To you from failing hands we throw

The torch; be yours to hold it high.

—from the poem "In Flanders Field;" 1915

I have a confession to make: I am reaching the end of my personal level of nonviolent tolerance when being forced to listen to non-elected "authorities" standing in front of TV cameras reading their "prepared notes" from teleprompters without the vaguest clue as to what they are talking about.

Worse still are the elected "representatives of the citizenry" of any country, state or province, standing in that very same spot ordering the populace to "stay indoors" while warning that the police have been instructed to issue citations (or arrest) those in violation of an order that has never been enacted into law.

Whether they are politicians or bankers or bureaucratic buffoons of questionable agenda, all of them should be gagged and bound and carted off to a facility of incarceration with zero chance of release back into the "general population." They all represent an ever-increasing threat to not only my sanity but also, and more importantly, to my personal liberty.

I reside in a country whose citizens are known the world over for their civility. Canadians are usually a pretty laid-back group, rarely voicing complaint or even irritation over day-to-day inconveniences such as long lines at the beer store or wearing silly masks designed to prevent the spread of viruses. The other day I forgot my mask when entering the local post office and when this battle axe of a postal clerk screamed that I should "Get a mask or leave the store immediately," I calmly turned to her and said: "I have a medical condition that prevents me from wearing one." Her face, which had been contorted like one of the witches in Shakespeare's "Macbeth," slowly began, in agonizing graduality, to return to its normal state of "scowl" as she searched frantically for a suitably authoritarian comeback. Failing miserably, she harrumphed her way back behind the counter and mailed my package with nary a word said.

This is what happens to a populace that would normally not raise one blood pressure degree even if a bomb went off in the town square. People whose conduct over forty decades has been exemplary (if not docile) have been transformed into shrieking hydras of distrust and condemnation. Furthermore, everybody has become a "COVID Cop," with fingers pointed and cell phones aimed at any and all possible transgressors, quick to report anyone who is even mildly tilted in the direction of lifestyle normality and historical routine.

The arrival of the global pandemic in the first quarter of 2020 marked a watershed of sorts in the machinations of the banco-political cartel that controls Western society. Since then, there has been a subtle shift in the emphasis of policy initiatives in both Canada and the U.S., but it is also being felt in Australia and New Zealand, and to a lesser degree in Europe. With mass shootings in the U.S. totaling forty-five in the month of March alone, there has arisen a growing dread by those in charge that the "have-nots" who dominate the American population base have finally decided that they no longer wish to be the personal doormats for the Hampton crowd and, only as can happen in the States, guns are as good a means of protest and "policy adjustment" as speeches or elections.

For the last three decades, the banco-political cartel followed the old "Trickle Down" economic policy, which states that if you look after the rich through tax cuts and credits, their excess cash will "trickle down" to the lower classes as jobs are created, and wealth will be redistributed naturally and organically throughout the population, thus allowing everybody a legitimate shot at the realization of "The American Dream" The problem with that lies in the outcome of such a policy, which saw the entire manufacturing sector of the U.S. economy completely gutted by globalization, and forced families into DINK (double income no kids) lifestyles mainly in service industries that required college degrees and penalized the high school-only graduates that used to stock the automotive and textile sectors for decades.

So, after the dotcom meltdown in 2001, the central bankers and the politicians embarked on a manic bubble-blowing extravaganza in an effort to recapture the heady days of 1990s prosperity and balanced budgets brought to bear during the Bill Clinton lovefest (at which he was particularly adept). Before you could say "quantitative easing," the world had a Wall Street-engineered "Great Financial Crisis" that resulted in the "Great Financial Bailout" (by the taxpayers of the banks). This, in turn, led to record budget deficits and a Federal Reserve balance sheet floating in the stratosphere, while the top 1% of wage earners in the U.S. (and abroad) are sitting with the greatest percentage of financial and real estate assets in history.

All this while Joe Six-pack waits for his "stimmy check," having given up on finding a job because McDonald's had installed robotic burger-flipping machines all in the name of "enhanced productivity."

However, as the elites beg citizens to take a needle so the germs they "think" are causing the illnesses cannot be spread, and as the global economy (sans Canada) opens up and returns to normality, I am seeing signs that, at first glance, were subtle but have become more recently a blatant shift in the tone and texture of policy initiatives. Whereas the 2009-2021 period was dominated by ensuring the survival and prosperity of the elite class through monetary policy, this new paradigm, arriving with mass shootings and growing social unrest, represents the passing of the torch from the central banks that control the "price" of money to the politicians that control fiscal policy and therefore the "allocation" of money.

From Greenspan to Powell, and including all of the sock puppets in between, there has been a fifty-year campaign to keep the wealth "where it belongs" (in the hands of the wealthy). But now that the doormats are no longer quietly allowing shoes to be wiped on their backs, the onus of civil order has been passed ("with failing hands the torch: be yours to hold it high") to the government bodies whose job it is to ensure that these bearers of pitchforks (and torches of their own) are mollified back into behavioral complacency through fiscal largesse that can only be provided by government.

What this means for me as an investor is that no longer will the Fed's moves be linked to the current rate of inflation, but rather to the average rate of inflation. What this means is that they will stay "accommodative" even if inflation rates hit 5–6%, because those are "average," not "current."

It also appears to me that with the Biden Administration's stimulus packages (which include infrastructure) are designed to target wages, because the best way to reduce these mass shootings and accelerating public demonstrations is to throw money in the form of jobs at the problem.

With the average portfolio manager having thrived over three decades of Fed-orchestrated disinflation, where a 40% position in long bonds represented an insurance policy for the equity holdings, this new paradigm has removed that insurance, because fiscal policy targeting accelerating wage growth virtually guarantees that the "average inflation rate" is going to overshoot the level at which portfolios start to implode. Not only will stock portfolios implode, think about the highly-leveraged holders of government bonds, where a 50-basis-point jump in yields vaporizes the equity. Then consider the interest cost to the government that happens when yields rise, although it will be "de minimis" only because the Fed will eventually own all of the government debt anyway.

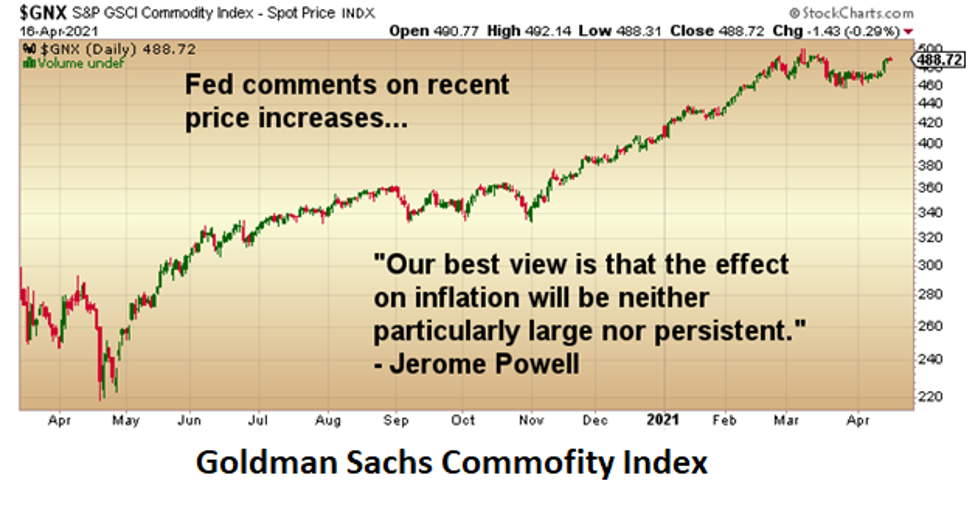

What this means to me is that I must construct a portfolio that will be able to successfully navigate a financial landscape that no longer promotes disinflation, but one which actively and aggressively promotes wage inflation at the expense of price inflation. When the carnival barker that runs the U.S. Fed tells you, while commenting on recent consumer price increases, that "our best view is that the effect on inflation will be neither particularly large nor persistent," he is contradicting himself from the outset, because price increases at the consumer level are "inflation." What astounds me is the callousness with which JayPo dismisses "maintaining price stability," one of the two primary mandates of the Fed and the reason for its very existence.

Portfolios that I own are overweight gold and silver, and more recently copper and uranium, as I attempt to not only adjust for this gargantuan shift in policy but also profit as entire generations of portfolio managers and wealth advisors clamor to take advantage of actively promoted fiscal and monetary policies that invite inflation rates not seen in over forty years. This assumes that increased volatility is in the cards, but also increased uncertainty. What is certain is that bonds, both sovereign and corporate, are not where you want your wealth to be stored.

As the torch of banco-political policy is passed "from failing hands," it is important to know "to whom" it is being passed. Once you have that figured out, we must all remember the immortal words of the late U.S. President Ronald Reagan : "As government expands, liberty contracts."

Smart man, the Gipper was.

Originally published on Saturday, April 17, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at [email protected] for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.