Cabral Gold Inc.'s (CBR:TSX.V; CBGZF:OTC.MKTS) Cuiú Cuiú project in Brazil was the center of the 1978–1995 Tapajós Gold Rush, the world's largest, when an estimated 30 million ounces of placer gold were produced, 2 million ounces of which was produced from Cuiú Cuiú.

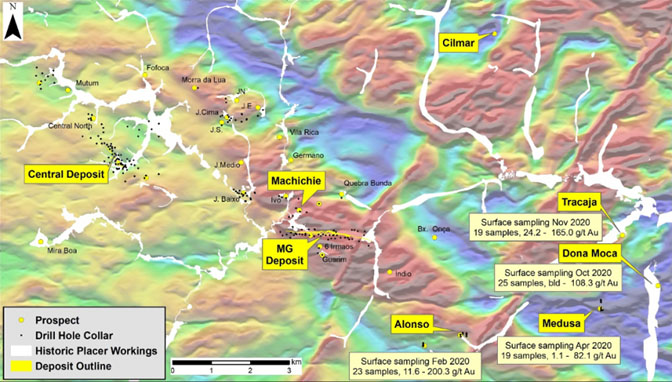

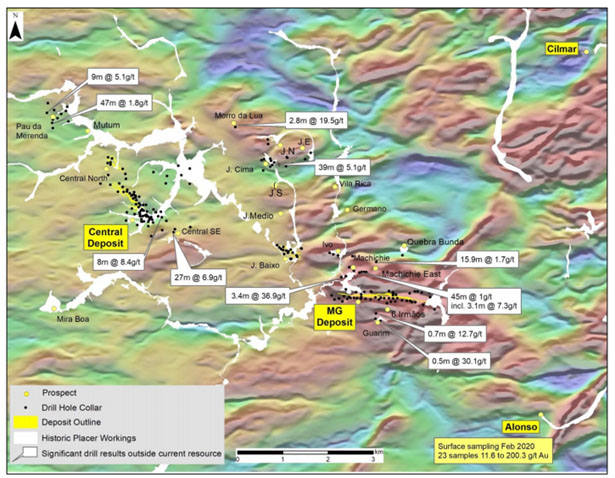

The company has so far identified two deposits on the 360-square kilometer property—MG and Central, which together have a 1 million ounce gold resource. Drilling in 2019 confirmed zones of continuous high-grade mineralization including 7.6 meters at 18.5 grams per tonne (g/t) and 5.6 meters at 13.0 g/t gold. Both are open at depth.

Drilling in 2019 also led to the discovery of two high-grade zones, Machichie, where results as high as 3.4 meters at 36.9 g/t gold were recorded, and Morro da Lua, which saw an assay of 2.8 meters at 19.5 g/t gold.

But the Cuiú Cuiú project landholding is large and the company believes that there is much more gold to be found.

Cabral had identified eight new targets outside the existing resource and just announced the addition of a new target, Tracaja. The company reported that 19 surface grab samples collected from the edge of historical placer workings "returned values of 24.2 g/t to 165.0 g/t gold and average 74.9 g/t gold."

The company has begun conducting reconnaissance drilling on its new targets this year. The first target to be drilled was Alonso. "Alonso has boulders on surface averaging 91 g/t gold, and it's never been drilled until now," Cabral CEO Alan Carter told Streetwise Reports. "We are trying to pin down the source of the boulders. None of the initial 15 holes encountered the source of these boulders and several additional holes will test alternative trending structural targets and the possibility that the high-grade surface boulders may have been transported further than we anticipated."

Cabral has now moved its reconnaissance rig to the Medusa target, about 4 km east of Alonso, which also has not seen any prior drilling. The company has so far drilled 20 holes on that target and results are pending.

"It's a big drill program—25,000 meters—so Alonso and Medusa are just the initial two targets. We are planning on drilling a total of between 10 and 15 targets over the next six months, including a number of more advanced targets where we already have excellent drill results, which is the reason that we have added a second drill rig, which will double the news flow, and of course all of these targets are outside the two known gold deposits at Central and MG," Carter said.

The second, larger drill is focusing on these more advanced targets and is currently drilling Machichie and Machichie SW, targeting extensions of high-grade drill results on both targets. "Recent surface sampling from the Filao de Amor vein structure in the Machichie SW area returned gold values of 0.5–324.5 g/t, with an average of 123.4 g/t gold," the company announced.

"The question is," Carter asked, "how many of these targets are actually going to have continuity of gold mineralization and will turn into the next gold deposits within the property? We clearly have a very large district and we are identifying new targets all the time. There are a lot of potential catalysts here."

In parallel with the drilling, Cabral has continued to identify new high-grade veins on surface. The company knows that some of the targets are east-west trending and some are northwest trending. "There's a very, very strong northwest trending structure that cuts through our whole project area and is a big regional feature that probably extends 200 kilometers," Carter said. "We've now identified a third trend, which is a northeast set of gold-bearing veins. In the Machichie area, which is very close to one of the existing deposits, just north of MG, we've now identified six new northeast trending veins, all outcropping on surface. And there is another northwest trending vein that we have identified about 3 km to the north, in a place called Jerimum North."

Samples at Jerimum North have returned assays as high as 5.3 meters at 24 g/t gold. During the gold rush, Jerimum North was the richest part of the Cuiú Cuiú concession. "The streams were very, very rich, and we think they were probably being fed by a constant erosion of this very high-grade vein system that is exposed on surface. It has never been drilled." Carter explained.

"The eastern part of the Cuiú Cuiú district is proving to be just as prolific as the central part where we already have two gold deposits drilled off and multiple high-grade targets," Carter noted. "Tracaja has some exceptionally high-grade blocks on surface averaging 74.9 g/t gold, but in this particular case, we have strong evidence that the surface blocks are derived from two NE trending veins which are currently submerged under water in an adjacent pit."

"It's quite an exciting time for the company," Carter concluded.

Cabral has around 119 million shares outstanding, 128 million fully diluted. Insiders hold 17%, institutions 39% and retail investors 44%. Phoenix Gold Fund, Crescat Capital, Dundee Goodman, RBC Precious Metals Fund and Osisko all hold shares. Carter himself is the second largest shareholder in Cabral having so far invested $1.7 million of his own money.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Cabral Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cabral Gold, a company mentioned in this article.