This StreetSmart Live! episode began with an explanation of the royalty business model. These types of companies develop a diversified portfolio of royalties on assets that are expected to generate cash in the future, said Spencer Cole, executive vice president, North America, for Vox Royalty Corp. (VOX:TSX.V). They acquire these royalties, typically a percentage of future revenue from a potential mine, from a prospector or junior explorer that has a discovery but no funds or desire to build a mine. The buyer may or may not fund the building of the mine. In the latter case, as is the situation with Vox Royalty, it purchases royalties from a third party.

David Talbot, managing director of equity research at Red Cloud Securities, noted that royalty companies have limited downside. Compared to operating companies, they have less direct exposure to operating risks, are not directly affected by capital or operating costs and are not subject to cash calls. Because these businesses do not need a large operating or management team, their corporate general and administrative costs tend to be low.

"Ultimately, it's just a very efficient business model," Talbot said.

When considering a royalty/streaming stock, he said to look at for four key factors. One is whether the company has a commodity mix, in terms of companies and jurisdiction. The second is the property owners and operating partners; know who they are. The third is the type of royalty or royalties in place, as "not all royalties are created equal." The many kinds include net smelter returns (NSR), net profit interest (NPI), working interest (WI), gross overriding and sliding scale.

"A 5% NPI or WI royalty is not worth as much as a 5% stream, and neither is worth as much as a 5% NSR," Talbot said. "Sometimes it comes down to the underlying associated cost."

The final factor to consider is whether the company has potential for organic growth because future cash flow is more important than current cash flow. Larger royalty companies like Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) and Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) can afford to buy or create royalties or streams on advancing mines, but most juniors, like Vox, cannot. Thus, it is preferable to see the smaller companies acquire a little bit earlier and build a portfolio of royalties that have yet to reach their ultimate value.

"Essentially, for deep value creation, you want to see a pipeline of exploration and development growth in a broad, diversified portfolio of cash flowing assets," Talbot advised. "For those good quality assets, any future resource estimates, production increases, discoveries can certainly help expand the life of that cash flow at no further cost."

Streetwise Live! Moderator Cyndi Edwards introduced Vox Royalty by way of noting various analysts rate the company Buy and have target prices on it between CA$4–6 per share. At the time of the broadcast, the company was trading at about CA$3.40 per share.

Today, Vox Royalty has a portfolio of 74 third-party royalties, transacted 19 deals in the past two years and has been public for only 10 months. Most of the assets associated with its royalties are in precious metals, with some in copper and vanadium.

"Vox Royalty was created to be a better risk-adjusted opportunity for investors to get exposure to the commodity sector," said CEO and Chairman Kyle Floyd. "We built a company with specific competitive advantages for the industry and a mission of driving accretive growth for shareholders."

Vox Royalty differentiates itself from its competitors in two ways, Cole noted. One is with its proprietary database containing nearly 8,000 hardrock mining royalties, compiled over a decade. This intellectual property allows Vox Royalty to identify hidden and forgotten royalties. Through its database, Vox Royalty discovered and acquired some royalties from atypical owners: one in iron ore from a telecom firm, one in gold from a hearing aid company and some from an automotive entity. Because it has so many to choose from for potential acquisition, the company can be, and is, picky and disciplined in its ultimate selections.

The second factor setting Vox Royalty apart is its technically focused management group composed of mining engineers and geologists who have worked on every major mining continent, with all types of deposits and for well-known industry names. Vox's team is critical to evaluating assets and understanding where the value and key risks lie with each royalty it considers.

"When we do allocate capital, it's in a very technically informed way where the risk-adjusted returns are maximized for our investors," Spencer added.

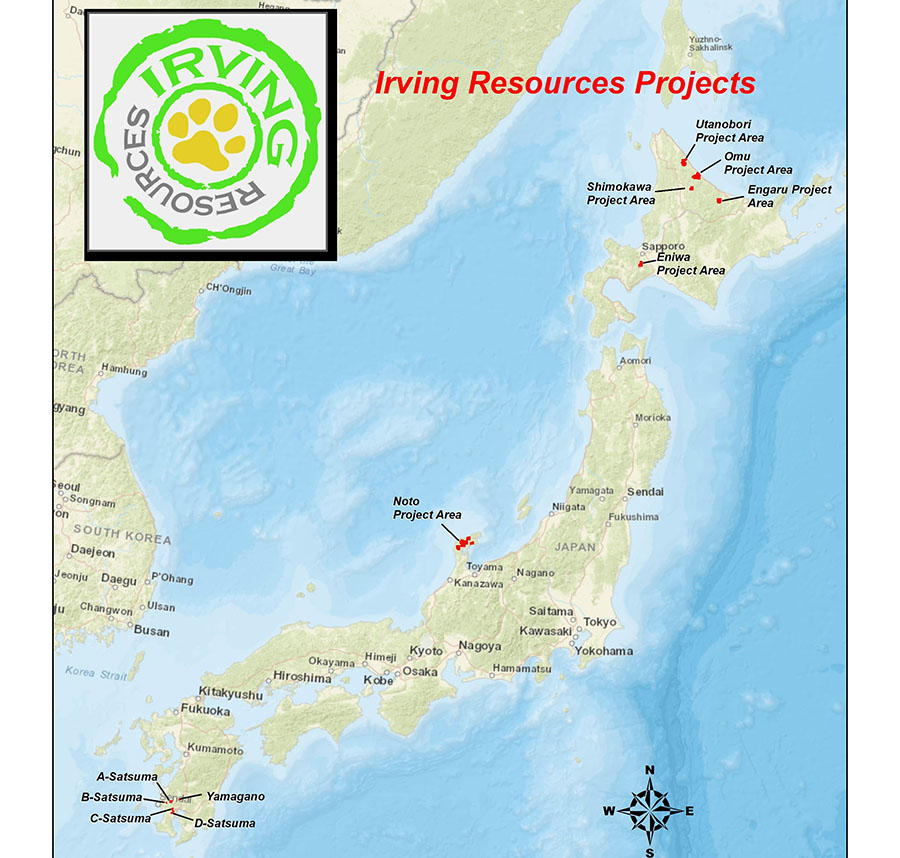

Vox Royalty aims to acquire royalties in various jurisdictions but only ones with low geopolitical risk. Thus, 80% of the royalties in its portfolio are on assets in Canada, the U.S. and Australia.

The company considers Western Australia the No. 1 mining jurisdiction for gold and one of the safest and most stable places worldwide in general. The fundamentals, the geology and the prospectivity of its greenstone belts are ideal. Further, because the locale has seen fewer than 1,000 COVID-19 cases, the mining business has continued there relatively uninterrupted. (Similarly, the pandemic has not significantly affected Vox.)

When some pending transactions close, Vox Royalty will own 25 royalties in Western Australia, and 20% of its assets will be in Australia. The company is the second largest holder of royalties on that continent, where it has "great first mover advantage."

When Vox's management team members evaluate new opportunities, Cole said, they consider a royalty's upfront and a reasonable price to pay for it, but also and equally important, the growth catalysts for the asset, so investors benefit from royalty cash flow. Some of what Vox Royalty looks at are the number of meters being drilled, the release date of a feasibility study and the time when production could begin.

What Talbot likes about Vox, he said, are the company and its high activity level, its experienced management, its base of a good precious metals mix, its edge-providing proprietary database, its diversification in opportunities, commodities and jurisdictions and its cost- and risk-lowering concentration on third party assets.

"We expect continuous deal flow," Talbot added. "We expect a lot of catalysts here; there is significant organic growth as their assets mature toward production."

Vox Royalty is currently trading at a discount to its peers because, Talbot said, it is an emerging "cash flow vehicle. As the company grows, I think this valuation gap will really shrink."

Floyd said analysts generally estimate Vox Royalty revenue this year to grow organically to $6 million and next year, to $8 million, but the company itself expects to exceed those figures.

"Exponential growth in revenue is going to continue really at this point as far as the eye can see as we continue to have acquisitions and organic growth, seeing further assets acquired and other assets go into production," Floyd purported.

In the short term, Vox Royalty intends to continue delivering organic growth, finding and acquiring, at increasing velocity, assets that will provide shareholders value over the long term. Further out, the company plans on continuing to execute its current strategy.

When asked why investors should get into Vox Royalty now rather than waiting, Floyd said, "We're gaining critical mass by the day both in terms of overall portfolio and in terms of current and future expected cash flow growth. . .We believe our business model at the end of the day will warrant a premium valuation in the sector. So that's all essentially very significant upside to our investors."

Talbot described Vox Royalty as a long term investment, one in which investors are buying for future organic growth.

"Once investors are in the company, they have little to do except follow and count the money as it comes," he said.

To conclude the broadcast, Edwards played a video that depicts and explains what Vox does and how it does it.

CEO Floyd followed with a final comment to viewers. "We're excited about what Vox Royalty is building for our shareholders," he said. "We hope to have you as part of the journey with us."

View the broadcast here:

Read what other experts are saying about:

Streetwise Reports Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Vox Royalty, Franco-Nevada and Osisko Gold Royalties, companies mentioned in this article.

Streetwise Live! Disclosures:

1. The following companies discussed in this broadcast have paid a fee to participate: Vox Royalty.

2. This broadcast does not constitute investment advice. Each viewer is encouraged to consult with his or her individual financial professional and any action a viewer takes as a result of information presented here is his or her own responsibility. This broadcast is not a solicitation for investment. Streetwise Live does not render general or specific investment advice and the information should not be considered a recommendation to buy or sell any security. Streetwise Live does not endorse or recommend the business, products, services or securities of any company mentioned here.

3. Statements and opinions expressed are the opinions of the presenters and not of Streetwise Live or its officers. The presenters are wholly responsible for the validity of the statements. The presenter was not paid by Streetwise Live for this broadcast. Streetwise Live requires presenters to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Live relies upon the authors to accurately provide this information and Streetwise Live has no means of verifying its accuracy.

4. From time to time, Streetwise Live and its directors, officers, employees or members of their families, as well as persons interviewed for broadcasts and interviews on the site, may have a long or short position in securities mentioned. As of the date of this broadcast, officers and/or employees of Streetwise Live (including members of their household) own securities of the following companies discussed in this broadcast: Vox Royalty. Vox Royalty is not a billboard sponsor of Streetwise Reports, an affiliate of Streetwise Live (description available at https://www.streetwisereports.com/disclaimer/).

5. Kyle Floyd is CEO and chairman, and Spencer Cole is executive vice president, North America, of Vox Royalty; both own securities of the company.

6. Disclosures for Red Cloud Securities Inc. and David A. Talbot, Managing Director, Head of Research: I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: None. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: Vox Royalty Corp. In the last 12 months, Red Cloud Securities Inc. has performed investment banking services or has been retained under a service or advisory agreement by the issuer. In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or the analyst involved in the preparation of the research report has received compensation for investment banking services from the issuer.

7. Disclosures for Cyndi Edwards, moderator: I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: None. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: None