below $70. Per the latest International Monetary Fund (IMF) projections, the Saudi Kingdom needs an oil price of $68 per barrel to balance its 2021 budget. With improving balance in the oil market, it's right on target to meet that goal—one that is even more critical now that Saudi Arabia's economic diversification is likely to cost $7.2 trillion.

Energy investors should also consider ongoing instability in the Arabian Peninsula, making Saudi energy facilities a perpetual target for terrorism.

As Bloomberg writes, the Houthi rebels—an anti-Saudi militia engaged in Yemen's ongoing civil war—attacked Saudi Aramco sites in the eastern oil terminal of Jubail and the western city of Jeddah with explosive-laden drones. Saudi television reported the explosives were intercepted by the Kingdom's military.

Just over a month ago, news broke of a similar attack, as the Houthis launched a drone-based attack on the Ras Tanura port, the site of Saudi Aramco's oldest and largest oil refinery and the world's biggest offshore oil loading facility. Though the 550,000 bpd facility supplies over a quarter of the Kingdom's fuel supply, the Kingdom states no damage or casualties have been reported. At the time MRP noted more pressure would be on tap, as the Houthis have continued to step up their attacks on the Saudi Kingdom.

This latest attack shows the Houthis are prepared to continue its campaign of targeting Saudi energy infrastructure. Back in September 2019, the Yemeni militia struck their most significant blow to major Saudi Arabian oil installations, when a drone attack brought half of the Kingdom's total output (5.7 million bpd) offline—equivalent to 6% of the global supply of oil. In the aftermath, Brent crude futures rose as much as 19.5% at the next day's open, the biggest jump in crude prices on record.

Theme Alert

Based on supply-side trends that have bolstered crude oil prices in recent months, MRP added LONG Energy to our list of themes on February 12, 2021. Shares in the space have suffered several years of underperformance, as exhibited in the Energy Select Sector SPDR Fund (XLE). We believe that trend is set to reverse with energy prices remaining buoyant for months to come.

Additionally, energy demand is picking up quickly in the U.S. market, with some products closing in on pre-pandemic consumption. Gasoline demand, for instance, jumped by 1 million bpd at the end of February, totaling almost 8.8 million, data-analysis firm Descartes Labs reported. That's close to estimates of demand just slightly above that level at this time last year.

According to Wood Mackenzie, the biggest oil firms could see record cash flows this year if oil prices average $55 per barrel as corporate cash flow breakevens have now reduced to a mean of just $38 per barrel from $54 before the COVID crisis.

Since we added the theme, the XLE has outperformed, returning +7% versus the S& 500's gain of +5% over the same period.

Originally published April 13, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

|

|

Sign Up |

Disclosure:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.