It appears silver is in a new uptrend with support from the longer term up trend channel. Silver should test recent highs, so is doing much better than gold. A close at $29 or higher would signal a breakout. There is a lot of scuttle but and rumors out there about the Reddit and Robinhood (Wallstreetbets) gang piling into silver and causing the greatest short squeeze of all time. JP Morgan has been known to have a large short position for a long time, but has covered its short position, according to Ted Butler who has been following this topic for years. However, many other banksters are still short. Last September JP Morgan was fined almost $1 billion for precious metals manipulation. JP Morgan is the custodian for physical silver in the iShares Silver Trust (SLV) ETF.

Thursday and Friday saw volume increases in many silver investments, including a big jump in volume on the silver ETF SLV. Whether driven by rumor or the Reddit army actually coming in, their plan is severely flawed. Their plan from a number of internet postings is to create huge buying volume into the ETF to drive silver prices higher.

This article suggests Wallstreetbets has started their move into silver.

It just so happens the SLV ETF posted a share prospectus on January 13. It looks like great timing to protect their butt. Below is some of the highlights in the prospectus, the bold highlighting is their doing.

"The Trust intends to issue Shares on a continuous basis. The Trust issues and redeems Shares only in blocks of 50,000 or integral multiples thereof. A block of 50,000 Shares is called a "Basket." These transactions take place in exchange for silver. Only registered broker-dealers that become authorized participants by entering into a contract with the Sponsor and the Trustee ("Authorized Participants") may purchase or redeem Baskets. Shares are created to reflect, at any given time, the market price of silver owned by the Trust at that time less the Trust's expenses and liabilities."

A short squeeze is not possible on the ETF because an unlimited amount of shares can be created. If these buyers believe that JP Morgan will be forced to buy more silver because of the rising demand in the ETF, they have all kinds of outs as reported in the prospectus.

"The Trustee may suspend the delivery or registration of transfers of Shares, or may refuse a particular deposit or transfer at any time, if the Trustee or the Sponsor think it advisable for any reason. Redemptions may be suspended only (i) during any period in which regular trading on NYSE Arca is suspended or restricted, or the exchange is closed, or (ii) during an emergency as a result of which delivery, disposal or evaluation of silver is not reasonably practicable.

If the process of creation and redemption of Baskets encounters any unanticipated difficulties or is materially restricted due to any illiquidity in the market for physical silver, the possibility for arbitrage transactions by Authorized Participants, intended to keep the price of the Shares closely linked to the price of silver may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV

The COVID-19 outbreak will have serious negative effects on social, economic and financial systems, including significant uncertainty and volatility in the financial markets. For instance, the suspension of operations of mines, refineries and vaults that extract, produce or store silver, restrictions on travel that delay or prevent the transportation of silver, and an increase in demand for silver may disrupt supply chains for silver, which could cause secondary market spreads to widen and compromise our ability to settle transactions on time. Any inability of the Trust to issue or redeem Shares or the Custodian or any subcustodian to receive or deliver silver as a result of the outbreak will negatively affect the Trust's operations.

The Sponsor and its affiliates manage other accounts, funds or trusts, including those that invest in physical silver bullion or other precious metals, and conflicts of interest may occur, which may reduce the value of the net assets of the Trust, the NAV and the trading price of the Shares.

Furthermore, although the Custodian is generally regulated in the UK by the Prudential Regulatory Authority and the Financial Conduct Authority, such regulations do not directly cover the Custodian's silver bullion custody operations in the UK. Accordingly, the Trust is dependent on the Custodian to comply with the best practices of the LBMA and to implement satisfactory internal controls for its silver bullion custody operations in order to keep the Trust's silver bullion secure.

Silver transferred to the Trust in connection with the creation of Baskets may not be of the quality required under the Trust Agreement. The Trust will sustain a loss if the Trustee issues Shares in exchange for silver of inferior quality and that loss will adversely affect the value of all existing Shares.

Share Splits

If the Sponsor believes that the per Share price in the secondary market for Shares has fallen outside a desirable trading price range or if the Sponsor determines that it is advisable for any reason, the Sponsor may cause the Trust to declare a split or reverse split in the number of Shares outstanding and to make a corresponding change in the number of Shares constituting a Basket."

As you can see JP Morgan has all kinds of outs from actually purchasing physical silver if you trust them in the first place. Ultimately as highlighted below, this ETF could just blow up and even be terminated.

"Authorized Participants with large holdings may choose to terminate the Trust. Holders of 75% of the Shares have the power to terminate the Trust. This power may be exercised by a relatively small number of holders. If it is so exercised, investors who wished to continue to invest in silver through the vehicle of the Trust will have to find another vehicle, and may not be able to find another vehicle that offers the same features as the Trust."

The volatility could just cause it to blow up like the NUGT ETF last March. NUGT is supposes to be 2X the GDX and you can see it turned into 1/2 times.

Investors that bought GDX have a +60% gain while those in NUGT have a -30% loss over the shown time frame.

As of the close of business on January 13, 2021, the net asset value of the SLV Trust was $14,091,710,671 and the NAV was $23.54. Gamestop (GME) has traded twice this valuation and more in a single trading day.

The Wallstreetbets crowd could cause volatility and another likely outcome is a spillover into silver related stocks, the silver miners. I would avoid the SLV ETF. I prefer the Sprott Physical Gold and Silver Trust (CEF). It is 50/50 gold and silver. For a pure silver play, the Sprott Physical Silver Trust (PSLV). Before I get into some of the silver stocks, more on the silver metal itself.

Silver is a very unique metal. It is considered a precious metal and often referred to as "poor man gold." I consider it a distant second to gold as a precious metal, but silver's strong industrial demand is an advantage it has over gold. The other unique thing about silver is it's very small market size. The Silver Institute is projecting mine supply for 2020 at 790.8 million ounces, which is eight year lows. At current prices around $25 this annual production is valued around $20 billion. Just one stock, Apple (AAPL) is valued 100 times higher. This very small market presents a challenge for investors because you will not find many $1 billion plus liquid investments.

Next, let's look at the industrial demand. For investors this makes the silver market much less liquid and why there are high premiums on silver coins. So much silver is off the market lying in silver panels, jewelry and silverware.

Silver in solar panels grew 7% in 2019 to its second highest annual level ever. With a Biden victory, The Green New Deal is back in play so solar and consequently silver is in the limelight.

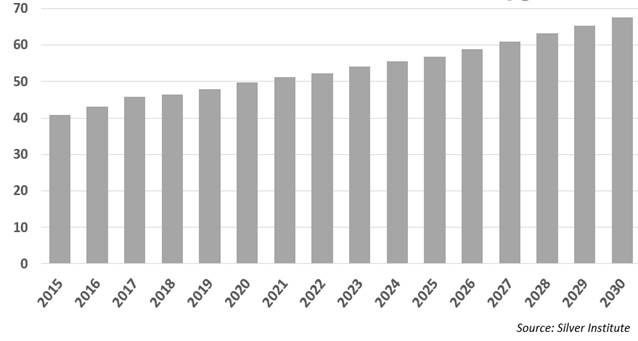

Silver is the best conductor of electricity and is in high demand with the electrification in the auto industry. Projections in the chart below show a steady increase into 2030.

Silver is known as poor man's gold because it often runs up in price with gold and was once extensively used in coinage around the world. Currently the gold to silver ratio just came off historical highs and today is around 73, shown in this next chart.

Silver is more difficult to analyze than gold because gold has almost no uses except as money. (Gold is widely used in jewelry, but I consider gold jewelry a hard asset, what I call "wearable wealth.")

Silver, has many industrial applications and is both a true commodity and a form of money. This means that the price of silver may rise or fall based on industrial use, but can also be influenced by monetary factors such as inflation, deflation and interest rates. Silver will always be a form of money. I have been commenting that all the recent money printing and more so under the Biden administration, that confidence will erode in central bank money. Investors and savers will increasingly turn to physical money (gold and silver) and non-central bank digital money (Bitcoin and other cryptocurrencies) as stores of wealth and a medium of exchange.

The issue for silver investors is the lack of highly liquid, $billion companies. Some favorites in the past like Hecla (HL) and Coeur Mining (CDE) are really more so gold miners. Coeur's revenue from silver is only about 27% of revenue, the rest is gold, according to its Q3 report. Hecla is has a better silver to gold ratio, with about 48% of revenues from silver over 9 months according to its Q3 report and using today's metal prices. Pan American Silver (PAAS) has only about 31% of revenue from silver according to its production numbers in its Q3 report and using its realized gold and silver prices.

The best leverage to silver for a major miner is First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) with a market cap last Friday of US$4 billion. According to its presentation, 65% of revenue is from silver and 35% from gold.

I have already suggested First Majestic and it is up substantially. The stock had a nice move in the last few days to $17.86 from $14. It could be attributed to increased interest with the Wallstreetbets news, but there was another development with First Majestic last week: its mines are in Mexico and for some time the company has been in dispute with the government over tax rates.

Bloomberg reported that First Majestic won a reprieve on criminal tax fraud charges in initial Mexican court hearings .A judge in Mexico City declined to charge the Canadian mining company with criminal tax fraud, said the people, who spoke on condition of anonymity as the matter is private. Prosecutors can still return to court and present additional evidence. One of the people said the judge delayed ruling until an audit by Mexico's tax authority was finished and that the judge hadn't ruled yet on the evidence presented in the case.

First Majestic has 146.5 million ounces silver equivalent in the Proven and Probable category plus 267.8 million ounces silver equivalent (M&I) Measured and Indicated Resources. The total is 414.3 million. Market cap at 222 million shares X $18.12 = $4.022 billion, less $238 million cash, plus $140 million debt cash gives a rough EV per silver ounce of $9.50.

This next graphic is from First Majestic's presentation. It shows that BMO's silver report is predicting 70% revenues from silver for First Majestic. It is also a good comparison to other silver producers.

The stock broke out above resistance Thursday/Friday. A short squeeze might also be in play here. Shortsqueeze reports the last short position at 45.8 million shares.

Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE) is worth a look and will trade with the silver price.

The company has Proven and Probable reserves of 82 million ounces silver equivalent plus 43.6 million ounces M&I for a total of 125.6 million ounces. There are 157 million shares out X $4.95 = $777 million market cap less $45 million cash, plus $7 million debt for a rough EV per ounce of $5.90.

Endeavour is valued cheaper than First Majestic on a per ounce basis but is a much smaller producer. Endeavour achieved its 2020 production guidance with 6.5 million ounces silver equivalent produced.

First Majestic produced 25.6 million ounces in 2019 and it looks like it will come in around 20 million ounces for 2020, a drop due to Covid-19 mine shutdowns.

Near term I prefer First Majestic because the break out on the chart and the large short position. The company provided this chart in its presentation that shows the large increase in the short position. I noted the 45.8 million shorts reported on the U.S. side and when we add in the 4.1 million shorts reported on Toronto, the total is almost 50 million for the period to January 15.

I am avoiding Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE) with a market cap around US$1.1 billion. All its production is in China. Relations are on the decline between China and Canada as well as the U.S. Recently in December Canada blocked a Chinese takeover of a gold mine in Nunavut, Canada.

Next is to explore further down the chain to the silver developers and explorers.

I have already presented Blackrock Gold Corp. (BRC:TSX.V; BKRRF:OTCMKTS), so this is some follow up developments. Despite its name, the company ended up discovering a high grade silver discovery in Nevada. Here are some recent drill results from its Tonopah West project in the Walker Lane Trend:

- Jan 14, 2021, news - TW20-061C cut 18.5 meters grading 295 g/t Ag Eq (142 g/t silver and 1.54 g/t gold) which included 1.52 meters of 1,791 g/t Ag Eq (808 g/t silver and 9.83 g/t gold)(Ag/Au = 100:1);

- and TW20-041C cut 3.11 meters grading 386 g/t Ag Eq (198 g/t silver and 1.88 g/t gold), including 0.31 meters of 1,121 g/t Ag Eq (571 g/t silver and 5.5 g/t gold);

- December 3, 2020 news - TW20-037 cut 3 meters returning 10.5 g/t gold and 1,188 g/t silver or 2,238 g/t Ag Eq along the Merton vein and indicates 290 meters of dip potential. SilverĖgold ratio is 100:1 using a 200 g/t Ag Eq cut-off grade;

- and TW20-027 drilled 12.2 meters grading 297 g/t Ag Eq at Bermuda-Merton vein intersection;

- and TW20-022 intersected 4.5 meters grading 285 g/t Ag Eq on the Paymaster vein.

There was significant news on December 18 when Summa Silver Corp. (SSVR:TSX.V; SSVRF:OTC) reported results of core drilling along the eastern border of the Tonopah West project. It shows the Victor vein extends 480 meters to the east. Summa Silver's drilling along strike of the Victor/Murray vein adjacent to Blackrock's eastern border returned 1,079 g/t Ag Eq (5.19 g/t Au and 560 g/t Ag; Au/Ag=100/1) over a 0.9 meter interval in SUM20-17 (see Summa Silver (CSE: SSVR) news release December 17, 2020). Additional reported intercepts from Summa Silver in the Victor/Murray zone included 582 g/t Ag Eq (2.41 g/t Au and 341 g/t Ag) over 0.7 meters and 6.8 meters grading 212, which included a high interval 0.8 meters of 727 g/t Ag Eq (3.56 g/t Au and 371 g/t Ag).

These drill intercepts confirm the Victor/Murray vein system extends to the eastern border of the Tonopah West project giving an additional 480 meters of strike on Blackrock's project. Blackrock is awaiting additional assays from further drill holes from this target area. This property and drill map of Blackrock's project gives a good picture of its recent drilling. I pasted in a red arrow to point out the direction of Summa Silver's recent drill hit.

This graphic is from Summa's presentation and gives a better representation of their relevance to Blackrock Gold. I highlighted Summa's relevant drilling with the red circle.

Summa Silver is a worthy silver play but the company is less advanced than Blackrock. It is not as well financed and the liquidity on the stock is far less. Junior exploration companies have to continue to raise cash because they have no cash flow. This is a risk factor with these exploration stocks, so their cash levels and finance ability are important. Blackrock's last financial statements ending July 31,2020, reveal $10.7 million in cash and no long term debt. Furthermore, it just announced a $7 million bought deal financing with Red Cloud Securities that was increased to $9 million last Friday. Famed billionaire Eric Sprott, who is known to be very bullish on silver, is a major shareholder. Most liquidity for the stock is on the TSX.V, symbol BRC where it traded 2.3 million shares on Friday.

The stock has corrected a long way from its peak and has mostly filled the gap from last July. It has recently bounced off of support and I see as a good buy near recent lows. A close above $1.10 will confirm a new uptrend.

Another silver company I have followed for many years and is approaching the mine development stage is Discovery Metals Ltd. (DSV:TSX.V; DSVMF:OTCQX). The company was formerly known as Levon Resources and I had known CEO Ron Tremblay for many years. Sadly he passed away in March 2019. Subsequently Levon was combined with Discovery Metals in May 2019.

Discovery's flagship project is its 100%-owned Cordero silver project in Chihuahua state, Mexico. The company's drill results to date show that Cordero is developing all the attributes of a Tier 1 projectógrade, scale, significant organic growth opportunities and well located in one of Mexico's premier mining belts. The 43-101 resource in 2018 came in at 407,761,000 ounces silver Indicated with 8 billion pounds of zinc, 3.7 billion pounds lead and 1.27 million ounces of gold. This is a massive deposit at 1.5 billion ounces silver equivalent (Ag Eq) at a cutoff grade of 40 g/t Ag Eq, hence the high leverage to silver. I often commented in the past that Discovery has the largest leverage to the silver price and I still believe that today. That said, the company is progressing with a higher grade portion of the project.

Shares outstanding 307 million.

- Founders/Management 11%

- Eric Sprott 27% (his largest silver related holding)

- Institutions 28%

This slide from its presentation shows its focus to a higher grade portion of the project.

Discovery Metals outlined its 2021 work program and budget for its Cordero project, Mexico, in a January 19 press release. Taj Singh, president and chief executive officer, stated: "We anticipate 2021 will be a transformative year where we firmly establish Cordero as one of the few silver projects globally that offers margin, size and scaleability. Our focus is to both derisk the project by delivering a technically robust PEA [preliminary economic assessment] and to deliver resource growth by expanding known zones and making new discoveries. We plan to complete 66,000 meters of drilling."

"Other key project development milestones for 021 include completion of social baseline assessment and progress on environmental baseline studies. Our planned work for metallurgy, processing, geotech and hydrology will go above and beyond what is typically included in a PEA study and will identify areas where we can accelerate prefeasibility work.

"Our current cash balance of approximately $82-million places us in a very strong position to fund our planned expenditures at Cordero this year of approximately $26-million."

2021 drill plans

The company plans on completing 66,000 meters of drilling in 2021 based on four drill rigs operating throughout the year. This program and the number of drill rigs may be expanded when the company is confident that the health and safety risks related to COVID-19 can be managed effectively. This next slide from its presentation highlights the high grade area it will focus on. A central portion of this could be a high grade starter pit.

At C$1.85 close on Friday, the market cap is about C$568 million. Less $82 million cash, the EV per ounce of silver equivalent is around C$0.32 or around US$0.25 per ounce. This is very low because of the low grade of many of these ounces. If silver were to climb to $40 or more, suddenly a lot more ounces become economic. The project is also sensitive to zinc, that has increased to about $1.20 pound from $0.80 in March 2020.

This chart is in $Canadian where most volume trades under symbol DSV. The stock responded very well to silver's rise in July. There was a healthy correction and a new up trend is underway. I am looking for the stock to test old highs over $2.50. A drop below $1.50 would be bearish.

I believe the silver ETF SLV is not a good way to play a rise in silver prices. The silver market is very small and a considerable amount of buying could absorb much or all of the physical metal. How SLV would respond if it cannot obtain and back the trust with physical metal is unknown and a considerable risk. Sprott's PSLV trust does not automatically issue shares, but could do so at its discretion when physical metal can be obtained. They initiated at-the-market equity programs in Canada and the United States; Sprott (as the manager of the Trust) and the Trust entered into an amended and restated sales agreement (the "Sales Agreement") with Cantor Fitzgerald & Co. At its discretion it could issue shares for aggregate gross proceeds to the Trust of up to $1,218,630,164.

First Majestic offers the leverage of a silver producer, is very liquid and has the added enhancement of a possible short squeeze.

Blackrock offers investors a possible high beta return because of the very high grade of their silver discovery. Discovery Metals offers high leverage to rising silver prices because of the low grade nature of a many of the silver ounces in their deposit.

First Majestic and Discovery Metals operate in Mexico, so there is some country related risk. Mexico is well known as a favorable country for mining and has deemed mining essential under Covid-19 protocols. Blackrock operates in Nevada, probably one of the best precious metal jurisdictions in the world.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

[NLINSERT]Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Sprott Central Fund CEF, First Majestic, Blackrock Gold and Discovery Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Blackrock Gold is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver, a company mentioned in this article.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.