This chart compares gold (GLD) to gold mining stocks, measured by GDX, the seniors and GDXJ, the more junior producers, since the bull market topped out in 2011. It is easy to see that while gold has recovered to its 2011 highs and did break higher, the gold stocks are a long ways from that. The GDX is about -35% below 2011 levels and the GDXJ -65%. This is an opportune time to accumulate still undervalued gold stocks.

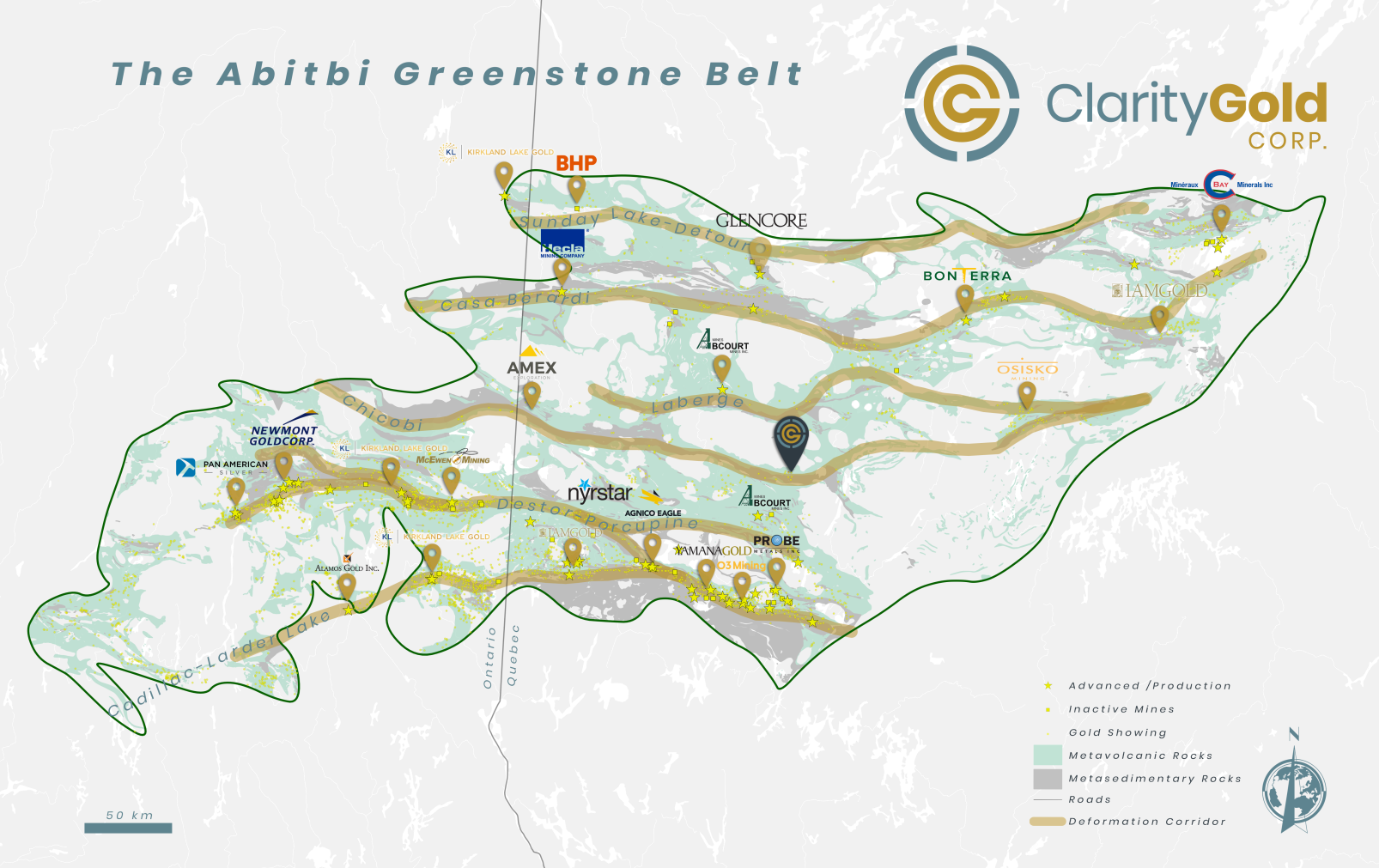

One of our most successful junior explorers last year was Amex Exploration in the Abitibi Greenstone Belt in Canada. For a quick refresher, the Abitibi is the world's largest mineral-rich greenstone geological belt, hosting many major gold and base metal deposits. It is a 450 km long by 150 km wide geological structure that runs through the Canadian Shield, from west of Timmins, Ontario, then eastward to Chibougamau, Quebec.

Gold was found in the area in the late 1800s, but significant gold mining activity accelerated with the discovery of the Dome, Hollinger and McIntyre mines near what is now Timmins, Ontario, around 1909. Since that time, more than 100 mines have produced in excess of 170 million ounces of gold. While the belt is known primarily for its prolific gold mining history, base metals mines in the region have produced over 400 million ounces of silver, 15 billion tons of copper and 35 billion tons of zinc.

The above map comes from a great article on the Abitibi Belt here.

We bought Amex Exploration (AMX) on a pull back, just a couple months after its discovery at a market valuation of C$70 million. Just two months earlier it was only valued at C$10 million. For sure I wanted to get in my next pick in the belt early with Clarity Gold. It has a current market valuation of C$24 million.

Clarity Gold Corp. (CLAR:CSE; CLGCF:OTC) Recent Price $1.20

Shares outstanding: 20.37 million, fully diluted, 23.24 million

The next graphic shows that Clarity is on the same break/fault as Amex Exploration. What is unique about this break/fault is that it does not have as much gold surface showings as the Destor Porcupine and Cadillac Larder Lake to the south and the Detour and Casa Berardi to the north. The Chicobi break where Amex and Clarity are located has some over burden, so it has had much less exploration. That is a good thing as much more potential remains as proven by Amex Exploration.

Another important point is that Clarity has a head start over what Amex Exploration had because it has a 43-101 resource of 360,000 Indicated gold ounces and 247,000 Inferred ounces on one small area of the project. And just like Amex when it started out, most of the previous drilling was at shallow depths when the Abitibi is known to go down to deep depths.

Management

James Rogers, Director, CEO, is a resource professional and entrepreneur active in the exploration and mining sector for over 13 years, and has developed projects in the Americas, Europe and Africa. Rogers is the principal of Longford Exploration Services. Since 2017, James and his teams have identified and vended over 90 resource properties to public and private companies. James specializes in generating projects through focused-area selection from large databases. Results are achieved by employing a number of GIS, 3D software and remote sensing solutions, along with the timely execution of field exploration.

Andrew Male, Director, is an experienced director and executive officer of public and private companies in the resource and investment sectors. A former founder and CEO of a TSX Venture Top 50 company ranked 9th, Male guided the company through the initial financing phases, project acquisitions, deployment of exploration programs, development financing, transitioning mining assets from greenfield to brownfield and the acquisition of adjacent producers and eventual sale to Private Equity. As a seasoned director and officer, Male has sat on a number of boards and worked with multiple companies in varying capacities.

Theo Van Der Linde, Director, is a Chartered Accountant with 20 years extensive experience in finance, reporting, regulatory requirements, public company administration, equity markets and financing of publicly traded companies. He has served as a CFO and director for a number of TSX Venture Exchange and Canadian Securities Exchange (CSE) listed companies over the past several years.

Ian Graham, Advisor, has over 20 years of experience in the development and exploration of mineral projects, corporate transactions, project evaluations and exploration. Graham's experience is mostly at major mining companies, namely Rio Tinto and Anglo American, including as chief geologist with the Project Generation Group at Rio Tinto. He has been involved with evaluation and predevelopment work on several projects in Canada and abroad, including Resolution Copper (Arizona, USA), Diavik Diamond Mine (Northwest Territories, Canada), Eagle Nickel (Michigan, USA), Lakeview Nickel (Minnesota, USA) and Bunder Diamonds (India).

Michel Robert, Advisor, (B.A., B.A.Sc. (Hons), M.A.Sc (Hons)) is a metallurgist and mining engineer with over 45 years of diverse technical experience in the mining industry, both identifying assets for acquisition and then putting those mines back into production. Robert's experience in mining operations with major companies, include Quebec Cartier Mining Ltd., Teck Corp., SNC, Lac Minerals (now Goldcorp), AMEC, Minero Peru, Fluor Daniel and Pan American Silver Corp., where Michel¹s roles have ranged from foreman to President. As senior vice president for Pan American Silver Corp. from 1995 to 2001, Michel managed operations in Latin America including the expansion of the company into Peru, Mexico and Bolivia.

Michael Williams, Advisor, has over 24 years of experience as a senior mining executive. He has held the role of executive chairman with several different public companies, including Underworld Resources Ltd, which was sold to Kinross Gold Corp in 2010 for $138 million.

Rory Kutluoglu , Advisor, is a professional geologist with over 15 years of international mineral exploration experience and executive management roles in North American and European companies. Kutluoglu was the exploration manager for Kaminak Gold Corp., leading their team to deliver the maiden and updated resources on the Coffee Gold Project prior to Kaminak's acquisition by Gold Corp. in 2016.

Properties: Destiny, 100% option, 5,013 hectares

Being in a prolific gold belt, there is very good infrastructure with road access to the project. It is located 75 km NNE of Val d'Or Quebec.

Previous work on the property includes:

- 172 Diamond drill holes comprising approximately 50,400 meters

- Reconnaissance till sampling from 11 Sonic drill holes

- 2,430 MMI geochemical samples

- 982 line km of airborne VTEM surveys

- 171 line km of ground magnetics surveys

- 128 line km of IP

There are numerous historical high grade intersects, such as:

- 23.95 g/t over 3.1 meters from 118.8m (Dac zone)

- 22.14 g/t over 1.4 meters from 161.8m (Dac zone)

- 19.49 g/t over 2.7 meters from 166.0m (Dac zone)

- 167.0 g/t over 1.0 meter from 221.7m (Dac zone)

- 25.65 g/t over 1.1 meter from 372.9m (Daria zone)

- 90.3 g/t over 1.0 meter from 87.5m (Gap zone)

Dac deposit: the 2011 NI 43-101 Resource consists of Indicated resources of 360,000 oz Au at 1.05 g/t and Inferred resources of 247,000 oz Au at 0.92 g/t

This next graphic is from CLAR's presentation that gives a very good picture how this could easily grow into a multimillion ounce deposit. There is at least 3.5 km of strike that has sporadic drill holes that have assayed grades similar to the Dac deposit. You can see how small the area is that makes up the Indicated resources of 360,000 oz Au and Inferred resources of 247,000 oz Au at Dac. Most of the drilling is relatively shallow so there is lots of potential at depth, especially when we know mines in the Abitibi go to depths to a thousand meters and more. The largest mine in the Abitibi is Agnico Eagle's LaRonde mine, about 50 kms from CLAR's Destiny and has produced over 6 million ounces and still has 2.9 million ounces of reserves. The current underground mining operation are through the 2.2-km-deep Penna Shaft, the deepest single-lift shaft in the Western Hemisphere. The LaRonde mine extension ("LaRonde 3") allows access to even deeper ore at the lower part of the ore body. All the high grades hits I quoted on the previous page on CLAR's Destiny project were at intervals of 222 meters and less. Most drill holes are on angles, so actual depth would be far less.

CLAR has three other projects in British Columbia, but the focus for now is the Destiny project in the Abitibi Belt. There is more info on the website here. The Empirical project had a drill intersect of 21 meters at 3.67 g/t Au. The other two projects have some high-grade surface assays.

Financial

Last financials show $790,000 in cash and no long-term debt. Since then Clarity completed a first tranche of a non-brokered private placement, issuing 1,563,956 units at a price of 96 cents per unit for gross proceeds of C$1,501,397.76. Each unit consists of one common share in the capital of the company and one-half of one common share purchase warrant. Each warrant is exercisable into one additional share at a price of C$1.25 per share for a period of one year from the closing date. The company expects to close a second tranche shortly. The company is planning a minimum of C$3 million in financing and a maximum of C$9.6 million that will go along way funding the first round of exploration and drilling.

Conclusion

The stock is cheap and the story not well known yet, an ideal time to buy. This will be an exploration play, but they already have 360,000 ounces in the indicated category. At C$1.20 per share, the value on these indicated ounces is about US$50 per ounce, not very much for a project in the Abitibi with strong upside potential.

Amex Exploration hit C$4.00 per share within 18 months of their discovery hole. This was a market valuation of about C$310 million. If we assume another financing after this one, for a total than of 30 million shares out, a C$310 million valuation would be about C$10 per share. I think a reasonable target for 2021, with successful drill results would be between C$5 and C$7 per share, If the gold bull market continues and gold prices go higher as I expect, than we could easily see higher prices on the CLAR stock.

The historical drilling means that downside risk is very low. It also means that targets are already well defined and I doubt there will be too much surface exploration before drilling begins. The company has a good handle on the gold zones and their orientation.

I am only showing a 6 month chart because the stock just started trading beginning of July. It has been consolidating between C$1.15 and C$1.30 since October making a good base here. A break above C$1.30 will be a clear sign the stock is going up to the next level. It is probably still in this range because of the C$0.96 financing announced and that will probably close soon. This project will have no trouble getting financed.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Clarity Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Clarity Gold is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.