Riley Gold Corp. (RLYG:TSX.V) recently optioned two exploration projects, both located in recognized major trends in Nevada, a top-ranked gold mining jurisdiction. Tokop is located in the Walker Lane Trend, while Pipeline West/Clipper is situated in the Battle Mountain-Eureka Trend.

Riley Gold has an experienced leadership team. Todd Hilditch, the former CEO of Terraco Gold that was acquired by Sailfish Royalty Corp. in August 2019, serves as CEO. Executive Chairman William Lamb is the former CEO of Lucara Diamond Corp. and has years of mining operations and project development experience. Consulting geologist Charles Sulfrian has more than 40 years of exploration and development experience, 22 years of that at Barrick Gold Corp. Independent director Stuart Smith is the former technical director of strategy and new projects for Teck Resources.

"We've got a good Nevada based team that we're bringing to the table," Hilditch told Streetwise Reports.

Hilditch explained that Riley Gold went looking for Nevada projects that "had some good drill holes, did not have a resource defined yet, and was something we could grow."

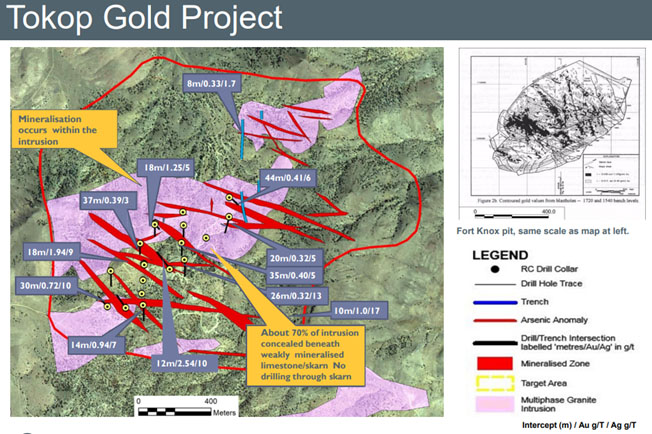

And that is exactly what it found with the company's Tokop project. An Australian exploration company held the project and inked an earn-in agreement with the original Osisko Mining Corp. on several projects in 2012. The partners drilled Tokop, during 2013, on a very wide-spaced program and came up with discovery hole and also trench results that "in any given market would garner attention: 12 meters of a little over 2.5 grams per tonne (g/t) gold, 18 meters of 1.25 g/t gold and 30 meters of 0.72 g/t gold. Trenches returned up to 18 meters of 1.94 g/t gold," Hilditch said.

"If you were to hear those numbers, you'd immediately think, okay, this is a neat prospect. We considered the boxes being checked for Tokop were something that Riley could really sink its teeth into: the fact that it's not far from other gold production and development in Beatty, Nevada, in the Walker Lane Trend, and the fact there are many old mines and prospects within the project area," Hilditch said. "Additionally, Dick Sillitoe, a well-known economic geologist, had visited to the project twice as a consultant and saw it as an Intrusive Related Gold ("IRG") system similar to the Tintina Gold Province in Alaska that includes Fort Knox (9 Moz), Dublin Gulch (2 Moz) and Donlin Creek (31 Moz), so we will explore this concept."

Not long after Tokop was drilled, and before all the results had been received, Goldcorp launched a hostile $2.3 billion bid for Osisko in early 2014, which was defended, and Osisko subsequently entered into a friendly $3.9 billion merger with Agnico Eagle and Yamana in spring 2014. Tokop subsequently slid into a quiet place in the Australian company's asset portfolio, while the company pivoted to other aspirations and gold was falling out of favor relative to other resource opportunities. This left the door open—years later—for an opportunity to which Riley is grateful.

Riley Gold put together several landowner pieces to consolidate the Tokop property. "It was a good start for us," Hilditch said. "This is an early-stage project. You get to multi-million ounce deposits by doing good discovery work and part of the discovery work was already done for us. We were fortunate to be able to pull all the pieces together without sacrificing our share structure by not paying any stock in the transactions."

The company plans to do additional work at Tokop—mapping, sampling and geophysics—before it begins a drill program, targeted for late Q1/21 or early Q2/21. "We are following up on previous work, and are doing some generative and exploration work to start leading us to identifying drill targets," Hilditch explained.

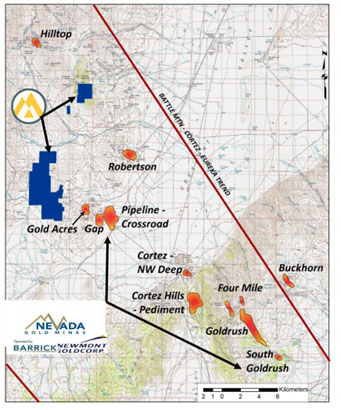

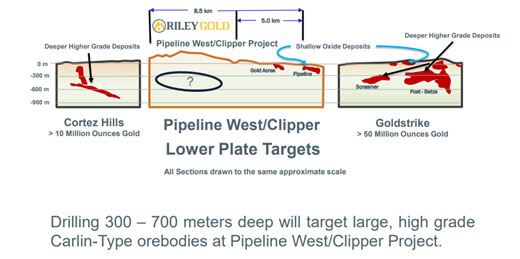

Riley's second project, Pipeline West/Clipper, is located around 80 km southwest of Elko, in the Battle Mountain-Eureka Trend. This is Nevada's "elephant country," where the Barrick Gold-Newmont joint venture operates the massive Cortez Complex of gold mines that has seen more than 40 million ounces of gold production and reserves of more than 10 million ounces.

Pipeline West/Clipper is also an earlier-stage project, and exploration plans are to target the lower plate carbonates. "We're hoping, because there hasn't been enough work done on this project and it hasn't been tested deep enough that we are going to be able to go in and identify a deeper seated deposit," Hilditch said. Historical drilling has not gone deeper than 250 meters.

"If we are lucky enough to figure it out, Pipeline West/Clipper could be quite a company maker, let alone what we do with Tokop," Hilditch said.

Riley Gold recently closed an oversubscribed CA$3 million placement. Each CA$0.20 unit consists of one common share and one half share of a purchase warrant. One warrant, valid for 24 months, entitles the owner to purchase one common share at the exercise price of CA$0.40.

The company has approximately 25.6 million shares issued and outstanding, 35.4 million shares fully diluted. Management owns around 18%.

[NLINSERT]Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Riley Gold. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riley Gold, a company mentioned in this article.