Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB) could be the next gold-silver producer in British Columbia, Canada, toll-milling high-grade, stockpiled ore from two properties (~30,000 tonnes in total) starting as soon as April/May, then potentially operating at 100 tonnes per day (tpd) from its flagship Dome Mountain project this winter.

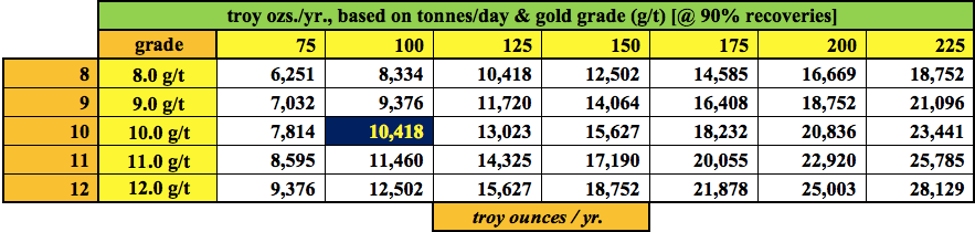

In 1H/2022, the company hopes to be running at 200 tpd. The permits allow for up to 75,000 tonnes/year. Depending on grades/recoveries, that could amount to >20,000 (20k) Au equivalent (Au eq.) ounces/year.

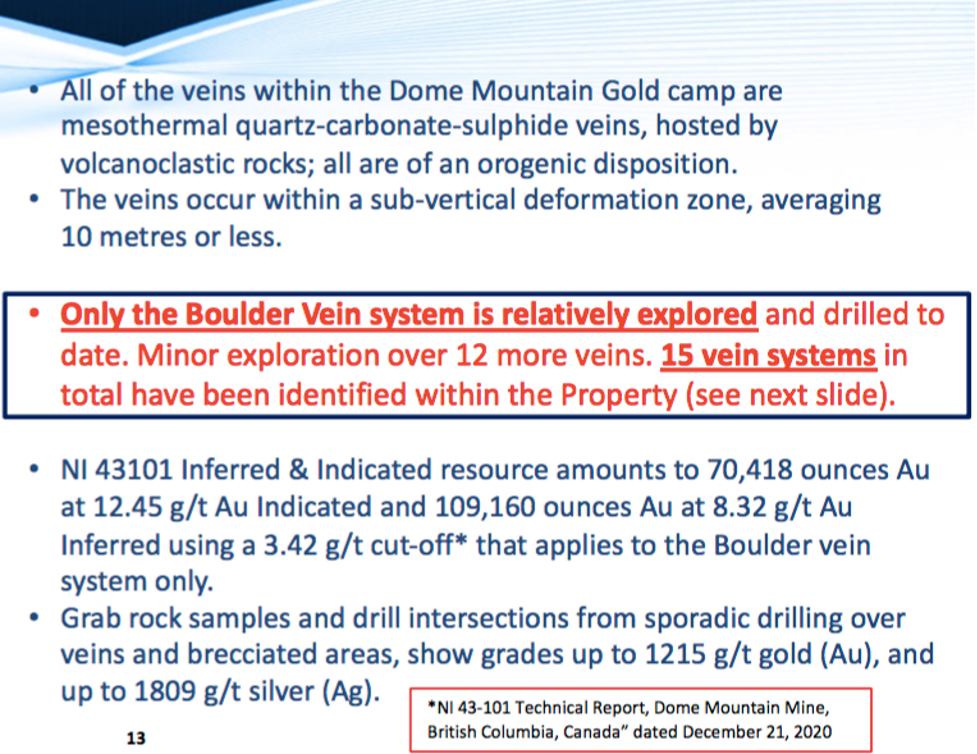

In today's dollars, >CA$100M has been spent on just a small portion of Dome's nearly 19k-hectare footprint. Management believes they can possibly deliver a new resource containing ~1 million (1M) high-grade ounces. That would be on <10% of Dome's property. Amazingly, there are 15 high-grade vein systems at Dome Mountain that have never been drilled.

How high-grade? The current resource is ~10.2 g/t gold equivalent. If Blue Lagoon can book 1M ounces in its next resource estimate at close to 10 g/t Au eq., it would be sitting on a top 5% (in terms of grade) pre-production project globally.

From there, management sees potential for a multimillion-ounce deposit, due to those 15 high-grade vein systems. Blue Lagoon is in great shape financially, with an enterprise value (EV) (market cap + debt – cash) of $32M, ($5.5M cash, zero debt).

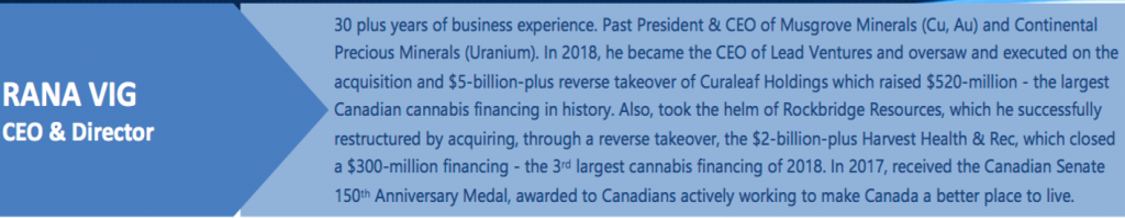

To find out more about Blue Lagoon, how soon it might reach production and its vast blue-sky exploration potential, I caught up with the very busy CEO of the company, Mr. Rana Vig.

Peter Epstein: Please give readers the latest snapshot of Blue Lagoon Resources.

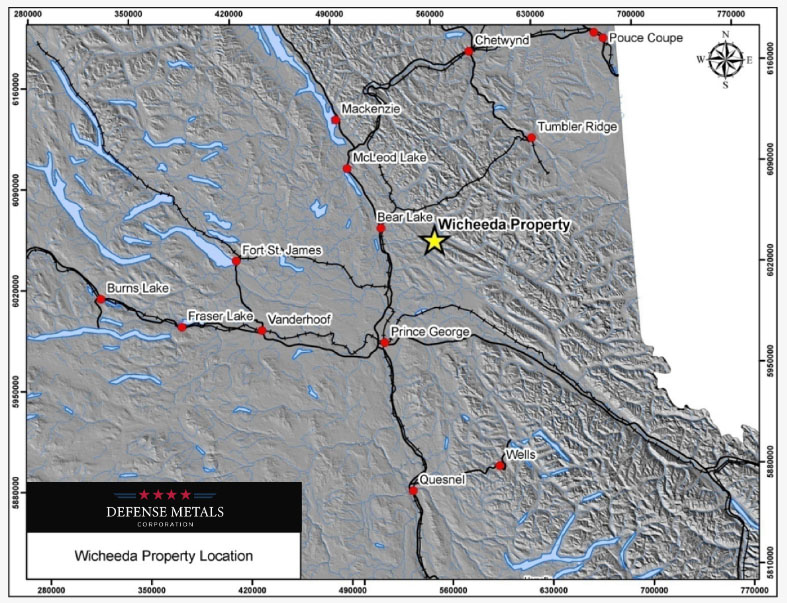

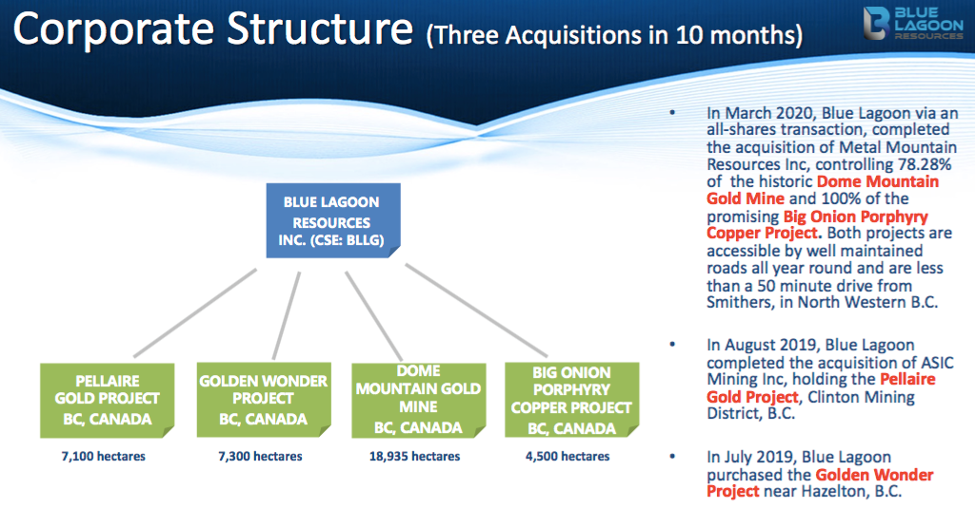

Rana Vig: Blue Lagoon Resources is focused on the past-producing, 18,935-hectare, Dome Mountain mine, a high-grade gold-silver project in northwestern British Columbia (BC). Permit amendments are expected to be completed in April/May, allowing us to submit documentation to the Mines Ministry for final review.

We expect to make a start production decision this fall, hoping to commence operations at ~100 tonnes per day (tpd), growing to ~200 tpd in 1H 2022. We're permitted for 75,000 tonnes per year (tpy).

Dome Mountain has a small but very high-grade deposit covering <10% of the property. The Indicated + Inferred resource totals ~191k ounces at a weighted average grade of~10.2 g/t Au eq. The resource was based on 398 drill holes totaling 39,398 meters from 1985 to 2016. The remaining 90%+ of Dome hosts at least 15 more high-grade vein systems that have never been drilled.

Our goal is to deliver a new resource estimate of around a million high-grade gold equivalent ounces, on the way to a potential multimillion-ounce resource across our 19k-hectare footprint.

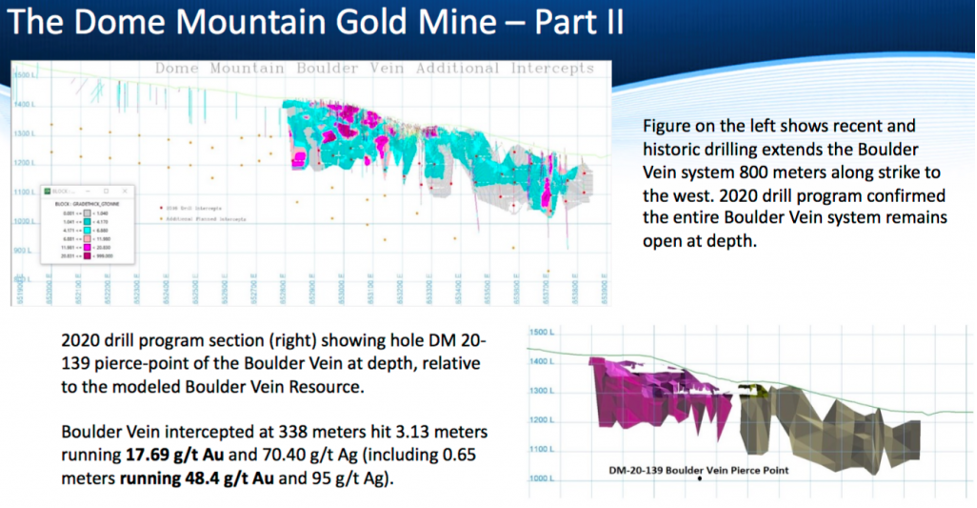

The reason we feel confident about delivering such a large resource increase is that we know there's high-grade gold-silver mineralization over a 800-meter (800m) strike length to the west (still in the Boulder zone).

We know this because of drill holes that did not make it into our resource due to spacing. Infill drilling will resolve that. And, we know there's high-grade mineralization beneath the current resource. For example, last year we hit ~18.7 g/t gold equivalent over 3.1m, ~140 meters below the deepest hole in our existing resource.

Production from Dome Mountain will be toll-milled until such time that we have steady cash flow and have delineated a meaningful Measured & Indicated resource to support building our own mill.

Depending on grades & recoveries, 100 tpd at 10 g/t Au eq. would generate ~10,400 Au eq. ounces/year (profits to be split with toll-miller). The chart below shows various scenarios.

For the purposes of the chart, gold-silver recoveries are set at 90%. However, there's a good chance that toll miller Nicola Mining Inc. (NIM:TSX.V), can extract the metals at >90%, perhaps 92–93%.

Dome has tremendous exploration upside (see this detailed press release). Substantially all historical exploration, development and mining occurred on just one of 16 known high-grade vein systems. In today's dollars, since the mid-1980s, over $100M has been invested by serious companies, including Noranda Income Fund (NIF.UN:TSE) and Timmins Gold Corp. Compare that figure to our EV of just $32M.

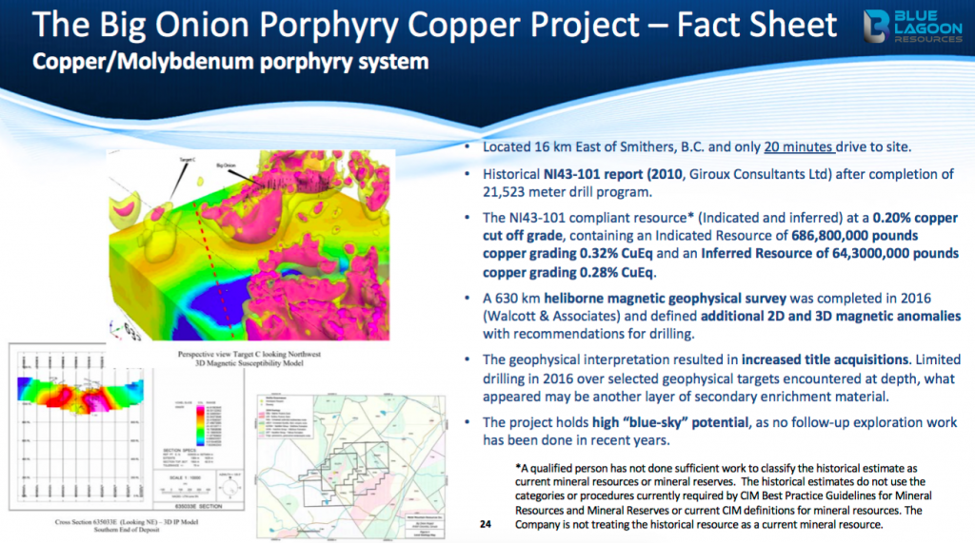

We also own 100% of the Big Onion porphyry copper project next door to Dome. While not our primary asset, consider that we closed on this deal in March of 2020. The copper price has nearly doubled since then. We think Big Onion will be monetized or farmed out on attractive terms in coming months.

We also own 100% of the Pellaire Gold property in BC, covering >4,400 hectares. Pellaire hosts at least 10 high-grade, gold-bearing veins. Importantly, there's ~25,000 tonnes of stockpiled material at Pellaire at an estimated grade of 5.5 g/t Au Eq.

This is a fairly straightforward, multimillion-dollar cash flow opportunity (over a five- to six-month period)expected to start this summer.

PE: Thank you. So three prospective properties, all in BC, with the primary focus being the past-producing, high-grade Dome Mountain. Please tell us more about Dome.

RV: We're very excited because there's a lot of activity at Dome right now. Twenty one people are onsite supporting our permit amendment work and 20k-meter drill program. Labs have been slow, but initial drill results should be in hand this month. Readers should know, the intense focus at Dome is not just on drilling, it's on near-term production.

By the end of April we hope to have completed three corporate initiatives involving (underground roof bolting, upgrades to a water treatment facility and updated reclamation plans), to submit applications to amend key mining permits allowing us to operate at up to 75,000 tpy.

We also have permission to remove roughly 6k tonnes of high-grade, broken ore sitting in a mine tunnel at Dome. Shipping that ore to Nicola is expected to start this spring, so we could be pouring gold by June.

PE: On Feb. 24, Blue Lagoon put out a press release on prospecting and soil sampling done last year at Dome Mountain. What are the main takeaways?

RV: First, let me say that we're very happy with these prospecting results. I guess most important, we identified strong anomalous gold in soils zones, which will be followed up on this spring/summer. The best way to convey our excitement is to refer to our chief geologist's comments. Bill Cronk, P.Geo, said, "We identified multiple gold-in-soils anomalies and strong multi-element associations with that gold. This initial sampling program was focused on: 1) covering areas of known gold mineralization at Freegold, Boulder and the Forks veins, to provide an orientation of what results can be used to guide future programs, and 2). . .as a quick pass program to cover initial geophysical anomalies seen in our preliminary Mag & EM data collected from our 2020 airborne surveys. Both goals were achieved, and we plan to collect a minimum of 4,000 additional samples this year. . ."

PE: Blue Lagoon has $5.5M in cash. How much exploration/development can you do with that liquidity runway?

RV: Good question. Even after advancing our drill program and amending two key permits, we should have ~$4M in cash at the end of April. And, we have ~$5M in $0.50 warrants that could potentially be exercised. Some of those warrants are held by very supportive friends and family who we think we can count on to exercise if need be.

PE: Blue Lagoon has an Indicated + Inferred resource grading ~10.2 g/t Au eq. You've said the next resource estimate will be substantially larger. How well might that 10 g/t hold up?

RV: In looking at historical data, including work done in 2016 and last year, we have no reason to believe the grade will change all that much. Generally, grades improve at depth, and we're drilling deeper than the 304 holes used to calculate our existing resource.

PE: As CEO, readers see you in video clips and read quotes attributed to you in press releases. Please name a few other critical team members.

RV: Thank you for asking. Yes, we have a tremendous team, plus advisors, at Blue Lagoon. I like to surround myself with people who are smarter than me. I think I've succeeded here.

Our chief geologist, Bill Cronk, P.Geo, has >25 years' experience as a geologist/manager of exploration programs for precious and base metal deposits. He has worked in Africa, Europe, North and South America. Bill's an expert mining executive in areas ranging from grassroots reconnaissance to advanced-stage exploration and prefeasibility work. Mr. Cronk has worked for mining industry leaders such as Dundee Precious Metals Inc. (DPM:TSX), where he was also chief geologist, and Northern Empire (acquired by Coeur Mining Inc. [CDE:NYSE]).

Yannis Tsitos is on our advisory board. He has over 30 years' experience, 19 with BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK). He has lived and worked in Sout Africa, Ecuador, Greece and the UK. Originally a physicist-geophysicist, he left BHP, where he had the title of New Business Manager for Minerals Exploration, in 2007.

Yannis has been instrumental in the identification, negotiation & execution of over 50 exploration agreements. Mr. Tsitos is president of Goldsource Mines Inc. (GXS:TSX.V) and sits on several companies' boards as an independent director.

Director Norman Brewster is CEO of Cadillac Ventures Inc. He has served on many public and private company boards. Prior to Cadillac Ventures, Mr. Brewster was executive chairman of Iberian Minerals, successfully financing, developing and putting into production the Aguas Tenidas Mine in Spain. He later led the eventual sale of Iberian to Trafigura Group.

PE: Historically, over $100M (in today's dollars) has been invested at Dome Mountain. Given its grade profile, why has it not been more actively mined by now?

RV: Great question. Prior operators did a fantastic job raising nearly $30Mover the past decade, in what was a terrible market. They simply ran out of steam, but not before obtaining key mining permits and completing a great deal of exploration and development work. Frankly, I was amazed at what they were able to accomplish.

One thing I've learned over the past few decades is that sometimes luck comes into play. I was at the right place at the right time to pick up Dome and Big Onion a year ago at highly attractive valuations. Other companies tried to purchase Dome, but the timing was never right.

We issued ~13.5M shares to acquire 78% of Dome when our shares were trading at ~$2.00. Today, with a nearly 20% pullback in gold since its all-time high in August, our share price is in the low $0.50s. We think Blue Lagoon is very undervalued, which is why I exercised options on 1M shares and have been buying in the open market.

PE: Yes, I see you've been building your position in Blue Lagoon. Why should readers consider following your lead?

RV: We think we're extremely undervalued. Are there better projects in Canada? I'm sure there probably are. But are they permitted? Clearly, the vast majority are not. In fact, I don't know of any pre-PEA (preliminary economic assessment) company that has any mining permits.

Blue Lagoon is truly in an enviable position. It can take over 10 years to get mining permits in BC! Another reason why we're undervalued is that we have three projects (Dome Mountain, Big Onion and Pellaire), but our valuation is tied to (the very considerable) work done on <10% of Dome.

We hope to table upward of 1M ounces of high-grade gold and silver from the Boulder zone alone, and we already know of 15 more high-grade gold-silver vein systems on Dome's 19k-hectare footprint. The blue-sky potential here is fantastic.

We didn't have enough time to talk about our 100%-owned Big Onion copper-moly porphyry project, but it's a very attractive prospect. It was acquired a year ago when copper was roughly half today's price. Big Onion has an historical (non-NI-43-101-compliant) resource of ~900M lbs. copper (Cu), at a 0.15% Cu eq. cutoff grade.

The real excitement comes from its blue-sky potential—to upward of a billion tonnes—versus 176M tonnes at the 0.15% cutoff level in the 2009 resource estimate. If we (or another group) could (potentially) increase the resource by five times, Big Onion could become ~1.5 billion pound Cu eq. (0.35% Cu eq. cutoff) resource, at a grade of ~0.45% Cu eq.

PE: Thank you, Rana, very informative. I really like the near-term production profile here. Like you, I've been buying shares of Blue Lagoon in the low $0.50s. Hopefully gold and silver prices will bounce back from the recent selloff.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research[ER], (together, [ER]) about Blue Lagoon Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER]has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Blue Lagoon Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Blue Lagoon Resources was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sassy Resources, a company mentioned in this article.